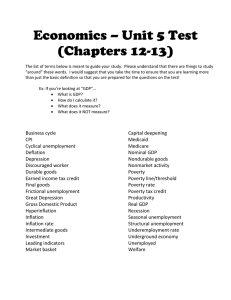

The welfare state as an efficiency device

advertisement

Social safety nets in (the) crisis Anti-poverty policies in Greece 2010-2015 Manos Matsaganis Associate Professor Athens University of Economics and Business Lunch debate European Trade Union Institute Brussels (9 February 2016) The Greek crisis and austerity in brief Greece entered into a bailout agreement with the EU, the ECB and the IMF (May 2010), in return for massive spending cuts and tax hikes, and a programme of structural reforms. The bailout agreement has (so far) enabled Greece to remain part of the Euro area – at the cost of a severe recession, widespread misery, and political instability. Other ‘programme countries’ such as Latvia (January 2012), Ireland (December 2013) and Portugal (June 2014) have now successfully exited their programme. But Greece’s attempts at an early exit (October 2014) under the previous conservative-socialist coalition government, and renegotiation (FebruaryJuly 2015) under the new radical left-nationalist right coalition government backfired badly. A new three-year programme was signed in August 2015. the economy GDP contraction In recent years the Greek economy has shrunk enormously: by 2014 GDP had fallen 26.0% below its 2007 level. This only compares with the US Great Depression (approx. -30% in 1929-1933). In other countries badly hit by the crisis, GDP fell less and/or recovered faster (-6.8% in Portugal, -7.5% in Latvia in 2007-2014). Gross domestic product at market prices, in real terms (2007=100). Source: Eurostat. the economy divergence In 2000 GDP per head in Greece was at 74% of the EU-15 average. At the pre-crisis peak (in 2009) relative income had converged to 86%. By 2015 Greece had fallen back to 64% of the West European average. Gross domestic product at current market prices per head of population (PPS: EU-15 = 100). Source: AMECO Eurostat. the labour market employment Employment had always been below the EU average. But in recent years it fell precipitously: from 61.4% in 2008 to as low as 48.8% 2013. This, in effect, undid the progress of the previous two decades and more (the employment rate in 1992 had been 53.7%). Employment rate (%). Source: Eurostat. the labour market unemployment GDP contraction caused unemployment to rise, same as everywhere. Except that in Greece it rose more sharply, peaked later and is now the highest in the EU. In September 2015, seasonally adjusted unemployment stood at 24.6%. Unemployed rate (%). Source: Eurostat. the labour market earnings Real wages also fell, both as a result of the recession (reduced demand for labour) … … and in the context of ‘internal devaluation’ (policy-driven compression of wages via labour market deregulation). The decline in gross earnings in 2008-2013 was estimated at 24.6% in Greece (vs. 12.3% in Portugal). Source: Myant & Piasna (2014) ‘Why have some countries become more unemployed than others?’ ETUI Working Paper 7 2014. the labour market earnings growth by category In Greece, earnings growth in 2000-2009 was undone by earnings decline in 2010-2014. On average, earnings in 2014 were 8.4% below their 2000 level. Trends differed by category: workers in public utilities had been awarded fabulous pay rises in the past (and still remained 3.4% above the 2000 level). Source: Bank of Greece. the labour market internal devaluation Recent labour market reforms in Greece included a legislated cut in the minimum wage (February 2012): -22% in nominal terms (-32% for young workers) Also, sweeping deregulation of labour market institutions: collective bargaining employment protection legislation etc. Changes especially affected those newly hired and/or young workers: administrative data from IKA (the social insurance agency for private sector employees) indicate that in 2010-2014 median reported earnings of all insured workers fell by 18.3% in real terms. real median earnings were cut less (by -9.6%) for those who kept their job with the same employer. for those aged below 30 the decline was -34.8% (newly-hired workers: -34.2%). poverty three indicators We estimate poverty effects in 2011-2015, using EUROMOD, in terms of three different indicators. The standard poverty rate shows the proportion of the population with a net equivalent disposable income below 60% of median. 2015 threshold: €824 per month for a couple with two children The second indicator ‘anchors’ the poverty line at 60% of the 2009 median, adjusted for inflation. 2015 threshold: €1,271 per month for a couple with two children The third indicator measures the proportion of population who are unable to purchase the cheapest basket of goods consistent with dignified living without dissaving, borrowing, or getting into debt. 2015 threshold: €640 per month for a couple with two children living in Athens, in owner-occupied housing Source: PARU estimates. poverty three indicators In 2015, our estimated headcount rate was: 23.2% (relative poverty) 45.3% (anchored threshold) 15.2% (extreme poverty) Source: PARU estimates. poverty headcount rates (2015) poverty thresholds population share relative anchored extreme 100.0% 23.3% 45.3% 15.2% men women 49.1% 50.9% 23.5% 23.1% 45.4% 45.3% 15.9% 14.6% 0-17 18-29 30-44 45-64 65+ 17.5% 13.5% 23.0% 26.5% 19.5% 24.3% 34.7% 23.1% 25.6% 11.6% 46.3% 58.6% 42.8% 46.3% 37.0% 18.0% 24.6% 16.6% 16.7% 2.7% unemployed employee (public sector or banking) employee (private sector excl. banking) liberal profession own account worker farmer pensioner inactive, student, other 8.3% 11.8% 23.7% 3.3% 10.6% 6.7% 32.9% 2.6% 81.2% 1.5% 17.9% 7.8% 32.1% 38.7% 13.3% 55.3% 91.0% 10.2% 45.4% 13.2% 54.3% 66.3% 39.8% 77.6% 70.8% 0.7% 12.2% 4.9% 24.1% 18.3% 3.8% 43.7% all households gender age household head is Source: PARU estimates. poverty in old age We find that elderly poverty rates are well below average … (although with an important caveat as regards extreme poverty) Source: PARU estimates. child poverty … while child poverty rates are higher than for the general population. Source: PARU estimates. poverty public sector workers Households whose main earner was a public sector employee (a politically influential, highly-unionized category) seem to have done rather well … Source: PARU estimates. poverty private sector workers … certainly compared to families whose main earner worked in a private firm (where union density is below 10%) … Source: PARU estimates. poverty unemployed workers … while families whose head is jobless now experience alarming poverty rates. The ‘New Social Question’? Source: PARU estimates. policy responses an obvious strategy Given the above, a pretty obvious anti-poverty strategy suggests itself: protect children support the incomes of the unemployed tackle extreme poverty We know this strategy was not pursued very effectively because (extreme) poverty rates for the unemployed, children and others remain very high to this date. Let us see what happened (and why). policy responses the core business of the welfare state? In principle, a well-designed system of social protection should be able to mitigate the social effects of an economic crisis. “These are precisely the kinds of emergencies that welfare state programmes and institutions are designed to deal with, so that when a financial crisis turns up we have routine mechanisms […] for coping with its consequences. Long lines of the unemployed caused by economic crises are the core business of the welfare state” Source: Castles F.G. (2010) ‘Black swans and elephants on the move: the impact of emergencies on the welfare state’. Journal of European Social Policy. Granted, the magnitude of the Greek crisis would have put to a severe test any welfare state, even the most developed/prepared. But the current configuration of the Greek welfare state (strongly supported by the unions) was particularly unfit for the challenge. policy responses anti-poverty effectiveness policy responses anti-poverty effectiveness (cont’d) In Greece, most people in extreme poverty are not in receipt of income support. This is not the case in Portugal nor Latvia. Source: Matsaganis M., Ozdemir E. & Ward T. (2013) The coverage rate of social benefits. Research Note 9/2013. Social Situation Observatory, European Commission. policy responses Greek welfare unfit for the crisis? Pre-crisis Disappointing social effectiveness … gross inefficiencies in core programmes (pensions and health) remained income support and social care to the poor and other vulnerable groups neglected serious gaps in the social safety net (no guaranteed minimum income) … in spite of rapidly increasing social expenditure faster than GDP faster than the EU average policy responses Greek welfare unfit for the crisis (cont’d) Post-crisis The welfare state failed to act as an ‘automatic stabiliser’ as the deep recession increased the demand for social protection … … the austerity reduced its supply The political economy of austerity prevented the reallocation of social spending that was needed to soften the impact of the crisis on the most vulnerable the poor the unemployed (and their families) policy responses social expenditure (% GDP) In terms of social spending as a share of GDP, things look rather reassuring. Since 2006 (i.e. well before the ‘Greek crisis’), social expenditure has risen very fast, and has continued to do so post-2009. Greece now spends more than the EU-15 (much more than Portugal). Warning: Eurostat figures out of date (2012) Source: Eurostat. policy responses social expenditure (per head) But in terms of euros spent per inhabitant (in real terms, 2005 prices), social expenditure in Greece remains well below the EU-15 figure. What is more: social spending is actually falling since 2009 (which is when the crisis hit the country). Source: Eurostat. policy responses pension spending (per head) In contrast, expenditure on pensions (per head of population, in 2005 prices) has continued to increase … Source: Eurostat policy responses pension spending (% GDP) … while as a share of GDP, pension spending in Greece seems to be growing out of control sustainability concerns? crowding-out effects (vis-à-vis other social benefits)? Source: Eurostat; Ministry of Labour policy responses by programme Let us take a closer look at: pensions unemployment benefits other anti-poverty policies policy responses pension benefit cuts (2010-2014) Pensions were cut significantly under austerity. Higher pensions were hit more … … even though low-income pensioners were also affected. level of monthly pension (in 2010) annual pension income in real terms (€) 2010 2014 change (%) €600 pcm 8,400 7,069 -15.8% €800 pcm 11,200 9,079 -18.9% €1.300 pcm 18,200 13,898 -23.6% €2.200 pcm 30,800 19,611 -36.3% €2.500 pcm (age >65) 35,000 20,500 -41.4% €2.500 pcm (age <55) 35,000 19,059 -45.5% Source: Ministry of Labour; own calculations policy responses effective retirement age (March-May 2015) Nevertheless, the number of pensioners kept growing (to 2.7m) (… as the number of workers continued to shrink to 3.6m) Retiring at a tender age continued to be easy 25% of all retirees in spring 2015 were aged below 55 (in the public sector: 34%) all retirees public sector age at retirement no. % no. % <25 1,080 4% 219 4% 26-50 1,935 7% 532 9% 51-55 4,108 14% 1,319 22% 56-61 8,338 29% 2,135 36% 62-67 5,789 20% 912 15% 68-73 3,092 11% 292 5% >73 4,038 14% 601 10% unknown 16 0% 0 0% total 28,396 100% 6,010 100% Source: Ministry of Labour; own calculations policy responses unemployment benefit receipt (2010-2015) Meanwhile, other social protection programmes fared less well. While the number of unemployed workers sky-rocketed, the number of recipients of unemployment insurance benefit (the main income support scheme in the event of job loss) actually fell. Source: ElStat and ΟΑΕΔ (Public Employment Service). policy responses unemployment benefit coverage rate (2010-2015) As a result, the coverage rate of unemployment insurance benefit fell to 9.5% in 2015. Source: ElStat and ΟΑΕΔ (Public Employment Service). policy responses unemployment benefit coverage rate (2010-2015) As a result, the coverage rate of unemployment insurance benefit fell to 9.5% in 2015. The coverage rate went up to 11.8% if two minor unemployment benefits (for the longterm unemployed, and for those formerly self-employed) are also included. Source: ElStat and ΟΑΕΔ (Public Employment Service). policy responses retrenchment and (some) expansion (2013-2014) On the whole, the austerity programmes entailed massive fiscal consolidation, especially in the context of the 2013-2014 Spending Review: 5% of GDP in 2013 and 2.25% in 2014 Social protection was identified as a key source of savings: cuts in social spending: 45% of total savings increases in social contributions: another 5% Some (limited) scope was left for policies to strengthen the social safety net Ratio of contractionary vs. expansionary measures in fiscal terms: approx. 4:1 policy responses expansionary policies (2013-2014) Policies to strengthen the social safety net unemployment assistance eligibility conditions broadened in 2012/2014 … but number of recipients plummeted in 2015 minimum income pilot was to start 1 January 2014 / launched in November 2014 / lasted 6 months 13 municipalities participated (5.6% of the country’s total population) cash transfer via fiscal system / no social workers involved / no activation child benefits comprehensive means-tested scheme introduced in 2013 social dividend paid as a lump sum in 2014 policy responses single child benefit Until recently, the majority of families received little or no support, even when they lived in poverty. In contrast, child benefits for larger families, and family allowances for core workers, were rather generous. From January 2013, a noncategorical single child benefit has been introduced on a means-tested basis in place of large family benefits and child tax credits. Unlike most of the programmes it replaced, single child benefit is available from the first child, and for a larger age group (up to 18; or up to 23 if in college; or irrespective of age if disabled). The new benefit, even though welcome, is quite modest: it pays up to €40 per month to families with one child, raised to €245 per month for families with three children (NB: since 2012, the monthly minimum wage is set at €586). The number of recipients is approx. 750,000 families (i.e. 53% of all households with at least one child under 25 years). Spending on the scheme reached 0.33% of GDP in 2013 (in gross terms). policy responses social dividend In 2014, after six consecutive years in recession, the Greek economy registered a small positive growth (GDP up by +0.7%). In view of that, the then (conservative-socialist coalition) government decided to pay a one-off lump-sum ‘social dividend’ to low-income groups to (partially) compensate them for their losses during the crisis and austerity. The social dividend was worth €500 for a single person or €833 for a couple with two children (€647 per receiving household on average). The number of recipients was over 690,000 households (16% of all households). Spending on the scheme amounted to 0.25% of GDP in 2014. In 2015 the scheme was discontinued. policy responses dealing with the ‘humanitarian crisis’ (2015-) The radical left-nationalist right coalition that emerged victorious from the 2015 general election(s) had made a lot of political capital by railing against the (allegedly) Troika-engineered ‘humanitarian crisis’. But those who might have been led to expect that strengthening social safety nets would now be priority were in for disappointment. The new government’s anti-poverty measures were less ambitious even relative to those introduced under the previous government. energy subsidy (max. €40 pcm) rent benefit (worth €160 pcm for a couple with two kids, paid directly to landlords) food card (voucher to purchase food, worth €160 pcm for a couple with two kids) policy responses dealing with the ‘humanitarian crisis’ (cont’d) The total resources set aside for the government’s three new measures amounted to €200m in all (0.11% of GDP) Actual cost turned out to be just below €130m (0.07% of GDP) including the projected cost of 2015 entitlements paid in 2016 Food card accounted for the lion’s share (€114m) The previous government’s discretionary measures – which had been rightly criticized as inadequate – had cost more: €654m (0.36% of GDP) in 2013 €1,135m (0.64% of GDP) in 2014 Moreover, other anti-poverty policies were neglected No action to improve the coverage of unemployment benefits No enthusiasm for continuing the guaranteed minimum income pilot assessing policy responses focus on extreme poverty Arguably more relevant for policy (?) The extreme poverty threshold has recently converged to the relative poverty threshold … 50% of median income in 2013 Poverty thresholds (€ pcm) Source: PARU estimates assessing policy responses focus on extreme poverty (cont’d) … in spite of the fact that our basket of goods is very Spartan. The ‘social participation budget’ for food alone (‘healthy diet & kitchen equipment’) estimated under the EU reference budgets project for a couple with two children in Athens was €915 per month (67% of median in 2015). HBS data show that in Greece poor families with children spent 52.5% of their income on food (in 2012) assessing policy responses focus on extreme poverty (cont’d) … in spite of the fact that our basket of goods is very Spartan. Health care is not part of the basket of basic goods. Health services assumed to be free at the point of use (at least for the poor). We know this is not true: HBS data show that in Greece the poor spent 8.3% of their income on health (in 2012) Eurostat data show that 13.9% of respondents in the bottom income quintile reported unmet need for medical examinations because ‘too expensive’ (in 2013) assessing policy responses three emblematic policies We estimate the effectiveness in reducing (extreme) poverty of three ‘flagship’ policies: single child benefit (2013) social dividend (2014) food card (2015) using the European tax-benefit model EUROMOD in terms of Beckerman’s poverty gap efficiency assessing policy responses Beckerman’s poverty gap efficiency income income line poverty gap efficiency: 𝐴𝐵𝐶 poverty gap Ε poverty threshold F B D 𝐴𝐷𝐹𝐶 C transfer Α households (ranked by income) households below the threshold Source: Beckerman W. (1979) ‘Impact of income-maintenance payments on poverty in Britain, 1975’. Economic Journal. policy responses summing up How did the three ‘flagship’ anti-poverty policies fare? Single child benefit (2013) extreme poverty rate reduced by 0.8 pp. (overall); 1.9 (children) poverty gap efficiency: 8.0% (overall); 17.5% (children) cost: 0.33% of GDP net cost (relative to previous array of family benefits and tax relief): negligible Social dividend (2014) extreme poverty rate reduced by 1.1 pp. (overall); 1.7 (children) poverty gap efficiency: 9.1% (overall); 10.5% (children) cost: 0.25% of GDP Food card (2015) extreme poverty rate reduced by 0.2 pp. (overall); 0.4 (children) poverty gap efficiency: 8.7% (overall); 13.5% (children) cost: 0.07% of GDP concluding remarks taking stock Anti-poverty policy in Greece remains extremely low profile - which is rather impressive for a country having just experienced such a dramatic increase in poverty. Under austerity, total social spending has fallen – except for pensions, which dominate the Greek welfare state even more than they have always done. Policies to strengthen the social safety net were introduced (sometimes at the insistence of the country’s lenders), but they were mostly ‘too little too late’. Large protection gaps still evident too few unemployed workers receive income support (even when they are very poor) Greece still lacks a social assistance scheme of last resort (GMI-type or equivalent). concluding remarks the political economy of austerity The Greek crisis shows that achieving massive fiscal consolidation in a deep recession is not impossible … but is certainly difficult very costly often self-defeating (it can make the recession deeper) Cutting deficits while at the same time strengthening social safety nets is even more demanding … though again not impossible (technically possible, politically rather complicated) For this to happen, someone has to lead in a perfect world: domestic actors would have taken the initiative … … supported by the EU concluding remarks domestic actors In Greece, emphasis on raising living standards and ‘catching up with Europe’ (pre-crisis) has gone hand in hand with a relative indifference towards a more effective anti-poverty policy, broadly shared across the political spectrum This legacy proved durable after the crisis has broken out the socialists (let alone the conservatives) neglected poverty for far too long the radical left has used the rhetoric of general impoverishment and ‘humanitarian crisis’ to justify the status quo Political economy of austerity the poor not influential: voiceless / disenfranchised pensioners / recipients of disability benefits: more powerful lobbies farmers / providers of public services: virtual veto points (middle-class groups: medical / legal / engineering professions) governments like to take the path of least resistance (Greek ones apparently more so …) concluding remarks ‘Social Europe’ But the Greek crisis has also exposed the contradictions of ‘Social Europe’ Bound by the principle of subsidiarity, EU policy actors (especially the European Commission) have for decades attempted to influence national social policy through the Open Method of Coordination and other soft instruments relying on peer review and mutual learning But in the ‘Programme Countries’ it supervised, the European Commission was in an unprecedented position: as part of the EU-ECB-IMF ‘Troika’ of donors, it was able not just to influence, but to dictate national policy Instead of that, its role was limited to issuing periodic invitations to national governments to ‘strengthen social safety nets’ and ‘protect the most vulnerable victims of the crisis’ Governance issues: DG-EMPL sidelined by DG-ECFIN (the Commission sidelined by the IMF?) European Semester excludes ‘Programme Countries’ concluding remarks ‘Social Europe’: theory vs. practice Theory “During economic downturns, eligibility conditions and replacement rates need to cater for the increased rate of job destruction and the stronger need for stabilising incomes, and the duration needs to be adapted in line with the reduced chances of finding a job. Conversely, during recoveries, the unemployment benefit system needs to provide stronger incentives to re-enter the labour market in order to prevent cyclical unemployment from becoming structural.” Employment and Social Developments in Europe Review 2012 (p.210) Practice Eligibility conditions for UI benefit were worsened in 2011, when a ceiling was set on the total duration of separate spells of benefit receipt over a period of four years (ceiling gradually lowered to 400 days since 2014) Furthermore, in the context of sweeping changes concerning the minimum wage, the benefit level paid under unemployment insurance was cut in February 2012, from €454 to €360 per month The interaction of the above changes with pre-existing features of UI benefit has led to a decline of coverage rates from over 40% in 2010 to below 10% in 2015 concluding remarks ‘Social Europe’: the way forward? Change in strategy? A partnership approach – e.g: EU help member states upgrade their minimum income schemes use the 20% quota within existing ESF resources to: strengthen administrative capacity fund activation of minimum income recipients move towards EU automatic stabilizers EU-wide unemployment insurance jointly funded by the EU and member states very much like US unemployment insurance additional slides policy responses publicly-provided services Income losses might have been less painful if the victims of the recession could at least rely on the public provision of health and other vital social services (free of charge – or nearly so - at the point of use). Given the extend of waste and inefficiency before the crisis, it would not have been impossible to cut costs while at the same time maintaining an adequate quantity and quality of service. As it turned out, the opposite has happened: austerity cuts have been largely indiscriminate reforms have been disruptive and/or have raised co-payments most suppliers have reacted to arrears by withholding supplies industrial action has contributed to the general unreliability of public provision some public sector workers have reacted to wage cuts by reducing effort (though most others work more for less) policy responses local provision Local initiatives flourished, partly compensating for central government inaction. School meals In response to reported cases of undernourished children, the Athens Municipal Nursery started to deliver school meals on a daily basis. In 2012-2013, the number of children receiving school meals amounted to over 8% of all children attending the schools concerned, or approx. 2% of the total school population in the City of Athens. Other local councils run a similar though less ambitious service. Soup kitchens Emergency food aid is also provided in soup kitchens run by local councils, the church, and voluntary organizations. In 2014, a survey of 500 persons attending soup kitchens in Athens found that 54% received food for themselves as well as their family, while 37% reported having children. About two thirds of all respondents were actually Greek.