PPT - Pro Bono Net

advertisement

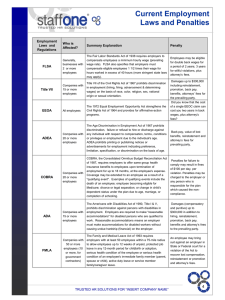

Employment Law Basics February 2015 Texas RioGrande Legal Aid Legal Assistance to Microenterprise Project (L.A.M.P.) The following information is intended to assist in spotting legal issues relevant to small businesses in the State of Texas. There are many factors to be considered in determining which actions and decisions would be most appropriate to any specific situation. This presentation only discusses some of the more important factors. It is not intended to substitute for legal advice. You should decide which course of action is best after discussing it thoroughly with an attorney. Independent Contractors v. Employees What is an Employee? • Employees are subject to the employer’s control • Employer must withhold and pay employment taxes on employees. • Employer must comply with labor laws. What is an Independent Contractor? • Independent contractors are people who perform services for others but who do not have the legal status as employees. • Independent contractors are not subject to the employers control • Employer must file form 1099-MISC if paid more than $600 to an independent contractor a rose by any other name… • Federal and state labor laws apply only to employees, not independent contractors. • Employment taxes and withholding apply only to employees, not independent contractors • A business must not call an employee an independent contractor to avoid compliance with these laws. Knowing the Difference • It is very important that a business properly identify a person as an employee or independent contractor. • The burden is on the employer to prove the worker is NOT and employee. BE CAREFUL…. • Classify your workers correctly, if you classify an employee as an independent contractor, you can end up having to pay the employment taxes with interest and penalties! • If in doubt, check with an attorney or with the IRS!! Question? • What is the test to determine whether a worker is an employee or an independent contactor? Answer: • There is NO sure test. • Under the Fair Labor Standards Act, the employer-employee relationship is determined by “economic reality” rather than “technical concepts”. • Other laws, such as state workers compensation and unemployment compensation, IRS, and National Labor Relations Board use different factors. Which factors indicate a worker is an independent contractor? • • • • • • • • The employer controls the details of the work. The work is done without supervision. The worker is skilled. The worker provides equipment or tools. The worker is located at the employer’s site. The worker is paid by the project. The employer did not intend to create an employee relationship. The worker has the opportunity to make a profit or incur a loss. IRS Guidelines – Behavior Control (tasks, results, training) – Financial Control (reimbursements, how paid,extent of worker’s investment, opportunity for profit and loss) – Type of Relationship (written contract, benefits, permanency, integral to regular business) IRS Form SS-8 • If you are not sure whether a worker is an employee or independent contractor, get IRS Form SS-8 and Publication 15A. • Two defining factors: – Right to control – Contractor is an entrepreneur Reasonable Mistake • Section 530 of the IRS code protects an employer from liability for failure to withhold taxes if the employer had a reasonable basis for not treating the worker as an employee. Safe Harbor • Reasonable Basis includes: – court rulings, IRS letter ruling to the employer, technical advice – past IRS audit that did not consider substantially similar positions to be employees – long-standing practice of a segment of the industry – legal advice from a qualified attorney who is properly advised of the facts and circumstances Best Practices Tip • If you have a question whether a person is an employee or independent contractor, ask an attorney. At Will Employment • Can terminate employment at any time for any reason or no reason, so long as it is not an illegal reason. • If enter into an employment contract with employee, terms of contract will control. • If want to maintain ‘at will’ employment relationship, have employee sign acknowledgment stating that: employment is at will and that an employment contract will not be valid unless in writing and signed by owner/CEO of business. HIRING Recruiting • Prepare a written job description, identifying minimum qualifications including: necessary education, skills, experience and essential job functions. • Prepare a job advertisement and distribute the ad to a variety of distributors, widely seen media, list with the TWC. • Develop a standard application form that includes important information and avoids questions that raise discriminatory issues. Job Application Form • Inform the applicant about the basic terms/conditions of the job, and that employment is ‘at will’ • Obtain the applicant’s written consent to have you conduct a background check, reference check, and/or drug test • Have the applicant acknowledge that untrue or incomplete information can result in not getting the job • Ask: – Name, address, phone number – Is applicant legally entitled to work in U.S.? – If hired, when available to start? – Education and employment history – Special training and achievements – Convictions and guilty pleas – names and contact information for persons to be notified in case of emergency Interviewing • Review applications for minimum qualifications. • Schedule interviews for best candidates • Prepare interview questions to ask of all candidates. • Use a panel to conduct interviews. • Obtain an information release. • Check references. • Make clear that employment is at-will. Interview Questions • What year did you graduate from high school? • Have you ever been arrested? • Have you ever filed for bankruptcy? • Have you ever filed a workers’ compensation claim? • Can you make child care arrangements? • Where did you get your accent? • Are you married? Reviewing Applications • Respect privacy rights; make sure you have written consent to do background checks, reference checks, etc. • If you are going to drug test, make sure you have written consent and a ‘drug-free workplace’ written policy that employees have agreed (in writing) to abide by. • Fair Credit Reporting Act: requires that if you do not hire based on result of credit report, disclose report and reporting agency to applicant. • Interviewing: ask only about things that are directly related to job requirements, do not ask about protected information, like ethnic origin, marital status, gender, age, etc. Criminal History • A conviction, by itself, cannot be an absolute bar to employment. • However, an employer may consider the relationship between a conviction and the applicant’s fitness for a particular job. Factors to Consider • The nature, gravity, and number of the applicant’s criminal acts; • The length of time since the convictions; • The nature of the job sought. Regulated Industries and Licensing Issues Child Care Facilities • Background check required for all applicants in licensed day care facilities or registered family homes. • Includes civil and criminal proceedings involving assault, lewdness, endangerment of a child. • Applicants with some types of conduct are barred from employment. Other State Laws • Nursing homes-no employees with convictions such as homicide, arson or robbery. • Apartments, hotels, or other similar facilitiesmay request an applicant to disclose his or her criminal history at any time. • Driving record or professional license-no restrictions on inquiry. Employers should verify if necessary for the position. Hiring Decision • Base hiring decision only on job-related criteria, let applicants know your decision. • “You appear to have some good qualifications, but we feel we have hired the most qualified applicant for this position.” • Verify authorization to work within 3 days, complete I-9 and keep copies of documentation in employee’s file. • All employers are required to report certain information on new hires to Texas Employer New Hire Reporting Operations Center. State and Federal Discrimination Laws Discrimination prohibited by state, federal and local laws. • Discrimination on basis of race, color, gender, religious beliefs, national origin, disability, age all prohibited. Title VII of the Civil Rights Act • Applies to employers with 15 or more employees. • Prohibits discrimination in employment based on race, color, sex, national origin, or religion; prohibits sexual harassment. Harassment Question? • True or False? • An business is not liable for sexual harassment of an employee committed by a client of the company. Question? • True or False? • If the employee does not complain about the behavior, it is probably welcome and not harassment. Question? • True or False? • A person cannot make a claim of sexual harassment against a person of the same gender. Question? • True or False? • A person cannot make a claim for sexual harassment against a manager if the employee was in a consensual relationship with the manager before. Harassment • Harassment, retaliation, and sexual harassment will get you sued. • Your business can be held liable if you or a supervisor knows or should know sexual harassment is being committed by employees or clients or vendors on premises. • You are under a legal duty to take the necessary steps to prevent sexual harassment. Start by adopting a formal policy that it will not be tolerated, and let your employees know who they should talk to if it happens. Sexual Harassment • Unwelcome sexual advances, requests for sexual favors where submission to the conduct becomes a term or condition of employment • Unwelcome sexual conduct that creates a hostile work environment • Express or implied demands for sexual favors • Verbal or physical conduct of a sexual nature creating a hostile or abusive work environment HOSTILE ENVIRONMENT Unwelcome discriminatory conduct or sexual conduct that unreasonably interferes with an individual’s job performance Establishing an AntiDiscrimination Program • Adopt and communicate a policy of no tolerance • Train supervisory and non-supervisory employees • Adopt grievance procedures • Investigate complaints promptly and confidentially • Monitor compliance with policies Costs of Prevention v. Litigation and Damages • • • • • Prevention Creating policies and grievance procedures Training Investigation Monitoring Insurance or Attorney fees? • • • • Litigation Attorney fees Actual damages? Punitive damages? Loss of clients/ business due to bad publicity Age Discrimination Act • Applies to employers with 20 or more employees. • Prohibits discrimination against those 40 years or older. Americans With Disabilities Act • Applies to employers with 15 or more employees. • Prohibits discrimination against qualified individuals with disabilities; requires reasonable accommodation unless it creates an undue hardship on employer. Texas Commission on Human Rights • Applies to employers with 15 or more employees. • Prohibits discrimination based on race, color, gender, religion, national origin, age, or disability. Family and Medical Leave Act • Applies to employers with 50 or more employees. • Provides that employers must provide up to 12 weeks unpaid leave for birth or adoption of child or serious health condition of child, spouse or parent. Pregnancy Discrimination Act • Applies to employers with 15 or more employees. • Provides that employers must treat pregnancy, childbirth, and related conditions the same as other temporary disabilities. Equal Pay Act • Applies to employers engaged in interstate commerce (which is broadly interpreted). • Requires equal pay for men and women who perform substantially the same work in the same business establishment. Vietnam Veteran’s Readjustment Act • Applies to employers with federal government contracts in excess of $10,000. • Requires contractors to take affirmative action to employ and promote qualified disabled and Vietnam era veterans. Uniformed Services Employment and Reemployment Rights Act • Applies to all employers. • Requires rehire of members of uniformed services upon completion of active duty military service. Texas Child Labor Law • Generally prohibits employment of children under 14 • Children 14-15 may be employed in non-hazardous jobs and hours are restricted • 16-17 year olds have restrictions on type of work Managing Employees Training • Employee handbooks are a good starting point if there is disagreement with employee. • Manual can include: – – – – – – – – – – Employment is ‘at will’ Overtime policy Anti-discrimination policy Drug abuse policy Probationary period/raises Leave, payday, work hours Safety & training Discipline & grievances Termination Receipt and acknowledgment • Have policies and procedures in place so employees know what you want them to do and how you want them to do the job. • Be consistent in applying policy to avoid discrimination claims. • All training time/hours count as time worked and must be paid. Documentation • • • • Document job performance Periodic evaluations Employee feedback/complaints Retaliation (termination, demotion) Paying Employees Minimum Wage • Currently $7.25 an hour • Some exceptions; ex. Tipped employees – but must make sure you meet all requirements for exception and for compliance with the exception. Fair Labor Standards Act • Non-exempt employees must be paid overtime for each hour worked in excess of 40 hours in a workweek. • Make sure your employees fill out time sheets, clock in and out, or otherwise account for their time! Exempt Employees • • • • Executive Professional Administrator Outside Salesperson “Off the Clock Hours” • There is no such thing as “voluntary work” that does not have to be paid. • Even unauthorized work must be paid. • Travel (after arriving at work) and waiting time must be paid. Leaves of Absence Types of Leave • • • • • • • • • Jury duty Time off to vote Responding to subpoenas Military duty Personal leave Pregnancy leave Family and medical leave Disability leave Workers’ compensation leave Workplace Safety Occupational Safety and Health Act • Applies to employers with more than 10 employees • Standards of workplace safety include: – Providing protective equipment – Reducing hazards – Establishing safety programs – Posting notices and labeling materials – Reporting accidents Modifying Risk: Safety • Anticipate risk of injuries • Plan for accidents • Train for emergencies Modifying Risk: Safety • Simple Safety Tips – Post safety signs – Post emergency numbers – Stock first-aid kits – Keep fire alarms and extinguishers working – Train employees on emergency actions – Encourage employees to make recommendations Worker’s Compensation Insurance • Optional in most cases for Texas employers • Will provide lost wages and medical benefits to your employees if they are injured on the job • In most cases will limit liability if the employee sues your business for his injuries • Employee notifications, TDI notifications Employment Taxes Federal Employment Taxes • Must withhold income taxes, employee share of social security and medicare taxes from employee paychecks. • Employer pays employer share of social security and medicare taxes. • Federal unemployment tax paid quarterly. • Must periodically deposit withheld monies; may be worth hiring a payroll service. Texas Workforce Commission Unemployment Tax • Applies if pay • Must post required $1,500 in wages in a posters at work site. quarter or have an Posters are employee for 20 provided by TWC. weeks. • Depending on • Employer must number of register with TWC employees, may be within 10 days. required to put up other posters as well. What you need to know about health care reform • Businesses with fewer than 50 full time equivalent employees are exempt from penalties; however, you may qualify for employer health care tax credits. • If you're self-employed with no employees, you're not considered an employer. • If your business has even one employee (other than yourself, a spouse, family member, or owner), you may be able to use the SHOP Marketplace for small businesses to offer coverage to your employees. Termination Termination • Have an employee handbook stating your policies. It is a good starting point if you have a disagreement with your employee. • Document what employee did wrong and why terminated. • Be consistent in applying your policy to avoid discrimination claims • Unemployment compensation: employees who are ‘laid off’ are generally entitled to unemployment. Employees who ‘quit’ or are fired for cause are generally not entitled to unemployment. Balance the cost of fighting a questionable claim! All the Wrong Reasons to Fire an Employee • • • • • • • • • • Refuses to take a lie detector test Is subject to court-ordered garnishment Is pregnant Is black, a woman, from a foreign country, or Jewish Has AIDS Filed a discrimination complaint Joined a union Is a veteran Complained about safety rules Refused to commit an illegal act Best Practices Tip • • • • • Be fair and consistent with all employees Confine comments to job-related criteria Let the employee respond Document performance Follow policies and procedures END Texas C-BAR/Legal Assistance to Microenterprises Project 512-374-2712