Microeconomics Teaching Guide

advertisement

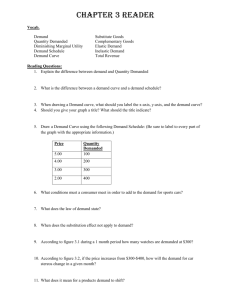

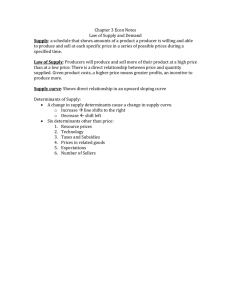

Economics Unit 2: Microeconomics Teaching Guide SSEMI1 The student will describe how households, businesses, and governments are interdependent and interact through flows of goods, services, and money. a. Illustrate by means of a circular flow diagram, the Product market; the Resource (factor) market; the real flow of goods and services between and among businesses, households, and government; and the flow of money. b. Explain the role of money as a medium of exchange. Key Terms and Concepts circular flow businesses productive resources consumers taxes unit of account Text Pages: resource/factor market income goods and services producers transfer payments store of value product market revenue expenditures government’s role money 6 characteristics of money households profit/net profit goods and services public goods and services medium of exchange Circular Flow – Chapter 2, Section 2; pp. 29-30 Role of Money – Chapter 10, Section 1; pp. 243-245 SSEMI2 The student will explain how the Law of Demand, the Law of Supply, prices, and profits work to determine production and distribution in a market economy. a. Define the Law of Supply and the Law of Demand. b. Describe the role of buyers and sellers in determining market clearing price. c. Illustrate on a graph how supply and demand determine equilibrium price and quantity. d. Explain how prices serve as incentives in a market economy. Key Terms and Concepts demand inverse relationship movement along curve direct relationship market clearing price Text Pages: quantity demanded (x-axis) demand curve supply supply curve Law of Demand demand schedule quantity supplied (x-axis) supply schedule price (y-axis) Law of Supply equilibrium Law of Supply – Chapter 5, Section 1; pp.101-104 Law of Demand – Chapter 4, Section 1; pp. 79-82 Market Equilibrium – Chapter 6, Section 1 – pp. 125-128; Section 2; pp. 133-135 Price Incentives – Chapter 6, Section 3; pp. 139-142 SSEMI3 The student will explain how markets, prices, and competition influence economic behavior. a. Identify and illustrate on a graph factors that cause changes in market supply and demand. b. Explain and illustrate on a graph how price floors create surpluses and price ceilings create shortages. c. Define price elasticity of demand and supply. Key Terms and Concepts demand curve shift complementary goods determinants of demand price ceilings rent control variable costs elastic supply determinants of demand normal goods supply curve shift black market minimum wage elasticity inelastic supply income effect inferior goods determinants of supply shortage vs. scarce production costs elastic demand perfectly elastic substitute goods demand curve shift price floors surplus fixed costs inelastic demand relatively elastic perfectly inelastic Text Pages: relatively inelastic Changes in Supply/Demand – Chapter 4, Section 2; pp. 85-88; Chapter 5, Section 1; pp. 104-106; Section 3: 117-119 Production Costs – Chapter 5, Section 2; pp. 111-112 Price Floors/Ceiling – Chapter 6, Section1; pp. 128-131 Elasticity – Chapter 4, Section 3; pp. 90-95 SSEMI4 The student will explain the organization and role of business and analyze the four types of market structures in the U.S. economy. a. Compare and contrast three forms of business organization—sole proprietorship, partnership, and corporation. b. Explain the role of profit as an incentive for entrepreneurs. c. Identify the basic characteristics of monopoly, oligopoly, monopolistic competition, and pure competition Key Terms and Concepts business organization sole proprietorship partnership advantages/disadvantages of sole proprietorship , partnership, corporation limited liability shared risk entrepreneurs profit motive market structures monopoly monopolistic competition pure competition Text Pages: corporation entrepreneurship oligopoly Forms of Business Organization – Chapter 8, Section 1; pp.185-188; Section 2; pp. 190-193; Section 3; pp. 195-198 Entrepreneurs and Profit – Chapter 8, Section 1; pp. 185-186 Market Structures – Chapter 7, Section 1; pp. 151-154; Section 2; pp. 157-164; Section 3; 166-171