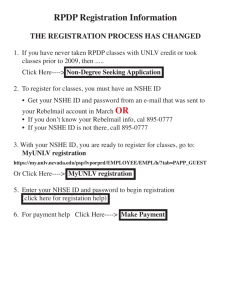

getting to know your fixed assets/equipment inventory

advertisement

GETTING TO KNOW YOUR FIXED ASSETS/EQUIPMENT INVENTORY Kathy Schultz PURCHASING & FIXED ASSETS • Request for Purchase (requisition) – Defining Fixed Assets • Unit cost of $5,000.00 or more (effective 7/1/07) • Complete in itself • Does not lose its identity even though it may become a component part of another item when placed in use • Life expectancy of 1 year or more – Special items regardless of cost • revolvers, shotguns, pyrotechnic devices, vehicles CATEGORIES OF ASSETS • • • • • • • Equipment Buildings/Building improvements Land/Land improvements Collections Fixtures Library books Intangibles – Effective FY10 PURCHASING & FIXED ASSETS • What makes up the cost? – Shipping/installation/shipping insurance – No: • maintenance agreements • training expenses • supplies • Funds – State/grant/other (asset type) – “NOTE” screen – Coding (60 vrs 30) PURCHASING & FIXED ASSETS • Why do we need to give it an asset tag? – Responsibility – Tracking/indentifying – Missing tags • When do we book an asset (“in-service” date)? – Payment Voucher (PV) date (equipment valued at less than $50,000) – “In-service” date determined through direct contact and confirmation with the user department (equipment with a total cost of $50,000 ) BETTERMENTS • What is a betterment? – A betterment of inventoried equipment is any modification which changes or alters a unit’s original function/design and certain major repairs. Contact BCN Purchasing to determine if a repair is deemed major. The depreciation schedule and the useful life may need to be adjusted. • • • • Betterment versus repair Betterment threshold is $5,000.00 Referencing asset tag number Numbering on inventory list – x.xxxxxxA FABRICATIONS • What is a fabrication? – A fabrication is a piece of equipment that is being constructed at the University by University personnel. Generally, each part of a fabrication would not be large enough (over $5,000) to be capitalized and would not function as a separate piece of equipment. There are exceptions, as in lasers, where the parts that make up the finished piece of equipment are over $5,000 but these parts must meet the unable to function alone criterion. If a piece of a fabrication can function on its own, and is over $5,000, it is a piece of equipment and must be tagged separately. A fabrication must, when complete, be $5,000 or over in value. • Fabrication procedure – – – – Paperwork Coding Life of fabrication Ending fabrication LEASE PURCHASE • What is a lease purchase? – Leased equipment can be included on the inventory if it meets one of the following accounting rules: • 1. it transfers ownership • 2. there is a bargain purchase option • 3. the term of the lease is greater than or equal to 75% of the equipment’s economic life • 4. the present value of the payments is greater than or equal to 90% of the equipment’s fair value – If you have questions about whether your leased equipment should be included on your inventory, please contact Philomena McCaffrey at the Controller’s Office (784-4176) for further guidance. • Lease purchase procedure – Coding (60-LS) LOAN AGREEMENTS • Type of Loans: – NSHE institution to outside entity – NSHE institution to NSHE institution – NSHE department to NSHE department • Memorandum of Understanding (MOU) • Signature requirements • Distribution requirements LOAN AGREEMENTS • NSHE department to NSHE employee • Equipment Loan Agreement • Signature requirements • Distribution requirements • Keep a file of all MOU’s and Loan Agreements ANNUAL PHYSICAL INVENTORY • Why is this important? – Board of Regents’ Policy – Audit exceptions – Responsibility • Procedure – Verify each asset • Pencil in notes on report • Assets below $5,000.00 • Sensitive items (guns, vehicles, artwork) ANNUAL PHYSICAL INVENTORY – Report any changes • Room number • Responsible person • Corrections to asset record – model, serial number, description – Deletions • Surplus • Scrap/parted out • Obsolete – Must be signed by verifier and department chair HELPFUL HINTS – Make changes during the course of the year • • • • Property Transfer form E-mail/memo Surplus Property Disposal form List of assets by location code can be downloaded from CAIS SURPLUS PROPERTY • How does it work? – Surplus Property Disposal pickup request • http://www.howler.unr.edu/bcnpurchasing/OnLineForms/SurplusForm.htm – Procedure • • • • Reutilization Sales Donation Disposal/scrap SENSITIVE EQUIPMENT • Effective March 1, 2008, the following sensitive items or items subject to theft must be separately tracked by the responsible department if the items have a value in excess of $2000 and less than $5000: • • • • • • • • • • • • • 1. Bicycles 2. Cameras: digital, film, video 3. Cell phones, two-way radios, individual communication devices 4. Computers (costing less than $5,000): desktop, servers, laptop, PDAs (regardless of acquisition cost) 5. Copy, fax and multifunctional machines 6. Lawn mowers 7. Microscopes and telescopes 8. Music systems and components 9. Musical instruments 10. Printers 11. Scales and balances 12. Televisions 13. Video: projectors, recorders, monitors SENSITIVE EQUIPMENT • Institutions that wish to inventory additional items may do so at their discretion • Kept by individual departments – Develop a tracking system – Object/subject codes 30-SE • Auditors will ask for sensitive equipment list – – – – – Description including model, serial number Responsible person Transaction number and date Asset dollar amount Disposition (if disposed) ACCOUNTING • CEPL Report – Reconciles “60” purchases • PO’s/JV’s/P-Card • Moving asset expenses – Within the current fiscal year – Outside the current fiscal year • Selling an asset – Reimbursement to account Questions???????????????