Identity Theft, Privacy, and Technology

advertisement

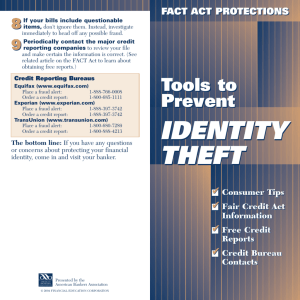

Identity Theft, Privacy, and Technology COMM 2500-001 Rebeca Castaneda Introduction Identity Theft is a federal crime with countless of variations. “It happens when someone uses bits and pieces of information about an individual, generally a social security number, to represent him or herself as that person for fraudulent purposes” (Privacy Rights Clearinghouse). In this research paper I will be discussing three impacts of identity theft, privacy, and technology, as well as analyzing its current status in society. The three impacts include a legislation law taken into effect, uproar on ID protection programs, and life-altering effects of identity theft and intrusion of privacy. Impact 1 The first impact has to do with a Legislation Law that has been taken into effect in 1998 after a notorious case in identity fraud: a convicted felon came to the possession of a federal home loan, as well as purchasing houses, motorcycles, and handguns all in the victim’s name. Unfortunately, that was just the beginning, for the offender also acquired more than $100,000 in credit card debt and even filed for bankruptcy. After making a misleading statement to obtain a firearm, the felon served a brief sentence. This case caused Congress to create a new federal law of identity theft in the fall of 1998; Congress passed the Identity Theft and Assumption Deterrence Act. (The United States Department of Justice) The law reads “18 U.S.C. § 1028(a)(7): This offense carries a maximum term of 15 years in prison, a fine, and criminal forfeiture of any personal property used or intended to be used to commit the offense” (The United States Department of Justice). The legislation created a new crime of identity theft, which forbids “knowingly transferring or using, without lawful authority, a means of identification of another person with the intent to commit any unlawful activity that constitutes a violation of Federal law” (The United States Department of Justice). “Plans to commit identity fraud or theft may also involve violations of other regulations: such as identification fraud (18 U.S.C. § 1028), credit card fraud (18 U.S.C. § 1029), computer fraud (18 U.S.C. § 1030), mail fraud (18 U.S.C. § 1341), wire fraud (18 U.S.C. § 1343), or financial institution fraud (18 U.S.C. § 1344). Each of these federal offenses are felonies that carry extraordinary penalties, some as high as 30 years in prison, fines, and criminal relinquishment.” (The United States Department of Justice) Federal prosecutors also work with federal agencies such as the Federal Bureau of Investigation, the United States Secret Service, and the United States Postal Inspection Service to litigate identity theft and fraud cases (The United States Department of Justice). Impact 2 The internet has become the most common place, in recent years, for criminals to acquire information to steal banking data, passwords, and just about anything private and personal. In most cases, these criminals have used computer technology to collect large amounts of personal data. But most uncommon, is realizing how easy it is for these criminals to obtain this kind of information (The United States Department of Justice). Downloading files or software, opening email attachments or clicking on pop-ups, and visiting devious web sites are just some of the ways criminals can get your information. The second impact I will be talking about is how identity fraud has caused identity theft protection programs to go up as well as enhance privacy and technology. According to Best Identity Theft Protection of 2016 | Top Ten Review, LifeLock ID Protection was rated number 1: it includes fraud monitoring, fraud notifications, resolution services, stolen wallet assistance, and countless of protection. LifeLock monitors over a trillion data points a day using proprietary technology, and alerts you through email and mobile devices. If LifeLock were to notice any suspicious activity, they would back it up with a team of U.S. based specialists who are there to make the calls, file the paperwork, and take all the steps to help restore your identity if it ever is compromised. (LifeLock) Identity Theft is on the rise again after trending downward for four years. In the year of 2009, more than 11 million consumers were hit by the crime (Consumer Reports). Identity fraud has enhanced privacy and technology. According to the American Civil Liberties Union (ACLU), they work to expand the right to privacy, make sure individuals are developing control over their personal information, and guarantee civil liberties are enhanced rather than compromised by technological innovation. Technological innovation is the act of using technology in new ways. Technological innovation has fully extended our privacy protections. The ACLU works to establish a future in which the Fourth Amendment’s ban on unreasonable searches carries on to digital property and your data is your own. (American Civil Liberties Union) It is the ACLU’s opinion that Americans should not have to choose between using new technologies and protecting their civil liberties. Impact 3 Every two seconds, someone in America becomes the victim of identity theft, according to Javelin Strategy and Research. It is the number 1 complaint reported to the Federal Trade Commission (FTC), according to the agency’s 2013 Consumer Sentinel Report. My last and final impact I will discuss is the effects of identity theft and intrusion of privacy. These effects include impacts on the victim’s health, emotional well-being, and relationships with others. According to Diane Turner, a licensed clinical social worker and certified life coach based in Illinois and Arizona, identity theft victims frequently show emotions, such as the way a trauma survivor would react. Turner says victims often experience emotional symptoms and show signs of grief similar to depression and heightened anxiety, emotional volatility, sleeplessness, self-medicating with food or alcohol, and loss of motivation. These Victims may feel self-blame, vulnerable, isolation, and just overall financial stress. (Equifax) There were 13.1 million victims of identity fraud in the United States in 2013 (Equifax). “Financial is like any stress,” says Nancy Molitor, PhD, a clinical psychologist based in Wilmette, Illinois. “If we don’t remain vigilant and track our stress, we can get overwhelmed.” Those who already have financial struggles, they may feel the extra stress. From rebuilding credit to filing police reports, especially after undergoing a fraudulent case, it can take some time for victims to get their finances back in order. Unfortunately, those who become victims of identity theft are left to deal with the outcomes of this crime. That is typical with most cases. In the first impact, I mentioned the story of the couple who were victims in a notorious identity theft case. The victim and his wife spent more than four years and $15,000 of their own money restoring their credit and reputation, the criminal made no restitution to his victim for any harm he had caused (The United States Department of Justice). Conclusion Identity Theft is a huge problem in the United States, but there are countless of ways to prevent it. According to Consumer Reports, placing security freezes and fraud alerts, securing your devices, reviewing all your personal data files, and having ID protection programs are just some of the ways to prevent this crime from happening to you. Also taking the initiative to do daily tasks, such as shredding personal and important files as well as choosing unique passwords, to prevent identity fraud is recommended. Society should care about this issue because it can happen to anyone. In most cases, people believe that it will not happen to them, but by not taking precautions, it can happen when you least expect it. With this legislation law taken into effect, I feel that it is still not enough. I feel that there should be some sort of help provided for the victims in the aftermath of identity theft. The government should provide that help. Possibly setting up a program for the victims where they are provided with options to help them through this tough time. The government should be taking care of these victims. Bibliography "A Lasting Impact: The Emotional Toll of Identity Theft." Personal Solutions (n.d.): n. pag. Equifax, Feb. 2015. Web. 11 Nov. 2015. <http://www.equifax.com/assets/PSOL/159814_psol_emotionalToll_wp.pdf>. "Best Identity Theft Protection of 2016 | Top Ten Reviews." TopTenREVIEWS. N.p., n.d. Web. 15 Nov. 2015. <http://identity-theft-protection-services-review.toptenreviews.com/>. "How To Protect Yourself From Identity Theft." Consumer Reports. Consumer Reports Money Adviser, July 2010. Web. 22 Nov. 2015. <http://www.consumerreports.org/cro/2010/07/protect-your-identity/index.htm>. "Identity Theft: How It Happens, Its Impact on Victims, and Legislative Solutions." Privacy Rights Clearinghouse. N.p., n.d. Web. 11 Nov. 2015. <https://www.privacyrights.org/ar/id_theft.htm>. "Identity Theft Protection From ID & Credit Fraud | LifeLock." LifeLock. N.p., n.d. Web. 15 Nov. 2015. <https://www.lifelock.com/dm/restoration/?promocodehide=GOOGSEARCH30MB&gcl id=CP2c_bz8k8kCFQmPaQodSWUAgA>. "Identity Theft." The United States Department of Justice. N.p., n.d. Web. 11 Nov. 2015. <http://www.justice.gov/criminal-fraud/identity-theft/identity-theft-and-identity-fraud>. "Privacy & Technology." American Civil Liberties Union. N.p., n.d. Web. 15 Nov. 2015. <https://www.aclu.org/issues/privacy-technology>.