CHAPTER 14 SECTION 1 THE NATIONS SICK ECONOMY

advertisement

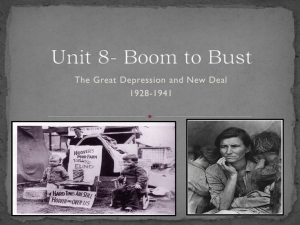

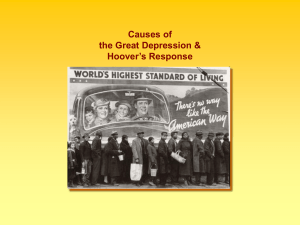

CHAPTER 14 SECTION 1 THE NATIONS SICK ECONOMY MAIN IDEA: As the prosperity of the 1920s ended, severe economic problems gripped the nation. ECONOMIC TROUBLES ON THE HORIZON Superficial prosperity Basic industries barley made profit Coal mining hit hard b/c of new forms of energy (hydroelectric power, fuel oil, natural gas) Automobile industry weakened The number of houses being built fell Farmers Need A Lift Agriculture suffered the most WWI prompted farmers to take out loans for land and equipment Demand fell after war Crop prices decline by 40% or more 1919-1921 annual farm income declined from $10 billion to $4 billion FARMERS McNary-Haugen bill-Price Supports for wheat, corn, cotton and tobacco Price Support-government buys a surplus of goods at a fixed price and sells then on the world market Consumers Have Less Money To Spend Americans buy less because: – Rising prices – stagnant wages – Unbalanced distribution of income – Overbuying on credit LEADS TO…GAP BETWEEN RICH AND POOR – Look at page 466 in your texbook LIVING ON CREDIT CREDIT-an arrangement in which consumes agreed to buy now and pay later for purchases Credit easily available Businesses encouraged Americans to pile up large consumer debt Uneven Distribution of Wealth Rich got richer…poor got poorer In come of wealthiest 1 percent of population rose by 75% 9% increase for Americans as a whole 70% of the nation’s families earned less than 2,500 per year Average person bought one new clothes outfit a year 1 in 10 city homes had an electric refrigerator Hoover Takes the Nation 1928 Election Republican Herbert Hoover vs. Democrat Alfred E. Smith Hoover won with an overwhelming victory Message was clear: Americans were happy with Republican leadership Dreams of Riches in the Stock Market Stock market the most visible sign of a prosperous American Economy Dow Jones Industrial- measure based on the stock prices of 30 representative large firms trading in the NY Stock Exchange Barometer of stock market’s health Stock Market Dow reached a high of 381 points (300 points higher than 5 years earlier) “Bull Market”-a period of rising stock prices 1929 4 million Americans-3% of the nation’s population owned stock Speculation- buying stocks and bonds on the chance of quick profit Buying on Credit- paying a small percentage of a stock’s price as a down payment and borrowing the rest THE STOCK MARKET CRASHES Black Tuesday-October 29-the bottom fell out of the market Shareholders frantically tried to sell before prices plunged lower People who bought stocks on credit were stuck with huge debts Others lost their savings Investors lost about $30 billion by mid-November=how much American spent in WWI FINANCIAL COLAPSE Great Depression-1929-1940 economy plummeted and unemployment skyrocketed Banks failed and people could not get their money because the bank had invested in the stock market 1929-600 banks closed 1932-11,000 of the nation’s 25,000 banks failed Unemployment leaped from 3% to 25% 1 out of every 4 workers was out of a job World Wide Shock Waves Europe suffered from high war debts Great Depression compounded the problems b/c it limited America’s ability to import European goods HAWLEY SMOOT-TARIFF: 1930; Established the highest protective tariff in the U.S. Tariff made unemployment worse Countries retaliated by placing their own tariffs Causes of the Great Depression 1. Tariffs and war debts policies cut down foreign markets 2. A crisis in the farm sector 3. Availability of easy credit 4. Unequal distribution of wealth & income Factors led to a falling demand for consumer goods