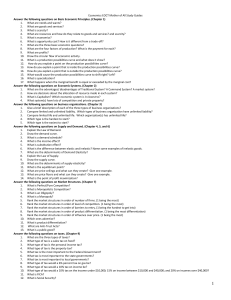

Chapter 13 power point

advertisement

Second Edition Chapter 13 Business Fluctuations and the Dynamic Aggregate Demand-Aggregate Supply Model Chapter Outline The Dynamic Aggregate Demand Curve The Solow Growth Curve Real Shocks Aggregate Demand Shocks and the ShortRun Aggregate Supply Curve Shocks to the Components of Aggregate Demand Understanding the Great Depression: Aggregate Demand Shocks and Real Shocks 2 Introduction Real GDP grew at an average rate of 3.3% over the past 50 years. Growth is not a smooth process. 3 Introduction Business fluctuations – fluctuations in the growth rate of real GDP around its trend growth rate. Recession – a significant, widespread decline in real income and employment. 4 Introduction The unemployment rate increases during a recession: 5 The Dynamic Aggregate Demand Curve Dynamic aggregate demand curve – shows all the combinations of inflation and real growth that are consistent with a specified rate of spending growth, M Recall the quantity theory in dynamic form: M P YR Inflation Real Growth The AD curve – gives combinations of inflation and real growth consistent with a given rate of spending growth, M v . 6 The Dynamic Aggregate Demand Curve Inflation Note: The sum of inflation and real growth will always equal spending growth, which equals money growth plus the growth of velocity. i.e. M v P YR Rate (p) 7% 5% 2% 0% -2% 5% + 0% = 5% 2% + 3% = 5% AD (spending growth = 5%) 0% 3% 5% 7% Real GDP growth rate7 Check The Math If the money supply is growing a 5% per year ( M = 5%) and velocity is stable ( = 0%) then Inflation + Real growth must equal 5%. If Real growth is 3% then inflation must be 2%. 8 Shifts in the Dynamic Aggregate Demand Curve Inflation Rate (p) 1. Increases in spending growth, M and/or 7% shifts the AD curve to the right. 2. Decreases in spending growth, 5% M and/or shifts the AD curve to the left. AD (spending growth = 7%) 2% AD (spending growth = 5%) 0% -2% 0% 3% 5% 7% Real GDP growth rate 9 Check Yourself If we have a dynamic aggregate demand curve with M = 7% and = 0%, what will inflation plus real growth equal? If we find out that real growth is 0%, what is inflation? Increased spending growth shifts the dynamic aggregate demand curve which way: inward or outward? 10 The Solow Growth Curve Solow growth rate – is an economy’s potential growth rate, the rate of economic growth that would occur given the flexible prices and existing real factors of production. Important point – If markets are working well and prices are perfectly flexible, the economy will grow at the potential growth rate. 11 The Solow Growth Curve Inflation Rate (p) Solow growth curve Why is the Solow Growth Curve vertical? • Potential growth does not depend on the inflation rate. 3% Real GDP growth rate 12 Shifts in the Solow Growth Curve Real shock – also called a productivity shock, is any shock that increases or decreases the potential growth rate. • Positive real shock – shifts the Solow growth curve to the right → higher real growth. • Negative real shock – shifts the Solow growth curve to the left → lower real growth. Let’s see how this works. 13 Shifts in the Solow Growth Curve Solow growth curve Inflation Rate (p) Negative shock -1% Positive shock 3% 7% Positive productivity shocks • Shifts the Solow growth curve to the right. Negative productivity shocks • Shifts the Solow growths curve to the left. Real GDP growth rate 14 Putting the AD and the Solow Growth Curve Together Inflation Rate (p) Solow growth curve Negative shock Positive shock 11% 7% 1. A positive shock results in a higher real growth rate, 7%, and lower inflation, 3%. 2. A negative shock results in a lower real growth rate, -1%, and higher inflation, 11%. 3% AD (M v 10%) -1% 3% 7% Real GDP growth rate 15 Real Shocks Changes in economic conditions that increase or decrease the productivity of capital and labor. We will take a closer look at different kinds of real shocks: • Weather • Oil shocks • Other shocks including wars, terrorist attacks, major new regulations, mass strikes, tax changes, and new technologies. 16 Real Shocks Weather • Economies that depend heavily on agriculture are most effected by weather. • India is a good example. • Let’s look at the next diagram and see what we can learn about weather on the overall economy. 17 Real Shocks: Weather Panal A: changes in rainfall have a large impact on agricultural output. Panal B: Prior to 1980 changes in the growth rate of real GDP are closer Related to changes in rainfall than after 1980. Why? 18 Real Shocks: Oil Economy with a large manufacturing sector: a reduction in oil supply is like a decrease in rainfall in an agricultural economy. First oil shock: 1973, Oil embargo • Price of oil more than tripled → higher gas prices. • Higher gas prices reduced the demand for larger cars → costly changes in the auto industry 19 Real Shocks: Oil Sharp increases in oil prices adversely affects many industries including: • Those industries that convert oil into products such as plastics and textiles. • Transport of goods • Industries that depend on people traveling to destinations e.g. the hospitality industry (resorts and hotels), airlines. The cumulative effect of these impacts can result in recessions. 20 Real Shocks: Oil 21 Real Shocks: Oil It is more difficult to eyeball the effect of smaller oil shocks. Statistical analysis can disentangle the effect of oil shocks from other shocks that occur at the same time. The following graph shows that the impact of a 10% increase in the price of oil can impact real GDP growth for two and a half years! 22 Real Shocks: Oil 23 More Shocks Economies are continually hit by many small shocks. Typical year: good shocks outweigh the bad and the economy grows. Bad year: A recession results when: • Economy is hit by a large bad shock, or • More small shocks are negative than positive. The next table summarizes the major shocks that can shift the Solow growth curve 24 Real Shocks 25 Check Yourself Consider the ubiquity of cell phones throughout the world. How can this ubiquity be considered a positive stock? (Hint: Compared with 10 years ago). How would a large and sudden increase in taxes, for example, a tax on energy, shift the Solow growth curve? 26 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve John Maynard Keynes (1883–1946) • The General Theory of Employment, Interest, and Money, 1936. • Wrote in the context of the Great Depression. • Explained that when prices are not perfectly flexible (sticky), deficiencies in aggregate demand could cause recessions. 27 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve Aggregate demand shock – a rapid and unexpected shift in the AD curve (spending growth) • Short-run: Increase in AD is split between increases in inflation and increases in real growth. • Long-run: Increase in AD results only in higher inflation. • Essence of the short-run aggregate supply curve – the short-run increase in output resulting from sticky prices and wages 28 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve SRAS – shows the positive relationship between the inflation rate and real growth when prices and wages are sticky. • Upward sloping – increase in AD will increase both inflation and real growth. • Each SRAS curve is associated with a particular rate of expected inflation E(p). Let’s put everything together to see what happens if the money supply increases unexpectedly. 29 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve Inflation Rate (p) Solow growth curve 1. E(p) = current rate of inflation, 2%. 2. Note: there is a different SRAS for every level of expected inflation, E(p). SRAS (E(p) = 2%) 2% AD (M v 5%) 3% Real GDP growth rate 30 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve Inflation Rate (p) Solow growth curve What if there is an unexpected ↑ in M ? • Short-run: a → b SRAS (E(p) = 2%) b 4% 2% AD (M v 10%) a AD (M v 5%) 3% 6% Real GDP growth rate 31 How a Spending Increase Can Create a Temporary Increase in Growth Increase in spending → higher prices Higher prices encourage producers to increase output. Increased output → overtime and higher hourly wages. Workers are eager to work longer for overtime wages. 32 How a Spending Increase Can Create a Temporary Increase in Growth Eventually workers realize they are working more for lower real wages and demand higher regular wages. Nominal wage confusion – Occurs when workers respond to their nominal wage instead of their real wage. Prices don’t always change quickly due to menu costs. Menu costs – costs of changing prices. 33 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve Inflation Rate (p) Solow growth curve SRAS (E(p) = 7%) What if there is an unexpected ↑ in M ? • Short-run: a → b • Long-run: b → c c 7% SRAS (E(p) = 2%) b 4% 2% AD (M v 10%) a AD (M v 5%) 3% 6% Real GDP growth rate 34 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve Why does the SRAS shift up? • In the long-run, unexpected inflation becomes expected inflation. • An increase in AD → higher expected inflation. • Higher expected inflation causes producers and workers to raise prices and wages in order to hold real incomes and wages constant. • The SRAS shifts up so that the actual inflation rate equals the expected inflation rate. 35 Aggregate Demand Shocks and the Short-Run Aggregate Supply Curve Preview of some dilemmas in policy: • Once c is reached, policy makers may try to increase growth by increasing the expected rate of inflation even higher (above 7%) and may get trapped in an inflationary spiral. • Lowering the inflation rate by reducing the growth rate of money may cause a recession due to prices being more sticky downward. Let’s use the model to see this. 36 A Fall in Aggregate Demand Could Induce a Lengthy Recession Inflation Rate (p) Solow growth curve (SRAS) (E(p) = 7%) 7% 6% a b AD1 (M v 10%) AD2 (M v 5%) -1% 0% 3% Real Growth 37 Check Yourself The Solow Growth curve is vertical, the short-run aggregate supply curve is not. What explains the difference? Why do inflation expectations form the dividing line between the short-run and the long-run? Why does growth in spending lead to an increase in both inflation and real growth in the short-run? Why isn’t this the case in the long-run? 38 Shocks to the Components of Aggregate Demand Changes in are the same as changes in the spending rate, holding M constant. If increases, the growth rate of C, I, G, or NX must increase. We will look at changes in each of these components as a change in . Changes in tend to be temporary (we will explain why later) 39 A Shock to the Growth Rate of Spending Inflation Rate (p) Solow growth curve Fear of consumers → temporary decrease in AD Short-run (SRAS) • Wages are (E(p) = 7%) sticky • Real growth ↓ Long-run • AD returns a • Real growth ↑ 7% 6% b AD1 (M v 10%) AD2 (M v 5%) -1% 0% 3% Real Growth 40 Why Changes in Tend to Be Temporary Changes in differ from changes in M • M can be set permanently at any rate. • Changes in tend to be temporary. Example: • As consumers cut back on purchases, other goods become more important so they stop cutting back • As consumers cut consumption, savings increase and they become more reassured about spending. 41 Why Changes in Tend to Be Temporary Another example • The growth rate of government spending can’t be greater than the growth rate of GDP for too long. The shares of GDP devoted to C, I, G, and NX have been stable over time. Changes C, I, G, and NX do not change the rate of inflation in the long-run. 42 Other AD Shocks Fearand confidence – affect I the same as with C . Wealth shocks • Stock prices tumble: household wealth falls and consumers reduce C . • House prices rise quickly: household wealth increases and consumers increase C . C Changes in Taxes are another shifter of and I The next table provides a good summary 43 Some Factors That Shift the Dynamic Aggregate Demand Curve 44 Check Yourself What always happens to unexpected inflation in the long run? Show what happens to the dynamic aggregate demand curve if consumers fear a recession is coming and cut back on their expenditures. 45 Understanding the Great Depression: Aggregate Demand Shocks and Real Shocks Most catastrophic economic event in the history of the United States (1929-1940). • GDP plummeted by 30 percent. • Unemployment rates exceeded 20 percent. • Stock market fell to less than a third of its initial value. • It was a worldwide event In Germany, it led to a totalitarian regime. • Economic policy was partly at fault. 46 Understanding the Great Depression: Aggregate Demand Shocks and Real Shocks The “Narrative”: • October 1929 – the stock market crashed. Caused in part by tight monetary policy aimed at limiting a stock market bubble. Created a wealth shock – along with the tight monetary policy shifted the AD curve to the left. • 1929-1933 Four waves of bank panics By 1933, 40 percent of all American banks had failed. 47 Understanding the Great Depression: Aggregate Demand Shocks and Real Shocks The “Narrative” (cont.): • 1929 - 1933 investment spending fell by nearly 75 percent. By 1940 the U.S. capital stock was lower than it was in 1930. • 1931 – the Fed allowed the money supply to contract even further. The money supply fell by 1/3. This is the largest negative shock in U.S. history. 48 Understanding the Great Depression: Aggregate Demand Shocks and Real Shocks What should the Fed have done? • Increase the money supply: To drive up output. Increase reserves of banks to stop the panics. 1937-1938—The Fed caused another monetary contraction. • Contracted the economy and unemployment increased. • Prolonged the “Great Depression”. Our model can help understand this narrative. 49 The Great Depression and the Fall in Aggregate Demand Solow growth curve Inflation Rate (p) SRAS 1. C C 0% Sequence: 2. I I 3. M M AD (M v 4%) -10% AD (M v 23%) -13% 4% Real GDP growth rate 50 Real Shocks and the Great Depression Linked to AD shocks in most recessions. We will look at several that played a role in the failure of the economy to recover more quickly: Bank failures: • Reduced the efficiency of financial intermediation • The bridge between savers and investors collapsed. • Small businesses were especially harmed 51 Real Shocks and the Great Depression Policy mistakes • Fed failed to use monetary policy to increase aggregate demand • Policies that tried to combat deflation by reducing aggregate supply NIRA – Businesses were encouraged not to invest in machinery and to raise prices by creating cartels. AAA – Govt. paid farmers to kill animals and plow under crops (Both laws were later declared unconstitutional) 52 Real Shocks and the Great Depression Smoot-Hawley Tariff of 1930 • Intent was to boost demand for domestic goods. • What really happened? Other countries retaliated with tariffs and exports fell. This reduced AD. A tariff is a negative productivity shock (shifts LRAS to the left). • Pushes capital and labor into lower productivity sectors. 53 Real Shocks and the Great Depression The Dust Bowl – natural shock • Severe drought ruined millions of acres of crops. • Hundreds of thousands of people were forced to leave their homes. • Millions of acres of farmland became useless. The Dust Bowl was a real shock 54 Real Shocks and the Great Depression Final thought: • In a good year, any of the real shocks of the Great Depression individually could have been absorbed without major difficulty. Compounded they made a desperate situation even worse. 55 Takeaway We have used the framework of dynamic aggregate-demand and short-run aggregate supply to analyze business fluctuations. Business fluctuations refers to the fact that the growth rate of real GDP is volatile in the short-run. The aggregate demand curve slopes downward and the short-run aggregate supply curve slopes upward. When you combine the AD and the SRAS curves into a single diagram, you can analyze a wide variety of economic scenarios and how they affect the growth rate of the economy. 56 Takeaway Changes in AD can be broken up into changes in M and changes in . Changes in can be broken down into changes in C, I , G, NX. You should know and understand what makes wages and prices sticky. The Great Depression resulted from concentrated and interrelated series of aggregate demand and real shocks. 57 Takeaway The material in this chapter is the central core of macroeconomics. • If you understand where the curves come from and how to shift them… You will have a basic toolbox for analyzing many economic questions. You will be ready to tackle many of the core topics of macroeconomics and business cycles. 58 Second Edition End of Chapter 13