Document

advertisement

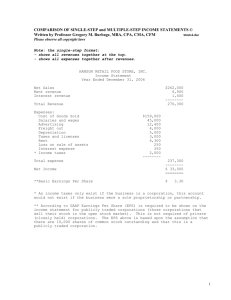

Chapter 2 - Income Statement Usefulness Evaluate past performance. Predicting future performance. Help assess the risk or uncertainty of achieving future cash flows. Chapter 4-1 LO 1 Understand the uses and limitations of an income statement. Income Statement Limitations Companies omit items that cannot be measured reliably. Income is affected by the accounting methods employed. Income measurement involves judgment. Chapter 4-2 LO 1 Understand the uses and limitations of an income statement. Format of the Income Statement Elements of the Income Statement Revenues – Inflows or other enhancements of assets or settlements of its liabilities that constitute the entity’s ongoing major or central operations. Examples of Revenue Accounts Sales Fee revenue Interest revenue Dividend revenue Rent revenue Chapter 4-3 LO 1 Understand the uses and limitations of an income statement. Format of the Income Statement Elements of the Income Statement Expenses – Outflows or other using-up of assets or incurrences of liabilities that constitute the entity’s ongoing major or central operations. Examples of Expense Accounts Cost of goods sold Depreciation expense Interest expense Rent expense Salary expense Chapter 4-4 LO 1 Understand the uses and limitations of an income statement. Format of the Income Statement Elements of the Income Statement Gains – Increases in equity (net assets) from peripheral or incidental transactions. Losses - Decreases in equity (net assets) from peripheral or incidental transactions. Gains and losses can result from sale of investments or plant assets, settlement of liabilities, write-offs of assets. Chapter 4-5 LO 1 Understand the uses and limitations of an income statement. Single-Step Format The single-step statement consists of just two groupings: Revenues Expenses SingleStep Net Income No distinction between Operating and Non-operating categories. Chapter 4-6 Income Statement (in thousands) Revenues: Sales Interest revenue Total revenue $ 285,000 17,000 302,000 Expenses: Cost of goods sold Selling expense Administrative expense Interest expense Income tax expense Total expenses 149,000 10,000 43,000 21,000 24,000 247,000 Net income $ 55,000 Earnings per share $ 0.75 LO 2 Prepare a single-step income statement. E4-4: Prepare an income statement from the data below. Single-Step Format Income Statement For the year ended Dec. 31, 2011 Administrative expense: Officers' salaries Depreciation Revenues: $ 4,900 3,960 Cost of goods sold 63,570 Rental revenue 17,230 Selling expense: Sales $ Rental revenue 96,500 17,230 Total revenues 113,730 Expenses: Cost of goods sold 63,570 17,150 Transportation-out 2,690 Selling expense Sales commissions 7,980 Administrative exense 8,860 Depreciation 6,480 Interest expense 1,860 Income tax expense 7,580 Sales 96,500 Income tax expense 7,580 Interest expense 1,860 Chapter 4-7 Solution on notes page Total expenses Net income 99,020 $ 14,710 LO 2 Prepare a single-step income statement. Single-Step Format Review The single-step income statement emphasizes a. the gross profit figure. b. total revenues and total expenses. c. extraordinary items more than it is emphasized in the multiple-step income statement. d. the various components of income from continuing operations. Chapter 4-8 LO 2 Prepare a single-step income statement. Multiple-Step Format Income Statement Sections 1. Operating section 2. Nonoperating section 3. Income tax 4. Discontinued operations 5. Extraordinary items 6. Earnings per share Chapter 4-9 LO 3 Prepare a multiple-step income statement. Multiple-Step Format Background Separates operating transactions from nonoperating transactions. Matches costs and expenses with related revenues. Highlights certain intermediate components of income that analysts use. Chapter 4-10 LO 3 Prepare a multiple-step income statement. Multiple-Step Format The presentation divides information into major sections. 1. Operating Section 2. Nonoperating Section 3. Income tax Chapter 4-11 Income Statement (in thousands) Sales $ 285,000 Cost of goods sold Gross profit 149,000 136,000 Operating expenses: Selling expenses Administrative expenses Total operating expense 10,000 43,000 53,000 Income from operations 83,000 Other revenue (expense): Interest revenue Interest expense Total other Income before taxes Income tax expense 17,000 (21,000) (4,000) 79,000 24,000 Net income $ 55,000 Earnings per share $ 0.75 LO 3 Prepare a multiple-step income statement. Illustration (E4-4): Prepare an income statement from the data below. Administrative expense: Officers' salaries Depreciation Multiple-Step Format Income Statement For the year ended Dec. 31, 2011 Sales $ 4,900 3,960 Cost of goods sold 63,750 Operating Expenses: Rental revenue 17,230 Selling expense 2,690 Sales commissions 7,980 Income from operations Depreciation 6,480 Other revenue (expense): Sales 32,750 17,150 Administrative exense Transportation-out 96,500 Income tax expense 7,580 Interest expense 1,860 8,860 Total operating expenses 26,010 6,740 Rental revenue 17,230 Interest expense (1,860) Total other 15,370 Income before tax 22,110 Income tax expense Chapter 4-12 Solution on notes page 96,500 63,750 Gross profit Cost of goods sold Selling expense: $ Net income 7,580 $ 14,530 Multiple-Step Format Review A separation of operating and non operating activities of a company exists in a. both a multiple-step and single-step income statement. b. a multiple-step but not a single-step income statement. c. a single-step but not a multiple-step income statement. d. neither a single-step nor a multiple-step income statement. Chapter 4-13 LO 3 Prepare a multiple-step income statement. Chapter 4-14 An Income Statement Chapter 4-15 Sales Minus Cost of Goods Sold = Gross Profit Minus Operating Expenses Selling expenses General and Administrative expenses Depreciation and Amortization Expense = Operating income (EBIT) Minus Interest Expense = Earnings before taxes (EBT) Minus Income taxes = Net income (EAT) 1 FIN3000, Liuren An Income Statement Chapter 4-16 Sales Minus Cost of Goods Sold = Gross Profit Minus Operating Expenses Selling expenses General and Administrative expenses Depreciation and Amortization Expense = Operating income (EBIT) Minus Interest Expense = Earnings before taxes (EBT) Minus Income taxes = Net income (EAT) 1 FIN3000, Liuren Sample Income Statement Chapter 4-17 1 FIN3000, Liuren Evaluating a Firm’s EPS Chapter 4-18 We can use the income statement to determine the earnings per share (EPS) and dividends. EPS = Net income/Number of shares outstanding Example 1: A firm reports a net income $90 million and has 35 million shares outstanding, what will be the earnings per share (EPS)? EPS = Net income ÷ Number of shares = $90 million ÷ $35 million = $2.57 1 FIN3000, Liuren Evaluating a Firm’s Dividends per share Dividends per share = Dividends paid ÷ Number of shares Example 2: A firm reports dividend payment of $20 million on its income statement and has 35 million shares outstanding. What will be the dividends per share? Chapter 4-19 Dividends per share = dividend payment ÷ Number of shares = $20 million ÷ $35 million = $0.57 1 FIN3000, Liuren Connecting the Income Statement and the Balance Sheet What can the firm do with the net income?: 1. 2. Chapter 4-20 Pay dividends to shareholders, and/or Reinvest in the firm Example 3: Review examples 1 & 2. How much was retained or reinvested by the firm? Amount retained = Net Income – Dividends = $90m - $20m = $70m The firm’s balance on retained earnings will increase by $70 million on the balance sheet. 2 FIN3000, Liuren Interpreting Firm Profitability using the Income Statement What can we learn from Boswell Inc.’s income statement? The firm has been profitable as its revenues exceeded its expenses. The gross profit margin (GPM) = gross profits ÷ sales = $675 million ÷ $2,700 million = 25% 1. 2. Chapter 4-21 GPM indicates the firm’s “mark-up” on its cost of goods sold per dollar of sales. 2 FIN3000, Liuren Interpreting Firm Profitability using the Income Statement (cont.) The operating profit margin = net operating income (EBIT)÷ sales = $382.5 million ÷ $2,700 million = 14.17% 4. Net profit margin: = net profits (Net income) ÷ sales = $204.75 million ÷ $2,700 million = 7.58% These profit margins (gross profit margin, operating profit margin, and net profit margin) should be closely monitored and compared to previous years and those of competing firms. 3. Chapter 4-22 2 FIN3000, Liuren