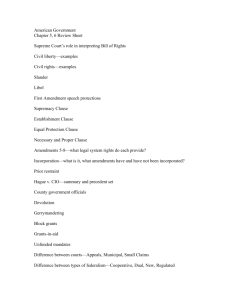

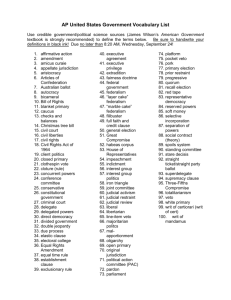

Federalism Chap. 3

advertisement

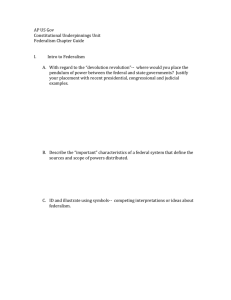

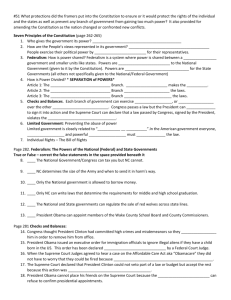

Federalism Government Forms of Government 1. Federalism a. Consists of national and state governments b. Both exercise governmental power in the same system c. Germany, U.S., Mexico, Canada 2. Confederation a. Loose collection of states b. Main power at the individual state level c. U.S. under A. of Confed. (The United Nations) 3. Unitary system a. Principle power is reserved to central government b. Britain, France, China Why Choose Federalism? 1. Shared resources 2. Allows unity without uniformity - one state's needs are not the needs of other states 3. Protects against a runaway federal gov’t 4. Encourages experimentation and cooperation b/t states 5. Allows states to administer federal programs 6. Equalizes financial resources Models of Federalism 1. Dual federalism (prior to 1930 – each supreme in own realm) a. State and national gov't separate b. Each exercises its own powers in its own spheres c. Layer cake analogy 2. Cooperative federalism (today with involvement by both) a. Intertwining relationship b/t national, state and local b. Powers often overlap – highways, schools, police, taxes b. Marble cake analogy 3. Horizontal Federalism a. Between States b. Full Faith and Credit, Extradition, Contracts, Privileges and Immunities, Interstate Commerce Constitutional Powers and the Role of the States National Powers Under the Constitution Inherent Powers Self evident powers each branch possesses because of what it does (President is Commander-in-Chief because he is the boss!) Make laws, enforce laws, interpret laws Enumerated Powers 17 specific powers granted to Congress Necessary and Proper Clause AKA Elastic Clause Article I, Section 8, Clause 17 Implied Powers Supremacy Clause (Article VI) Article 1, section 8 of the U.S. Constitution Taxation Coinage of money Regulation of commerce National defense Mandates that national law is supreme to all other laws passed by the states or by any other subdivision of government Concurrent Powers Authority is possessed by both state and national governments and exercised at the same time State Powers Under the Constitution Article 1 Allows states to determine time, place, and manner of elections for House Representatives and Senators Article II Requires that each state appoint electors to vote for president Article IV Privileges and immunities clause Republican form of government Protection against foreign attacks and domestic rebellion Tenth Amendment States’ reserved powers described here “The powers not delegated to the US by the Constitution, nor prohibited by it to the states, are reserved to the states respectively, or to the people. Police powers Authority of the state to protect and promote the public morals, health, safety and general welfare Relations Among the States Interstate disputes directly settled by U.S. Supreme Court under its original jurisdiction Full Faith and Credit Clause Privileges and Immunities Clause The rights of citizens of a state can’t be denied to non-citizens. Extradition Clause Ensures judicial decrees and contracts made in one state will be binding and enforceable in others States can vary considerably on social issues- implications? Criminals who flee state borders can be returned for prosecution Interstate compacts Over 200 exist today Contracts between states that carry the force of law - Drivers License Compact Consent of Congress Denied Powers States cannot (Article 1 Sec 9) Enter into treaties Coin money Impair obligation of contracts Cannot enter into compacts with other states without congressional approval Denied the authority to take arbitrary actions affecting constitutional rights and liberties Cannot pass a bill of attainder Find you guilty w/o trial No ex post facto laws Making a law retroactive Congress cannot Favor one state over another in regulating commerce Cannot lay duties on items exported from any state Cannot pass a bill of attainder No ex post facto laws Suspend habeas corpus Suspend right to know why you are in jail Checks and Balances & Judicial Decisions on Federalism Federal Supremacy & Implied Powers McCulloch v. Maryland Maryland state assembly passes a “stamp tax” on paper that banks used to print bank notes. If bank was not chartered by the state, they had to pay the tax. McCulloch, a cashier at the national bank, refused to pay the tax. Maryland brought suit. Can a state tax an institution of the federal gov’t? Does Congress have the power to create a national bank? Marshall Court ruled that creation of a national bank was necessary in order for Congress to carry out delegated powers such as creating and coining a national currency, collecting taxes, etc. Decision: National government “supreme” so state can’t tax Decision: National gov’t needs place to collect taxes and pay bills so under elastic clause, creation of bank is implied power National Supremacy Gibbons v. Ogden (1824) Argument over Gibbons federal license to operate steamboats (ferry) over Ogdens license from the state of New York. Can a state regulate interstate trade? Marshall Court says commerce is more than traffic, it includes business and trade b/t nations and parts of nations Court says if state law regulating trade interferes w/a federal law, the federal law is always supreme Decision: Federal law is supreme over state law, Gibbons federal license is supreme National Supremacy Heart of Atlanta Motel v. U.S. Motel in Atlanta refused to serve blacks claiming that Congress exceeded its authority when it regulated local businesses open to the public under the Civil Rights Act of 1964. Is the Civil Rights Act of 1964 constitutional? What constitutes interstate trade? How wide is its range? Can the feds prohibit segregated public accommodations? Court ruled that since the motel engaged in interstate commerce by seeking out of state customers and since 75% of its customers were out of state refusing black customers interfered with interstate commerce. Decision: Under supremacy clause, CRA of ’64 is covered as national regulation of trade Relationships in a Federal System Fiscal Federalism Pattern of spending, taxing and providing grants in a federal system 2010 – state and local governments received $480 billion in federal grants Fiscal Federalism 2011 Fiscal Federalism Categorical grants Target specific programs with restrictions State and Local government must apply for the money Intense competition for funds Bureaucracy decides who gets the money (based on need) There is little say by the state and local government on how the money will be spent (increasing power of national gov) Formula Grant – States and fed share costs (airports, bridges, highways) Project Grant – Money given out for a purpose applied for by state (health research, university research grants) Fiscal Relationships Block Grants Blocks of money for area of policy but not a specific category to spend it in $$ goes to states with a few strings attached States have greater discretion to determine how to use $$ Very few are granted, distributed based on formula set by Congress Fiscal Relationships Revenue Sharing Transfer of $ from taxes, etc. from nat. to state/local Could be used for almost any purpose Done away with in 1988 by Reagan Fiscal Relationships Federal Mandates Demand that states carry out policies even with little or no government aid (unfunded mandates) Most common - Civil rights, air and water pollution, auto emissions, services for illegal aliens, inspection of hospital and nursing homes, education National gov't can set up laws but relies on state enforcement (OSHA, Clean Air) Federal law prohibits under the Contract with America Fiscal Relationships March 1995 - Unfunded Mandates Reform Act (UMRA) setting up procedures to keep congress from imposing costs on states without appropriating funds requires analysis of any bill expected to cost state, tribunal, or local governments more than $50 million if expected to cost lower levels of government or the private sector more than $100 million, House and Senate committees are required to show where funding will come from to offset these costs Unfunded Mandates Examples of Unfunded Mandates 1970s 55 mph or lose hwy assistance during Energy Crisis 1984 drinking age to 21 or 15% cut in hwy aid 1991 incentives for seatbelt/helmet laws; states that did not lost 3% of their highway money for safety programs NCLB (No Child Left Behind) Budgetary Relationships Every president since LBJ has tried to decrease gov’t size If feds don’t provide programs, states must Interest on the debt consumes about 20 % of all incoming revenue People demand more services from gov’t for less cost Effects of Federal Budget on the states: Less federal money for states Increase in federal mandates Entitlements will have to be cut (welfare, social security, etc) Taxes will have to increase or spending be cut Budgetary Techniques of Federal Control over the states Direct orders – required or face fines Clean up water and air; end discrimination in workplace Cross Cutting requirements – sets conditions before aid is granted Hire minorities in proportion to population on highway project Cross over sanctions – money is given on one program based on condition of another 21 drinking age or no highway $$