(“This is Belk”).

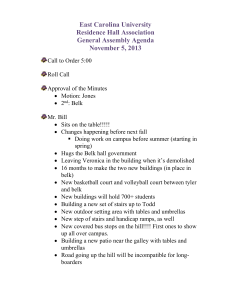

advertisement