FLSA Developments and Managing Overtime Eligible Employees

advertisement

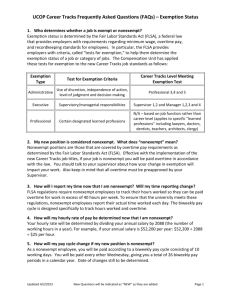

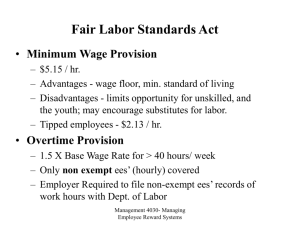

Fair Labor Standards Act (FLSA): New Developments & Managing Overtime Eligible Employees Jeffrey N. Jensen Senior Associate General Counsel Legal Symposium October 15, 2015 Office of Legal Affairs HISTORY OF THE FLSA President Franklin D. Roosevelt signed the Fair Labor Standards Act into law in 1938. The FLSA banned oppressive child labor, set the minimum hourly wage at 25 cents, and the maximum workweek at 44 hours. TODAY’S FAIR LABOR STANDARDS ACT • Establishes minimum wage, overtime pay & recordkeeping standards for full-time and part-time workers in the private and public sectors. • The U.S. Department of Labor’s Wage and Hour Division administers and enforces the FLSA. THE WAGE & HOUR LAW’S BASIC TENETS 1. Minimum wage must be paid 2. Overtime pay - must pay one and one-half times regular hourly rate of pay for all hours worked over 40 MINIMUM WAGE • Since July 24, 2009, overtime eligible workers are entitled to a minimum wage of not less than $7.25 per hour. • Since January 2015 federal contractors must pay a minimum wage of at least $10.10 per hour. COMPENSEATION TIME IN LIEU OF OVERTIME PAY • Tool available to public sector employers • Employee must have a reasonable opportunity to use their comp time • Maximum accrual limit under law/policy, after which employer must pay out COMPENSATION TIME 1. Overtime eligible public sector employees in North Carolina may accrue up to 240 hours of comp time (160 hours straight time). 1. Any overtime hours worked above the 240 hour maximum accrual limit shall be paid in the employee’s next regular paycheck at their overtime rate (time and a half). COMPENSATION TIME 3. An employer must honor requests to use comp time within a reasonable period of time, as long as the time off does not unduly disrupt operations. 4. Pursuant to North Carolina policy, the University should allow overtime compensation to be taken as soon as possible. COMPENSATION TIME 5. Pursuant to North Carolina policy, overtime eligible employees shall use accrued compensatory leave within twelve months from the date the work was performed. 6. Moreover, if comp time is not taken within 365 days, the time shall be paid out in the employee’s next paycheck. EXEMPT or NONEXEMPT Employees whose jobs are governed by the FLSA are either “exempt” or “nonexempt.” • Nonexempt employees are entitled to overtime pay. • Exempt employees are not. Which employees are exempt? With few exceptions, to be exempt an employee must the following tests: (a) be paid at least $455 per week ($23,660 per year), and (b) be paid on a salary basis, and also (c) perform exempt job duties. * Most employees must meet all three “tests” to be exempt. The “White Collar” Exemptions The most well-known and commonly used of the dozens of FLSA exemptions are the so-called “white collar” exemptions for three categories of employees: • Executive • Administrative, and • Professional. Test #1 Salary Level Test • must be paid a minimum of $455 per week ($23,660 per year) • employees paid less are nonexempt and eligible for overtime Test #2 Salary Basis Test An exempt employee is paid on a salary basis … • For any week in which work is performed • Employee receives a fixed, guaranteed amount of pay • Pay not subject to reduction regardless of the quality or quantity of work, or of the hours worked Test #3 Duties Tests by Job Category • Executive • Administrative • Professional: Learned and Creative There are typical job duties for each of these white collar categories. EXECUTIVE EXEMPTION • Primary duty of managing the enterprise, department or division • Regularly directs two or more employees • Must possess the authority to hire, fire, or otherwise affect the status of other employees or to recommend such action ADMINISTRATIVE EXEMPTION • Primary duty of non-manual or office work • Directly related to the management or general business operations of the employer or the employer’s customers (i.e., the University’s students) • Primary duty includes the exercise of discretion and independent judgment with respect to matters of significance PROFESSIONAL EXEMPTION “Learned Professional” • Primary duty is performing work that requires advanced knowledge in a field of science or learning, customarily acquired by a prolonged course of specialized intellectual instruction • Work requires consistent exercise of discretion and judgment • Fields of science or learning from which degreed professionals qualify for this exemption: accounting, engineering, medicine, law architecture, teaching, etc. PROFESSIONAL EXEMPTION “Creative Professional” • Primary duty requires invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor • Work requires consistent exercise of discretion and judgment To review … Most “White Collar” employees must meet all three “tests” to be exempt. With few exceptions, to be exempt these employees must: (a) be paid at least $23,660/year, and (b) be paid on a salary basis, and also (c) perform exempt job duties. Regulatory Development On July 6, 2015 DOL proposed a regulatory change to the “White Collar” Exemption’s Minimum Salary Rule • Current minimum annual salary threshold of $23,660 will increase to $50,440 in 2016 • Moreover, in future years the Minimum Salary Threshold will automatically escalate Regulatory Development • Exempt “White Collar” employees in the Executive, Administrative or Professional Categories currently making between $23,660 and $50,440 annually would no longer qualify as exempt, and would become eligible for overtime • The “White Collar” Minimum Salary Rule would not affect learned professional workers who are not subject to the Salary Level Test, including teachers Regulatory Development Bottom Line – The new FLSA “White Collar” Exemption regulations will likely require the University to reclassify dozens of employees as nonexempt, making them eligible to earn comp time for all overtime hours they work. NEXT STEPS? 1. Review the exempt status of employees based on proposed salary increase to $50,440 2. Prepare to pay overtime, or to extend comp time, for all overtime hours worked 1. Alternatively, prepare to limit or prohibit overtime work to avoid overtime or comp time payouts NEXT STEPS? 4. Consider raising the salary of affected employees above the new $50,440 threshold to maintain their exempt status 5. Consider eliminating select positions 6. Alter jobs by shifting duties and responsibilities 4. Use a combination of the above strategies to manage Are there other emerging FLSA challenges for University management? Timekeeping Records • The FLSA requires employers to keep accurate time records for all nonexempt employees. • Federal law does not require any particular method for recording time worked. Best Practice - A method which requires nonexempt employees to clock in or write in their own time, or at least sign off on their time is strongly preferred, as this limits their ability to later say their time recorded is not accurate. How to record “hours worked”? As the FLSA does not prescribe a method, an employer can use: • a time clock • manual time sheets, or • a computerized timekeeping tool Timekeeping Records • Many employers utilize time clocks and computerized timekeeping systems, in an effort to increase efficiency, decrease cost, and eliminate some of the human error that goes along with manual time keeping. • No system is foolproof! Beware: U.S. Department of Labor can factor in work time not reflected on an employee’s official time records, if there is evidence work is being performed but not recorded. Email, Texting & Twitter as working time? Q. If nonexempt employees are using electronic devices to receive and reply to work-related messages during nonworking hours, is that time compensable under the FLSA? A. It depends. Best Practice #1 - Supervisor should establish a clear expectation, preferably advising all nonexempt employees to not use their home computer, laptop, smartphone, PDA or tablet to perform work outside of working hours or during their unpaid meal breaks. Email, Texting & Twitter as working time? Best Practice #2 - Supervisors should be careful not to encourage nonexempt employees to check or respond to work-related emails during nonworking hours. Best Practice #3 - If such work is permitted or expected, however, supervisors should carefully manage and record all such work by requiring nonexempt employees to record all time spent checking, sending, or receiving workrelated emails, and then compensate the employee for that time. • In the spring of 2011, the U.S. Department of Labor launched “DOL – Timesheet,” a free application for smart phone with an easy-to-use electronic timesheet. De Minimus Doctrine • FLSA’s general rule is that all work is compensable. • The de minimus doctrine permits employers to treat very small increments of time as non-compensable (e.g., 10 minutes or less). • This means that if an nonexempt employee occasionally works for a few minutes “off the clock” either at home or before clocking in at work, the employer does not need to track this time. Email, Texting & Twitter - Recommendations 1. Use 10-minute (de minimus) rule as guideline 2. Factor in the regularity and aggregate amount of time spent 3. Establish clear expectations regarding use of electronic devices outside of normal work hours 4. When possible, prohibit nonexempt employees from using electronic devices to work outside of their normal business hours 5. Finally, be prepared to record and pay for all compensable working time Another Management Challenge: Maintaining Accountability While Providing Flexibility Mobile Communication Device (MCD) Allowances University Policy 317 Laura Williams University Controller Office of Legal Affairs Flexible Work and Telework Arrangements for SPA and EPA Non-Faculty Employees University Policy 101.22 Jeanne Madorin Executive Director of Human Resources for EPA Non-Faculty Administration, Employee Relations, and Compliance Office of Legal Affairs