Stephen G. CECCHETTI • Kermit L. SCHOENHOLTZ

Chapter Twenty-One

Output, Inflation, and Monetary Policy

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.

Introduction

• An important part of economic analysis is speculation

about the impact of the new data on monetary policy.

• The FOMC in the U.S. and the Governing Council in

the Euro area always tie their policy actions to current

and expected future economic conditions.

• Traders are trying to out-guess each other to make a

profit by betting on what the next interest rate move

will be.

• The rest of us are just hoping the central bank will

succeed in keeping inflation low and real growth high.

21-2

Introduction

• The objective of this chapter is to understand

fluctuations in inflation and real output and

how central banks use conventional interestrate policy to stabilize them.

• We will develop a macroeconomic model of

fluctuations in the business cycle in which

monetary policy plays a central role.

21-3

Introduction

• We will see that short-run movements in inflation and

output can arise from two sources:

• Shifts in the quantity of aggregate output demanded, or

• Shifts in the quantity of aggregate output supplied.

• We will develop our macroeconomic model in three

steps:

• A description of long-run equilibrium,

• The derivation of the dynamic aggregate demand curve, and

• An introduction of short-run and long-run aggregate supply.

21-4

Introduction

• We will see how modern central banks can use

their policy tools to stabilize short-run

fluctuations in output and inflation.

• Our ultimate objective is to understand how

modern central bankers set interest rates.

• When policymakers change the target interest

rate, what are they reacting to and what is the

impact on the economy?

21-5

Output and Inflation in the Long Run

• The best way to understand fluctuations in the

business cycle is as deviations from some

benchmark or long-run equilibrium level.

• What would the levels of inflation and output

be if nothing unexpected happened for a long

time?

• In the long run, current output equals potential

output and the inflation rate equals the level implied

by the rate of money growth.

21-6

Potential Output

• Potential output is what the economy is capable

of producing when its resources are used at

normal rates.

• In a business, conditions will change over time.

• If you think the increase or decrease in demand for

your product is permanent, you will change the

scale of your factory.

• Technological improvements allow you to increase

production at given levels of capital and labor.

21-7

Potential Output

• Your normal level of output changes over time.

• In the short run you can deviate from normal,

but in the long-run, the normal level itself

changes.

• There is a normal level of production that

defines potential output for the country as well.

• Potential output tends to rise over time.

21-8

Potential Output

• Unexpected events can push current output

away from potential output called an output

gap.

• When current output is above potential, it creates an

expansionary output gap.

• When current output falls below potential, it creates

a recessionary output gap.

• In the long run, current output equals potential

output.

21-9

• What do people mean when they talk about

inflation?

• Inflation means a continually rising price level,

a sustained rise, that continues for a substantial

period.

• Temporary increases in inflation represent onetime adjustments in the price-level.

• A permanent change is a rise or fall in the longrun course of inflation.

21-10

Long-Run Inflation

• We can restate the equation of exchange from

Chapter 20 in terms of potential output, YP.

%M %V %P %Y

In the long run :

%Y %Y

P

%V 0

Therefore :

%P %M %Y P

21-11

Long-Run Inflation

• In the long run, inflation equals money growth

minus growth in potential output.

• While central bankers focus primarily on

controlling short-term nominal interest rates,

they keep an eye on money growth.

• Ultimately long term money growth affects

inflation.

• But in the short-run, over periods even as long

as a few years, fluctuations in velocity weaken

this link.

21-12

Monetary Policy and the Dynamic

Aggregate Demand Curve

• If we want to understand the role of central

bankers in stabilizing the economy, we need to

examine the connection between short-term

interest rates and policymakers’ inflation and

output targets.

• This will also explain how policymakers themselves

think about their role.

21-13

Monetary Policy and the Dynamic

Aggregate Demand Curve

•

•

The goal is to understand the relationship

between inflation and the quantity of aggregate

output demanded by those people that use it.

We will proceed in three steps:

1. Examine the relationship between aggregate

expenditures and the real interest rate;

2. Study how monetary policymakers adjust their

interest-rate instrument in response to change in

inflation; and

3. Put these two together to construct the dynamic

aggregate demand curve that relates output and

inflation.

21-14

Monetary Policy and the Dynamic

Aggregate Demand Curve

1. Aggregate expenditure and the real interest

rate:

•

There is a downward sloping relationship between

the quantity of aggregate expenditure and the real

interest rate.

2. Inflation, the real interest rate, and the

monetary policy reaction curve:

•

There is an upward sloping relationship between

inflation and the real interest rate that we will call

the monetary policy reaction curve.

21-15

Monetary Policy and the Dynamic

Aggregate Demand Curve

3. The dynamic aggregate demand curve:

•

•

•

This is a downward sloping relationship between

inflation and aggregate output.

Economic decisions of households to

consume and of firms to invest depend on the

real interest rate, not the nominal interest rate.

Central banks must therefore influence the

real interest rate.

21-16

Monetary Policy and the Dynamic

Aggregate Demand Curve

• Remember that

i r

e

solving for r :

r i e

• For a central bank that is effective at stabilizing

inflation and output, inflation expectations

adjust slowly

in response to changes in

economic conditions.

• That means that changes in the nominal interest

rate change the real interest rate.

21-17

Monetary Policy and the Dynamic

Aggregate Demand Curve

• We can see this in Figure 21.2.

• This figure plots the nominal federal fund rate

against a measure of the real federal funds rate

using survey data on expected inflation.

• The real interest rate, then, is the level through

which monetary policymakers influence the

real economy.

• In changing real interest rates, they influence

consumption, investment, and other

components of aggregate expenditure.

21-18

The Nominal and Real

Federal Funds Rate

21-19

Aggregate Expenditure and the Real

Interest Rate

• The best way to describe aggregate expenditure

is to start with the national income accounting

identity from principles of economics.

Aggregate

Government

Consumption Investment

Exports Imports

Expenditures

Expenditures

Y C I G (X M )

21-20

Aggregate Expenditure and the Real

Interest Rate

1. Consumption is spending by individuals. It is

2/3 of GDP.

2. Investment is spending by firms for additions

to physical capital. It also includes newly

constructed residential homes and the change

in business inventories. It is 16% of GDP.

3. Government purchases is spending on goods

and services by federal, state, and local

governments. This is 20% of GDP.

4. Net exports equals exports minus imports.

This averages -4.5% of GDP.

21-21

Aggregate Expenditure and the Real

Interest Rate

• We can think of aggregate expenditures as

having two parts:

• Those that are interest rate sensitive, and

• Those that are not.

• Three of the four components of aggregate

expenditure are sensitive to changes in the real

interest rate:

• Consumption, investment and net exports.

• Investment is the most important.

21-22

Aggregate Expenditure and the Real

Interest Rate

• Investment must be profitable for businesses.

• The higher the cost of borrowing, the less

likely that an investment will be profitable.

• Higher interest rates lead to:

• Lower level of business investment and

• Reductions in residential investment.

• For consumption, higher real interest rates

mean

• Higher inflation-adjusted loan payments and

• Increased saving meaning less spending.

21-23

Aggregate Expenditure and the Real

Interest Rate

• For net exports, the story is similar.

• When real interest rates in the U.S. rise, foreigners

increase foreign demand for dollars, causing the

dollar to appreciate.

• The higher value of the dollar makes U.S. exports

more expensive and imports cheaper.

• This means lower net exports.

21-24

Aggregate Expenditure and the Real

Interest Rate

• When real interest rates rise:

• Consumption falls because the reward to saving and

the cost of financing purchases are now higher.

• Investment falls because the cost of financing has

gone up.

• Net exports fall because the domestic currency has

appreciated, making imports cheaper and exports

more expensive.

21-25

Aggregate Expenditure and the Real

Interest Rate

• We can see in Figure 21.3 that a rise in the real

interest rate reduces the level of aggregate

expenditure.

• This leads to a downward sloping aggregate

expenditure (AE) curve.

• However, the AE curve can also shift if things

change that are unrelated to the real interest

rate.

21-26

Aggregate Expenditure and the Real

Interest Rate

21-27

Aggregate Expenditure and the Real

Interest Rate

• Table 21.1 provides a summary of the

relationship between aggregate expenditure and

the real interest rate.

• When economic activity speeds up or slows

down and current output moves above or below

potential output, policymakers can adjust the

real interest rate in an effort to close the

expansionary or recessionary gap.

21-28

Aggregate Expenditure and the Real

Interest Rate

21-29

The Long-Run Real Interest Rate

• What happens to the real interest rate over the

long run?

• There is some level of aggregate expenditure

that is consistent with the normal level of

output toward which the economy moves over

the long run.

• The long run real interest rate equates the level

of aggregate expenditure to the quantity of

potential output.

21-30

The Long-Run Real Interest Rate

21-31

The Long-Run Real Interest Rate

• For example, what happens when G increases?

• The level of aggregate expenditure increases at

every real interest rate.

• This shifts aggregate expenditure curve to the right.

• For the level of aggregate expenditure to remain

equal to potential output, the interest-sensitive

components of aggregate expenditure must fall.

• That means the long-run real interest rate must rise.

21-32

The Long-Run Real Interest Rate

21-33

The Long-Run Real Interest Rate

• What if a change in potential output causes a

change in the long-run real interest rate?

• When the quantity of potential output rises, the

level of aggregate expenditure must rise with it.

• This requires a decline in the real interest rate.

21-34

The Long-Run Real Interest Rate

21-35

The Long-Run Real Interest Rate

In summary:

• When components of aggregate expenditure

that are not sensitive to the real interest rate

rise, the long-run real interest rate rises with

them.

• When potential output rises, the long-run real

interest rate falls.

21-36

• Over short periods of a quarter of a year,

fluctuations in the business cycle means

understanding the changes in investment.

• Figure 21.6 plots the ratio of investment to

GDP over the past 50 years.

• The shaded bars are recessions.

• Changes in investment come from:

• Changes in the real interest rate and

• Changes in expectations about future business

conditions.

21-37

21-38

Inflation, the Real Interest Rate, and

the Monetary Policy Reaction Curve

• When current inflation is high or current output

is running above potential output, central

bankers will set a relatively high policy interest

rate.

• When current inflation is low or current output

is well below potential, they will set a low

policy interest rate.

• While they state their policies in terms of

nominal interest rates, they do so knowing that

changes in the nominal interest rate will

translate into a change in the real interest rate.

21-39

Inflation, the Real Interest Rate, and

the Monetary Policy Reaction Curve

• These changes in the real interest rate influence

the economic decisions of firms and

households.

• We can summarize all of this in the form of a

monetary policy reaction curve that

approximates the behavior of central bankers.

21-40

Deriving the Monetary Policy

Reaction Curve

• We introduced a version of the monetary

policy reaction curve in Chapter 18.

• Higher current inflation requires a policy response

that raises the real interest rate, and

• Lower current inflation requires a policy response

that lowers the real interest rate.

• This mean that the monetary policy reaction

curve slopes upward as shown in Figure 21.7.

21-41

Deriving the Monetary Policy

Reaction Curve

21-42

Deriving the Monetary Policy

Reaction Curve

• The monetary policy reaction curve is set so

that when current inflation equals target

inflation (T), the real interest rate equals the

long-run real interest rate.

r r * when

T

• We know the location of the curve, but what

tells us the slope?

• That depends on policymakers’ objectives.

21-43

Deriving the Monetary Policy

Reaction Curve

• Policymakers who are aggressive in keeping

current inflation near the target will have a

steep monetary policy reaction curve.

• Those who are less concerned will have a

relatively flat monetary policy reaction curve.

21-44

Shifting the Monetary Policy Reaction

Curve

• A movement along the curve is a reaction to a

change in current inflation.

• A shift in the curve represents a change in the

level of the real interest rate at every level of

inflation.

• What shifts the curve are those things we held

constant when we drew the curve:

• Target inflation and long-run real interest rate.

21-45

Shifting the Monetary Policy Reaction

Curve

• A decrease in T shifts the curve to the left.

• The same is true for an increase in r*.

• We can see this in Figure 21.8, Panel A.

• A decline in the long-run real interest rate, r*,

or an increase in the inflation target, T, shift

the monetary policy reaction curve to the right.

• We can see this in Figure 21.8, Panel B.

21-46

Shifting the Monetary Policy Reaction

Curve

21-47

The Monetary Policy Reaction Curve

21-48

Deriving the Dynamic Aggregate

Demand Curve

• We will construct the dynamic aggregate

demand curve:

• This relates inflation and the level of output,

accounting for the fact that monetary policymakers

respond to changes in current inflation by changing

the interest rate.

• Using information from before, we see that

when inflation rises, the quantity of aggregate

output demanded falls.

• The dynamic aggregate demand curve slopes

downward.

21-49

Deriving the Dynamic Aggregate

Demand Curve

• When current inflation rises:

• Monetary policymakers raise the real interest rate,

moving the economy upward along the monetary

policy reaction curve.

• The higher real interest rate reduces the interestsensitive components of aggregate expenditure.

• This causes a fall in the quantity of aggregate output

demanded.

• Therefore, changes in current inflation move

the economy along a downward-sloping

dynamic aggregate demand curve.

21-50

Deriving the Dynamic Aggregate

Demand Curve

21-51

Why the Dynamic Aggregate Demand

Curve Slopes Down

•

There are a number of reasons why increases

in inflation are associated with falling levels

of aggregate output demanded.

1. The higher the rate of inflation for a given

rate of money growth, the lower the level of

real money balances in the economy.

•

•

When P grows faster than M, M/P falls.

Even is monetary policymakers do not change the

real interest rate, the effect on M/P causes the

dynamic aggregate demand curve to slope down.

21-52

Why the Dynamic Aggregate Demand

Curve Slopes Down

2. Higher inflation reduces wealth, which lowers

consumption.

•

•

Inflation means money declines in value.

Inflation is also bad for the stock market.

3. Inflation affects the poor disproportionately

more than the wealthy.

•

The redistribution lowers consumption in the

economy as a whole, reducing the quantity of

aggregate output demanded.

21-53

Why the Dynamic Aggregate Demand

Curve Slopes Down

4. Inflation creates risk.

•

•

The higher the inflation, the greater the risk.

People increase saving, lowering the level of

consumption.

5. Inflation makes foreign goods cheaper in

relation to domestic goods.

•

•

This drives imports up and exports down.

In every case, higher inflation means a lower

level of aggregate output demanded, causing

the dynamic aggregate demand curve to slope

downward.

21-54

• When nominal interest rates are high, chances

are that inflation is high, too.

• If you are living off interest or investment

income, you can be fooled into thinking that

your income is high.

• Spending all of the interest income causes a

gradual decline in the purchasing power of

your savings.

• To maintain real purchasing power of your

income, you can only spend the real return.

21-55

Shifting the Dynamic Aggregate

Demand Curve

• In our derivation, we held constant both the

aggregate expenditure curve and the monetary

policy reaction curve.

• We assumed factors other than the real interest rate

were fixed; and

• That the inflation target and the long run interest

rate were fixed.

• Shifts in any of these will shift the dynamic

aggregate demand curve.

21-56

Shifting the Dynamic Aggregate

Demand Curve

• Any change in the components of aggregate

expenditure will shift the dynamic aggregate

demand curve.

• All of the following increase aggregate

expenditure, there by shifting the dynamic

aggregate demand curve to the right:

• Increased consumer confidence;

• Increased optimism about future business prospects;

• Increased government spending (or decreased

taxes); or

• Increased net exports.

21-57

Shifting the Dynamic Aggregate

Demand Curve

• Whenever the monetary policy reaction curve

shifts, the dynamic aggregate demand curve

shifts, too.

• Consider an increase in the central bank’s

inflation target.

• The monetary policy reaction curve shifts right.

• The real interest rate that policymakers set at every

level of inflation falls.

• The lower real interest rate increases the quantity of

aggregate output demanded at every level of

inflation.

• The dynamic aggregate demand curve shifts right.

21-58

Shifting the Dynamic Aggregate

Demand Curve

21-59

Shifting the Dynamic Aggregate

Demand Curve

• Changes in the long-run real interest rate shift

the dynamic aggregate demand curve.

• Suppose the level of potential output increases.

• The long-run real interest rate must fall.

• This drives up the interest-rate-sensitive

components of aggregate expenditure.

• This shifts the curve to the right, reducing the real

interest rate policymakers set at every level of

inflation.

• This shifts the dynamic aggregate demand curve

right.

21-60

Shifting the Dynamic Aggregate

Demand Curve

• Any shift in the monetary policy reaction curve

shifts the dynamic aggregate demand curve in

the same direction.

• Expansionary monetary policy shifts the dynamic

aggregate demand curve to the right.

• Contractionary monetary policy shifts the dynamic

aggregate demand curve to the left.

21-61

Dynamic Aggregate Demand Curve:

Summary

21-62

Aggregate Supply

• The aggregate supply (AS) curve tells us where along

the dynamic aggregate demand curve the economy

ends up.

• There are short-run and long-run versions of the AS

curve.

• When combined with the dynamic aggregate demand

curve, the short-run AS curve tells us where the

economy settles at any particular time.

• The long-run curve with dynamic aggregate demand,

tells us the levels of inflation and the quantity of output

that the economy is moving toward in the long term.

21-63

Short-Run Aggregate Supply

• The short-run AS curve is the upward-sloping

relationship between current inflation and the

quantity of output.

• In the short term, production costs don’t

change much, so when product prices rise,

firms increase supply in order to take

advantage.

• In the short run, higher inflation elicits more

aggregate output supplied by the firms that

produce it.

21-64

Short-Run Aggregate Supply

21-65

Shifts in the Short Run Aggregate

Supply Curve

•

•

When production costs change, the short-run

AS curve shifts.

This can happen for any of three reasons:

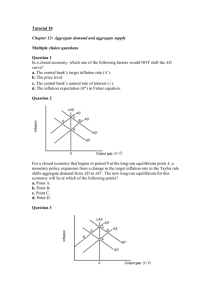

1. Deviations of current output from potential output.

2. Changes in expectations of future inflation.

3. Factors that drive production costs up or down.

21-66

Shifts in the Short Run Aggregate

Supply Curve

• When current output falls below potential

output, we have a recessionary output gap.

• Firms raise prices and wages by less than they did

at potential output.

• Production costs will rise more slowly so inflation

falls.

• When current output is above potential output,

we have an expansionary gap.

• Production costs will rise more quickly so inflation

increases.

21-67

Shifts in the Short Run Aggregate

Supply Curve

• Changes in inflation expectations are

analogous to changes in production costs.

• An increase in expected inflation increases

production costs lowering production at every level

of current inflation.

• This shifts the short-run AS curve to the left.

• Changes in the prices of raw materials, as well

as other external factors that change production

cists, shift the short-run AS curve:

• An increase in the price of oil, increase in labor

prices from higher payroll taxes, increased health

care costs, etc.

21-68

Shifts in the Short Run Aggregate

Supply Curve

21-69

Shifts in the Short Run Aggregate

Supply Curve

21-70

• Data show that inflation responds to the output

gap.

• Figure 21.13 plots changes in the inflation rate

against the output gap, lagged six quarters from

1988 to 2009.

• Inflation generally falls with a lag when there

is a recessionary output gap and rises when

there is an expansionary gap.

21-71

21-72

The Long-Run Aggregate Supply

Curve

• In the long-run,

• Current output must equal potential output, and

• Inflation must be determined by monetary policy.

• That means in the long run, output and

inflation are unrelated and the long-run

aggregate supply curve is vertical at the point

where current output equals potential output.

21-73

The Long-Run Aggregate Supply

Curve

• The fact that the short-run AS curve is stable

when there is no output gap means that the

long-run AS curve is vertical at that point.

• The short-run AS curve shifts:

• When current output deviates from potential output.

• When expected inflation deviates from current

inflation.

• So, at any point along the LRAS curve, current

output equals potential output and current

inflation equals expected inflation.

21-74

Long-Run Aggregate Supply

21-75

Aggregate Supply: Summary

21-76

• Policymakers talk about output growth.

• Textbooks teach about output gaps.

• When monetary policymakers use the term

growth, they are talking about increase in both

actual and potential output.

21-77

Equilibrium and the Determination of

Output and Inflation

Short Run Equilibrium

• SR equilibrium is

determined by the

intersection of:

• The dynamic aggregate

demand curve (AD) and

• The short-run aggregate

supply curve (SRAS).

21-78

Adjustment to Long-Run Equilibrium

• An expansionary output gap exerts upward

pressure on production costs.

• This shifts the SRAS curve to the left.

• This continues until output returns to potential.

• In a recessionary output gap we have

downward pressure on production costs.

• This shifts the SRAS curve to the right.

• This continues until current output returns to

potential.

21-79

Adjustment to Long-Run Equilibrium

SRAS2

LRAS

2

SRAS

1

0

Current output is greater than

potential output – an

expansionary gap.

SRAS shifts left until reaches

potential output, YP.

AD

YP

Y0

21-80

Adjustment to Long-Run Equilibrium

LRAS

SRAS

0

1

SRAS2

Current output is lower than

potential output - recessionary

gap.

SRAS shifts right until reaches

potential output, YP.

2

AD

Y0

YP

21-81

Adjustment to Long-Run Equilibrium

•

This example has several important

implications.

1. The economy has a self-correcting mechanism.

2. The fact that inflation changes whenever there is

an output gap reinforces our conclusion that in the

long run output returns to potential output.

•

Long run equilibrium is the point at which the

economy comes to rest.

21-82

Adjustment to Long-Run Equilibrium

There are three conditions for long run

equilibrium:

1. Current output equals potential output: Y=YP.

2. Current inflation is steady and equal to target

inflation: = T, and

3. Current inflation equals expected inflation:

= e.

21-83

The Sources of Fluctuations in Output

and Inflation

•

While shifts in the dynamic AD curve or the

SRAS curve can have the same effect on

inflation, they have opposite effects on

output.

1. Shifts in AD cause output and inflation to rise and

fall together, moving in the same direction.

2. Shifts in the SRAS curve move output and

inflation in opposite directions, one rises when the

other one falls.

21-84

The Sources of Fluctuations in Output

and Inflation

• Inflation in the long run will only change if

policymakers have changed their inflation

target.

• In the short run fluctuations can come from

• Increases in the components of AE that are not

sensitive to real interest rate (shift of AD),

• A permanent easing of monetary policy (shift of

monetary policy reaction curve,) or

• Increases in the costs of production (shift of

SRAS).

21-85

The Sources of Fluctuations in Output

and Inflation

• In the short run, fluctuations in output can

come from:

• A decline in aggregate expenditure,

• A shift to the left in monetary policy reaction curve

(policy makers could be responsible for recessions),

or

• Increases in either production costs or inflation

expectations drive output down.

21-86

What Causes Recessions?

• If demand shifts were the cause of recessions,

we should see inflation decline when output

falls.

• If production cost increases were the source,

then we should see inflation rise as the

economy weakens.

• Table 21.5 lists the dates of recessions since

the mid-1950s.

• It also shows the change in inflation from the

beginning to the end of the recession.

21-87

What Causes Recessions?

• Inflation fell in 7 of the past 9 recessions.

• The only one where inflation rose was in 19731975 when oil prices tripled, driving up

production costs.

• It appears that three-quarters of the recessions

listed can be traced to shifts in AD.

• What caused these shifts?

21-88

What Causes Recessions?

21-89

What Causes Recessions?

• Figure 21.17 shows that shortly before each

recession starts, just to the left of each of the

shaded bars, the interest rate tends to rise.

• This suggests that the Fed policy is at least

partly to blame of the business cycle downturns

over the past 50 years.

• They have done this to bring down inflation.

• The only thing the Fed could do was to raise

interest rates triggering a recession.

21-90

What Causes Recessions?

21-91

• The recovery from the financial crisis of 20072009 focused the monetary policy debate on

when the Fed would begin to raise the target

for its policy rate from the zero percent floor.

• The U.S. Senate’s reconfirmation of Ben

Bernanke as Fed chairman fueled expectation

that as the economy gained steam, the Fed

would resist popular pressure to keep its target

rate near zero.

• Will the Fed have waited too long to prevent an

unwelcome rise of inflation?

21-92

Stephen G. CECCHETTI • Kermit L. SCHOENHOLTZ

End of

Chapter Twenty-One

Output, Inflation, and Monetary Policy

McGraw-Hill/Irwin

Copyright © 2011 by The McGraw-Hill Companies, Inc. All rights reserved.