File - Jackie Mazer's Portfolio

advertisement

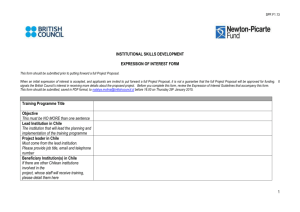

Final Paper - Calmante Winery Marketing 445 May 11, 2015 Jackie Mazer Christina McAuliffe Elizabeth Morris Francesco Sacchi Executive Summary Chile has a significant history and involvement with wine. The drink of choice for meals, social events, as well as everyday enjoyment is wine for most Chileans. According to The Wine Bible, the main reason wine has grown to be so popular relates to the large amount of French immigrants who moved to Chile during the late 20th century. These new citizens shared wine knowledge and experience with the Chilean natives. “Chile is now the fifth largest exporter of wines in the world, and ninth largest producer” (MacNeil). Since the climate is described between California and France, it is the best for baring grapes. Chile has been free of phylloxera, meaning that the vines do not need to be grafted. This makes Chile ideal to for hosting wineries. Calmante Winery located in Santiago, Chile focuses on its premium Sauvignon Blanc wine. The Santiago population relies heavily on local goods, which is why Calmante will be popular, despite the premium price. Our winery has the capacity to make 60,000 bottles a year for the premium price of $15 per bottle. We pride ourselves in hardwork and determination in order to make our winery as successful as possible. Chile General Facts Chile is a coastal country that is located in the southwest region of South America. The country shares its northern border with Peru and its eastern border with Argentina and Bolivia. Chile is geographically diverse from its furthest northern border to its furthest southern border. In Encyclopedia of the Nation’s article, Chile, they made a comment that said, “In the North, is the Atacama Desert, one of the driest places on Earth, while the southern tip points towards the polar ice of Antarctica“(2015). With this being said, Chile has a wide range of climates, such as deserts, temperate regions, lakes, beaches, glaciers and forests. Going back in history, the CIA World Factbook states that, “ Prior to the arrival of the Spanish in the 16th century, the Inca ruled northern Chile while the Mapuche were in control of central and southern Chile.” Chile declared their independence in 1810, but it wasn’t until 1818 when they fully received independence. In 1883, which marked the end of the War of the Pacific, Chile defeated Peru and Bolivia and won its present northern region. Since then, the country has gone through many governmental changes to end up where it currently stands today as a democratic nation. In Chile, their official language is Spanish. This is no surprise due to their history of the Spanish inhabiting their country for quite some time. From this, we decided to name our product Calmante because it means calming, or soothing in Spanish. We thought this name was good for our market because want to be able to provide our customers with a sense of calmness when they are associating themselves with our wine. Economic Analysis There are many reasons why we picked Chile as our place to start a business, and one of these reasons is the economic freedom level that the country has reached. We looked at all the countries in the South American continent with some concerns, because we were afraid that negative economic climates could impact our business. According to the website Heritage (heritage), Chile enjoys the highest degree of freedom in the Latin America continent and Caribbean countries. Freedom includes freedom in labour, freedom from corruption, and control of government spending. This has also increased the ease of investments in the country and property rights, vital for our business. Chile is second in the world for protecting property rights. Chile is largest producer in the world of copper and has a really open economy towards imports. Together with this, Chile is one of the main exporters in the world of fish, wood, minerals, fruit and wine. Chile is the least corrupted country of South America. Property rights and contracts are strongly enforced, and expropriation is rare. The top individual income tax rate is 40%, while the top corporate tax rate is 20%. The country has GDP of 334.5 Billion dollars, with an unemployment rate of 5.9% and inflation of 1.8%. The average income per capita is 19,067$, even though there is great disparity regarding the distribution throughout the country (Euromonitor International). In fact, with a population of 5,000,000 people (Morrison), in 2012 Santiago alone created half of the GDP of the nation. Santiago is the financial centre of Chile. Also, it hosts the major mining, engineering and energy industries in the country. According to the article of Ricardo Giensen, as of 2011, 60% of the population lived in the Santiago area (maximum 300 km away from the city). All these economic indicators convinced us to concentrate our product in Chile, more specifically in the Santiago area, where we believe it may be successful. Market Audit and Competitive Market Analysis 1. Relevant Trends Looking at relevant trends, there are many reasons why launching our product in Chile is a good idea. This can be seen in terms economic, demographic, social, and cultural trends. To start with economic trends, we analyzed several countries in South America and came to the conclusion that Chile was the right place to enter with our wine product. What convinced us was the fact that Chile is one of the faster growing nations within the continent of South America, with a relatively stable government compared to many neighboring countries (BBC news, 2012). The economy of the country grew slower than usual in 2014, only at 3.6%, but is expected to grow at above 4% in 2015, due to an improvement in the North American and European market. In fact, the economy of the country is still tied to the demand of copper. Even though one third of the economy is still determined by exports of commodities, the internal market is growing thanks to a friendly business environment (AMB country risk report, 2014). According to the World Bank data, Chile is ranked 42 out of 189 economies for ease of “doing business” rank. Also, Chile occupies the 74th spot in the tax rank, which means that the total tax rate in Chile for business is 27.9% compared to the 41.3% average for OECD. The OECD is composed of 34 members that cooperate to gain data and reviews with the common goal of a better, fairer world (OECD, 2015). The country is also ranked 59th for ease of starting a business and 45th for ease of registering properties (World Bank Group, 2015). Another economic trend that has greatly contributed in our decision to enter Chile was the risk index provided by the AMB country risk report. The valuation is based on three factors: political, financial, and the economic system risk. Chile belongs to the low risk tier with a: “predictable and transparent legal environment, legal system and business infrastructure; sufficient financial system regulation; mature insurance industry framework” (AMB country risk report, 2014). In terms of the political factor of the risk report, it talked about how Chile has a strong democratic system that is constantly working to give citizens better education, better healthcare and lower crime rates. On the financial side, it said that Chile has one of the stronger financial sectors in South America, with inflation around 3% and interest rates ranging between 3.75% and 4.25%. Looking at their economic system, Chile has the highest GDP per capita in South America. Chile is the only country in South America that belongs to the low risk tier. This is good for our company because our business plan is a long-term one; therefore, we needed a stable place to enter where we had opportunities of growth. Demographics also play a big role in why our product may be successful in Chile. As of July 2014, Chile’s population was 17,363,894. Historically, Chile has been known as a country of emigration. But, since becoming a democracy in 1990, it has grown to be more appealing to immigrants. This change has improved the economy overall by helping it to stabilize. Even though Chile has low fertility levels, mortality rates, and life expectancy rates (average of 78.44 years according to the CIA World Factbook), it is possible for Calmante to be successful in Chile because of Chile’s “favorable age structure” (CIA World Factbook). Social trends also gives a number of reasons as to why our product could be successful in Chile. First of all, the legal drinking age is 18, and we found that the average person aged 18-25 consumes 17 wine bottles per year (Hennicke). These are the people that we are going to be gearing our product towards. Another social trend that can be seen in Chile is that they offer 188 wineries of which 96 are aimed at tourists (Wine Tours of Chile). Theses numbers show that most of the wineries in Chile aren’t focused on the people of Chile. This gives us the opportunity to stand out from the other wineries, in that we will solely gear our product towards the Chileans rather than the tourists. There are a few cultural trends that give way as to why entering Chile could be successful for Calmante. According to John Mariani’s article, “Love Those California Whites? Then Try Chile’s Sauvignon Blanc”, in Chile “ The media has poured attention and praise on the country’s reds over the last decade, and whites have gone relatively unnoticed (2011). However, we think that our product may be successful in entering the country because there is a potential market for the product. Sauvignon Blanc is seen to be among the best white wine values produced in Chile and is proving to be successful (Guide to Chilean Wine), which is why we are leaning towards this type of wine for Calmante. Statistics show that Sauvignon Blanc had sales of $9,140,752 in 2011, which was an 8.6% increase from 2010 (Mariani, 2011). Continuing with cultural trends, it is seen that the people of Chile put a large focus on their local businesses. “Chileans show strong feelings favoring domestic production, and fear that imports can hurt jobs in the country” (Rojas-Mendez, et al). Considering their culture, they are ethnocentric, being that Chileans are more willing to purchase wine from their own country instead of imported wines. They believe that buying local products will help domestic employment, ergo they prefer domestic products. From this, Chileans are willing to pay more for domestic products to secure domestic employment in the country. Since our winery will be located in Casablanca, which is one of the best areas for a vineyard to be located, this is good for our company. The reason being is that it is located about an hour from Chile’s capital of Santiago, which is where our target market will be. Overall, our location will allow easy access for the citizens of Santiago, as well as other areas, to domestically purchase wine. 2. SWOT Analysis The main strength of Calmante Winery is location. The winery can be found in the valleys of Casablanca, Chile. It is roughly an hour drive from our target market, who live in Santiago. This means that our potential consumers are able to easily access our winery, while being able to get a view of the beautiful scenery that Chile has to offer. Another strength is that the wine sold at Calmante is strictly sold at this winery. This is a strength because it drives consumers to the winery to buy and try the wine, whereas every other company sells their wines in stores, or exports their wines to other countries. With this being said, our company is completely focused on selling to the people of Chile. Most wineries in Chile are aimed at attracting tourists, so we have the upperhand when it comes to attracting local Chileans. Calmante’s major weakness is the price per bottle. The wine is sold at a premium price of $15. Competitors on the other hand, sell mainly $2 to $6 per bottle. Another weakness is price oriented, as well. That weakness is lack of profit. Calmante will not be profitable for approximately three years. The first two years will be spent paying off equipment costs. An opportunity for Calmante is the desired market. The projection rate is exactly 3,529 people because the winery can produce 60,000 bottles a year. This is a major opportunity because it gives the company a chance to reach out specifically to every customer. A more personal connection is more likely to be achieved since it is such a small market. Extending from this opportunity, is that if we can successfully make a profit in 3 years, and save money moving forward, then we could eventually have to money to produce more bottles per year, and advertise towards a wider market in Chile. The small market we currently have is both an opportunity and a threat. Since there is such a small production capacity, prices are higher than competitors. This could cause some of our target market to not want to purchase our product. Another threat we have to take into consideration is the weather. Weather is a large threat because a bad season could potentially ruin our grapes, which would ultimately destroy our wine. 3. Target Market In terms of demographics, the age range we that we chose is between 18 and 25 years old. We chose this age group for various reasons. First of all, it is important to note that Chileans in this age group like to drink. A statistic shows that on average, they consume 17 bottles of wine per year (Hennicke). This is good for our company, because we are a wine company, and we want to attract these consumers to buy our product. Another reason we chose this group as our focus is because 18 is the legal drinking age, and if we can attract these citizens at a young age, they may eventually become loyal customers of Calmante, and continue to buy the product year after year. In fact, according to an article written by Jeremy Hobson on the website “Marketplace” (2012), the key is to attract people to a product at a young age because they could potentially stay with that brand forever. This is exactly what Calmante wants to do; which is, attracting the young generation in order to create a relationship that we plan to cultivate for the years to come. Additionally, it is good to attract people at a young age because they could then become free advertising for Calmante and spread the word about the brand. In terms of gender, we are aiming our product more towards males. In an article written by Cella Scruby, in The Santiago Times, she said, “As of 2014, Chilean men consume close to 14 liters of alcohol annually, while women drink about 5.5 liters annually” (2014). Looking at these numbers, we are going to target males more so than females, since the former drink more. To go more in- depth with our target market, we are going to aim our product towards college students, college graduates, and young professionals. These are the consumers that are going to be the middle class to upper-middle class, and who are mostly found in the northern boroughs of Santiago (Chilean Culture). They have enough money to purchase our premium product, which is one of the main reasons as to why we will be focusing our marketing campaign towards these consumers. In determining the size of our target market, we found that we will have 2,460,015 potential consumers, which is 14.17% percent of Chile’s total population. To come up with this number, it is important to note that Chile’s total population is 17,363,894, and that people in Chile who are of ages 15-24 take up 16.3% of Chile’s population, and people ages 25-54 take up 43.2% of Chile’s population. We took these numbers into consideration when making our calculations to determine our potential target market size. The first step we did was to multiply the total population by the percentage breakdown of each of the age groups ( 17,363,894 * .163= 2,830,314) and ( 17,363,894 *.432= 7,501,202). We then took these numbers and divided them by the age difference that each age group takes into consideration. For instance, the age difference between 15-24 is 9; therefore, (2,830,314/ 9= 314,479) and the difference between 25-54 is 29, so we have (7,501,202/29=258,662). Since our target market only consists of 18-25 year olds, we took 7 years from the 15-24 age group, which is 18-24, and we then took 1 year from the the 25-54 age group, which is just 25. From this, we then found our total target market breakdown for each of the age groups ( 314,479 *7= 2,201,353) and (258,662* 1= 258,662). Next, we added both of our age groups together to see how many potential consumers the target market consists of ( 2,201,353 + 258,662= 2,460,015 people). If we take 2,460,015/ 17,363,894 we get the percentage of our target market which is 14.17%. Since our target market is 14.17% of the total population of Chile, we don’t have a particular reason to believe the age distribution in the city of Santiago, where our target market is, to be any different than that for the country as a whole. Because this is the case, we applied the 14.17% to the city population to found out how many Santiago residents fell within this age range. 4. The Product Consumer needs it addresses Chileans drink of choice throughout the country is soft drinks, especially nuclear-red Blitz and lemon yellow Pap. However, beer, wine and liquor are also extremely well liked throughout the population. Over the years red wine has been very popular with the wine drinkers, however, white wine is currently becoming extremely popular in Chile which is why we felt we had the opportunity to fulfill Chileans needs for a good quality white wine specifically Sauvignon Blanc. Features and benefits One benefit for our company is that Chile has safe vineyards. Total Wine’s website states, “Chilean vineyards can be planted with original rootstock rather than having to latch onto vines that are phylloxera resistant” (Guide to Chilean Wine). Phylloxera has never attacked Chile’s vineyards, which is good because phylloxera is microscopic parasites that live on and eat roots of grapes (What is Grape Phylloxera). It is also important to note that most of Chile’s vineyards are in the central section of the country, meaning that most of the areas are dry during harvest (Guide to Chilean Wine). In terms of irrigation, the vineyards receive water from the melting snow of the Andes. Vineyards are mostly located in Casablanca Valley, Santiago, Valparaiso, and Colchagua Valley, according to Wine Enthusiast’s Top 10 Wine Travel Destinations in 2012. Also, there are many flavors that Sauvignon Blanc has to offer (Guide to Sauvignon Blanc), which we will take into consideration when coming out with our first Calmante item. The fact that there are many varieties of Sauvignon Blanc could lead to many opportunities for Calmante, which could eventually attract a numerous and diverse customer base. Competition: Shown in the chart above, the competition charges anywhere from $2 to 6 per bottle of wine. We gathered this information from alibaba.com. This research shows that these brands of white wines serve as a competition to our brand due to the fact that they are selling in the same location that we are looking to sell, the Central Valley. However, white wine isn’t our only competition, beer is also a potential factor to consider. Beer can be seen as a competitor because it is well-liked in Chile. One beer that is big in Chile is Cervecera CCU Chile Limitada (Santiago Times). CCU is the largest beer company in Chile, and is in control of 82 percent of the national beer market (Santiago Times). One of CCU’s most popular beers is Cristal. Cristal is sold in stores for about $3 a pack (6 bottles), which makes each bottle worth 50 cents (Cristal). This will be one of our bigger competitors because CCU can sell their product for a lower price, and it’s one of the most popular beer brands in Chile. We have to be able to compete with their low price and popularity within Chile. Price: considerations and comparison to competition Distribution Our business is located in Santiago, Chile. Our plan is to grow the grapes in our Vineyard and produce the wine on site. We will bottle the wine into 1 liter sized bottles. Since our target market is focused towards the locals of Santiago, we felt that it would be best for our consumers to be able to buy our product at our vineyard. We want it to be convenient for our consumers to buy our wine and to get the full experience. Our vineyard will have a shop on the property solely to sell our wine to the locals of Santiago. Buyers will be able to walk around our vineyard to see how we grow our grapes and have the feeling that they are buying high quality wine. Possible promotion Our promotion strategy will be concentrated in the urban area of Santiago. One of our main strategies will be using social media to get people familiar with our company.The first campaign will be the “Calmante challenge”, where someone has to drink a bottle of our wine, post a video or picture on social media, and nominate two other friends that will do the same thing. This campaign will be held to support and grow our Calmante winery, and we count on the young people to help us accomplish this task. At the same time, we want to get young people to drive to our winery and test out the wine. Since we want to get as many people as possible, we will hold a promotion for 3 months where the tasting will be held in our facility and will be completely free. There is going to be live music everyday with local young artists. It is crucial for us to not only deliver a great tasting product, but also create a long-term relationship with the young generation. We want to combine the testing experience typical of wineries with the energy of festivals, where mostly beer is consumed. After the 3 months are up, these events are still something that we want to do over time in order to attract people, and keep the energy that youngsters desire to have. This means that we will do them during holidays and at the change of seasons to keep our target market excited about our product. We also plan on sponsoring local events where we believe young people participate. Revenue and Profit Projections The realistic market penetration rate discovered for white wine consumption in Santiago for our target market of men and women ages 18-25 is .49%. The calculation for this number comes from the research for yearly alcohol consumption in Chile, specifically Santiago. The average person aged 18 to 25 consumes 17 bottles per year (Hennicke). The production capacity per year for Calmante Winery is 60,000 bottles. Out of the target market of 708,500 people (which is 14.17% of Santiago’s population of 5 million (Morison)) we chose to specifically go after 3,529 people because of our production capabilities. In order to calculate the expected revenue, we added variable costs ($453,507.36) by fixed costs ($161,572.32) and divided that number ($615,079.68) by 60,000 (bottle capacity) and came up with $10.25 per bottle. The expected profit is $285,000 per year. The capacity of 60,000 bottles multiplied by the profit ($4.75) amounts to the expected profit. The time frame of the profit projections is three years. Two out of the three years will be spent to recuperate from equipment costs, $749,012.34. Works Cited "Alcoholic Drinks in Chile." Research Monitor. N.p., 26 June 2014. Web. 26 Feb. 2015. "Casa Del Cerro Sauvignon Blanc - Buy Wine Product on Alibaba.com." N.p., n.d. Web. 16 Apr. 2015. "Chile." AMB Country Risk Report (2014): 1-4. 18 Aug. 2014. Web. 25 Feb. 2015. “Chile”, CIA World Factbook. 27 February 2015. "Chile Country Profile." BBC News. BBC, 14 Aug. 2012. Web. 25 Feb. 2015. "Chile." Doing Business. World Bank Group, 2015. Web. 28 Feb. 2015. "Chile." Economy: Population, GDP, Inflation, Business, Trade, FDI, Corruption. N.p., 2015. Web. 08 May 2015. "Chile Hourly Wage." Trading Economics. N.p., 2015. Web. 16 Apr. 2015. “Chile - Jobs”, Visual Geography. 27 March 2015. "Chile People Stats", NationMaster. 27 February 2015. "Cristal, Pack Cerveza Lager." Cerveza Lager 6 Botellas 355cc C/u Cristal |LIDER.cl. N.p., n.d. Web. 16 Apr. 2015. “Encyclopedia of the Nation.” Chile. N.p., n.d. Web. 07 May 2015. Fickle, Le Ann A. "Small Winery Investment and Operating Costs." (2005): 1+. Web. 16 Apr. 2015. "Guide to Chilean Wine." Guide to Chilean Wine. Total Wine & More, 2014. Web. 20 Feb. 2015. "Guide to Sauvignon Blanc White Wine." Guide To Sauvignon Blanc White Wine. Total Wine & More, 2014. Web. 20 Feb. 2015. Hennicke, Luis. "Chile Wine Annual Report." (2013): 1-5. Web. Hobson, Jeremey. "Millennials Less Likely to Be Brand Loyal." Millennials Less Likely to Be Brand Loyal. Marketplace Life, 11 May 2012. Web. 27 Mar. 2015. "Ilaia Sauvignon Blanc - Buy Wine Product on Alibaba.com." N.p., n.d. Web. 16 Apr. 2015. "Income Distribution and Poverty." Organisation for Economic Co- Operation and Development. N.p., 2015. Web. 16 Apr. 2015. "La Fortuna Sauvignon Blanc - Buy Wine Product on Alibaba.com." N.p., n.d. Web. 16 Apr. 2015. "Living There." Global Property Guide. N.p., 17 Nov. 2014. Web. 16 Apr. 2015. MacNeil, K. “The Wine Bible”. p 836-843. 8 May 2015. "Marques Del Nevado Sauvignon Blanc - Buy Sauvignon Blanc Wine Product on Alibaba.com." N.p., n.d. Web. 16 Apr. 2015. Mariani, John F. "Love Those California Whites? Then Try Chile's Sauvignon Blanc." Bloomberg Business. Bloomberg, 3 Oct. 2011. Web. 20 Feb. 2015. McCabe, Connie. "The Next Wine Country: Chile." Food & Wine. N.p., n.d. Web. 26 Feb. 2015. "Members and Partners." OECD. N.p., 2015. Web. 25 Feb. 2015. "Minimum Wages in Chile with Effect from 01-07-2014 to 30-06-2015." WageIndicator.org. N.p., 2015. Web. 16 Apr. 2015. Morrison, Marion. "Countries of World Chile." Google Books. N.p., n.d. Web. 22 Apr. 2015. "Parcela Agrícola De 8 Hectáreas En Casablanca." VivaStreet. N.p., 2015. Web. 16 Apr. 2015. Penaforte, Mariana. "Chile's Top Beer Imports Come from Mexico and the U.S." The Santiago Times. N.p., 27 Oct. 2011. Web. 16 Apr. 2015. Pike, Joe. "Wine Tours of Chile." Chile's Wineries. N.p., 27 July 2010. Web. 26 Feb. 2015. Porter, Eduardo. "Income Gap Shrinks in Chile for Better or Worse." Nytimes. Nytimes, 2 Dec. 2014. Web. Rojas-Mendez, Jose L., Manmohan D. Chaubey, and John E. Spillan. "Consumer Life Styles and Market Segmentation in Chile." EBSCO. Journal of International Business Research, 1 June 2013. Web. 26 Mar. 2015. "Santiago City Review." Santiago City Review. N.p., Nov. 2014. Web. 08 May 2015. "Sauvignon Blanc White Wine Vineyards Santa Catalina Vino Chileno - Buy White Wine,Vino Chileno,Sweet Wine Product on Alibaba.com." N.d. Web. 16 Apr. 2015. "Senda: Los Jóvenes Chilenos Toman Alcohol Hasta Que Se Les Apaga La Tele." Cooperativa.cl. Cooperativa, 8 Dec. 2012. Web. 27 Mar. 2015. “The Wine and Food Lovers Guide to Chile.” Wine Enthusiast, October 2013. 27 February 2015. "What Is Grape Phylloxera | Wine Folly." Wine Folly. N.p., 18 Mar. 2013. Web. 20 Feb. 2015. 234061, Grant Agreement No.:. "Experiences in Urban Logistic." Experiences in Urban Logistics: (n.d.): n. pag. Turblog, 20 Sept. 2011. Web.