Job Costing

advertisement

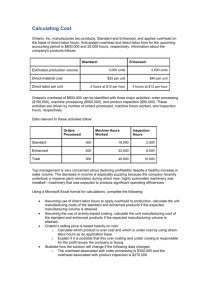

CHAPTER 3 Job Costing Dr. Hisham Madi 1-1 Basic Costing Terminology Because of the complexity of most manufacturing operations, companies need to establish a system to track costs so they can properly determine product costs Cost objects are anything for which a measurement of cost is desired Direct costs of a cost object are costs that can be traced to that cost object in an economically feasible way Indirect costs of a cost object are costs that cannot be traced in an economically feasible way 1-2 Basic Costing Terminology Cost pool—a grouping of individual indirect cost items Cost-allocation base—a systematic way to link an indirect cost or group of indirect costs to cost objects For example, let’s say that direct labor hours cause indirect costs to change. Accordingly, direct labor hours will be used to distribute or allocate costs among objects based on their usage of that cost driver 1-3 Costing Systems Management uses two basic types of costing systems to assign costs to products or services A job-costing system, or a job-order system, is used by a company that makes a distinct product or service called a job. The product or service is often a single unit. The job is frequently the cost object. Costs are accumulated separately for each job or service. A process-costing system is used by a company that makes a large number of identical products. Costs are accumulated by department and divided by the number of units produced to determine the cost per unit. 1-4 Costing Approaches Actual costing—allocates: Indirect costs based on the actual indirect-cost rates times the actual activity consumption Normal Costing—allocates: Indirect costs based on the budgeted indirect-cost rates times the actual activity consumption Both methods allocate direct costs to a cost object the same way: by using actual direct-cost rates times actual consumption 1-5 Costing Approaches Summarized 1-6 Seven-Step Job Costing A seven-step approach is used to assign costs to an individual job Step 1: Identify the Job that Is the Chosen Cost Object The source documents (original records that support journal entries in an accounting system) such as the job-cost sheet, the material-requisition record, and the labor-time record assist managers in gathering information about the costs incurred on a job. A job-cost record, also called a job-cost sheet, records and accumulates all the costs assigned to a specific job, starting when work begins 1-7 Step 2: Identify the Direct Costs of the Job. Most manufacturing operations have two direct cost categories—direct materials and direct manufacturing labor. Direct materials, materials-requisition record, which contains information about the cost of direct materials used on a specific job Direct manufacturing labor: labor-time sheet, which contains information about the amount of labor time used for a specific job in a specific department Sample Job Cost Source Documents 1-8 Seven-Step Job Costing Step 3: Select the Cost-Allocation Bases to Use for Allocating Indirect Costs to the Job. Because these costs cannot be traced to the job, they must be allocated in a systematic manner. Step 4: Identify the Indirect Costs Associated with Each Cost-Allocation Base. Hopefully, a cause-and-effect relationship can be established between the costs incurred and the cost-allocation base (or cost driver) Step 5: Compute the Rate per Unit of Each Cost-Allocation Base Used to Allocate Indirect Costs to the Job. Budgeted manufacturing overhead rate = Budgeted manufacturing overhead costs/Budgeted total quantity of cost allocation base. Step 6: Compute the Indirect Costs Allocated to the Job. Multiply the actual quantity of each different allocation base by the indirect cost rate for each allocation base 1-9 Seven-Step Job Costing Step 7: Compute the Total Cost of the Job by Adding All Direct and Indirect Costs Assigned to the Job. 1-10 Example; Job Costing Step 1: Identify the Job That Is the Chosen Cost Object.The cost object in the Robinson Company example is Job WPP 298, manufacturing a paper-making machine for Western Pulp and Paper. Step 2: Identify the Direct Costs of the Job.Robinson identifies two direct-manufacturing cost categories: direct materials and direct manufacturing labor. Step 3: Select the Cost-Allocation Bases to Use for Allocating Indirect Costs to the Job Robinson, however, chooses direct manufacturing labor-hours as the sole allocation base for linking all indirect manufacturing costs to jobs 1-11 Example; Job Costing Step 4: Identify the Indirect Costs Associated with Each CostAllocation Base. Because Robinson believes that a single costallocation base—direct manufacturing labor-hours—can be used to allocate indirect manufacturing costs to jobs, Robinson creates a single cost pool called manufacturing overhead costs. In 2011, budgeted manufacturing overhead costs total $1,120,000 Step 5: Compute the Rate per Unit of Each Cost-Allocation Base Used to Allocate Indirect Costs to the Job 1-12 Example; Job Costing Step 6: Compute the Indirect Costs Allocated to the Job. Manufacturing overhead costs allocated to WPP 298 equal $3,520 ($40 per direct manufacturing labor-hour × 88 hours) Step 7: Compute the Total Cost of the Job by Adding All Direct and Indirect Costs Assigned to the Job 1-13 Job Costing 1-14 Job Costing Overview 1-15 Actual Costing The difference between costing a job with normal costing and actual costing is that normal costing uses budgeted indirect-cost rates, whereas actual costing uses actual indirect-cost rates calculated annually at the end of the year The following actual data for 2011 are for Robinson’s manufacturing operations: 1-16 Actual Costing Step 1: identifies WPP 298 as the cost object; Step 2: calculates actual direct material costs of $4,606, and actual direct manufacturing labor costs of $1,579. Step 3: Robinson uses a single cost-allocation base, direct manufacturing labor-hours, to allocate all manufacturing overhead costs to jobs. Step 4: Robinson groups all actual indirect manufacturing costs of $1,215,000 into a single manufacturing overhead cost pool Step 5: the actual indirect-cost rate 1-17 Actual Costing Step 6; under an actual-costing system, 1-18 Actual Costing Step 7: the cost of the job under actual costing is $10,145, calculated as follows 1-19 Flow of Costs Illustrated 1-20 Journal Entries Journal entries are made at each step of the production process. The purpose is to have the accounting system closely reflect the actual state of the business, its inventories, and its production processes. All product costs are accumulated in the work-in-process control account. Direct materials used Direct labor incurred Factory overhead allocated or applied Actual indirect costs (overhead) are accumulated in the manufacturing overhead control account. 1-21 Journal Entries 1-22 Journal Entries 1-23 Journal Entries 1-24 General Ledger in a Job Cost Environment 1-25 Subsidiary Ledger for Materials, Labor, and Manufacturing Department Overhead 1-26 Subsidiary Ledger for Individual Jobs 1-27 Accounting for Overhead Recall that two different overhead accounts were used in the preceding journal entries: Manufacturing overhead control was debited for the actual overhead costs incurred Manufacturing overhead allocated was credited for estimated (budgeted) overhead applied to production through the workin-process account. 1-28 Accounting for Overhead Actual costs will almost never Accordingly, an imbalance situation overhead accounts. If Overhead Control > Overhead Underallocated Overhead If Overhead Control < Overhead Overallocated Overhead equal budgeted costs. exists between the two Allocated, this is called Allocated, this is called This difference will be eliminated in the end-of-period adjusting entry process, using one of three possible methods 1-29 Three Methods for Adjusting Over/Underapplied Overhead Adjusted Allocation-Rate Approach First, the actual manufacturing overhead rate is computed at the end of the fiscal year. Then, the manufacturing overhead costs allocated to every job during the year are recomputed using the actual manufacturing overhead rate Finally, end-of-year closing entries are made 1-30 Three Methods for Adjusting Over/Underapplied Overhead Proration Approach spreads underallocated overhead or overallocated overhead among ending work-in-process inventory, finished goods inventory, and cost of goods sold Assume the following actual results for Robinson Company in 2011: 1-31 Three Methods for Adjusting Over/Underapplied Overhead 1-32 Three Methods for Adjusting Over/Underapplied Overhead The journal entry to record this proration is as follows: If manufacturing overhead had been overallocated, the Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold accounts would be decreased (credited) instead of increased (debited) 1-33 Three Methods for Adjusting Over/Underapplied Overhead Some companies use the proration approach but base it on the ending balances of Work- in- Process Control, Finished Goods Control, and Cost of Goods Sold before proration 1-34 Three Methods for Adjusting Over/Underapplied Overhead Write-Off to Cost of Goods Sold Approach Under this approach, the total under- or overallocated manufacturing overhead is included in this year’s Cost of Goods Sold 1-35 Choosing among approaches Which of these three approaches is the best one to use? In making this decision, managers should be guided by the causes for underallocation or overallocation and the purpose of the adjustment 1-36 Variations from Normal Costing: A Service-Sector Example Job costing is also very useful in service industries such as accounting and consulting firms, advertising agencies, auto repair shops, and hospitals In an accounting firm, each audit is a job. direct labor costs of the professional staff—audit partners, audit managers, and audit staff—are traced to individual jobs. The costs of secretarial support, office staff, rent, and depreciation of furniture and equipment are indirect costs because these costs cannot be traced to jobs in an economically feasible way 1-37 Variations from Normal Costing: A Service-Sector Example actual direct-labor costs—the largest component of total costs— can be difficult to trace to jobs as they are completed the actual direct-labor costs may include bonuses that become known only at the end of the year (a numerator reason) the hours worked each period might vary significantly depending on the number of working days each month and the demand from clients (a denominator reason). A company will use budgeted rates for some direct costs and budgeted rates for indirect costs. All budgeted rates are calculated at the start of the fiscal year 1-38 Variations from Normal Costing: A Service-Sector Example For 2011, Donahue budgets total direct-labor costs $14,400,000, total indirect costs of $12,960,000, and total direct (professional) labor-hours of 288,000. In this case, 1-39 of Variations from Normal Costing: A Service-Sector Example Suppose that in March 2011, an audit of Hanley Transport, a client of Donahue, uses 800 direct labor-hours. Donahue calculates the direct-labor costs of the Hanley Transport audit by multiplying the budgeted direct-labor cost rate, $50 per direct labor-hour, by 800, the actual quantity of direct labor-hours The indirect costs allocated to the Hanley Transport audit are determined by multiplying the budgeted indirect-cost rate (90%) by the direct-labor costs assigned to the job ($40,000) 1-40 1-41