Text of Federal Rules: http://www.law.cornell.edu/rules/fre/ 104(b

advertisement

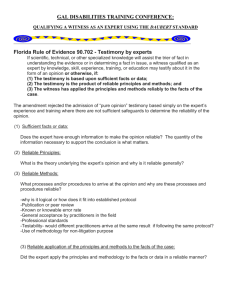

Text of Federal Rules: http://www.law.cornell.edu/rules/fre/ 104(b): When admissiblity depends on another fact, the court shall admit it subject to later introduction of evidence sufficient to support a finding of that fact 201: Judicial notice: proper for fact not in reasonable that is capable of accurate and ready determination from sources whose accuracy cannot reasonably be questioned 403: One appellate court collected authority & noted: “circuits have held, and we agree, that excluding evidence in a bench trial under ‘Rule 403's weighing of probative value against prejudice [is] improper.’” U.S. v. Kienlen, 349 Fed.Appx. 349, 351 (10th Cir. 2009) (alteration in original). Courts in this Circuit hold the same: “‘in the context of a bench trial, evidence should not be excluded under [Rule] 403 on the ground that it is unfairly prejudicial.’” Joseph S. v. Hogan, 06 cv 1042, 2011 WL 2848330, *3 (E.D.N.Y. July 15, 2011) (altered original; quotes Gulf States Utils. v. Ecodyne Corp., 635 F.2d 517, 519 (5th Cir. 1981)); Woods v. U.S., 200 Fed.Appx. 848, 853 (11th Cir.2006) (“the part of Rule 403 that authorizes exclusion of evidence because of its unfair prejudicial impact has no logical relationship to bench trials”) 404(b): Other wrongs or acts: admissible for motive, opportun, intent, preparat’n, plan, knowledge, absnc. of mistake. A bench trial presents less 404(b) concern that “other acts” evidence induces improper inferences by the factfinder. U.S. v. Duran-Colon, 252 Fed.Appx. 420, 422 (2d Cir. 2007): “We also reject [Defendant’s] claim that the district court abused its discretion in admitting ‘other crimes’ evidence under [Rule] 404(b). We follow an ‘inclusionary rule’ with regard to 404(b) evidence, ‘allowing the admission of such evidence for any purpose other than to show a defendant's criminal propensity.’ ... [H]ad this been a jury trial, ... such evidence may be unduly prejudicial insofar as it suggests to the jury the defendant's propensity .... In the context of a bench trial such as that conducted in this case, however, the factfinder knows the purpose for which evidence is admitted and is presumed to rest his verdict on the proper inferences.” 406: Ev of habit or routine practice, relevant to prove person’s conduct on partic occasion was in conformity 611(a)(3): “The court should exercise reasonable control over ... examining witnesses ... to ... protect witnesses from harassment or undue embarrassment” 611(c)(2): Hostile treatmt expressly allowed: not only adverse pty or agent, but any “witness identified w/” adv.pty 801(c)(2): Words are hearsay only if “offer[ed] in evidence to prove the truth of the matter asserted in the statement” → Verbal acts like an offer, acceptance, or demand are not offered as assertions of a true fact → Reporting a fact (cash or server) pre-litig.: corroborates he claimed the event, whether or not true 801(d): Not HS: (1)(A) prior inconsis. stmt, under oath (1)(B) prior consis. stmt, to rebut express/implied charge, recent fabric’n or improp influ or motive (2) party-opponent admisn by: (A) party; (B) adopted admisn; (C) person authzd to make a stmt on the subject; (D) agent concerning matter within scope of agency, during existence of relationship; (E) coconspirator 802: HS not admitted “except as provided by these rules or other rules prescr by the S.Ct.” 803: excepns: (3) then-existg mental/emotional conditn or state of mind, intent, plan, motive, or design (5) recorded recollec’n: memor’dm or rec; re matter W once had knowl but now has insuffic recollec to testify fully&accurately; made or adopted when matter fresh in W memory; & reflects that knowl correctly → read into rec but don’t admit as ev exc by adverse pty (6) rec of regularly conducted activity: mem’dm, report, rec, data compilatn; re acts, events, or opinions; made at/near time by, or from info fr, person w/ knowl; kept in course of reg conduc’d biz activity; if was reg prac of that biz activity to make such rec 804: unavail.W 807: residual excepn: (A) ev of mat’l fact; (B) more probatv than oth reas avail ev; (C) purp/Rs served by adm must disclose stmt in advance of trial, incl name & address of declarant ACn: can’t assume 803 excepns exhaustive; 807 allows for growth, dev’mt of HS law 901(a): authentic’n requires only ev sufficient to support a finding the ev is what its proponent claims 901(b): illustr’ns: (1) W w/ knowl of what the ev is (2) Nonexpert opin on handwrit by W w/ familiarity not obtained for purposes of litig (5) Voice ID, 1st-hand or thru machanical/electronic transmission or recording, by W with opinion based on hearing voice under any cirx who can connect it with the alleged speaker (ACn: non-expert ok) (6) Telephone convos, incl ev a call was to a known phone number assoc’d w/ person or co. 902: self-authentic: (6) periodicals (7) ‘trade inscripns & the like’ incl tags/labels, affixed in course/biz, showing own’shp/origin 903: subscribing W unneces to authenticate a writing 1003: Duplicate admis to same extent as orig unless (1) gen Q re authen or (2) under cirx unfair admit duplicate 1006: Can present chart/summary/calculatn of voluminous writings/recordings/photos that can’t be convenient exam’d in ct, as long as origs available for examinatn , TAX DISCLOSURE In cases seeking tax disclosure, “courts ... have found personal financial information to be presumptively confidential or cloaked with a qualified immunity. ... Courts ... have fashioned a reasonable standard to be employed before directing the release of tax information. ... This standard has a two pronged test: (1) the court must find that the requested tax information is relevant ... ; and (2) that there is a compelling need for this information because the information contained therein is not otherwise readily obtainable.” Trudeau v. N.Y. Consumer Protection Bd., 237 F.R.D. 325, 331 (N.D.N.Y. 2006); see Hanoch v. Janoff & Olshan, 1999 WL 262278, *1 (S.D.N.Y. May 3, 1999) (“Tax returns are ‘subject to a quasi-privilege; they will be ordered disclosed only if they are relevant and the information sought is not readily available from other sources.’”). Thus courts in this district deny tax disclosure when the relevance does not amount to the “compelling need” standard for tax disclosure, Sadofsky v. Fiesta Products, 252 F.R.D. 143, 149 (E.D.N.Y. 2008) (“‘a more stringent standard ... than the general standard of relevance”) (citation omitted); Carmody v. Rockville Ctr., 2007 WL 2042807, *2 (E.D.N.Y. 2007). Even given sufficient relevance, only “a limited production” is proper. Hanoch v. Janoff & Olshan, 1999 WL 262278, *1 (S.D.N.Y. May 3, 1999) (citation omitted); see Meranus v. Gangel, 1991 WL 120484, *3 (S.D.N.Y. June 26, 1991) (“Courts have created a quasi-privilege for tax returns, declining to require their production unless the information sought is both relevant and unavailable from other sources. ... [S]ome of the information ... is pertinent .... However, it will be available ... through the interrogatory answers and documents produced ....”). Thus the proper scope of any tax inquiry is subject to judicial judgment; we ask only to limit questioning to the sole relevant matter, whether cash existed, and not turn into a broad-based tax inquiry, because (a) Ds’ motion for tax return disclosure was denied and (b) the source of P’s funds is irrelevant because Ds waived the “unclean hands” and “culpable conduct” defenses years ago, to avoid a cross-summary judgment motion. JPTO at 3 (“Defendants withdrew their ... Fifth, and Eighth Affirmative Defenses[,] the defenses addressing ... unclean hands, and culpable conduct.”). VERBAL ACTS ARE NOT HEARSAY: ACn 801(c), HS is only stmt offered “for the truth of the matter asserted”: “If the signif of an offered stmt lies solely in the fact that it was made, no issue is raised as to the truth of anyth asserted, & the stmt is not HS. ... The effect is to exclude from hearsay the entire category of ‘verbal acts’ and ‘verbal parts of an act.’” • 2 J.Posner decis, illus/explain: verbal act R applies: oral stmt & writing alike, & accep’ncs & un-accep offers alike: - Twin City Fire Ins. v. Country Mutual, 23 F.3d 1175, 1182-83 (7th C. ’94) (offer letter that wasn’t accepted: “he is not making a statement that may be true or false; he is performing an act (inessentially verbal – it could be a handshake instead) that has legal consequences; ... anyone ... could testify that he uttered them, without running afoul of the HS rule”) - U.S. v. Montana, 199 F.3d 947, 950 (7th C. ’99) (oral offer: “Performative utterances are not within the scope of the hearsay rule, because they do not make any truth claims.”) CORROBORATING VICTIMS WITH PERSONAL KNOWLEDGE OF THE SAME MISREPRESENTATIONS First, recent on-point Supreme Court precedent analyzes evidence of the same actor’s similar civil wrongs against others under not Rule 404, but the Rule 401/403 relevance-prejudice balancing, deeming such evidence most admissible where, as here, “closely related . . . to the plaintiff’s circumstances and theory.” Second, 404(b) expressly admits “Other Acts” offered to prove not bad “character” (404(b)(1)) but relevant matters like “intent, . . . plan, . . . [and] absence of mistake” (404(b)(2)). This evidence is what (b)(2) allows: • same pitch: re profiting as an investor more than as a dealer, stated on a relaxing caribbean fam vacation re how espectailly rare coins are safe b/c liquid & almost never drop re helping him but not others b/c of their friendship re how he bought the same coins himself re Adamo wanting to get cash payments & keep cash on hand • relev to intent (that the value and liquidity misrepresentations were no mistake) • relev to the highly disputed fact of whose idea the coin-buying & the cash-dealing was; Adamo says it was a secret scheme Marini concocted, but Brancato shows Adamo himself pitched the same scheme U.S. v. Carlton, 534 F.3d @101-102 (2d Cir. 2008): affirmed admission, in bank robbery and weapons case, of D “prior convictions for bank robbery” where “similarities between the prior bank robberies and the charged crime – ... location, ... style of the robberies, or use of a getaway car – ... establish the existence of a pattern”) US v Pascarella: “highly relevant,” in bank fraud & stolen property case, evidence “other stolen checks had been recently deposited in the same bank account ... ‘prior act evidence is generally admissible to prove that the defendant acted with the state of mind necessary’” rather than any “innocent explanation.” 84 F.3d at 69 (c2’96) Other acts evidence “intent” without being identical: U.S. v. Sliker admitted an only partly similar prior fraud, in a prosecution for defrauding 1 bank by depositing checks from a fake bank and having a co-conspirator “claim to represent the non-existent bank and ... respond affirmatively to inquiries”; the “other act” evidence sliker allowed was that defendant used the fake checks for jewelry purchases too – it was enough that the commonality between the defendant’s diamond fraud and bank fraud “was ... probative ... of knowledge and intent.” Id. at 486. xxs 1. SIMILAR VIOLATIONS OF THE SAME STATUTE ARE ADMISSIBLE UNDER A RULE 401/403 ANALYSIS. The S.Ct. recently held a defendant’s violations of the same civil statute against others may be admissible – and that the relevant analysis is a Rule 401/403 relevance-prejudice balancing, not a Rule 404 inquiry. Sprint/United Management Co. v. Mendelsohn reversed exclusion of “testimony by five other[s] . . . that their supervisors had [also] discriminated against them because of age.” 552 U.S. 379, 380-81 (2008). The remand ruling was, under “both Rule 401 and Rule 403,” to admit evidence of defendant’s violations against those “similarly situated to plaintiff.” 587 F. Supp. 2d 1201, 1207-08 (D. Kan. 2008), aff’d, 402 F. Appx. 337 (10th Cir. 2010). Courts apply Mendelsohn in varied civil & criminal cases1 as to admissibility of a D’s violations against others. The Second Circuit held the same before Mendelsohn, admitting evidence of “actions with respect to other[s]” as long as similar actions by the same person. Quaratino v. Tiffany & Co., 71 F.3d 58, 65 (2d Cir. 1995) (reversing exclusion of evidence of other maternity leave decisions by same actor, as “material” to defendants’ intent). Here, the frauds not only were similar, but evidence a single scheme of serial defrauding: Adamo defrauded Bain through 2001-02, then moved on to Marini in 2002, then Brancato in 2006 when Marini stopped buying coins. Under this caselaw, evidence the same actor repeated the same civil violation is not properly analyzed as Rule 404(b)(1) “character” evidence at all. See Worthington v. Suffolk, No. 02 CV 723 (DLI), 2007 WL 2115038, *6 (E.D.N.Y. 2007) (“Rule 404(b) does not apply” where the “other acts” testimony of “other[s] . . . retaliated against . . . by the same individual . . . is being introduced to show motive or intent[,] . . . not to show . . . bad character”). 2. UNDER RULE 404, SIMILAR VIOLATIONS ARE PROBATIVE TO SHOW (A) INTENT, (B) COMMON PLAN, AND (C) INDUCING VICTIM TRUST AND RELIANCE. The Second Circuit has “repeatedly held ... [it] ‘follows the “inclusionary” approach to ‘other crimes, wrongs, or acts’ .... [S]uch evidence is admissible unless ... for the sole purpose of showing the defendant's bad character, or unless it is overly prejudicial under [Rule] 403 or not relevant.’” U.S. v. Carlton, 534 F.3d 97, 101 (c2 ’08) a. Intent and Absence of Mistake. b. Common Plan or Scheme. Rule 404(b)(2) deems other acts admissible if they and the charged violation comprise a common “plan,” i.e., “some overall scheme of which each of the crimes is but a part.” Charles A. Wright et al., 22 Fed. Prac. & Proc. Evid. § 5244 (1st ed. & 2012 update). Ismail v. Cohen, a § 1983 police brutality lawsuit, affirmed admission of evidence the officer “participated in a similar incident soon after,” using excess force “without provocation” followed by a “cover up . . . [of] falsely claim[ing] that he was responding to an attack”; the similarity of the violations made the other act probative evidence of a “pattern,” which Ismail deemed a “legitimate reason[] for the admission.” 899 F.2d 183, 188 (1990); see U.S. v. Carlton, 534 F.3d 97, 101-102 (2d Cir. 2008) (affirming admission, in bank robbery and weapons case, of defense “prior convictions for bank robbery” where “similarities between the prior bank robberies and the charged crime – ... location, ... style of the robberies, or use of a getaway car – ... establish the existence of a pattern”). The similarity and temporal proximity of Adamo’s efforts against all four men suffice, because “‘[t]he similarity sufficient to admit . . . past acts . . . need not be complete; it is enough that the characteristics relied upon are sufficiently idiosyncratic to permit a fair inference of a pattern[.].’” Carlton, 534 F.3d at 102 (quoting Sliker, 751 F.2d at 487). Especially apt is the Sliker holding that executing bank deposits with fraudulent checks is similar enough to unsuccessfully trying to buy diamonds with fraudulent checks, to show “existence of a common scheme or plan . . . [and] demonstrate the development of the . . . Bank scheme.” 751 F.2d at 486. Adamo’s fraud efforts were more similar than the failed diamond fraud and executed bank fraud of Sliker – and admissibility here serves the core purpose of the “common scheme or plan” doctrine: allow telling the whole story of a several-target scheme, not just an artificially truncated story of one victim. The actual story alleged is not just that an otherwise legitimate coin dealer named Adamo betrayed his friend Marini; it is that Adamo undertook a single long-term scheme, from at least 2001 to 2008, against a series of individuals he thought he could defraud into believing inflated values and entrusting him with custody of coins. Thus, Adamo targeted all with a common scheme and plan: his overpricing with Bain presaged what he started doing to Marini a year later, even more directly than the unsuccessful diamond fraud “demonstrate[d] the development of the Merchants Bank scheme”; and what he did to Brancato (as with Marini, overpricing and misrepresenting the nature of the investments as well as the ease of cashing out) and Albanese (as with Marini, retaining a coin and refusing to return it until the victim levied a police or court complaint) are probative to show “a common scheme or plan” of which Marini was but one part. Id 1 Luka v. Orlando, 382 F. Appx. 840 (11th Cir. 2010) (affirming admission of prior conduct under Mendelsohn in § 1983 case); US v. Awad, 369 F. Appx. 242, 246 (2d Cir. 2010) (criminal case citing Mendelsohn to affirm admissibility); US ex rel Loughren v. Unum Group, 613 F.3d 300, 315-16 (1st Cir. 2010) (qui tam insurance fraud; citing Mendelsohn to reverse exclusion). In short, Plaintiffs should be able to tell this whole truth of the story as they see it: Marini was but one victim of Adamo’s broad coin fraud scheme, not just one man fooled by a friend. U.S. v. DeCicco similarly allowed the whole story of a common scheme or plan that included other acts: DeCicco committed “the same type of crime, [arson] . . . and, more importantly, the object of all fires was the same property[,] . . . tend[ing] to show that the previous offense leads in progression . . . , that DeCicco had one common [arson] scheme,” progressing in serial to new victims after a prior crime “prove[s] financially unsuccessful . . . . The evidence is probative of a common scheme or plan and should be introduced to that effect.” 370 F.3d 206, 212-13 (1st Cir. 2004). c. Creation of a Relationship of Trust. The Brancato evidence shows how Adamo identically used friendships with Marini and Brancato to win their trust. Even “wholly different acts” are “admissible to show . . . development of a relationship of trust between the participants,” U.S. v. Pascarella held in admitting, in a bank fraud case, “[defendant’s] past gambling dealings . . . [to] establish the basis of a trust relationship.” 84 F.3d at 72-73 (citing U.S. v. Rosa, 11 F.3d 315, 333-34 (2d Cir. 1993) (affirming admission of two men’s past cooperation in auto theft otherwise unrelated to the narcotics and weapons offenses at issue); see U.S. v. Williams, 453 F. Appx. 74, 80 (2d Cir. 2011) (affirming admission of “involvement in possessing and distributing” because it could “‘explain how . . . [the] relationship developed . . . [and] help the jury understand the basis for the . . . mutual trust’”) (citation omitted). Thus, while Adamo’s acts to Brancato and Marini were nearly identical, even if they were “wholly different,” they still are probative to show how, with reliance is a disputed issue, Adamo built trust with his two victims of “‘affinity fraud, . . . investment scams that prey upon [and] . . . exploit the trust and friendship that exist in groups . . . [with] something in common.’” Drinkard v. Walnut St. Sec., No. 09 cv 66, 2009 WL 1322591, *3 (W.D.N.C. May 11, 2009) (quoting Sec. & Exch. Comm., Affinity Fraud: How To Avoid Investment Scams That Target Groups, http://www.sec.gov/investor/pubs/affinity.htm). PARTY-OPPONENT ADMISSIONS – LITIGATION DOCS/STMTS • Pleadings: “The law is clear that pleadings constitute admissions under Rule 801(d)(2) ‘and are admissible in the case in which they were originally filed . . . [and] subsequent litigation involving that party.’” Rosenberg v. Curry Chevrolet Sales, 152 F.3d 920, 1998 WL 406307 (Table) (2d Cir. Jun. 8, 1998) (affirming admission of prior contradictory pleadings that party had filed in prior state court actions) (quoting U.S. v. McKeon, 738 F.2d 26, 31 (2d Cir. 1984). • Disco Responses: per FRCP 26(g), all are signed by party or attorney as agent verifying as “complete & accurate”; FRE 801 party-oppo admisn covers not just signed but any “oral assertion [or] written assertion” • Atty Filings/Stmts: Purgess v. Sharrock, 33 F.3d 134, 143–44 (2d Cir. 1994) (counsel’s fact statement in brief was admissible party admission); United States v. GAF Corp., 928 F.3d 1253, 1258–61 (2d Cir.1991) (trial court erred in failing to admit original bill of particulars); Moody v. Twp. of Marlboro, 885 F. Supp. 101, 104 (D.N.J. 1995) (“[In] taking plaintiff's deposition . . . Kassel acted within the scope of the attorney-client relationship an, thus, as [defendant’s] agent”) (citing U.S. v. Brandon, 50 F.3d 464, 467-68 (7th Cir. 1995)). AUDIO RECORDINGS RM’s part isn’t for truth of matter asserted (801c); admit even if part is limited-purpose admissible (105) • Non-adverse party’s part of recording still admissible, b/c it’s not for the truth of the matter asserted, so it’s not hearsay: U.S. v. Nieves, 354 Fed.Appx. 547, 551 (2d Cir. 2009) (“[D] McTier argues that the District Court erred by admitting into evidence a taped telephone call between McTier and Lewin, an associate .... [T]he statements were not hearsay because they were either not admitted for the truth of the matter asserted or were non-hearsay admissions under Federal Rule of Evidence 801(d)(2).”); U.S. v. Lopez, 584 F.2d 1175, 1179 (2d Cir. 1978) (“While Romero's taped telephone conversation may be said to have occurred after the conspiracy ended, ... it was offered not to prove the truth of the declarations. ... It was, therefore, not hearsay and admissible.”). • That Plaintiff’s part of the recording is admissible for limited purpose doesn’t defeat admissibility per R.105: “When evidence which is admissible as to one party of for one purpose but not admissible as to another party of for another purpose is admitted, the court, upon request, shall restrict the evidence to its proper scope and instruct the jury accordingly.” Advis. Cmte. Note: “The present rule recognizes the practice of admitted evidence for a limited purpose and instructing the jury.” • Alternative argument: recording & transcript are recorded recollection (weaker b/c just lets recordings be read, not admitted, into evidence): U.S. v. Rommy, 506 F.3d 108, 138 (2d Cir. 2007) (affirming admission of transcript of “Det. Leichel's recorded past recollection of what she had heard on the intercepted telephone call. ... 803(5) recognizes as a hearsay exception ‘[a] memorandum or record concerning a matter about which a witness once had knowledge but now has insufficient recollection to enable the witness to testify fully and accurately, shown to have been made or adopted by the witness when the matter was fresh in the witness' memory and to reflect that knowledge correctly.’ Det. Leichel's testimony satisfied all...requirements in establishing the transcript as a record of...when she listened to the...conversation.”) BUSINESS RECORDS: The 2d Cir. has “adopted a generous view of the business records exception to the rule against hearsay, Fed. R. Evid. 803(6), favoring the admission of such evidence if it has probative value.” U.S. v. Copeland, 122 F.3d 1058, 1995 WL 595054, *2 (2d Cir. 1995). R.803(6) cases “favor the admission of evidence” that, as here, (1) has provative value, (2) was both made and kept in the course of a regularly conducted business, (3) has foundation provided by a custodian or other qualified witness, and (4) has sufficient indicia of trustworthiness: Rule 803(6) “favor[s] the admission of evidence rather than its exclusion if it has any probative value at all,” In re Ollag Constr. Equip. Corp., 665 F.2d 43, 46 (2d Cir. 1981) (quotation omitted), and the “principal precondition” to admissibility “is that the record[] [has] sufficient indicia of trustworthiness to be considered reliable.” Saks Int'l v. M/V “EXPORT CHAMPION”, 817 F.2d 1011, 1013 (2d Cir. 1987). Further, the proffered record must be supported by a proper foundation, namely, that the document was “‘kept in the course of a regularly conducted business activity’ and also that it was the ‘regular practice of that business activity to make the [record].’” United States v. Freidin, 849 F.2d 716, 719-20 (2d Cir.1988) (quoting Rule 803(6)). This foundation must be established by the “‘testimony of the custodian or other qualified witness' of the record.” Id. at 720 (quoting R. 803(6)). Phoenix Associates III v. Stone, 60 F.3d 95, 101 (2d Cir. 1995) (alterations in original) CASH LEDGER, “BUSINESS RECORD”: • The 2d Cir. “adopted a generous view of the business records exception to the rule against hearsay, favoring the admission of such evidence if it has probative value.” U.S. v. Copeland, 122 F.3d 1058, 1995 WL 595054,*2 (2d Cir.1995) • Plaintiff can testify re his & others’ entries under 803(6), like bank manager testifies re paper w/data from many - “[N]or is there any requirement under Rule 803(6) that the records be prepared by the party who has custody of the documents and seeks to introduce them into evidence.” Phoenix Associates v. Stone, 60 F.3d 95, 101 (2d Cir.1995). - Advisory Cmte Note: “Sources of information presented no substantial problem... All participants, including the observer or participant furnishing the information to be recorded, were acting routinely, under a duty of accuracy.” • Handwritten notes on investments are business records: Phoenix Assocs. v. Stone, 60 F.3d 95, 101 (2d Cir.1995) (reversing exclusion: notes on wire transfers “were completed regularly” and “transfer of large sums was a regular part of the partnership's investment activities. Thus, the exhibit clearly was made ‘in the course of a regularly conducted business activity,’... not ‘drafted in response to unusual or isolated events.’ U.S. v. Strother, 49 F.3d 869, 876 (2d Cir.1995)”) HANDWRITTEN NOTES as 803(6) BUSINESS RECORDS 803(6) handwriting on investment or payment documents are business records • Note-taking on conversations is an 803(6) business record although “sporadic and selective”: U.S. v. Kaiser, 609 F.3d 556 (2d Cir. 2010). “Kaiser argues that Redgate's note-taking on telephone conversations was not a ‘regular practice,’ and that he recorded the conversations to give himself cover in the event the fraud was exposed. Kaiser argues that Redgate's note-taking was too sporadic and selective ... , citing testimony ... he only wrote down ‘highlights’ and matters he perceived to be “important.’ The selectivity ... , however, is the nature of all note-taking. A business record need not be mechanically generated to be part of a ‘regular practice.’ Redgate's ... was maintained in a consistent way and was focused on a certain range of issues that were relevant to his business.” • Handwritten notations on wire transfers are 803(6) business record: Phoenix Assocs. v. Stone, 60 F.3d 95, 101 (2d Cir. 1995) (reverses exclusion: on a wire transfer, plaintiff had a handwritten “notation describing the transfer as a ‘Reimbursement of Investments ... ’”; the notations were admissible because witness testified such notations “were completed regularly” and “transfer of large sums was a regular part of the partnership's investment activities. Thus, the exhibit clearly was made ‘in the course of a regularly conducted business activity,’ ... [R.] 803(6), ... not ‘drafted in response to unusual or “isolated” events.’ U.S. v. Strother, 49 F.3d 869, 876 (2d Cir. 1995)”). FEIGENBAUM’S HANDWRITTEN VALUATIONS & REPORT DOCUMENTS (1) Writing @dep is non-hearsay depo testimony (R.32); (2) expert analysis is party-opponent admission (801d2) (1) Handwritten valuation is depo testimony, thus admissible per R.32 without separate ‘hearsay’ analysis: As Rule 802 expressly provides, evidence isn’t hearsay if it’s declared admissible by any other federal rule of evidence or civil procedure; the R.802 advisory cmte. note expressly lists R.32 deposition admissibility as another rule declaring admissible something that would otherwise be hearsay. See 7-32 Moore's Federal Practice, Civil § 32.02 (“Rule 32 was adopted to allow use of depositions at a hearing or trial in limited circumstances. The rule works as an exception to the hearsay rule.” ). (2) Report documents & handwritten valuations alike: D’s hired expert’s analysis, on the same topic D hired him to analyze, is a party-opponent admission per 801(d)(2)(D), which requires not that an agent was authorized to make that particular statement, only that the statement is “by the party’s agent ... concerning a matter within the scope of the agency, made during the existence of the relationship”: Long v. Fairbank Farms, 2011 WL 2516378, *10 (D. Me. May 30, 2011) (“[T]he testimony of [D expert] Dr.Zirnstein...is admissible pursuant to...801(d)(2)(C).... While [D] GOPAC did not expressly authorize Dr.Zirnstein to make ‘admissions,’ it expected him to testify ... within the sphere of his expertise as to his ... opinions. He did exactly that. ... [H]e was authorized ... to make a statement concerning the subject matter.”) - Farr Man Coffee v. Chester, 1993 WL 248799, *14 (S.D.N.Y. June 28, 1993) (report D procured but didn’t offer at trial, can be admitted by P: “Following plaintiffs' ... loss, the [D] Underwriters investigated the claim through ... Intertel .... The Intertel Report is admissible as an admission by a party-opponent pursuant to ... 801(d)(2)(D).... The Intertel Report was prepared at the Underwriters' request, creating an agency relationship ... The resulting report is the product of the agency relationship, and ... concerns a matter within the scope of the agency ... during the relationship.”) - Bianco v. Hultsteg, 2009 WL 347002, *12 (N.D.Ill. Feb. 5, 2009) (“We agree that [P’s expert's] sworn testimony constitutes admissions by a party opponent ... which [D] may offer into evidence.”) - In re Hanford Nuclear Reservation Litig. 534 F.3d 986, 1016 (9th Cir. 2008) (allowing D to use in evidence P expert’s testimony at prior bellwether trial: “Dr. Hoffman's testimony ... was an admission of a party opponent”). INDUSTRY PRACTICE D argues markups base on experience, not “tested” formula – but: Rule 702’s 2000 Advisory Committee note expressly says: “knowledge” from “experience” can “provide a sufficient foundation”: Nothing in this amendment . . . suggest[s] that experience alone – or . . . with other knowledge, skill, training or education – may not provide a sufficient foundation . . . . Rule 702 expressly contemplates that an expert may be qualified on the basis of experience. In certain fields, experience is the predominant, if not sole, basis for a great deal of reliable expert testimony. → As discovery ended, D retained experts & aggressively pressed the not just propriety but necessity of expert valuation, in a letter brief Dec. 10, 2009 (Docket #70): 1) “this case is likely to be decided by a proverbial battle of the experts – if expert testim shows that the coins were worth what Mr. Adamo sold them to Mr. Marini for, then all of Ps’ claims must fail” 2) “the true worth of these coins can only be established by expert discovery” 3) “expert reports ... are particularly vital ... given that this case is likely to turn on the question of the proper valuation of the coins at issue, which will be determined by expert testimony” 4) Those were all D’s own exact words. Most relev’ly, D stressed, expert analysis in this case is “particularly pressing when dealing with rare coins that are not often bought and sold” → D appears have decided not to call 1 or more of their experts, so now they’d like to argue vs not only our view that experts are helpful, but vs their own identical prior view. They were rt, 1st x. • Thus industry practices are “a traditionally proper subject for a qualified expert.” U.S. Media Corp. v. Edde Entm’t, No. 94 Civ. 4849, 1997 WL 61368 (S.D.N.Y. 1997). & Markups, not unreliable/made-up; all 3 D experts testified they apply sliding scale (P op D motion limine at 2). • So is valuation: Pizal v. Monaco Coach, 374 F. Supp. 2d 653, 657 (N.D. Ind. 2005), held: “because Trimmell made a valuation based upon his experience in the industry, and consulted various recognized and approved valuation guides, . . . [his] testify[ing] on . . . value[s] . . . would aid the jury.” • What forms of reliance & due diligence are customary: Pension Committee of Univ. of Montreal v. Banc of Am. Sec., 691 F.Supp.2d 448, 459 (S.D.N.Y. 2010) (expert can testify about investor due diligence to “educate the jury about the steps that an investor should take before investing in a hedge fund”); Sandwich Chef of Texas, Inc. v. Reliance Nat’l Indemn., 319 F.3d 205, 220, 221 (5th Cir. 2003) (securities fraud case; expert can testify on extent to which parties “customarily and reasonably rely on the accuracy of invoices”). APPRAISALS: Each of the four elements of business record admissibility supports admission here. 1st, probative value: These appraisals of Plaintiffs’ coins are among the key evidence in this case about whether Defendants misrepresented the value, nature, and investment prospects of those 100 coins. 2nd, regularly conducted business: Each witness (Fred Weinberg and Joseph Parrella) is an experienced coin dealer whose entire business depends on making successful and regular appraisals of rare coins to buy and sell. Courts have admitted appraisals of rare items such as art or coins. E.g., United States v. Licavoli, 604 F.2d 613, 622 (9th Cir. 1979) (affirming Rule 803(6) admission of an appraisal of a painting by an insurance company); United States v. Kayne, 90 F.3d 7 (1st Cir. 1996) (affirming admission under Rule 803(6) of valuation service’s appraisals of coins defendants sold). It is immaterial that the appraisals came after, not before, Plaintiffs’ deals, so long as their methodology was as professional as the appraisals they normally conduct. Selig v. U.S., 740 F.2d 572 (7th Cir. 1984) (that baseball team appraised player contracts belatedly, only after contract years completed, did not preclude admissibility of appraisals as business records, because appraisals still were consistent with team’s regular business). 3rd, foundation: Each witness will detail to how and when he created and kept the appraisal. 4th, sufficient indicia of trustworthiness: A factfinder may give records created for litig. less weight, lessening the reliability presumption a neutral appraiser’s work may enjoy, but they remain admissible if they satisfy the R.803(6) elements; the test isn’t a proponent’s motivation, but whether a record still qualifies as reg’ly conducted activity - & a record created for litig. has sufficient reliability if (a) the sort of activity the W regularly conducts, & (b) used for non-litigation purposes too, as here, where you’ll hear M values this analysis as a paid-for appraisal of his coins. U.S. v. Baxter, 492 F.2d 150, 165 (9th Cir. 1973) (affirms admission, rejecting defense argument “that the notebooks were inherently unreliable because Wright prepared them for the purpose of litigation”: even though “business records prepared specifically to assist in imminent litigation are unreliable, because they are likely to be self-serving ... , the test is not the motivation of ... preparing the record, but the function served by the records in the operation itself. ... [T]he Hernandezes continued to depend upon the notebooks, even after [litigation] ... [and] [t]he entries ... were still prepared in the regular course of the ... enterprise.”) Kaufman Federal Rule of Evidence 801(d)(2) deems admissible non-hearsay any statements of an opposing party: subsection (C) admits statements an agent was expressly authorized to make (inapt here); but subsection (D) admits any statements by an agent “on a matter within the scope of that relationship and while it existed.” Id. 801(d)(2)(D). “The authority granted in the agency relationship need not include authority to make damaging statement .... Nor is the availability of the declarant relevant under Fed. R. Evid. 801(d)(2)(D)”; rather, “sufficient foundation to support the introduction of vicarious admissions” under 801(d)(2)(D) “requires only that a party establish (1) the existence of the agency relationship, (2) that the statement was made during the course of the relationship, and (3) that it relates to a matter within the scope of the agency.” Pappas v. Middle Earth Condominium Ass'n, 963 F.2d 534, 538 (2d Cir. 1992). Especially “[i]n light of the liberal treatment proof under Rule 801(d)(2)(D) is accorded,” id., William Kaufman’s deposition testimony satisfies the required elements: (1) an agency relationship, as Defendants’ accountant; (2) statements made during the course of that relationship; and (3) relatedness to the relationship, in that all proffered testimony is on Defendants’ business and sales records. Statements by an “accountant .. [and] bookkeeper” for a party thus is “clearly admissible under FRE 801(d)(2)(D) ... as an admission by a party-opponent.” U.S. v. Chappell, 698 F.2d 308, 312 (7th Cir. 1983) (“Ricci stated that he was the accountant for General Oil and that he maintained the books and records. He ... described how he posted entries and prepared schedules. ... That rule defines as not hearsay any admission by a party-opponent through his agent concerning a matter within the scope of the agency, if made during the existence of the relationship. While ... Ricci was no longer on the General Oil payroll at the time that he gave testimony ..., he was nonetheless still acting as General Oil's bookkeeper ... [and] still acting as General Oil's accountant.”).