Giesting Financial Weekly Update WEEKLY QUOTE "A hunch is

advertisement

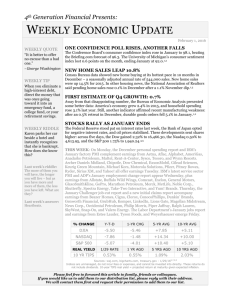

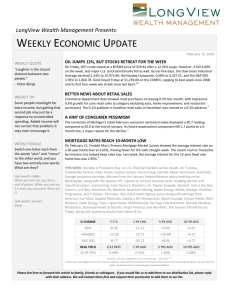

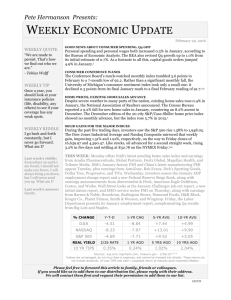

Giesting Financial Weekly Update February 22, 2016 WEEKLY QUOTE A MESSAGE FROM MARK… "A hunch is creativity trying to tell you something." - Frank Capra With many families filling out FAFSA forms this time of year, and high school students scheduling campus visits over spring break, I get a lot of questions from parents and grandparents about the best ways to fund college expenses – while still saving for retirement. With that in mind, I think you’ll find the attached article, “Building a College Fund”, very interesting. It provides an overview of the things to consider as you review funding options for your child's or grandchild’s college education. WEEKLY TIP Every two years, you should check to see if your retirement strategy needs adjusting in light of life events and changing goals. WEEKLY RIDDLE Everywhere on earth I am found, I should not make you frown, I will always bring you down, but I will never send you up. What am I? WALL STREET HAS ITS BEST WEEK OF 2016 Across four trading days, the S&P 500 rose 2.84% and the Dow Jones Industrial Average, 2.62%; the Nasdaq Composite beat them both with a 3.85% gain. The Friday settlements: Dow Jones, 16,391.99; Nasdaq, 4,504.43; S&P, 1,917.78. WTI crude settled at $29.64 on the NYMEX Friday and gold at $1,230.80 on the COMEX. 1 WHOLESALE PRICES OUTPACE CONSUMER PRICES Core producer prices rose o.4% in January according to the Bureau of Labor Statistics, with the headline Producer Price Index up 0.1%. The Consumer Price Index was flat in January, with the core index up 0.3%; core consumer prices rose 2.2% across the 12 months ending in January. 2 BUILDERS STARTED FEWER PROJECTS LAST MONTH January saw a 0.2% decline in building permits and a 3.8% dip in housing starts. Permits are still outpacing starts, so both Commerce Department indicators could see gains in February. 3 Last week's riddle: Switch one letter each from the words "plus" and "minus" to the other word, and you have two entirely new words. What are they? Last week's answer: Plum and sinus. INDUSTRIAL OUTPUT IMPROVES 0.9% IN JANUARY This was the largest monthly increase reported by the Federal Reserve since November 2014, and it included a 0.5% advance for the manufacturing sector. Prior to January, five months had passed without a gain in industrial production. 3 THIS WEEK: Wall Street looks at earnings from Allergan, Dillard's, Fitbit, Motorola Solutions, and Republic Airways on Monday. January existing home sales figures, the December Case-Shiller home price index, and the Conference Board consumer confidence index appear Tuesday, plus earnings from Avis Budget Group, Cablevision, Cracker Barrel, Dollar Tree, HealthSouth, Home Depot, J.M. Smucker, Macy's, Office Depot, Papa John's, Popeye's, and Toll Bros. Wednesday sees January new home sales numbers and earnings from Chesapeake Energy, Etsy, L Brands, La Quinta Holdings, Lowe's, NetEase, Sunoco, Target, TJX, and Transocean. Thursday offers reports on initial claims and January capital goods orders, plus earnings from AMC Networks, Baidu, Best Buy, Campbell Soup, Domino's, Gap, Health Net, Healthways, Icahn Enterprises, iHeart Media, Ingram Micro, Intuit, Kohl's, Kraft Heinz, Live Nation, Monster Beverage, Pinnacle Foods, Sears Holdings, Palo Alto Networks, and Sprouts. January personal spending figures, the second estimate of Q4 GDP, and the University of Michigan's final January consumer sentiment index arrive Friday, plus earnings from Berkshire Hathaway, Foot Locker, Hilton Worldwide Holdings, J.C. Penney, KBR, and Sempra Energy. % CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG DJIA NASDAQ S&P 500 -5.93 -10.04 -6.17 -8.86 -8.53 -8.57 +6.46 +11.79 +8.56 +4.81 +9.91 +4.95 REAL YIELD 2/19 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO 10 YR TIPS 0.50% 0.37% 1.25% 2.03% Sources: wsj.com, bigcharts.com, treasury.gov - 2/19/164,5,6,7 Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation. Please feel free to forward this article to family, friends or colleagues. If you would like us to add them to our distribution list, please reply with their address. We will contact them first and request their permission to add them to our list. We’re here to serve – please let us know how we may best serve you – and feel free to refer a friend. This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the "NYSE") and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. Citations. 1 - cnbc.com/2016/02/19/us-markets.html [2/19/16] 2 - investing.com/economic-calendar/ [2/19/16] 3 - reuters.com/article/us-usa-economy-idUSKCN0VQ1NV [2/17/16] 4 - markets.wsj.com/us [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F19%2F15&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F19%2F15&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F19%2F15&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F18%2F11&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F18%2F11&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F18%2F11&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F21%2F06&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F21%2F06&x=0&y=0 [2/19/16] 5 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F21%2F06&x=0&y=0 [2/19/16] 6 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/19/16] 7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/19/16] Mark Giesting, ChFC Owner and Principal Financial Adviser 4A East Boehringer St., Batesville, IN 47006 Phone: 812-933-1791 mgiesting@giestingfinancial.com www.giestingfinancial.com DISCLAIMER: This e-mail and any files transmitted with it are private, confidential and solely for the use of the intended recipient. It may contain material that is legally privileged, proprietary or subject to copyright belonging to the sender or its related parties, and it may be subject to protection under federal or state law. If you are not the intended recipient, you are notified that any use, distribution or copying of the message is strictly prohibited and may subject you to criminal or civil penalties. If you received this transmission in error, please contact the sender immediately by replying to this e-mail and delete the material from any computer. Please do not leave trade instructions via email as we cannot honor them. DISCLOSURE: Giesting Financial is not owned or controlled by the cfd Companies. Adviser not licensed in all States. Advisory Services are Provided through Creative Financial Designs, Inc., a Registered Investment Adviser, and Securities are Offered through cfd Investments, Inc., a Registered Broker/Dealer, Member FINRA & SIPC, 2704 South Goyer Road, Kokomo, IN 46902 765.453.9600 If you wish to be removed from our mailing list please click here. Advisory Services are offered through Creative Financial Designs, Inc., a Registered Investment Adviser, and Securities are offered through cfd Investments, Inc., a Registered Broker/Dealer, Member FINRA & SIPC, 2704 S. Goyer Rd., Kokomo, IN 46902. 765-453-9600. This email message may contain confidential information, and is intended only for the use of the persons to whom it was sent. If this message was received in error, please destroy the message and let us know about the error in transmission. The cfd companies cannot accept trade instructions sent through this email system.