2144 No 1

BUS 214 Test No. 1 April 21, 2014

1. Write the definition of accounting.

Name . .

2. What do we call the branch of accounting that provides information to external users?

What do we call the branch of accounting that provides information to internal users?

3. What organization creates accounting standards in the U.S.? Please do not abbreviate.

4. Of the types of business organizations discussed in our book, which types limit the legal liability to which their owners are exposed?

5. Of the business organizations discussed in our book, which types of business organizations are

NOT required to pay income tax?

6. What types of accounts comprise Net Income?

7. What types of accounts appear on the Balance Sheet?

8. Define “Expense.”

9. What are the three types of activities presented on the Statement of Cash Flows?

10. Choose your words carefully. Explain how a company might begin the year with limited cash on hand, report a net loss for the year, yet end the year with more cash than it began the year.

11. Indicate the effect a D ECREASE in each of the following accounts would have on net income.

Cash

Dividends

Prepaid rent expense

Increase Net Income no affect Decrease Net Income

Increase Net Income no affect Decrease Net Income

Increase Net Income no affect Decrease Net Income

Service revenue

Supplies expense

Increase Net Income no affect Decrease Net Income

Increase Net Income no affect Decrease Net Income

12. Indicate on which financial statement(s) each of the following accounts would appear.

Cash

Dividends

Prepaid insurance

Retained earnings

Unearned revenue

Income State State of Retained Earnings Balance Sheet

Income State State of Retained Earnings Balance Sheet

Income State State of Retained Earnings Balance Sheet

Income State State of Retained Earnings Balance Sheet

Income State State of Retained Earnings Balance Sheet

13.

For each of the following events, indicate whether it (INC) increases Net Income, has NO effect on Net Income or (DEC) decreases Net Income.

1) Paid $40,000 to purchase land

2) Purchase office supplies costing $3,700 on account

3) Performed services for a customer who agreed to pay $3,000 next month

4) Paid $3,700 on the account in transaction # 2

5) Accrued $4,500 salaries which will be paid on the 5 th day of next month

INC NO DEC

INC NO DEC

INC NO DEC

INC NO DEC

INC NO DEC

14. For each of the following transactions, indicate whether it (INC) increases Total Assets, has NO effect on Total Assets or (DEC) decreases Total Assets.

1) Declared and paid dividends of $6,000

2) Received $50,000 for issuing common stock

3) Performed services for a customer who agreed to pay $3,000 next month

4) Received $3,000 for the customer in transaction #3

INC NO DEC

INC NO DEC

INC NO DEC

INC NO DEC

5) Received and paid the telephone bill, $16,800 INC NO DEC

15. Match the definitions in the left column with the accounting terms in the right column.

Expense

Net income

Credit

Payable

Owners’ equity

A

_B_ Always a liability

C Revenue minus expenses

D

E

Right side of an account

Assets minus liabilities

Decrease in retained earning that results from operations

Cash

Supplies

Equipment

Trial Balance for 2013

Accounts receivable

Accounts payable

Salaries payable

Unearned revenue

Common stock

Retained earnings

Dividends

Service revenue

Rent expense

Salary expense

Supplies expense

Deprecaition expense

Utilities expense

152

125

20

236

32

10

18

3

4

11

611

140

6

2

388

0

75

611

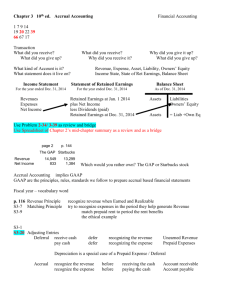

16. Use the information in the Trial

12/31/2013.

17.

Income Statement for the month ending 12/31/10

Use the information in the Trial

Balance to compute Net Income for the period.

Miller Motor Co.

Statement of Retained Earnings

18. Prepare journal entries for the following transactions

1) Performed services for customer ABC on account and billed ABC $3,000.

2) Paid salary expense of $2,700

3) Collected $1,000 from customer ABC, as partial payment on their account.

19. During 2013 Santa Maria Sales earned revenues of $500 on account. Santa Maria Sales collected all $510 from customers during the year. Expenses totaled $420, and the related cash payments were $400. Prepare a properly labelled income statement for Santa Maria Sales.

20.

When does “The Revenue Principle” indicate that revenue should be recorded?

21.

Describe the “Expense Recognition Principle” or the “Matching Principle.”

22. On Sept. 1 st , Ping-Pong Warehouse paid $900 for insurance coverage from 9/1/13 to 8/31/14.

Prepare the adjusting entry to record insurance expense on Dec. 31 st . No entries have been made since 9/1/13.

9/1/13 Prepaid Insurance

Cash

900

900 this is the entry they made on Sept. 1 st

23. On Jan. 1, 2013, the balance in the Supplies Account was $310. During the year, on May 5 th

$700 of supplies were purchased. At year end, $300 of supplies are still on hand. Prepare the required adjusting journal entry.

5/5/13 Supplies

Accounts payable

700

700 this is the entry they made on May 5 th

24. On Jan. 1, 2013, the Prepaid Insurance account had a $500 balance. On May 31 st we paid

$2,400 to renew our insurance policy for 2 years (from 6/1/2013 through 5/31/2015). How much

Insurance Expense should we report for 2013?

What is the balance in the Prepaid Insurance Account as of Dec. 31, 2013?

25. Some customers pay Miller Motor Co, in advance of performing the services. During 2013,

Miller Motor Co made the following journal entry when they collected $700 in advance from customers. Prepare the adjusting entry they need to make if Miller Motor Co. has earned $600 of that amount by On Dec. 31 st .

Cash

Unearned revenue

700

700 this is the entry they made when they collected cash

26. You need to accrue salary expense for December 2013. Employees are paid every Friday. The weekly payroll is $750 for a 5 day workweek. What adjusting entry should we make if Dec. 31 st falls on Wednesday?

27. Prepare an Income Statement, WITH PROPER TITLE AND DATING , from Miller Motor Co.’s trial balance.

28. Prepare a Statement of Retained Earnings, WITH PROPER TITLE AND DATING , from Miller Motor

Co.’s trial balance.

29. Prepare a Balance Sheet, WITH PROPER TITLE AND DATING

, from Miller Motor Co.’s trial balance.

Cash

Trial Balance for 2013

Accounts receivable

Supplies

Prepaid rent

Equipment

Accumulated depreciation

Accounts payable

Salaries payable

Income tax payable

Unearned revenue

Common stock

Retained earnings

Dividends

Service revenue

Rent expense

Salary expense

Supplies expense

Deprecaition expense

Utilities expense

Income tax expense

248

25

4

20

240

32

10

18

3

4

5

6

615

4

131

9

6

2

200

188

75

615