Good to Great First Who* Then What

advertisement

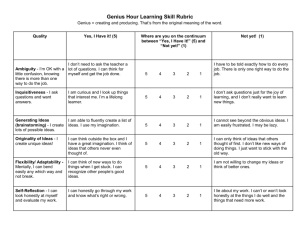

Good to Great First Who… Then What TEAM 3 Ann Marie Nanny James Everett Brittany Fowlkes Kara Vickers Andrew Rich Rick Henson Riley Drummond KEY POINT • Not JUST getting the right people on the team, but making sure that “who” questions come before “what” decisions • 1st “WHO?” -personnel • 2nd “WHAT”? -vision, strategy, structure, tactics, destination -”I don’t know where we should take this company, but I do know that if I start with the right people, ask them the right questions, and engage them in vigorous debate, we will find a way to make this company great.” -Dick Cooley CEO, Wells Fargo Bank -Instead of planning for unknown, ‘injecting an endless stream of talent’ helped WF adapt to changes. • Choosing “who” before “what” allows you to change “what” easier • Bus example: If you choose your personnel based on your strategy (destination) and your strategy (destination) changes….your S.O.L. Following the Genius • The primary driving force of the company’s success is the genius with its many followers. – This is a great asset, as long as the genius stays with the company and shares their strategies and visions. – Many geniuses rarely build great management teams, simply because they don’t need one. • Some just need an army of good workers to implement their great ideas. Losing a Genius • When a genius leaves a company, it leaves workers lost. This is because the strategies lay inside the genius’s head. – Even worse, the predecessor may try to mimic the genius (while not being genius) and be very unsuccessful. • Ex: Jack Eckerd, owner of Eckerd Corporation, was a genius on “What” to do, but lacked in the ability to assemble the right executive team. Eckerd’s revenues equaled Walgreens’ at the companies peak, but when he left to become a senator, the company began a long decline. Eventually being acquired by J.C. Penney. – The lack of developing a strong executive team, contributed to the demise of Converse going bankrupt and being acquired by Nike. Selecting a Successor • Finding and teaching the right successor is an executives most important decision. – This ensures the maintaining of a long lasting, successful company. • Ex: While Eckerd was a genius for picking the right stores, Cork Walgreen had a genius for picking the right people to hire and how to place them. Now Walgreen has selected a superstar successor, who may prove to be better than himself. • Another genius whom left his fortune 500 (293) company without a thought given to succession, is a man named Henry Singleton of Teledyne. “GENIUS WITH A THOUSAND HELPERS” MODEL Level 5+ A “Genius With a Management Team Thousand Helpers” (Good to Great Companies) (Comparison Companies) Level 5 Leader Level 4 Leader First Who First What Get the right People Set a Vision Then What Then Who Best path to Greatness Vision happen Enlist “Helpers” to make the It’s Who You Pay, Now How You Pay Them • There is no systematic pattern linking exec. compensation to the process of going from good to great. -Examined compensation data from proxy statements & performed 112 separate analyses looking for patterns & correlations for the top 5 officers (cash vs. stock, long-term vs. short-term incentives, salary vs. bonus, and so on) -Relative to comparison companies, there were no systematic differences found on the use of stock (or not), high salaries (or not), bonus incentives (or not), or long-term compensation (or not). -Only thing that was found was that good-to-great executives received slightly less total cash compensation 10 yrs. after the transition than their counterparts at the still-mediocre comparison companies. It’s Who You Pay, Not How You Pay Them • Good-to-great companies understand a simple truth: the right people will do the right things & deliver the best results they’re capable of, regardless of the incentive system -It’s not how you compensate your execs., it’s which execs. you have to compensate in the first place -this goes back to the manifestation of the “first who” principle • This does not mean that compensation & incentives are not important in good-to-great companies. They are important in these companies for very different reasons than an average or just good company. -the purpose of the compensation system should not be to get the right behaviors from the wrong people, but to get the right people on the bus in the first place, and to keep them there. It’s Who You Pay, Not How You Pay Them • In a good-to-great transformation, people are not your most important asset. The right people are. -Good-to-great companies place greater weight on character attributes than on specific educational background, practical skills, specialized knowledge, or work experience. -Not that these are unimportant, but they believe these traits are more teachable , whereas dimensions like character, work ethic, basic intelligence, dedication to fulfilling commitments, and values are more ingrained. – One good-to-great exec. said his best hiring decisions often came from people with no industry or business experience. In one instance he hired a manager who’d been captured twice during World War II & escaped both times. “ I thought that anyone who could do that shouldn’t have trouble with business.” Rigorous, Not Ruthless • Ruthless: firing without thoughtful consideration • Rigorous: consistently applying exacting standards at all times and at all levels, especially upper management • To be rigorous and not ruthless: the best people need not worry about their positions and can concentrate fully on their work Wells Fargo • Acquired Crocker Bank in 1986 – “integrated management” – Concluded vast majority of Crocker managers would be the wrong people of the bus. – “Look this is not a merger of equals; it’s an acquisition; we bought your branches and your customers; we didn’t acquire you.” • 1600 Crocker manager gone by day one, nearly all top executives • On the surface, this looks ruthless – Evidence suggests otherwise… During Bank Deregulation Era • Hundreds of thousands of lost jobs • Interesting note: – First, Wells Fargo did fewer big layoffs than its comparison company, Bank of America – Second, upper management suffered more on a percentage basis than lower-level workers in the consolidation – Rigor in a good-to-great company is focused on those who hold the largest burden of responsibility Good-to-Great Companies • Rarely used head-count lopping as a tactic – Almost never used as primary strategy • In comparison companies – Layoffs used five times more frequently • Endless restructuring and mindless hacking were never part of the good-to-great model How to Be Rigorous • 3 Practical Disciplines 1) When in doubt, don’t hire - keep looking. 2) When you know you need to make a people change, act. 3) Put your best people on your biggest opportunities, not your biggest problems. How to be Rigorous 1) When in doubt, don’t hire – keep looking. – “Packard’s Law”: If your growth rate in revenues consistently outpaces your growth rate in people, you simply cannot build a great company. – Cooper (Silo) vs. Wurtzel (Circuit City) • • Cooper’s first goal: growing as fast as possible. Wurtzel’s first goal: building the best management team in the inudstry How to Be Rigorous 2) When you know you need to make a people change, act. – “The moment you feel the need to tightly manage an employee, you have made a hiring mistake”. • When you do not make a change – Wasted time and energy – Unfair to both people • Must determine if the person is in the wrong seat, before you decide they are on the wrong bus entirely. Practical Discipline # 3 • Put your biggest people on your biggest opportunities, not your biggest problems. – Ex: Phillip Morris and R.J. Reynolds changing business approach to international markets. • Strategy for developing international markets not “what” but “who.” • Therefore put his number one executive George Weissman, off domestic business and in charge of international. – He went from running 99% of company to less than 1%. • Marlboro became best selling cigarette in the world three years before it became number one in the United States. Practical Discipline # 3 • The RJR versus Phillip Morris case illustrates a common pattern. – Good to great companies made a habit of putting their best people on their best opportunities instead of biggest problems. • Managing your problems can only make you good, whereas building your opportunities is the only way to become great. • If you create a place where the best people always have a seat on the bus, they’re more likely to support changes in direction. Practical Discipline # 3 • When you sell off your problems do not sell of your best people. – Ex: When Kimberly-Clark sold the mills, Darwin Smith made it clear. The company might be getting rid of paper business, but would keep its best people. – It turned from a paper mills to Proctor and Gamble. • Kimberly-Clark could become great by selling off the part of the company where he had spent most of his working life. Practical Discipline # 3 • We have noticed a Level 5 atmosphere at the top executive level of every good-to-great company, especially during transition years. – This suggest team members had Level 5 potential-or at least they were capable of operating in a manner consistent with Level 5 leadership style. • You need executives on one hand, who argue and debate in pursuit of best answers, yet who will unify behind a decision, regardless of parochial interests. • In the Nike brand, teams work across footwear, apparel and equipment product engines; their core consumer categories headed by their best people. First who, Great Companies, and a Great Life • Good to Great = Balance – Great Company, Great Life • Build your superior team – Nike Bill Bowerman and Phil Knight • Show love, respect for team and what you do • Become friends, maintain that friendship over time • Have fun Key Takeaways • “Get the right people on the bus” • “Who” questions come before “What” decisions – Easier adaptability to a changing world. • 3 practical disciplines for being rigorous in people decisions: 1) When in doubt, don’t hire – keep looking. 2) When you know you need to make a people change, act. 3) Put your best people on your biggest opportunities, not your biggest problems.