sk/update1-08 - Cloudfront.net

advertisement

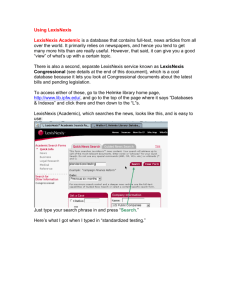

SQUIRREL-KILLERS Update Briefs #3, Part D December 3, 2015 Dr. John F. Schunk, Editor FIRST NEGATIVE BRIEFS 18. IMMIGRATION SURVEILLANCE SECOND NEGATIVE BRIEFS 19. BANK SECRECY ACT: ABOLITION Disad 20. ISIS TERRORISM Disad 21. TSA SURVEILLANCE CURTAILMENT Disad S-K PUBLICATIONS PO Box 8173 Wichita KS 67208-0173 PH 316-685-3201 FAX 316-260-4976 debate@squirrelkillers.com http://www.squirrelkillers.com SK/UPDATE3-18. IMMIGRATION SURVEILLANCE 1. ICE (IMMIGRATION/CUSTOMS ENFORCEMENT) TARGETS CRIMINALS SK/UP3-18.01) Sarah Parvini, LOS ANGELES TIMES, August 15, 2015, p. B4, LexisNexis Academic. Federal agents have arrested 50 fugitives in cities across the United States, including Los Angeles, who are suspected of murder and other human rights violations abroad, officials announced Friday. The arrests mark the second time U.S. Immigration and Customs Enforcement officials have targeted suspected war criminals illegally seeking shelter in the United States, the agency said. The investigation, dubbed Operation No Safe Haven II, concluded Thursday. Of the 50, seven were arrested in Los Angeles. Most of them are from Central America, according to ICE spokeswoman Jennifer Elzea. Five were arrested in San Francisco. SK/UP3-18.02) Sarah Parvini, LOS ANGELES TIMES, August 15, 2015, p. B4, LexisNexis Academic. In a statement, ICE said it was "committed to rooting out known or suspected human rights violators who seek a safe haven in the United States." Those suspected of human rights violations "didn't need to pull the trigger" to be considered criminals, Elzea [ICE spokeswoman] said. "Substantial involvement is still a human rights violation," she said. SK/UP3-18.03) Ciara O’Rourke, AUSTIN AMERICAN-STATESMAN, April 3, 2014, p. B1, LexisNexis Academic. However, since June 2009, nearly 4,600 people living in the country without legal permission have been deported after being booked into Travis County Jail, according to federal officials. Of those, nearly 4,000 had criminal convictions, and 1,400 were convicted of so-called "Level 1" offenses, which include homicide, sexual assault and drug crimes that result in a sentence of more than a year. SK/UP3-18.04) Editorial, THE PHILADEPHIA DAILY NEWS, July 18, 2014, pNA, LexisNexis Academic. The local ICE office covers Pennsylvania, West Virginia and Delaware and doesn't break down deportations by locality. ICE officials tell me there were 5,800 "removals" last year and two-thirds were convicted criminals. The other onethird were gangbangers and others who threaten the community. 2. SECURE COMMUNITIES PROGRAM TARGETS CRIMINALS SK/UP3-18.05) Ciara O’Rourke, AUSTIN AMERICAN-STATESMAN, April 3, 2014, p. B1, LexisNexis Academic. Launched under the Bush administration and expanded under President Barack Obama, Secure Communities is aimed at helping agents with U.S. Immigration and Customs Enforcement identify jail inmates for possible deportation by comparing their fingerprints with immigration databases. When people are arrested in Travis County, which started participating in the program in June 2009, their fingerprints are shared with local, state and federal law enforcement databases, including ICE's. If ICE suspects that person is in the country illegally, the agency will request a detainer that keeps the person in custody an extra 48 hours after he or she has posted bail or otherwise been cleared for release. SK/UP3-18.06) Editorial, THE PHILADEPHIA DAILY NEWS, July 18, 2014, pNA, LexisNexis Academic. It started in 2009 when illegal-immigrant sympathizers demanded the city [Philaselphia] end participation in "Secure Communities," a federal program in which local police provide names to ICE and hold suspects for up to 48 hours while ICE runs checks on them. The purpose: to identify and deport criminals. SK/UP3-18.07) Maryanne Taylor Peterson, PROVIDENCE JOURNAL, August 22, 2014, p. 1, LexisNexis Academic. According to the ICE website, Secure Communities is a federal law that identifies criminal aliens who are in the country illegally. As of April 30, 283,000 criminal aliens have been removed from the country. 3. ICE IS REDUCING IMMIGRANTS’ TIME AT PROCESSING CENTERS SK/UP3-18.08) Patrik Jonsson, THE CHRISTIAN SCIENCE MONITOR, August 22, 2015, pNA, LexisNexis Academic. As Republican presidential candidates toughen their stances on America's undocumented residents, a federal judge in California has ruled that a policy based on "fear-mongering" by the Obama administration violated the rights of migrant mothers and children who crossed into the US last year. On Friday, US District Judge Dolly Gee called the Obama administration's argument that releasing some 1,400 children and mothers from three detention facilities in Texas and Pennsylvania would inspire more illegal border crossings "speculative." Judge Gee ordered the government to release them "without unnecessary delay." SK/UP3-18.09) Molly Hennessy-Fiske & Cindy Carcamo, LOS ANGELES TIMES, August 8, 2015, p. A6, LexisNexis Academic. In their response filed late Thursday night, Justice Department lawyers urged the judge to reconsider her ruling, arguing that the facilities had improved in recent weeks and were being transformed into short-term "processing centers." U.S. Immigration and Customs Enforcement, which runs the family detention centers with contractors, now aims to hold immigrants with credible asylum claims no longer than 20 days, and most are being released within about two to four weeks. This week, according to an ICE spokesman, about 1,400 parents and children were being held at the country's three immigrant family detention centers, two in Texas and one in Pennsylvania. SK/UP3-18.10) Molly Hennessy-Fiske, LOS ANGELES TIMES, October 24, 2015, p. A8, LexisNexis Academic. On deadline to improve immigrant family detention centers, Obama administration officials said they had converted the facilities into shortterm processing sites, holding more families in recent months but for less time. SK/UP3-18.11) Molly Hennessy-Fiske, LOS ANGELES TIMES, October 24, 2015, p. A8, LexisNexis Academic. Government attorneys appealed the orders, arguing that the centers have made improvements and aim to hold immigrant families no longer than 20 days, which Gee has said "may fall within the parameters" of the Flores settlement. "In light of the Oct. 23 deadline for compliance with the court's Flores order, [Homeland Security] has worked diligently to ensure that we are in compliance with all aspects of the court's order," said Jennifer Elzea, a spokeswoman for the department's Immigration and Customs Enforcement, which runs the centers. SK/UP3-18.12) Molly Hennessy-Fiske, LOS ANGELES TIMES, October 24, 2015, p. A8, LexisNexis Academic. Last month, Homeland Security Secretary Jeh Johnson announced that family detention facilities were being converted into short-term processing centers where immigrants would be interviewed and screened quickly, "rather than detained for a prolonged period of time." "Family residential centers are an important part of the U.S. government's comprehensive response to the increased number of undocumented families arriving at our borders," said Jennifer Elzea, the ICE spokeswoman. SK/UP3-18.13) Seth Robbins [Associated Press], CHICO ENTERPRISERECORD (California), August 8, 2015, p. A3, LexisNexis Academic. Immigration authorities have vowed to make the detention facilities more child-friendly and to provide better oversight. Homeland Security and ICE officials say they are looking to release families as soon as they pass the interviews that are the first hurdle to being granted asylum. In Thursday's filing, lawyers for the government argued that ICE now aims to detain families no longer than 20 days and that most are being released within about two weeks. Last year the majority of families spent more than a month in detention, and some were detained several months. In recent weeks, more mothers have been released with their children. Bonds have been drastically reduced, and many of the women have been fitted with electronic ankle monitors, according to immigrant rights lawyers. SK/UP3-18.14) Oliver Laughland, THE GUARDIAN, August 7, 2015, pNA, LexisNexis Academic. The response filed late on Thursday, however, argues that a raft of reforms aimed at speeding up the processing of protection claims at the centres, announced by homeland security secretary Jeh Johnson in June, should mitigate against Gee's decision by shortening the average time of detention. The submission argues that 60% of detainees brought to the centre between 28 June and 11 July had been released or removed within 30 days, compared with the last six months of 2014 when just 21% had been released within a month. 4. ANKLE MONITORS ARE AN EFFECTIVE ALTERNATIVE TO DETENTION SK/UP3-18.15) Molly Hennessy-Fiske, LOS ANGELES TIMES, August 2, 2015, p. A10, LexisNexis Academic. GPS ankle monitors are becoming standard equipment for immigration officials along the border. In July, Immigration and Customs Enforcement, or ICE, used about 9,300 ankle monitors at a time -- 40% more than about six months ago. They are run by a government contractor, BI Inc., a subsidiary of the country's second-largest prison company, which also operates immigration detention centers. Officials say the monitors are a cheap and effective way to ensure that immigrants released from detention attend court hearings. SK/UP3-18.16) Molly Hennessy-Fiske, LOS ANGELES TIMES, August 2, 2015, p. A10, LexisNexis Academic. The monitors cost an average of $5 a day per person, according to an ICE spokesman, and are part of the agency's Alternatives to Detention program, which also may require immigrants to report by phone or in person. In contrast, detention costs an average of $130 per day per person, and can cost over $330 at some detention centers. SK/UP3-18.17) Molly Hennessy-Fiske, LOS ANGELES TIMES, August 2, 2015, p. A10, LexisNexis Academic. The ankle monitors are part of the government effort to handle the surge of thousands of children and families, mostly Central Americans, who have been crossing into the U.S. for more than a year. The U.S. went from one 95-bed immigrant family detention center in Pennsylvania to three, the two newest in Karnes City and Dilley, Texas. By year's end, the centers will have a total of 3,700 beds. SK/UP3-18.18) Molly Hennessy-Fiske, LOS ANGELES TIMES, August 2, 2015, p. A10, LexisNexis Academic. In June, Homeland Security chief Jeh Johnson announced several changes to family detention, including releasing on reasonable bonds and with ankle monitors family members found to have a fear of persecution in their home countries. Johnson told the House Judiciary Committee that ICE was "ramping up" its use of ankle monitors and intended to more than double the total number monitored, from 23,000 last year to 53,000 in 2016. SK/UP3-18.19) Molly Hennessy-Fiske, LOS ANGELES TIMES, August 2, 2015, p. A10, LexisNexis Academic. ICE officials say ankle monitors are used "on a case-bycase basis with a priority for detention of serious criminal offenders and other individuals who pose a significant threat to public safety. Those who are not subject to mandatory detention and don't pose a threat to the community may be placed on some form of supervision." 5. MANY LOCALITIES REJECT SECURE COMMUNITIES PROGRAM SK/UP3-18.20) Tracey Kaplan, SAN JOSE MERCURY NEWS, September 15, 2015, pNA, LexisNexis Academic. Before Kate Steinle was fatally shot July 1, most California counties, including all in the Bay Area, had stopped cooperating with ICE by mid-2014. Initially, many had complied with requests from ICE to hold inmates for an extra 48 hours after their official release dates to give agents the option of detaining some for possible deportation. But the California State Sheriff's Association advised its members to stop complying with "ICE holds" after federal courts ruled the practice was unconstitutional. SK/UPDATE3-19. BANK SECRECY ACT: ABOLITION Disad A. B.S.A. IS VITAL FOR PREVENTING CRIME & TERRORISM 1. MONEY-LAUNDERING IS A HUGE PROBLEM SK/UP3-19.01) Philip J. Ruce [Thomas Jefferson School of Law], QUINNIPIAC LAW REVIEW, 2011, LexisNexis Academic, p. 44. Money laundering, the process by which the proceeds of criminal activity are disguised as funds that appear legitimate, is a tremendous problem. The purpose of most criminal enterprises is of course to turn a profit, and money laundering allows arms dealers, drug dealers, smugglers, human traffickers, and terrorists to conceal the sources of their income. In other words, it makes crime pay. To understand the scope of the problem, one should consider the fact that money laundering is estimated to be a one to two trillion dollar business. The aggregate amount of money laundered around the globe is somewhere between two and five percent of the entire world's gross domestic product. SK/UP3-19.02) Mark B. Skerry [U.S. Department of Homeland Security, Office of the General Counsel], SANTA CLARA LAW REVIEW, 2013, LexisNexis Academic, p. 219. Countries that implement effective techniques to combat money laundering see significant benefits to their economies. Anti-money laundering efforts can assist in fighting crime and corruption, enhance the stability of financial institutions, and encourage economic development. 2. BANKS LACK INCENTIVE TO COMBAT MONEY LAUNDERING SK/UP3-19.03) Philip J. Ruce [Thomas Jefferson School of Law], QUINNIPIAC LAW REVIEW, 2011, LexisNexis Academic, pp. 44-45. Considering the sheer magnitude of illicit funds that are laundered, there is not always a tremendous incentive for financial institutions to work to prevent it. A large account is, after all, a large account, which means big fees and big commissions for a bank. The Bank Secrecy Act of 1970 ("BSA") was created to combat money laundering, primarily through reporting and record keeping requirements. These requirements mandate that financial institutions file documents and reports that the government considers likely to have a high degree of usefulness in regulatory, criminal, and tax matters. Law enforcement use these various documents to detect and deter money laundering and the crimes associated with it. 3. B.S.A. IS EFFECTIVE AGAINT MONEY LAUNDERING SK/UP3-19.04) Courtney J. Linn [former Asst. U.S. Attorney, Eastern District of California], SANTA CLARA LAW REVIEW, 2010, LexisNexis Academic, p. 407. The Bank Records and Foreign Transactions Act of 1970 (BSA) requires financial institutions to record (Title I) and report (Title II) information about their customers' transactions, particularly those involving large amounts of currency. The requirements rest on the Congressional finding that BSA records and reports have a high degree of usefulness for law enforcement, tax, intelligence, and regulatory authorities. SK/UP3-19.05) Philip J. Ruce [Thomas Jefferson School of Law], QUINNIPIAC LAW REVIEW, 2011, LexisNexis Academic, p. 45. The biggest reporting tool in the BSA's war chest is the Suspicious Activity Report ("SAR"). SARs must be filed by financial institutions when the institution "knows, suspects, or has reason to suspect" that a financial transaction has occurred that involves funds earned through illegal activities. SK/UP3-19.06) Philip J. Ruce [Thomas Jefferson School of Law], QUINNIPIAC LAW REVIEW, 2011, LexisNexis Academic, p. 50. SARs [Suspicious Activity Reports] are one of the government's primary weapons in combating money laundering and other financial crimes. These reports generate leads that various agencies use to launch investigations and, hopefully, to make arrests and convictions. SK/UP3-19.07) Josh Barro, THE NEW YORK TIMES, June 6, 2015, p. A13, LexisNexis Academic. Still, privacy concerns need to be balanced with the entirely valid purpose of anti-money-laundering laws, that is, disrupting the activities of illegal businesses and tax evaders. Even in this case, there is a tax angle: Large cash transactions that go unnoticed by the government might go unreported to the Internal Revenue Service. 4. B.S.A. FACILITATES DETECTION OF CRIME AND TERRORISM SK/UP3-19.08) Robert Almon et al., AMERICAN CRIMINAL LAW REVIEW, 2013, LexisNexis Academic, pp. 1053-1054. In 1970, Congress enacted the Currency and Foreign Transactions Reporting Act, commonly referred to as the Bank Secrecy Act ("BSA"), to address tax evaders' and organized crime's increasing use of financial institutions to launder unreported income. The BSA requires that financial institutions maintain "certain reports or records where they have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings, or in the conduct of intelligence or counterintelligence activities, including analysis, to protect against international terrorism." This enhanced documentation of the deposit, transfer, and exchange of currency can be used to uncover illegal concealment and thus improve the effectiveness of law enforcement. SK/UP3-19.09) Jesse Hamilton, PITTSBURGH POST-GAZETTE, March 11, 2013, p. A6, LexisNexis Academic. The Bank Secrecy Act was meant to curtail criminals from injecting the proceeds of their crimes into the legitimate financial system. It has since been used as a tool to combat international drug cartels and terrorist groups. Nine federal agencies monitor the act, said Heather Lowe, counsel and government affairs director at Global Financial Integrity, a Washington-based group advocating tighter controls on the flow of illicit money. SK/UP3-19.10) Jessica Silver-Greenberg, THE NEW YORK TIMES, March 27, 2013, p. B2, LexisNexis Academic. Under the Bank Secrecy Act, financial institutions like banks and check-cashing services must report any cash transaction of more than $10,000 and bring any dubious activity to the attention of regulators. The federal law also requires banks to have complex controls in place to detect any criminal activity. Porous monitoring, the authorities say, can enable drug dealers and terrorists to launder money through the United States. SK/UP3-19.11) Robert Almon et al., AMERICAN CRIMINAL LAW REVIEW, 2013, LexisNexis Academic, p. 1054. The increased interest in and importance of the BSA is due to the recognition of the global scale on which illicit funds enter the flow of commerce through legitimate financial institutions. The drug traffickers and global terrorism groups rely heavily on financial institutions to integrate and move funds. SK/UP3-19.12) Courtney J. Linn [former Asst. U.S. Attorney, Eastern District of California], SANTA CLARA LAW REVIEW, 2010, LexisNexis Academic, p. 410. The BSA's reporting and recordkeeping requirements make it difficult for crime proceeds or sources of terrorist financing to enter the financial system without creating a paper trail. Fearful of the paper trail left through BSA reports and records, criminals and terrorists engage in evasive and high-risk transactions such as structuring, making it easier for law enforcement agencies to detect their transactions amidst the huge volumes of legitimate transactions that occur each day. SK/UP3-19.13) Courtney J. Linn [former Asst. U.S. Attorney, Eastern District of California], SANTA CLARA LAW REVIEW, 2010, LexisNexis Academic, p. 510. The BSA acts as a barrier that criminals seeking to move illegitimate funds must confront and avoid; it forces criminals to act in ways that increase their risk of detection. B. ABOLITION OF B.S.A. WOULD BE CATASTROPHIC 1. FINANCIAL CRIMINAL OPERATIONS WILL FLOURISH SK/UP3-19.14) LEGAL MONITOR WORLDWIDE, August 28, 2014, pNA, LexisNexis Academic. House Republicans are agitating to dramatically curb federal bank regulators' ability to combat money laundering, calling for changes in decades-old financial fraud standards in an effort to aid payday lenders. Moving illegal cash through the financial system has long been barred by money laundering laws. But under a bill introduced by Rep. Blaine Luetkemeyer (R-Mo.), federal regulators would be forbidden from doing anything to "restrict or discourage" a bank from doing business with any company that has both a license to do business and a "reasoned legal opinion" from a lawyer claiming that the business doesn't break the law. That's not a high hurdle to clear. Obtaining a business license and hiring a lawyer is a routine money laundering tactic for everyone from the mafia to terrorists to, more commonly, petty fraud scammers. SK/UP3-19.15) Harry Bruinius, THE CHRISTIAN SCIENCE MONITOR, January 7, 2014, pNA, LexisNexis Academic. But this merry-go-round of cash was a classic Ponzi scheme, and on Tuesday, the US Department of Justice demanded a $1.7 billion criminal penalty from JPMorgan, now America's largest bank with about $2.4 trillion in assets. The penalty is part of a "deferred-prosecution agreement" in which the bank is charged with two felony violations of the Bank Secrecy Act, which requires banks to inform the government of any suspicious activity. It is the largest penalty ever issued for a violation of that law, and the agreement allows the Justice Department to pursue criminal charges again if JPMorgan does not abide by the terms of Tuesday's settlement. The bank was required to admit to the violations and to agree to overhaul its own safeguards against the kind of money-laundering Madoff was conducting in JPMorgan accounts. SK/UP3-19.16) Harry Bruinius, THE CHRISTIAN SCIENCE MONITOR, January 7, 2014, pNA, LexisNexis Academic. "J.P. Morgan failed to carry out its legal obligations while Bernard Madoff built his massive house of cards," said George Venizelos, FBI assistant director-in-charge, in a statement. "It took until after the arrest of Madoff, one of the worst crooks this office has ever seen, for J.P. Morgan to alert authorities to what the world already knew." The bulk of the $1.7 billion will be used to compensate the victims of Madoff's scheme, in which investors lost about $18 billion. 2. TERRORIST OPERATIONS WILL FLOURISH SK/UP3-19.17) Ben Protess, THE NEW YORK TIMES, March 13, 2015, p. B1, LexisNexis Academic. Pursuing a trail of illicit money from Geneva to Paris with stops in London, the United States authorities built a sweeping crackdown on some of Europe's biggest banks. On Thursday, that trail led to Commerzbank of Germany, which agreed to pay nearly $1.5 billion and dismiss some of its employees to resolve an array of charges in the United States. The case, the latest black eye for a giant global bank accused of sending tainted money through the American financial system, closes the book on several investigations into Commerzbank, one of Germany's largest lenders. One strand of the case focused on Commerzbank's dealings with Iranian companies blacklisted by the United States, showing that the bank processed hundreds of millions of dollars through New York on their behalf. SK/UP3-19.18) Ben Protess, THE NEW YORK TIMES, March 13, 2015, p. B1, LexisNexis Academic. Preet Bharara, the United States attorney in Manhattan who handled the Olympus part of the case, noted that “Commerzbank stands charged with Bank Secrecy Act criminal offenses for its acute, institutional anti-money laundering deficiencies that allowed over a billion dollars of the Olympus fraud to flow through its New York office.” And Cyrus R. Vance Jr., the Manhattan district attorney who focused on dealings with Iran and Sudan, said, “We have sanctions in place to prevent rogue nations and terrorists from accessing the U.S. financial system.” SK/UP3-19.19) Ben Protess & Jessica Silver-Greenberg, THE NEW YORK TIMES, December 11, 2012, p. A1, LexisNexis Academic. HSBC's actions stand out among the foreign banks caught up in the investigation, according to several law enforcement officials with knowledge of the inquiry. Unlike those of institutions that have previously settled, HSBC's activities are said to have gone beyond claims that the bank flouted United States sanctions to transfer money on behalf of nations like Iran. Prosecutors also found that the bank had facilitated money laundering by Mexican drug cartels and had moved tainted money for Saudi banks tied to terrorist groups. 3. DRUG CARTELS WILL FLOURISH SK/UP3-19.20) Katen Attiah, THE WASHINGTON POST, March 6, 2015, p. A17, LexisNexis Academic. After the attacks of Sept. 11, 2001, the United States began looking more seriously at the role that global money flows play in financing terrorism. The Patriot Act and the Bank Secrecy Act compel banks to assist government efforts to detect money laundering and terrorism. Institutions can be hit with gargantuan fines for failing to comply: In 2012, HSBC was fined almost $2 billion to resolve a laundering case involving Mexican drug lords. SK/UP3-19.21) Danielle Douglas, THE WASHINGTON POST, November 6, 2012, p. A12, LexisNexis Academic. Financial firms have in the past primarily dealt with their direct regulators on managing money-laundering controls. But in the aftermath of the financial crisis, Justice has launched more criminal cases under the Bank Secrecy Act, a law requiring financial institutions and their employees to combat money laundering. Attempts to contact officials at the agency were not successful. Justice exacted its biggest fine under the law in 2010, when Wachovia agreed to pay $110 million for failing to stop millions of dollars of Colombian and Mexican drug money from being laundered through accounts at the bank. SK/UP3-19.22) Jacob Bronsther [New York U.], THE CHRISTIAN SCIENCE MONITOR, September 2010, pNA, LexisNexis Academic. Mexico's cartels earn upward of $39 billion annually in illicit proceeds from the United States, the Justice Department estimates. To put that in context, it's roughly equal to the global annual revenue of Google and Halliburton combined. What's more, we help them launder their money. From 2003 to 2008, Wachovia Corp. alone laundered at least $110 million, according to the Justice Department. Wachovia admitted to "serious and systematic" violations of the Bank Secrecy Act and agreed to pay $160 million to resolve the criminal case against them. American Express Bank International and Western Union have also recently agreed to huge settlements with the government for laundering Mexican drug proceeds. SK/UP3-19.23) Jessica Silver-Greenberg, THE NEW YORK TIMES, March 27, 2013, p. B2, LexisNexis Academic. In December, HSBC agreed to a record $1.92 billion deal with authorities to settle accusations that it transferred billions of dollars for nations like Iran and enabled Mexican drug cartels to move money illegally through its American subsidiaries. 4. THOUSANDS WILL DIE SK/UP3-19.24) Michael Smith, PITTSBURGH POST-GAZETTE, July 3, 2010, p. A7, LexisNexis Academic. Wachovia admitted it didn't do enough to spot illicit funds in handling $378.4 billion for Mexican-currency-exchange houses from 2004 to 2007. That's the largest violation of the Bank Secrecy Act, an anti-money-laundering law, in U.S. history -- a sum equal to one-third of Mexico's current gross domestic product. "Wachovia's blatant disregard for our banking laws gave international cocaine cartels a virtual carte blanche to finance their operations," said Jeffrey Sloman, the federal prosecutor who handled the case. Since 2006, more than 22,000 people have been killed in drug-related battles that have raged mostly along the 2,000-mile border that Mexico shares with the United States. SK/UP3-19.25) Jacob Bronsther [New York U.], THE CHRISTIAN SCIENCE MONITOR, September 2010, pNA, LexisNexis Academic. Indeed, we are culpable for the rise of all the Mexican drug cartels, whose $39 billion criminal enterprise has led to more than 23,000 deaths since 2006, and brought a fledgling democracy to its knees. SK/UPDATE3-20. ISIS TERRORISM Disad A. ISIS POSES A HUGE TERRORISM THREAT TO U.S. SK/UP3-20.01) Eric Schmitt & David D. Kirkpatrick, THE NEW YORK TIMES, November 15, 2015, p. A1, LexisNexis Academic. The Islamic State, also known as ISIS, ISIL or Daesh, has for the first time engaged in what appears to be a centrally planned campaign of terrorist attacks aimed at inflicting huge civilian casualties on distant territory, forcing many counterterrorism officials in the United States and in Europe to recalibrate their assessment of the group. “They have crossed some kind of Rubicon,” said William McCants, a scholar at the Brookings Institution and author of “The ISIS Apocalypse.” They have definitely shifted in their thinking about targeting their enemies.” SK/UP3-20.02) Jessica Mendoza, THE CHRISTIAN SCIENCE MONITOR, November 16, 2015, pNA, LexisNexis Academic. But on Monday, ISIS released a videotaped message threatening Washington, D.C. The self-described Islamic State warned that countries taking part in air strikes against Syria would suffer the same fate as France, and threatened to attack Washington, reported Reuters. Friday night's terrorist attack in Paris, which killed at least 129 people and wounded more than 350, raised tensions at airports and other points of entry across the US. SK/UP3-20.03) Eric Schmitt & David D. Kirkpatrick, THE NEW YORK TIMES, November 15, 2015, p. A1, LexisNexis Academic. Defying Western efforts to confront the Islamic State on the battlefield, the group has evolved in its reach and organizational ability, with increasingly dangerous hubs outside Iraq and Syria and strategies that call for using spectacular acts of violence against civilians. SK/UP3-20.04) Eric Schmitt & David D. Kirkpatrick, THE NEW YORK TIMES, November 15, 2015, p. A1, LexisNexis Academic. The massacre in Paris on Friday, following bombings in Beirut, Lebanon, and the downing of a Russian passenger jet over Egypt, all claimed by the Islamic State, reveals a terrorist organization that has changed in significant ways from the West's initial understanding of it as a group focused on holding territory in Syria and Iraq and building a caliphate, or Islamic state. SK/UP3-20.05) Eric Schmitt & David D. Kirkpatrick, THE NEW YORK TIMES, November 15, 2015, p. A1, LexisNexis Academic. When the Islamic State's Egyptian arm claimed responsibility for blowing up a Russian charter plane over Sinai two weeks ago, some analysts wondered if the group's so-called Sinai Province of the Islamic State had acted on its own and leapt out in front, even at the cost of risking a Russian military backlash on the parent group in Syria and Iraq. But the attacks last week in Paris and Beirut, which the Islamic State also said it carried out, appear to have settled that question and convinced even skeptics that the central leadership was calling the shots. “There is a radical change of perception by the terrorists that they can now act in Paris just as they act in Syria or Baghdad,” said Mathieu Guidere, a terrorism specialist at the University of Toulouse. “With this action, a psychological barrier has been broken.” SK/UP3-20.06) Eric Schmitt & David D. Kirkpatrick, THE NEW YORK TIMES, November 15, 2015, p. A1, LexisNexis Academic. Indeed, at a time when many Western officials were most concerned about Islamic State-inspired, lone-wolf attacks -- terrifying in their randomness but relatively low in casualties -- the attacks in Paris have revived the specter of coordinated, high-casualty attacks planned with the involvement of a relatively large number of perpetrators. American and European authorities said the Paris assault bore the hallmarks of complex attacks conducted by Al Qaeda, or of the Mumbai plot in 2008, when 10 Islamic militants carried out a series of 12 shootings and bombings in the Indian city, lasting four days and killing 164 people. B. ATTACKS IN FRANCE PROVE RISK OF REDUCED SURVEILLANCE 1. FRENCH SURVEILLANCE IS LIMITED SK/UP3-20.07) Katrin Bennhold & Eric Schmitt, INTERNATIONAL NEW YORK TIMES, February 19, 2015, p. 4, LexisNexis Academic. By law, the domestic surveillance powers of French intelligence agencies are limited. Wiretaps are still governed by rules drafted in 1991, long before cellphones and the Internet became ubiquitous. French intelligence agencies cannot legally track cars or bug apartments in their own country. Since 2006, they have had some access to the metadata of electronic communications, but they cannot spy on the content of emails. 2. LIMITED SURVEILLANCE ENABLED TERRORIST ATTACKS SK/UP3-20.08) Editorial, CHARLESTON GAZETTE-MAIL (West Virginia), November 19, 2015, p. 5A, LexisNexis Academic. The Paris attacks are a tragic reminder of the need for vigilant surveillance against terrorism. SK/UP3-20.09) Ewen MacAskill, THE GUARDIAN (London), November 19, 2015, pNA, LexisNexis Academic. The problem with this, as with almost every terrorist incident since 9/11, is that the French intelligence agencies already knew at least three of the attackers. Abelhamid Abaaoud was known as an accomplice of two jihadis killed in Belgium in January. The police had a file on Omar Ismaïl Mostefai even before he travelled to Syria in 2013, while Sami Amimour had been detained in 2012 on suspected terrorist links. In other words, the failure of the French intelligence agencies is not that they did not have enough data - but that they did not act on what they had. The three could have been the subject of traditional targeted surveillance. While physical surveillance is difficult in terms of staffing, keeping tabs on their communications is less labour-intensive. Tracking such suspects does not require the collection of the communications data - phone records, emails, Facebook postings, chat lines - of every French citizen, only the suspects. SK/UP3-20.10) Wesley Wark [Visiting Professor, Graduate School of Public & International Affairs, U. of Ottawa (Canada)], OTTAWA CITIZEN, January 13, 2015, p. C4, LexisNexis Academic. While the French Republic's security manhunt for the perpetrators of the Charlie Hebdo and Jewish supermarket killings involved an impressive and vast mobilization of forces, and while French society's response to the attacks was awe-inspiring in its public show of support for free speech and unity, questions have begun to emerge about the performance of French intelligence in failing to prevent the attacks. The French prime minister, Manuel Valls, has already stated that there was a "clear failing ... when 17 people die, it means there were cracks." The three French terrorists were all known, indeed well known, to the French authorities. SK/UP3-20.11) Wesley Wark [Visiting Professor, Graduate School of Public & International Affairs, U. of Ottawa (Canada)], OTTAWA CITIZEN, January 13, 2015, p. C4, LexisNexis Academic. The fact that the Kouachis and Coulibaly may have taken steps to adopt a low profile and stay out of the sights of French surveillance points to another problem facing counter-terrorism agencies - the problem is one of perseverance. At a high operational tempo, intelligence agencies are forced to change target sets frequently. The challenge is in being able to maintain levels of lawful scrutiny of suspects who may be further down the priority list but who may reactivate themselves. SK/UP3-20.12) Wesley Wark [Visiting Professor, Graduate School of Public & International Affairs, U. of Ottawa (Canada)], OTTAWA CITIZEN, January 13, 2015, p. C4, LexisNexis Academic. French intelligence and security agencies are highly experienced with terrorism threats and have particular knowledge and capabilities in the Middle East, North Africa and the sub-Saharan region. But there are lessons to be learned, for France, and for other countries, in the failures of counter-terrorism on display last week. Those lessons point in four directions: perseverance in maintaining a strategic watch on presumed lower-tier threats; better technological capabilities; better intelligence sharing at home and abroad; and better external scrutiny. SK/UP3-20.13) Katrin Bennhold & Eric Schmitt, INTERNATIONAL NEW YORK TIMES, February 19, 2015, p. 4, LexisNexis Academic. The decision to drop surveillance of the Kouachis was one in a series of developments that, in the aftermath of the deadliest acts of terrorism in France since Algeria's struggle for independence in the 1960s, suggests substantial failures or weaknesses in French intelligence and law enforcement. It also highlights security challenges facing other Western governments, as Denmark was reminded this weekend when a native-born Muslim gunman in Copenhagen killed two people in an attack that had numerous similarities to the rampage in and around Paris last month. SK/UPDATE3-21. TSA SURVEILLANCE CURTAILMENT Disad A. DOWNING OF RUSSIAN PLANE REVEALS MASSIVE THREAT SK/UP3-21.01) Ellen Nakashima, THE WASHINGTON POST, November 8, 2015, p. A1, LexisNexis Academic. The hardening prospect that a Russian airliner was brought down over the Sinai Peninsula by a terrorist bomb is raising concerns that the threat from the Islamic State has dramatically expanded, and it points to the potentially deadly role of insurgents around the world who have allied themselves with the militant group. SK/UP3-21.02) Ellen Nakashima, THE WASHINGTON POST, November 8, 2015, p. A1, LexisNexis Academic. On Saturday, the Islamic State's affiliate in Sinai, Ansar Beit al-Maqdis, claimed responsibility for downing the jet. Its brief statement said that "Soldiers of the Caliphate were able to down a Russian airplane over Sinai province," according to the SITE Intelligence Group. SK/UP3-21.03) Ellen Nakashima, THE WASHINGTON POST, November 8, 2015, p. A1, LexisNexis Academic. The apparent ability of the group to smuggle a bomb on board a plane loaded with tourists is disturbing to U.S. security officials, who had comforted themselves with the idea that the Islamic State appeared focused on establishing its caliphate and was so far unwilling or unable to strike outside its immediate area of operations. "This is the most significant terrorist-related airline incident since 9/11," Hoffman [terrorism expert, Georgetown U.] said. "So the repercussions for this have to be quite profound." B. CURTAILING TSA SURVEILLANCE WOULD BE CATASTROPHIC 1. TSA SURVEILLANCE IS VITAL SK/UP3-21.04) Jessica Mendoza, THE CHRISTIAN SCIENCE MONITOR, November 16, 2015, pNA, LexisNexis Academic. Another, broader issue officials face is the Transportation Security Administration's (TSA) reliance on airport operators to vet aviation workers - a matter that drew attention following the crash of a Russian charter plane over the Sinai peninsula late last month. Concerns that a bomb may have brought down the plane, and that attackers could have taken advantage of security gaps at the Sharm el-Shiekh airport to get an explosive device aboard, led US national security officials to scrutinize the airport security process here. The nation's 450 airports use contractors from the TSA, which oversees travel security in the US, to check employees' names against terrorism databases, and review their immigration status and criminal histories. SK/UP3-21.05) USA TODAY, November 13, 2015, p. 7A, LexisNexis Academic. As individuals are becoming self-radicalized in ways that are virtually impossible to monitor, preventing terrorism by an insider takes constant vigilance. A worker who passes background checks today could be drawn to join the Islamic State days or months later. Initial vetting is only the beginning. It's a shame this kind of scrutiny is necessary, but the crash in Egypt suggests that the biggest terrorist threat to jetliners these days isn't necessarily from passengers trying to board them. 2. TSA NEEDS GREATER SURVEILLANCE, NOT LESS SK/UP3-21.06) USA TODAY, November 13, 2015, p. 7A, LexisNexis Academic. While the TSA checks applicants against the government's consolidated terrorist watchlist, these applicants are not automatically checked against a broader database that a few years ago contained about 550,000 names of people with potential links to terrorism. The TSA doesn't have automatic access to it, creating a weakness in the vetting program. This particular database, known as TIDE, is important because it contains raw data, sometimes uncorroborated, that might provide the first hint of a terrorism connection. Remember the "underwear bomber" who attempted to blow up a Detroit-bound jetliner on Christmas Day of 2009? The Nigerian man had been added to TIDE after his father tipped U.S. authorities to his son's radicalization. But he was not on a watch list. SK/UP3-21.07) USA TODAY, November 13, 2015, p. 7A, LexisNexis Academic. TSA needs easy and complete access to TIDE, closing a hole that the agency itself has sought to close since last year. While preliminary data in the TIDE listings shouldn't disqualify a job applicant, the TSA at least ought to be aware of any potential red flags. 3. PUBLIC SAFETY DEMANDS 100% EFFICACY SK/UP3-21.08) Priscilla Alvarez, NATIONALJOURNAL.COM, June 16, 2015, pNA, GALE CENGAGE LEARNING, Expanded Academic ASAP. "Terrorists only have to be right once. To defend ourselves, we have to be right 100 percent of the time. Millions of travelers pass through our nation's airports every year, and we need to know the systems in place will protect them," said Republican Rep. Michael McCaul during a hearing Tuesday.