Arkansas State University

advertisement

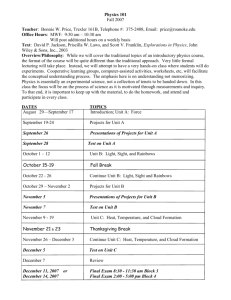

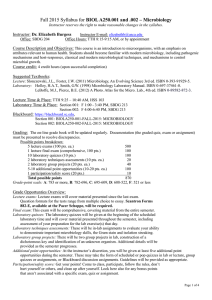

Arkansas State University College of Business Spring 2012 COURSE: FIN 3713, Business Finance SCHEDULE: WEBA INSTRUCTOR: Bill X. Hu Office: 309 Phone: 972-2470 Email: xhu@astate.edu Office Hours: M 9:00am-noon; TR 8:30-9:30am; or By appointment PREREQUISITES: ACCT 2133 or 2023 COURSE OBJECTIVES 1. Students will demonstrate the ability to solve time value of money problems using a financial calculator. (Technology, Business Knowledge) 2. Students will calculate the value of equity and debt instruments using discounted cash flow analysis. (Business Knowledge) 3. Students will demonstrate an understanding of the risk/return tradeoff present in investment decisions. (Critical Thinking) 4. Students will calculate a firm’s cost of capital and describe the factors that may lead to changes in the cost of capital. (Critical Thinking, Business Knowledge) 5. Students will be able to complete an analysis of a capital budgeting project using NPV and IRR. (Critical Thinking, Business Knowledge) REQUIRED MATERIALS Textbook: Finance Applications & Theory, ISBN-10: 0077596129 | ISBN-13: 978-0077596125, Cornett, Adair, & Nofsinger, 2nd edition, McGraw-Hill Irwin. (Required with Connect access) Connect Account: Quizzes and exams for the course will be administered through Connect located within the Blackboard 9 environment. You must set up a Connect account either using the access code that comes with the textbook or registering with Connect separately if your textbook does not have an access code. Note: "Start Free Trial" option is also available during registration, enabling students to register and access Connect Plus without an access code (typically for 2 to 3 weeks) before being required to get one. This option is useful for students awaiting financial aid, those who may drop the class, or those who want to try the Connect Plus eBook before they buy. When a student’s free trial expires, they can simply purchase access and continue with all of their previous saved work. Final Exam: The comprehensive final exam must be taken in a proctored environment. You should arrange and take the final exam either at a testing center or at a regional campus. The final exam will be available online through Connect or Blackboard during the final week of the semester. Thus you need to have access to a computer and the Internet. One formula sheet is allowed along with your financial calculator. Details will be announced again before the final exam. 1 Financial Calculator: You must have a financial calculator to get through the course. Texas Instrument BA II Plus Professional is highly recommended. Calculators with text-storing capacities are not allowed in exams. GRADING There will be three exams throughout the semester, two during the semester and one during the final exam week. The final exam will be comprehensive. Your grade in the course will be determined based on your performance on the three examinations, quizzes, and participation. Weekly Quizzes 200 Participation 100 st 1 Mid-term Exam 200 2nd Mid-term Exam 200 Final Exam (Comprehensive) 300 Grading Scale: 900 —1000 A, 800 — 899 B, 700 —799 C, 600 — 699 D, 0 — 599 F The participation points are determined mainly through discussions and projects on blackboard. I will initiate discussions on blackboard and students shall respond. The instructor reserves the right to curve grades at the end, or during the course. Policies: Class attendance will be checked by weekly quizzes. You quiz grade will be determined by the total of your best 10 quizzes out of 11 quizzes. If you miss a quiz, the grade for that quiz would be zero. Your participation grade will be mainly based on your postings in the Course Blog section on Blackboard. Good news: Your first self-introduction posting will be 10 points. The remaining points will be specified in the discussion topics and/or projects (to be prepared and posted by the instructor). Bonuses might be added to reward the students according to their efforts in the class. I encourage students forming study groups of 2 to 8 students. Although forming a group is entirely voluntary, there are benefits for forming groups. For example, you can discuss difficult course materials together and learn from each other. In addition, you can work on projects together and post on the discussion board as a group. In this case, please specify your group members clearly so that I will give each of you participation points accordingly. The instructor will vigorously enforce all University policies concerning academic dishonesty and misconduct. Postings on Blackboard discussion forums should follow Posting Rubrics. The final exam, administered online via Connect or Blackboard, must be taken in a proctored environment either at a regional campus or at a testing center. Grades will be recorded in numerical form until the final grades are determined at the end of the semester. 2 TENTATIVE CLASS SCHEDULE This schedule is extremely tentative, and subject to change. Any change will be announced via Blackboard in advance. Date Week 1 Week 2-3 Week 4 Week 5 February 12-19 Week 6 Week 7-8 Week 9 March 11-18 Week 10 March 19-24 Week 11 Week 12 Week 13-14 Week 15 Week 16 May 1-7 Topic Introduction to Financial Management Time Value of Money Project 1: Lease or Buy? Valuing Bonds Mid-Term Exam I Valuing Stocks Characterizing Risk and Return Estimating Risk and Return Chapters 1 4-5 7 8 9 10 Project 2: Beta calculation Mid-Term Exam 2 Spring Break Understanding Financial Markets and Institutions Calculating the Cost of Capital Estimating Cash Flows on Capital Budgeting Projects Weighing Net Present Value and Other Capital Budgeting Criteria Comprehensive review and practice test Final Exam (comprehensive) 3 6 11 12 13