MREP_IL_7E_Errata_(2011-09-21)

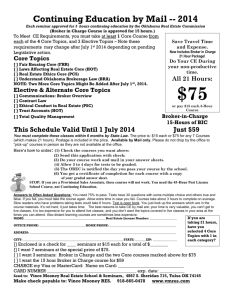

advertisement

Modern Real Estate Practice in Illinois 7th Edition Errata (2011-09-21) At Dearborn™ Real Estate Education, we are proud of our reputation for providing the most complete, current, and accurate information in all our products. We are committed to ensuring the kind of quality you rely on. Please note the following changes, which will be reflected in the next printing of Modern Real Estate Practice in Illinois 7th Edition. Page/Location Was Change to Page 283, question 17 b. The past address of the grantee b (55) b. The full address of the grantee personalty See personal property. b (42) c (58) b (58) b (102) c (117) a (125) a (126) b (137) b (140) c (140) b (140) b (184) c (184) b (181) a (181) c (190) b (190) b (211) a (211) b (228) b (228–229, 246) d (261) b (262) c (261) d (262) a (275) b (275) Page 675; insert new glossary definition Page 683, Chapter 4, question 4 Page 683, Chapter 4, question 19 Page 684, Chapter 6, question 16 Page 684, Chapter 6, question 18 Page 684, Chapter 7, question 11 Page 684, Chapter 7, question 12 Page 684, Chapter 9, question 5 Page 684, Chapter 9, question 16 Page 684, Chapter 9, question 18 Page 684, Chapter 10, question 18 Page 684, Chapter 11, question 18 Page 685, Chapter 12, question 17 Page 685, Chapter 12, question 18 Page 685, Chapter 13, question 17 ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition Chapter 5 Updates The following terms should be added to the Chapter 5 Key Terms list on page 74. These terms and their definitions should also be added to the Glossary. errors and omissions insurance Business liability insurance that helps protect real estate professionals, individuals, or companies from bearing the full cost of the defense for lawsuits relating to an error or omission in providing covered professional services. fiduciary standard A legal standard that holds a licensee to the highest ethical standards that the law provides. professional real estate services Services that require a person to have an Illinois real estate license in order to perform those services on behalf of clients, customers, and consumers. Add the following to page 79, immediately before the “Managing Broker Responsibilities” section. IRS Tax Considerations: Independent Contractor/Regular Employee One of the most important decisions a sponsoring broker needs to make is how to classify workers for tax purposes. Determining employee classification should always be discussed with a tax professional. This section is not intended to provided tax advice; it is only to provide information to help a business owner better utilize a tax professional. The relationship between the sponsoring broker and the person who performs services for that broker is viewed by the IRS in its Publication 15-A (2010), Employer’s Supplemental Tax Guide, as a statutory nonemployee. The IRS has three categories of statutory nonemployees: direct sellers, licensed real estate agents, and certain companion sitters. The IRS has two requirements for the statutory nonemployee: Payment or compensation for the service must be directly related to sales or other work output and not on the number of hours worked. The workers have contracts specifying that they will not be treated as regular employees for tax purposes. Workers who meet these two requirements will be treated as self-employed or independent contractors. A sponsoring broker’s relationship with a licensee who is an independent contractor can be very different from the relationship with an employee. As the name implies, independent contractors usually have a more flexible work schedule than that of employees. A broker may determine what the independent contractors do (especially because the contractors represent the broker as the broker’s agents) but cannot dictate how they do it. As such, a company can expect independent contractors to comply with its policies and procedures. An independent contractor’s income is typically commission-based. Independent contractors are responsible for paying their own income taxes and Social Security taxes. ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition It is not unusual for the IRS to investigate independent contractor and regular employee statuses in real estate offices. Under the qualified real estate category in the Internal Revenue Code, three requirements must be met in order to apply independent contractor status to an individual: 1. The individual must have a current real estate license. 2. The individual must have a written contract with the sponsoring broker specifying that the licensee will not be treated as a regular employee for federal tax purposes and that the taxes will be paid by the licensee. 3. At least 90 percent of an individual’s income as a licensee must be based on sales production and not on the number of hours worked. IN ILLINOIS Illinois real estate laws do not currently define the concept of a team, although the laws that define activities that require a real estate license in Illinois apply to them. The sponsoring broker must consider whether licensed real estate team members should be treated as independent contractors or employees under the Internal Revenue Code and the Fair Labor Standards Act, to name a couple of applicable statutes. If a licensed team member is a statutory independent contractor, this might be true for tax purposes only. For other purposes, the licensee might be a common law employee; in that case, Illinois workers’ compensation laws might apply. A licensed team member must have a written employment contract/independent contractor agreement with the sponsoring broker. Unlicensed team members are regular employees. Either the sponsoring broker or a licensed team member might compensate them. The sponsoring broker will want to ensure that proper withholding requirements are met if a team member is compensating the regular employee. It is vital to consult an attorney and a competent tax advisor on these issues. Similarly, the use of an unlicensed personal assistant, whether or not a member of a team, must comply with the laws that determine who is an independent contractor. By definition, the unlicensed personal assistant does not meet the safe harbor provisions of an independent contractor and would likely need to be paid as a regular employee. If the safe harbor provisions do not apply, then the employer should review the IRS test, with the advice of a tax professional, to determine if the worker meets the criteria. The managing broker must remember that determining whether a worker is or is not an independent contractor is primarily done for tax purposes and has no impact on activities that require an Illinois real estate license. Add the following to page 83, immediately before the “Business Planning” section. ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition Safety Concerns: Appointments and Showings Real estate agents enjoy working with the public and have historically felt safe while performing their jobs, but the trend has shifted in recent years, with a number of agents robbed, raped, and murdered while showing homes and other properties. Many real estate firms have responded to the violence by incorporating safety procedures into their procedure manual as a way to help keep their agents safe. Licensees can help minimize risks by implementing the following suggestions. Ask the customer for work, home, and cell phone numbers and a physical address. Verify the information by calling the customer at one or more of the numbers. Give someone in your office an itinerary of properties you plan to show and then check back in often by cell phone. Do not meet unknown customers at a property. Require that they meet you at your office. Make sure someone writes down their license plate number and the type of car they are driving. Never get into a car with someone you don’t know. Use your vehicle for showings or ask your customer to follow you in another car. Program your cell phone to dial 911 at the touch of a button. Never work at a public open house by yourself. Do not show vacant properties by yourself unless you know your customers, and never show properties after dark. Keep pepper spray or mace handy. Always follow the customers into the property and let them enter while you stay by the door. Pay attention to exits. Ask someone else to accompany you to show or list property if you feel uncomfortable about the people you are working with. Don’t assume that women are safer customers than men. Women are as just as capable of armed robbery and sometimes work with a partner who waits at the house for the two of you to arrive. For offices that don’t have office safety procedures, the National Association of REALTORS® and other state and local associations have developed safety guidelines that will aid licensees when showing or listing properties and holding open houses. Add the following to page 83, immediately before the “Personal Assistants” section. Errors and Omissions Insurance Sponsoring or managing brokers have an array of issues and options to consider when deciding to obtain an errors and omissions insurance (E&O) policy. In general they need to determine what level of protection to seek in the policy and how to tailor the coverage to their sponsoring/managing practice. Because insurance policies and practices vary from company to company, the sponsoring or managing broker must be careful to review any specific policy intended for the ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition office and should discuss coverage with more than one insurance provider before obtaining coverage. Brokers are licensed professionals who are held to fiduciary standards. A fiduciary standard is a legal standard that holds a licensee to the highest ethical standards that the law provides. Licensees have the duties of advice and counsel to the represented client and must be fair, honest, and accurate in dealing with consumers and customers whom they do not represent. In this regard, the broker is treated no differently than a doctor, lawyer, or other licensed professional acting in a confidential environment. However, unlike a doctor or a lawyer, the broker is expected to engage in sales activities that can conflict with the duties owed by a fiduciary. This conflict can create significant professional liability exposure for the real estate licensee. The classes of services performed by licensees shape the types of liability claims most often filed against real estate licensees. Real estate licensees may represent buyers, sellers, lessors, and lessees. They coordinate a variety of services, such as insurance, title, loan origination, home inspection, and legal. In addition they often function as independent professionals managing their own offices, advertising campaigns, and other related business functions. In providing these services licensees become vulnerable to potential liabilities. Licensees earn a specified commission or negotiated fee (typically based on some percentage of the final sale price or annual rental cost) as they help secure buyers or tenants for various kinds of real property usually owned by third parties. Because earnings are a function of commission for each transaction, increasing the number of transactions increases the annual earnings. Dual agency also increases the total compensation through representation of both parties in the transaction but can also increase the possibility of conflicts of interest. In order to prevent a breach of fiduciary duty, licensees must know how to balance a client’s specific requirements with the duties owned to third parties. Liability claims can also arise from a number of related services provided occasionally for a separate fee basis or are incidental to the transaction. These include property appraisal, property management, auctioneering, consulting, and handling earnest monies or security deposits. The real estate licensee needs to be aware that not all these activities are covered by standard real estate broker’s liability coverage forms. Some real estate licensee services require a special endorsement to the insurance policy for an additional premium; other services require the purchase of a separate insurance policy. The most common errors and omission claims against real estate licensees include the following: Mishandling moneys (earnest money or security deposits) during transactions Making misstatements about material facts regarding the property, such as the presence of lead-based paint, asbestos, or radon ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition Misrepresenting the property dimensions or failure to measure property dimensions accurately Disclosure of confidential information without authorization from the client Undisclosed dual agency Failure to identify the real or personal property correctly in the contract Mistakes regarding the property tax identification number (PIN) for the subject property or failure to provide an adequate legal description of the property Misrepresentations about financing arrangements Failure to disclose a financial interest in the customer who is negotiating with the client Failure to disclose financial relationships compensating the licensee in the transaction Violations of the federal Fair Housing Act and the Illinois Human Rights Act Breaching the terms of the listing or buyer agreement or the property management agreement Policy Protection and Covered Services A real estate licensee needs insurance protection from claims made by clients, customers, and consumers related to the provision real estate activities, referred to as professional services by the insurance industry. The sponsoring/managing broker must determine whether the errors and omissions policy adequately addresses what 1. Services are covered; 2. Person(s) are covered; 3. Damages are covered; 4. Defenses are covered; and 5. Territory is covered Real estate licensees should know whether the services they provide constitute “professional services” and are thus insurable under the policy. They should also be aware that professional services are defined differently in each insurer’s policy. Professional real estate services typically refer to services that require a person to have an Illinois real estate license in order to perform those services on behalf of clients, customers, and consumers. As a prerequisite for coverage, the licensee must possess all valid necessary licenses or certifications at the time of the act or omission giving rise to the claim and must be acting within the scope of the employment agreement, either written or oral. Sometimes insurance companies will include coverage for ancillary professional real estate services rendered by the insured for others such as a notary public’s duties. Covered Defense Costs ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition Errors and omission policies may sometimes pay the costs involved in investigating, defending, and settling claims. These costs primarily involve attorney’s fees but also include related expenses required by the claim settlement process. The sponsoring broker should determine whether defense costs are covered by the policy or in addition to the policy limits. If defense costs are covered within the policy limits, then as the legal fees increase, the limits of the coverage of the policy are proportionately reduced. Excluded Coverage Most E&O policies exclude certain ancillary real estate-related activities. These exclusions include a licensee’s involvement in areas that do not require an Illinois real estate license, such as property development and insurance agency operations. Depending on the insurer, coverage for such services may be “bought back” for an additional premium, if an insured’s operations require such coverage. A real estate licensee who wants coverage for such services may obtain it by paying an additional premium or, depending on the limitations of the policy, by obtaining a separate policy. The sponsoring or managing broker should also be aware that violations of fair housing laws, some civil sanctions, and criminal act are not covered by E&O policies. Some policies will cover the legal defense for certain issues, such as discrimination, but not the damages awarded. Other possible exclusions from coverage under E&O policies include the following: Bankruptcy of the insured Violation of securities law Wrongful termination Employee Retirement Income Security Act (ERISA)violations Claims by or against related entities Workers’ compensation claims Personal injury claims Claims arising from usage of vehicles, aircraft, and watercraft Environmental issues, such as mold and asbestos Real estate owned by the insured Commission disputes Because there can be coverage gaps between E&O policies and commercial general liability (CGL) policies, the sponsoring/managing broker should ensure that excluded coverage for bodily injury, property damage, and personal injury are covered by CGL policies or by special endorsement. Potential gap coverage between E&O policies and CGL policies should be discussed by the sponsoring broker with the insurer to best customize the coverage to the brokerage firm. Covered Persons Errors and omissions policies are intended to cover those licensees whose licenses are held by the sponsoring broker, as well as office staff and unlicensed assistants ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition in an insured real estate broker’s office who may be involved in a transaction— even if their function does not involve professional activities. Where the sponsoring broker is a business entity, such as a partnership, corporation, or Limited Liability Company (LLC), these policies can include coverage for past and present partners, officers, directors, and regular employees. Because the nature of the claims against the policies can survive the death or incapacity of the insured, coverage should be structured to include the heirs, executors, administrators, and trustees in bankruptcy of the insured. Independent Contractors Most real estate offices that sell residential real estate will sponsor licensees who are treated as independent contractors. Therefore, it is important that the E&O policies cover those independent contractors. The sponsoring/managing broker must keep in mind that unlicensed assistants cannot be treated as independent contractors because it is a violation of federal tax law. Therefore, the sponsoring/managing broker must be certain that the E&O policy is written to cover unlicensed assistants. A sponsoring broker must also address liability arising from predecessor firm issues. For example, brokerage firm A acquires brokerage firm B with at least 50 percent of brokerage firm B’s licensees joining brokerage firm A or where brokerage firm A assumes at least 50 percent of brokerage firm B’s assets and/or liabilities. Under these circumstances, a claim against a brokerage firm B licensee (for an incident prior to the acquisition) who currently works with brokerage firm A could become the obligation of brokerage firm A. Covered Territory Most E&O policies cover claims resulting from anywhere in the world, provided the claim and concomitant litigation is brought in the United States, its territories or possessions, or Canada. Actions conducted outside the United States will likely require additional coverage or separate policy. The licensee should be aware that use of Internet Web sites with their worldwide exposure might lead to claims and litigation outside the United States; a licensee would need a policy with unrestricted territorial coverage to address this issue. Other Policy Issues The sponsoring or managing broker should be aware of additional issues that might affect E&O coverage. The insurance claims process varies from insurer to insurer. Therefore, licensees need to understand the procedures of their provider. Some policy issues to be aware of include the following: Most E&O policies have liability caps that set a payment limit per claim and an aggregate payment limit; the licensee should obtain coverage that matches the licensee’s liability exposure. There are two basic types of deductible provisions. One type of deductible applies to each error committed, and the other type applies to each claim filed. Limits per error are found in a non-accumulation clause. For example, if a licensee represents a condo developer whose units have a ©2011 Kaplan, Inc. Modern Real Estate Practice in Illinois 7th Edition series of claims filed for multiple coverage periods, the policy will restrict coverage to the monetary limit of the first coverage period. Also, most policies permit the insurer to assess the deductible even if the claim does not lead to a liability against the licensee if the insurer pays for the successful legal defense. Most E&O policies have provisions that limit payment to the amount offered in a settlement offer. If the licensee refuses the settlement and the subsequent trial judgment is higher than the settlement offer, then the licensee will be liable for the payment amount in excess of the settlement offer, as well as the defenses costs of the trial. All E&O policies have some additional conditions that are essential elements of the policy’s coverage. All policies have subrogation provisions that allow the insurer the right to initial litigation where the insurer has paid on claims against the policy. Insurers require the insured to cooperate with the claims process and subsequent litigation and prohibit the insured from making voluntary settlements. Problems may arise when one insured sues another insured. This can occur when one licensee sues another licensee in the sponsoring broker’s office resulting from a claim arising from professional services provided (e.g., one agent selling another agent’s property) in that office. The policy should include a special clause that ensures coverage for that type of claim. Although most insurers limit coverage to the inception date of the policy, some insurers will consider providing first-time insurance buyers coverage for prior acts (for an additional premium). Generally, prior acts coverage are limited to retroactive claims for no more than five years. If the policy expires or is cancelled and is not replaced with a new policy with prior acts coverage, then the licensee must have an extended-reporting-period clause that allows a claim that occurred during the coverage period to be processed against the expired policy. This type of coverage is usually limited to no more than one to three years after expiration of the policy. It is the duty of the sponsoring broker to determine what level of E&O insurance is necessary to meet the needs of the brokerage office. ©2011 Kaplan, Inc.