Factory Overhead

advertisement

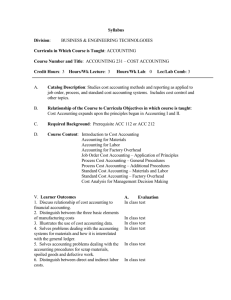

LESSON 20-1 Journalizing Manufacturing Accounting Transactions CENTURY 21 ACCOUNTING © Thomson/South-Western 2 JOURNALIZING MANUFACTURING ACCOUNTING COSTS Accounting for a manufacturing business is more complex than accounting for a merchandising business. To provide financial statements, it must make journal entries to reflect cost transactions in general ledger accounts. Cost data are generally recorded daily to provide up-to-date cost information for managers. Most manufacturing costs are recorded for financial reporting purposes when up-to-date account balances are needed to prepare financial statements. End-of-fiscal-period journal entries update the general ledger manufacturing accounts before financial statements are prepared. CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 3 FLOW OF MANUFACTURING COSTS page 585 1. Record materials purchased. 1 2 6 2 3 7 2. Record materials transferred. 3. Record factory payroll. 5 3 4 4. Close individual manufacturing expense accounts. 5. Record applied overhead. 6. Record cost of products completed. 7. Record cost of products sold. CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 4 JOURNAL ENTRIES TO RECORD FACTORY PAYROLL FOR A MONTH page 586 Direct Labor is recorded as Work in Process. Indirect Labor is recorded as Factory Overhead. 1 2 3 5 6 4 January 15 January 31 1. Debit the factory accounts. 4. Debit the factory accounts. 2. Credit the three tax withholding accounts. 5. Credit the three tax withholding accounts. 3. Credit cash for the next payroll. 6. Credit cash for the next payroll. CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 5 RECORDING MATERIALS PURCHASES page 587 A business will record the amount of direct & indirect materials purchased and issued in the general ledger account Materials Purchases are made on account and are recorded in the Materials Purchases Journal At the end of a month, the total of the materials purchases journal is posted to Materials and Accounts Payable in the general ledger CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 6 RECORDING MATERIALS REQUISITIONS page 587 A memorandum with monthly summary information of the direct & indirect materials totals is prepared at the end of the month. After direct materials are issued, the requisition amount is recorded on a cost sheet & the requisition is filed. At the end of a month, the total value of all direct materials issued to specific jobs must be transferred from Materials to Work In Process At the end of a month the total value of all indirect materials issued is transferred from Materials to Factory Overhead CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 7 MATERIALS & LABOR USED IN PRODUCTION Work In Process Bal. Jan. 15 Dir. Lab. Jan. 31 Dir. Lab. Jan. 31 Dir. Mat. $82,579.00 $39,245.00 $44,255.00 $156,477.00 page 589 Factory Overhead Jan. 15 Ind. Lab. Jan. 31 Ind. Lab. Jan. 31 Ind. Mat. $11,774.00 $13,276.00 $11,447.50 The balance in the Work in Process account, $82,579, is the beginning inventory of Work In Process. The other debits represent the total amounts of direct labor & direct materials used for all jobs during the month. The debits to Facotry Overhead represent the total amounts of indirect labor used & indirect materials issued during the month CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 8 JOURNALIZING ACTUAL FACTORY OVERHEAD page 589 Factory overhead includes various indirect factory expenses such as indirect labor, indirect materials, taxes, depreciation, & insurance. Actual factory overhead expenses are summarized in an account titled Factory Overhead . CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 9 JOURNALIZING ACTUAL FACTORY OVERHEAD page 589 At the end of each month, other indirect expenses account balances are transferred to the factory overhead account. The actual factory overhead can then be compared with the estimated amount of factory overhead recorded on the job cost sheets Date Jan. 31 Account Title Factory Overhead Doc. No. M241 Post. Ref. Debit Credit 30,456.00 Depr. Exp.-Factory Equip 2,500.00 Depr. Exp.-Building 1,300.00 Heat, Light, & Power Exp. 6,158.50 Insurance Exp. – Factory 620.00 Miscellaneous Exp. – Factory 784.40 Payroll Taxes Exp. – Factory 15,414.10 Property Tax Exp. – Factory 1,463.60 Supplies Exp. - Factory 2,215.40 CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 10 JOURNALIZING ACTUAL FACTORY OVERHEAD page 589 At the end of each month, other indirect expenses account balances are transferred to the factory overhead account. The actual factory overhead can then be compared with the estimated amount of factory overhead recorded on the job cost sheets Factory Overhead Jan. 15 Ind. Lab. Jan. 31 Ind. Lab. Jan. 31 Ind. Mat. Jan. 31 Act. OH (New Bal.) $11,774.00 $13,276.00 $11,447.50 $30,456.00 $66,953.50 CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 11 RECORDING APPLIED OVERHEAD Work In Process Bal. Jan. 15 Dir. Lab. Jan. 31 Dir. Lab. Jan. 31 Dir. Mat. Jan. 31 App. OH $82,579.00 $39,245.00 $44,255.00 $156,477.00 $66,800.00 page 589 Factory Overhead Jan. 31 Act. OH. $66,953.50 (New Bal. $153.50) Jan. 31 App. OH $66,800.00 At the end of each month the business totals the applied factory overhead recorded on all job cost sheets. The journal entry to record applied factory overhead is shown above CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 12 DISPOSINGOF OVERAPPLIED & UNDERAPPLIED FACTORY OVERHEAD • The rate used to calculate applied factory overhead is only an estimate • The factory overhead account may have an ending balance Factory Overhead Jan. 31 Act. OH. $66,953.50 (New Bal. $153.50) Jan. 31 App. OH $66,800.00 • The amount by which applied factory overhead is less than actual factory overhead is called underapplied overhead • The journal entry to close underapplied factory overhead is: Date Jan. 31 Account Title Income Summary Doc. No. M243 Factory Overhead CENTURY 21 ACCOUNTING © Thomson/South-Western Post. Ref. Debit Credit 153.50 153.50 LESSON 20-1 13 DISPOSINGOF OVERAPPLIED & UNDERAPPLIED FACTORY OVERHEAD • A credit balance in the Factory Overhead account indicates that applied factory overhead is more than actual factory overhead • The amount by which applied factory overhead is more than actual factory overhead is called overapplied overhead • An example of a journal entry to close overapplied factory overhead is: Date Doc. Post. Account Title Debit Credit No. Jan. 31 Factory Overhead M243 Ref. 186.21 Income Summary 186.21 • Two reason for overapplied or underapplied overhead • Actual expenses may be higher or lower than normal, which requires closer control over expenditures • Factory overhead applied rate may be inaccurate – requires a revised rate CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 14 RECORDING FINISHED GOODS TRANSACTIONS page 590 Finished Goods Bal. $115.140.00 Jan. 31 Completed Cost Sheets $280,352.50 The cost of work finished during the month Work In Process Bal. Jan. 15 Dir. Lab. Jan. 31 Dir. Lab. Jan. 31 Dir. Ma Jan. 31 App. OH (New Bal. Jan. 31 ) The business totals the cost sheets for all jobs completed during the month This amount is transferred from Work In Process to Finished Goods The balance in the finished goods account represents beginning inventory CENTURY 21 ACCOUNTING © Thomson/South-Western $82,579.00 $39,245.00 $44,255.00 t.$156477.00 $66,800.00 $109,003.50 Jan. 31 Completed Cost Sheets to Finished Goods $280,352.50 The cost of finished goods transferred from the factory to the stockroom LESSON 20-1 15 RECORDING FINISHED GOODS TRANSACTIONS page 590 This cost of work finished during the month is transferred from Work In Process to Finished Goods CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 16 RECORDING SALES AND COST OF GOODS SOLD page 590 At the end of the month, cost information on all sales invoices is totaled This number represents the total cost of products sold, not the sales price This total cost is transferred from the inventory account Finished Goods to Cost of Goods Sold CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1 17 TERMS REVIEW page 592 underapplied overhead overapplied overhead CENTURY 21 ACCOUNTING © Thomson/South-Western LESSON 20-1