National Income Accounts

advertisement

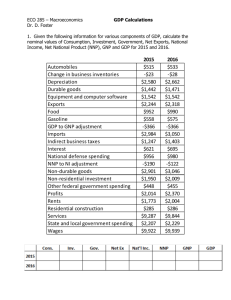

National Income Accounts Endogenous are determined (explained) within the macroeconomy, they cannot be directly influenced (e.g., national output, employment, inflation). Exogenous variables are independently determined outside the model and are treated as given (e.g., changes in the growth of government spending, exogenous shocks,…). See Table 2.1. 1. Gross Domestic Product (GDP): total (market) value of a country’s output. GDP is the value of all final goods and services produced. Nominal GDP measures these values using current prices. Real GDP measure these values using the prices of a base year. 2. Inflation: % rate of change of a price index • • Consumer price index GDP deflator • GDP deflator = Nominal GDP/Real GDP See Table 2.3. – The Fed prefers the personal consumption expenditure (PCE) index • CPI = (Σpiqo)/Σ(poqo) See Table 2.4 • CPI is used to – track changes in the cost of living – allow comparisons of dollar amounts over time – adjust many contracts for inflation (“COLAs”) Example 2006 2007 2008 P Q P Q P Q $30 900 $31 1,000 $36 1,050 good B $100 192 $102 200 $100 205 good A • nominal GDP 2006: $46,200 = $30 900 + $100 192 2007: $51,400 2008: $58,300 • real GDP 2006 Ps 2006: $46,200 2007: $50,000 2008: $52,000 = $30 1050 + $100 205 U.S. Nominal and Real GDP, (billions) 1960-2009 Real GDP (in 2000 dollars) Nominal GDP Source: http://bea.gov The composition of the CPI’s “basket” Source: Bureau of Labor Statistics, http://www.bls.gov/cpi/ Source: Bureau of Labor Statistics, http://www.bls.gov/cpi/ Factors that can cause overstatement of inflation: 1. 2. 3. 4. Substitution bias New product bias Quality bias Outlet substitution The expenditure components of GDP • consumption, C • investment, I • government spending, G • net exports, NX An important identity: Y = C + I + G + NX value of total output aggregate expenditure Consumption (C) definition: The value of all goods and services bought by households. Includes: – durable goods last a long time e.g., cars, home appliances – nondurable goods last a short time e.g., food, clothing – services intangible items purchased by consumers e.g., dry cleaning, air travel U.S. consumption, 2011 $ billions Consumption % of GDP 10,726 71.1 Durables 1,163 7.7 Nondurables 2,484 16.5 Services 7,079 46.9 Investment (I) • Spending on capital, a physical asset used in future production • Includes: – Business fixed investment Spending on plant and equipment – Residential fixed investment Spending by consumers and landlords on housing units – Inventory investment The change in the value of all firms’ inventories U.S. Investment, 2011 $ billions Investment Business fixed Residential Inventory % of GDP 1,916 12.7 1,532 10.2 338 2.2 46 0.3 Investment vs. Capital Note: Investment is spending on new capital. Example (assumes no depreciation): – 1/1/2012: Economy has $10 trillion worth of capital – during 2012: Investment = $2 trillion – 1/1/2013: Economy will have $12 trillion worth of capital Government spending (G) • G includes all government spending on goods and services. • G excludes transfer payments (e.g., unemployment insurance payments), because they do not represent spending on goods and services. U.S. Government Spending, 2011 $ billions % of GDP Govt spending 3,031 20.1 - Federal 1,233 8.2 Non-defense 408 2.7 Defense 825 5.5 1,798 11.9 - State & local Net exports (NX) • NX = exports – imports – exports: the value of g&s sold to other countries – imports: the value of g&s purchased from other countries • Hence, NX equals net spending from abroad on our g&s U.S. Net Exports, 2011 $ billions Net exports of g & s Exports Goods Services Imports Goods Services % of GDP –579 –3.8 2,086 13.8 1,473 9.8 612 4.1 2,664 17.7 2,238 14.8 426 2.8 Net Exports: NX = EX – IM • def: the value of total exports (EX) minus the value of total imports (IM) 20% NX 16% exports imports 12% 8% 4% 0% -4% -8% 1950 1960 1970 1980 1990 2000 2010 Paradigm shifts • • • • • The US in the Great depression of the 1930s Stagflation of the 1970s Subprime crisis Japan since the early 1990s Western Europe since 2008 ‘Using macroeconomic models is not like building a bridge’ because of anticipation and changing expectations. See Table 2.2.