Presentation by CA Krishnan Ramachandran

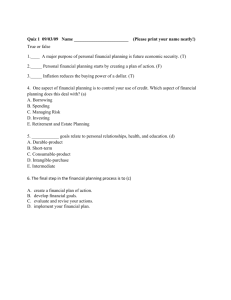

advertisement

THE FUTURE OF YOUR NETWORTH Talking Points Future You !!!! Networth Song…take away’s…….. Hard work, no savings Dreams – marry a wealthy spouse Gamble – take risks, lottery… Aspire for money / wealth In a rich mans world – money is sunny & funny Assessing / Measuring Your Financial Health Financial literacy Determine where your money goes Create your own ‘wealth’ definition Prioritize, estimate your goals & needs Make up for lost time Way to Wealth A part of all you earn is yours to keep Men of action are favored by the Goddess of good luck We cannot afford to be without adequate planning Where there is determination, the way can be found Time matters ….not timing Money Is a medium of exchange. Financial goals are stated in monetary terms Need to consider utility, or amount of satisfaction derived from purchases, as well as cost. May be closely linked to personal psychological concepts. May play key role in personal relationships. Networth Determinants List all of your assets (financial and tangible assets) with their market values. Cash (in the bank, short term deposits, liquid funds, etc) Investments (mutual funds, insurance, equity, gold, fixed deposits, bonds etc.) Property (land at market prices, buildings, the resale value of your home etc.) Automobile (the resale value of your car) Personal Effects (resale value of jewelry, household items, etc.) Other assets Your goal should be to continually increase your assets. Networth Determinants Next, you can look at your liabilities, which should be everything you owe. Here are some common liability categories: Remaining home loan balance Car loans Student loans Any other personal loans Credit card balances Margin Loans Fixed commitments What's Important ? Budget ? Or Savings Plan ? Rewards of Sound Financial Planning Maintain and improve standard of living. Control spending in order to live well today & tomorrow Accumulate wealth. Average Propensity to Consume The percentage of each AED of income that is spent, on average, for current needs rather than saved. What is your average propensity to consume? Income spent on current needs Total income Personal Financial Planning Process Taking conscientious and systematic steps toward fulfilling your financial goals………. 1. Define financial goals 2. Develop plans 1. Define financial goals 2. Develop plans 3. Implement plans 4. Saving Plans FINANCIAL ACTIONS •Basic asset decisions •Credit decisions •Insurance decisions •Investment decisions •Retirement and estate decisions 1. Define financial goals 2. Develop plans 3. Implement plans 4. Saving Plans Prepare financial statements 5. Evaluate results 6. Revise plans FINANCIAL ACTIONS •Basic asset decisions •Credit decisions •Insurance decisions •Investment decisions •Retirement and estate decisions How To Achieve Your Financial Goals Be specific in defining goals and focus on results. Make goals realistically attainable. Involve family members and enlist their cooperation. Prioritize goals and set a definite time frame. Putting Target Dates on Financial Goals Short-term goals—to be accomplished within the next year. Intermediate-term goals—to be accomplished in the next 2-5 years. Long-term goals—to be accomplished in time periods greater than 5 years. Personal Financial Planning Lifecycle Income Income Stream Retirement/ Estate Taxation Family Commitments Savings / Investments Liability / Insurance Asset Acquisition 10 20 30 40 Age 50 60 70 80 Investment Avenues Bank Deposit Bonds Stocks Mutual Funds / ETF’s Insurance (incl asset protection) Gold Property / Land Derivatives / Alternatives Growth of $1,000 at 8 % interest: $50,000 $40,000 $30,000 21,725 $20,000 10,063 $10,000 2,159 4,661 $0 0 10 20 Years 30 40 Growth of $1000 at 10% interest: 45,259 $50,000 $40,000 $30,000 21,725 17,449 $20,000 6,727 $10,000 2,594 Years $0 0 10 20 30 40 Compound interest is the eighth wonder of the world. He who understands it, …..earns it. He who doesn’t …..pays it. …..Albert Einstein The Time Value of Money Increases in an amount of money as a result of interest earned. Saving today means more money tomorrow. Spending means lost interest. 4 types of time value calculations Future value of a single amount Future value of a series of deposits (annuity) Present value of a single amount Present value of a series of deposits Future Value of a Lump Sum Example Future Value (FV)–Value of an asset at the end of a particular time period. ? Example: Value of $1,000 in 4 years at 8% interest Exhibit 1-A FVF (8%, 4 years) = 1.360 1,000 x 1.3605 = $1,360 Future Value of an Annuity Example FV of an Annuity (FVOA)- What principal will grow to over time if a series of regular deposits are made. ? Example: $2,000 annual deposits at 8% interest for 40 years from age 22 to 62 = $518,120 Exhibit 1-B FVOA (8%, 40 years) = 259.060 $2,000 x 259.060 Financial Planning Calculators SIP Calculator Financial Planning Sheet "The gratification of wealth is not found in mere possession but in its wise application." This is the future of your Net Worth Thank You