CalSTRS Pension 2

advertisement

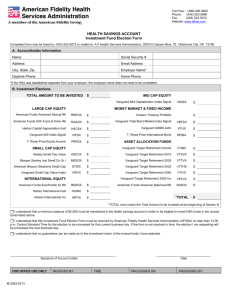

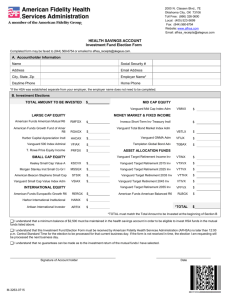

Today you will learn: • How to determine your retirement income gap • How to fill in your gap with CalSTRS Pension2 • What investment choices are available • How to determine an investing strategy • How to enroll in Pension2 What is your retirement income gap? CalSTRS/CalPERS defined benefit pension—your “first pension”—typically replaces about 55% of your salary. Experts say you’ll need 80% ̵ 90% to live comfortably. You’ll need to fill in any gap between your current income and retirement benefit with additional savings. How do you fill in the gap? Enroll in—or increase your contributions to—a supplemental savings plan, such as the CalSTRS Pension2 plan. What isPension2? An employer-sponsored program offered by CalSTRS that lets you enhance your income in retirement through pre-tax or post-tax payroll deductions. Open to both certificated and classified employees. What plans does Pension2 offer? CalSTRS Pension2 includes all Supplemental Saving Plans offered by CalSTRS Plans currently offered: 403(b) 457 Roth 403(b) How do the plans differ? Tax-Deferred Contributions Earnings Penalty-Free Distributions* After age 59 ½ 403(b) Yes Tax-deferred 457 Yes Tax-deferred At any age After age 59 ½ Roth 403(b) No Tax-free *Upon separation from employment How do tax-deferred plans work? Pre-tax deduction reduces taxable income so you may be able to invest more Contribution Reduces take-home pay by $25 $18.75 $50 $37.50 $75 $56.25 $100 $75 *Assumes 25% federal marginal income tax rate. Small investments add up $700,000 $600,000 $500,000 15 Years of Conribution 30 Years of Contributions $400,000 $300,000 $200,000 $100,000 $0 $100/month $200/month $500/month *For illustration only. Assumes annual yield of 7 percent, not including fees, taxes or expenses. Your results may differ. Annual Contribution Limits 2015 Contribution Limits Plans Maximum Contribution Age 50+ Catch-up Contribution 403(b) Roth 403(b) $18,000 $6,000 457 $18,000 $6,000 Total $36,000 $12,000 The advantage of enrolling in a 403(b) and a 457 plan is the contribution limits are combined. If enrolled in both, you can contribute up to $36,000 in 2015. If over age 50 and in both plans, you can defer up to $48,000 in 2015. Which plan is right for you? • Do you think you’ll be in a lower tax bracket when you retire? • Do you plan to be in a higher tax bracket when you retire? • Do you plan on withdrawing any of your savings before you retire? • Do you plan on keeping the money invested until age 59 ½? • Do you like the idea of not being taxed when you withdraw your retirement savings? • Do you plan on contributing more money than the maximum per year? Select 403(b) Select Roth 403(b) Select 457 What investment options are available? Pension2 offers two investment strategies. Which is right for you? Election A CalSTRS Easy Choice Portfolios Investment strategies are based on your projected retirement date and your risk tolerance Election B Build Your Own Portfolio Choose from 22 professionally selected core funds Build Your Own Portfolio Foreign Stock • Artisan International • Dodge & Cox International • DFA International Small Company • Vanguard Developed Markets Index • Vanguard Emerging Markets Index Specialty • Vanguard REIT Index • PIMCO All Asset U.S. Large Cap Stock • American Growth Fund of America • Dodge & Cox Stock • Vanguard Institutional Index • Vanguard Total Stock Market Index • TIAA Social Choice Equity Stability of Principal • Voya Fixed Plus III • Federated U.S. Treasury Cash Bond • Vanguard Total Bond Market • Vanguard Short-Term Bond Index Inflation Protection • Vanguard InflationProtected Securities Global Stock • GMO Global Equity Asset Allocation • ESG Managers Growth U.S. Small/Mid Cap Stock • Vanguard Mid Cap Index • Vanguard Small Cap Index Easy Choice Portfolio Retired 2020 2030 Conservative + Moderate = Aggressive 2040 2050 Moderate 2020 What are the fees for each option? Core Funds 25 basis points + fund’s expense ratio Average fund expense ratio: .31% A basis point is .01% of your account balance Charged annually EXAMPLE: If you have $10,000 in your account, your annual fee would be: .25% + .31% = .56% = $56 annual fee What are the fees for each option? Easy Choice Portfolios Conservative Retired (least expensive) Total Weighted Annual Fee: .30% Aggressive 2050+ (most expensive) Total Weighted Annual Fee: .48% Compare CalSTRS Pension2 fees to other plans at 403bCompare.com. Many have: • Higher expense ratios (many >1%) • Annual fees • Load fees Self-Directed Brokerage Account • • • • Self-managed account Roll over money from Pension2 Initial minimum investment: $5,000 Fees: $50 annually, plus brokerage fees tdameritraderetirement.com How do you determine your strategy? How involved do you want to be in building and maintaining your portfolio? • Do you prefer to keep • Are you tracking things simple? economic trends? • Comfortable knowing • Keeping a watchful investment managers are eye on your portfolio? assisting you? • Enjoy making asset adjustments and trades on your own? Select Election A Select Election B How do you enroll? 1. Go to www.Pension2.com 2. Click “Enroll Now” 3. Obtain 403(b)/457 Salary Reduction Agreement from Payroll Office/Online 4. Choose contribution amount 5. Select CalSTRS Pension2 as vendor 6. Start saving! Call us at (888) 394-2060 for walkthrough Pension2 Facts to Remember Ways to save other than payroll deductions: • Roll over other supplemental savings plans into Pension2 • Compare plans at 403bCompare.com • Roll over your Cash Balance benefit • Purchase additional service credit by rolling over your Pension2 money Pension2 Facts to Remember Your CalSTRS Defined Benefit Supplement account: • Lump-sum payment • Annuitize over period of years • Roll over to CalSTRS Pension2 Distributions not required until age 70½ Thank you.