RBR – PRESS RELEASE London, 23rd December 2014 Improving

RBR – PRESS RELEASE

London, 23 rd December 2014

Improving economic conditions give retailers fresh impetus to invest in EPOS

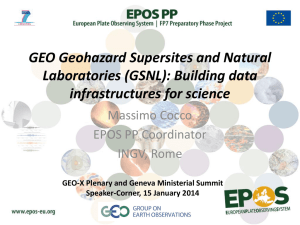

After a disappointing 2012 for the global programmable EPOS market, the strengthening economic recovery gave retailers renewed confidence to invest in store technology in 2013.

New research by strategic research and consulting firm RBR shows the global programmable

EPOS market saw healthy growth in 2013, as shipments increased by 8% to reach 1.8 million.

Hardware refreshes which in many cases had been postponed in the aftermath of the financial crisis were finally undertaken by retailers, especially in North America, which saw shipments increase by 12% in 2013. Business picked up in other established markets too, particularly in western Europe’s two largest markets, the UK and Germany, following a decline in activity in recent years. Equally, the Japanese market, which had been subdued over several years, grew by 15% and a major project at the Australian Post Office helped to boost activity there by 28%, representing the largest percentage increase in the region.

Latin America also enjoyed a boost in EPOS shipments in 2013, with Argentina, Mexico and

Brazil all growing strongly, the latter of which has been buoyed in part by retailers’ preparations for both the FIFA World Cup in 2014 and the Summer Olympics in 2016.

Global Programmable EPOS Shipments 2010-2019 (thousands)

2,200

2,100

2,000

1,900

1,800

1,700

1,600

1,500

1,400

1,300

1,200

1,523

1,661 1,667

1,797

1,928

1,973

1,962

1,920

1,948

2,010

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Source: Global EPOS and Self-Checkout 2014 (RBR)

Other markets fared less well however. In China, for example, the rate of growth decreased to

4%, as the economy there slowed. Shipment numbers declined in the Czech Republic and

France - both markets have suffered from a lack of new store openings in recent years, as retailers have opted to freeze investment during unstable economic times. Activity in India slowed down too, with continuing uncertainty ove r the country’s foreign direct investment policy harming the retail market.

Mobile EPOS and self-checkout expected to put pressure on fixed EPOS

In the long term, the fixed EPOS market is expected to be negatively affected by the increasing deployment by retailers of handheld mobile devices, which can improve both efficiency and customer experience. This is most visibly the case in the USA, where some retailers have already started paring back fixed hardware installations in favour of tablets, particularly in the general merchandise sector and, to a lesser extent, in hospitality.

Although the use of mobile technology will primarily be alongside fixed terminals, some retailers, including, for example, luxury fashion chain Coach, have decided to migrate to handheld devices only, to free up instore floor space. Manufacturers have responded to retailers’ needs, with the leading suppliers all bringing their own mobile solutions to the market to compete with products from non-EPOS vendors.

© RBR 2014 Page 1 www.rbrlondon.com

RBR – PRESS RELEASE

A key trend in the grocery segment, which is likely to see little migration to mobile EPOS, is the increasing prevalence of self-checkout terminals, with pilot activity increasing in markets as diverse as Brazil, Russia and Saudi Arabia. This will also squeeze the fixed terminals market, as retailers use self-service solutions in an attempt to increase throughput at stores.

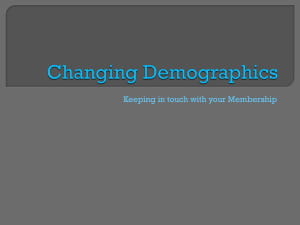

Toshiba remains the largest supplier in global EPOS market

Having become the world’s largest EPOS manufacturer following Toshiba TEC’s acquisition of

IBM’s “Retail Store Solutions” division in 2012, Japan’s Toshiba GCS maintained this position in

2013, with 23% of global shipments.

US supplier NCR remained in second place, with 12% of shipments, after a particularly strong year in Europe, followed by third-placed HP . Germany’s Wincor Nixdorf accounted for 8% of shipments, increasing its share in western Europe. It remains the largest supplier to Central and

Eastern Europe (CEE). Both Taiwan’s Posiflex and Japan’s Fujitsu strengthened their positions in 2013, with Posiflex moving into second place in both CEE and Middle East and Africa, while

Fujitsu was successful in Asia-Pacific in particular. Much of the rest of the market remains fragmented.

Vendors’ Shares of Programmable EPOS Shipments, 2013

32%

3%

4%

4%

5%

8%

23%

10%

12%

Toshiba

NCR

HP

Wincor Nixdorf

Posiflex

Fujitsu

Micros

DigiPoS

Others

Source: Global EPOS and Self-Checkout 2014 (RBR)

Growth of fixed EPOS installed base forecast to slow in medium to long term

RBR ’s Global EPOS and Self-Checkout 2014 study forecasts that the installed base of traditional EPOS terminals will grow at a CAGR of 3%, to reach 14 million worldwide by 2019.

This represents a slowdown, owing partly to the aforementioned pressure from mobile EPOS and self-checkout solutions in the most mature markets. The strongest growth is expected in developing markets, especially in the Middle East and Africa, and Latin America.

Notes to editors

The information in this press release draws on RBR ’s new study Global EPOS and

Self-Checkout 2014 , which comprises the findings of extensive primary and secondary research into the global market for retail automation hardware. The study describes the market for programmable EPOS and self-checkout terminals (units shipped and installed), and end-users ’ expenditure. It also provides vendor shares (units shipped and installed). The study covers 52 country markets and four customer segments, and includes annual forecasts to 2019.

For more information visit www.rbrlondon.com/retail or email Tom Hutchings

( tom.hutchings@rbrlondon.com

).

The information and data within this press release are the copyright of RBR, and may only be quoted with appropriate attribution to RBR. The information is provided free of charge and may not be resold.

RBR • 393 Richmond Road, London TW1 2EF, UK • Tel +44 20 8831 7300 • Fax +44 20 8831 7301 • www.rbrlondon.com

© RBR 2014 Page 2 www.rbrlondon.com