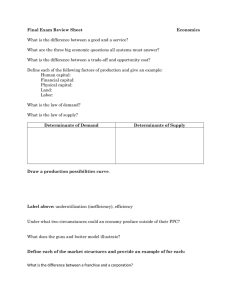

Honors Economics Final Exam Part II

advertisement

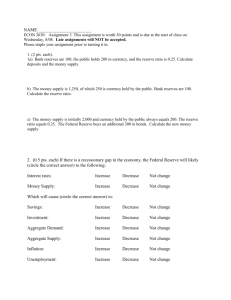

Name:____________________________________Date:_____________________ Period:______ Honors Economics Final Exam, Part II 11. The next best alternative to a choice you make is called _______________: a. Scarcity b. Opportunity Cost c. CPI d. Business Cycle Use the Production Possibilities Curve Below for question #2. 13. _____ You are part of a Space Colony that settles on Mars. There are 300 survivors, including you. The government does not regulate the economy. The colony does not use barter, but instead uses a currency similar to the dollar. What type of economy does your colony have? a. Traditional Economy b. Market Economy c. Command Economy d. Mixed Economy 14. _____ You want to start a business by yourself. Which business type would you use? a. Sole Proprietorship b. Partnership c. Corporation d. None of the above 12. Letter A is _________________. a. Inefficient b. Efficient c. Unattainable d. None of the Above Use the PACED Decision-Making Grid below to answer question #5 James is thinking about buying a car. Based on the PACED decision grid below, which car should he buy? (Assume that he values all of the criteria equally) Used Station Wagon 2006 Hyundai Elantra 2012 Ford F150 2013 Chevy Camero Cost + + - Reliability + + + Gas mileage + - Style + + 15. Which car should James buy? a. Used Station Wagon b. 2006 Hyundai Elantra c. 2012 Ford F150 d. 2013 Chevy Camero 16. Which type of business would require you to draw up Articles of Partnership? a. Sole Proprietorship b. Partnership c. Corporation d. None of the above Name:____________________________________Date:_____________________ 17. Which of the following would be a COST? a. Enjoying a pizza that you chose to eat for dinner b. Leaving Wisconsin’s cold weather for Florida c. Factories polluting the atmosphere because the companies chose to produce goods for profit. d. Earning money because you have a job. 18. The concept of voluntary exchange means that ______________. a. No money was exchanged b. People freely and willingly engage in market transactions c. Only workers will benefit from the exchange d. Neither the buyer nor seller profits Period:______ 20. _____ Which of the following is FALSE about financial institutions? a. They provide a place for households to save money and receive interest b. They allow businesses to borrow money from one location instead of gathering individual investors c. They provide various opportunities for investment d. They allow investors to invest any amount of money with no risk of losing any of it. 21. _____ The price of ketchup goes down. What would be the effect on mustard? a. Demand moves left b. Demand moves right c. Supply moves left d. Supply moves right 19. _____ You take out a loan to buy a car. The bank requires you to pay the original amount back plus additional money. What is the additional money called? a. Interest b. Principle c. Allocation d. Savings __________________________________________________________________________________________ Use Figure 3 to answer question 12: 22. Based on the information from Figure 1, the arc Figure 3: price elasticity of demand when the price Cups of Coffee Demanded per Week changes from $1 to $2 is Price Quantity a. .01 (per cup) Demanded b. .18 $6 80 c. .25 5 100 d. 1.01 4 120 3 140 2 160 1 180 0 200 Use Figure 4 to answer question 13: Name:____________________________________Date:_____________________ 23. What does Figure 4 show? a. Supply b. Demand c. Change in quantity supplied d. Change in demand Use Figure 5 for question 14: Figure 5: Period:______ 25. Which of the following is a definition of elasticity as related to economics? a. The ability of an object or material to resume its normal shape after being stretched or compressed; stretchiness. b. A measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. c. A balance achieved between two desirable but incompatible features d. The degree to which a demand or supply is sensitive to changes in price or income. 26. Which of the following is NOT a Factor that shifts the Demand Curve? a. Income b. New Technology c. Preferences d. Number of Buyers 27. Which of the following is a Factor that shifts the Supply Curve? a. Income b. Time c. Taxes d. Substitutes 24. What is the equilibrium Price of Figure 5? a. $1 b. $2 c. $3 d. $4 28. A machine that produces a product for a business is an example of a ______ good. a. Consumer b. Capital c. Durable d. Non-durable True/False (Answer A for True or B for False) Name:____________________________________Date:_____________________ Period:______ 29. ____ Opportunity Cost is the state of being scarce or in short supply 30. ____ As price goes up, supply goes up. 31. ____ As price goes up, demand goes up. 32. ____ Which of the following is NOT one of the Federal Government’s goals for the economy (as established by the Employment Act of 1946)? a. Full Employment b. Economic Growth c. No inflation d. Price Stability Use the Table below to complete question 23. Year Civilian Noninstitutional population over age 16 150 163 172 200 220 1830 1840 1850 1860 1870 Civilian Labor Force Employed Unemployed Total 70 77 88 110 125 Unemployment Labor Force Rate Participation Rate 6 8 10 8 12 33. ____ The Unemployment Rate in 1860 is approximately ___________________. a. 5% b. 6% c. 7% d. 8% Use the following paragraph to answer questions 24 and 25. Last year consumption expenditure was $50 billion, investment was $20 billion, government purchases of goods and services were $12 billion, exports were $3 billion and imports were $8 billion. 34. ____ What does last year’s GDP equal? a. $77 billion b. $82 billion c. $97 billion d. $107 billion 35. Which of the following is NOT a stage of the business cycle a. Contraction b. Peak c. Inflation d. Trough e. Expansion Name:____________________________________Date:_____________________ 36. Assume the U.S. population in 300 million. If the working age population is 240 million, 150 million are employed, and 6 million are unemployed, what is the size of the labor force? a. 300 million b. 240 million c. 156 million d. 150 million 37. If a country has a CPI of 105.0 last year and a CPI of 102.0 this year, then a. The average prices of goods and services increased between last year and this year. b. The average prices of goods and services decreased between last year and this year. c. The average quality of goods and services decreased between last year and this year. d. The quantity of consumer goods and services produced decreased between last year and this year 38. Suppose a basket of consumer goods and services costs $180 using the base period prices, and the same basket of goods and services costs $300 using the current period prices. The CPI for the current year period equals a. 166.7 b. 66.7 c. 160.0 d. 60.0 Period:______ 39. A standard definition of a recession is a decrease in real GDP that lasts for at least two a. Years b. Quarters c. Months d. Weeks 40. A business cycle is a. A regular up and down movement in production and jobs. b. An irregular up and down movement in production and jobs. c. A regular movement in price changes d. An irregular movement in price changes 41. Olga was trained to repair VCRs. The repair shop she worked at let her go because no one was bringing in VCRs to be repaired. Customers wanted DVD and Blu-ray players repaired, which Olga could not do. What type of unemployment does Olga now find herself in? a. Cyclical Unemployment b. Seasonal Unemployment c. Structural Unemployment d. Frictional Unemployment 42. Which of the following is NOT an entitlement? a. Medicare b. Medicaid c. Social Security d. Military Expenditures 43. Which of the following Tax Reform proposals would change Federal Taxation from income to a national sales tax? a. FairTax b. Flat Tax c. 9-9-9 d. Higher taxes for the rich. Name:____________________________________Date:_____________________ Period:______ 44. A ________ in the federal budget year after year will lead to ___________ in the national debt. a. surplus; an increase b. surplus; no change c. deficit; an increase d. deficit; a decrease Use the chart below to answer questions 35 and 36. 45. Which year saw the highest decrease in Total Revenue over the previous year? a. 1997 b. 2001 c. 2003 d. 2009 46. Which 5 year period saw the greatest increase in the National Debt? a. 1993-1997 b. 1998-2002 c. 2003-2007 d. 2008-2012 47. Which of the following is an example of Expansionary Fiscal Policy? a. A balanced budget b. Decreasing federal spending c. Increasing federal spending d. Increase in federal taxes Name:____________________________________Date:_____________________ Period:______ 48. Which of the following Economists would advocate for a Command Economy to be implemented in the United States? a. Adam Smith b. F.A. Hayek c. John Maynard Keynes d. Karl Marx 49. Regulating the amount of money in the United States is one of the most important responsibilities of the a. State Department b. Treasury Department c. Federal Reserve d. U.S. Mint 50. The Fed’s policy tools include a. Required reserve ratios, the discount rate, and open market operations b. Holding deposits for the U.S. government, reserve requirements, and the discount rate c. Supervision of the banking system and buying and selling commercial banks d. Required reserve ratios, income tax rates, and open market operations 51. If Federal Reserve notes and coins are $765 billion, and banks’ reserves at the Fed are $8 billion, the gold stock is $11 billion, and the Fed owns $725 billion of government securities, what does the monetary base equal? a. $765 billion b. $773 billion c. $776 billion d. $1,509 billion 52. If the Federal Reserve _____ the required reserve ratio, the quantity of money _____. a. Lowers; increases b. Lowers; decreases c. Raises; does not change d. Raises; increases 53. A bank has checkable deposits of $500,000, loans of $300,000, and government securities of $200,000. If the required reserve ratio is 10 percent, the amount of required reserves is a. $20,000 b. $30,000 c. $50,000 d. $500,000 54. The Fed increases the interest rate when it a. Fears recession b. Wants to increase the quantity of money c. Fears inflation d. Wants to encourage bank lending 55. An advantage monetary policy has over fiscal policy is that monetary policy a. Can be quickly changed and implemented b. Is coordinated with fiscal policy c. Is approved by the president of the united states d. Affects consumption expenditure and investment without impacting international trade Name:____________________________________Date:_____________________ Key: 11. B 12. A 13. B 14. A 15. B 16. C 17. C 18. B 19. A 20. D 21. A 22. B 23. B 24. C 25. D 26. B 27. C 28. B 29. B 30. A 31. B 32. D 33. C 34. A 35. C 36. C 37. B 38. A 39. B 40. B 41. C 42. D 43. A 44. C 45. D 46. D 47. C 48. D 49. C 50. A 51. B 52. A 53. C 54. C 55. A Period:______