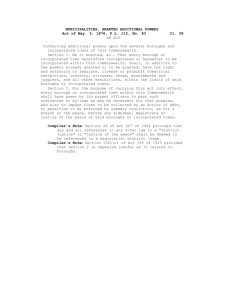

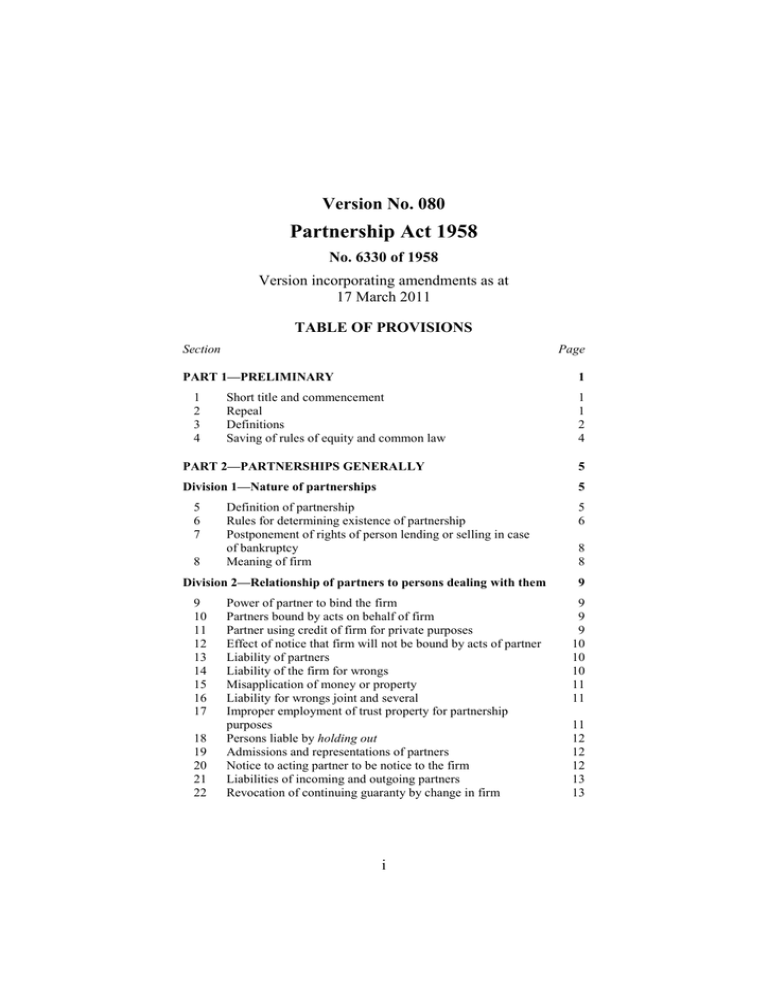

Partnership Act 1958

advertisement