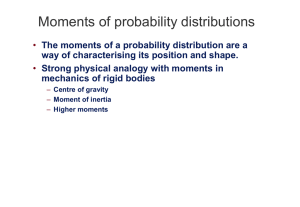

Mean and Higher Moments

advertisement

MEAN AND HIGHER MOMENTS Lecture VIII EXPECTED VALUE Definition 4.1.1. Let X be a discrete random variable taking the value xi with probability P(xi), i=1,2,…. Then the expected value E[X] is defined to be E[X]=i=1xiP(xi) if the series converges absolutely. We can write E[X]=+xiP(xi)+ -xiP(xi) where in the first summation we sum for i such that xi>0 and in the second summation we sum for i such that xi<0. If +xiP(xi)= and -xiP(xi)=- then E[X] does not exist. If +xiP(xi)= and - finite then we say E[X]=. If -xiP(xi)=- and + is finite then we say that E[X]=. ROLLING DICE Number 1 Probability 0.167 E[X]=i=1xiP(xi) 0.167 2 3 4 5 6 0.167 0.167 0.167 0.167 0.167 0.333 0.500 0.667 0.833 1.000 3.500 EXPECTED VALUE OF TWO DIE Die 1 1 2 3 4 5 6 Die 2 1 1 1 1 1 1 Number 2 3 4 5 6 7 E[X ]= 0.056 0.083 0.111 0.139 0.167 0.194 7 Expectation has several applications in risk theory. In general, the expected value is the value we expect to occur. For example, if we assume that the crop yield follows a binomial distribution as depicted in figure 1, the expected return on the crop given that the price is $3 and the cost per acre is $40, becomes: EXPECTED PROFIT ON CROP 15 20 25 30 35 40 45 50 55 60 65 0.0001 0.0016 0.0005 0.0016 0.0315 0.0315 0.0106 0.2654 0.3716 0.0425 1.274 2.1234 0.1115 3.9017 7.246 0.2007 8.0263 16.0526 0.2508 11.287 23.8282 0.215 10.7495 23.649 0.1209 6.6513 15.1165 0.0403 2.4186 5.6435 0.006 0.393 0.9372 45 95 In the parlance of risk theory, the expected value of the wheat crop is termed the actuarial or fair value of the game. It is the value that a risk neutral individual would be willing to pay for the bet. Another point about this value, it is sometimes called the population mean as opposed to the sample mean. Specifically, the sample mean is an observed quantity based on a sample drawn from the random generating function. The sample mean is defined as: x i 1 xi n RANDOM SAMPLE Observation 1 2 3 4 5 6 7 8 9 20 Yield Profit 40 40 40 50 50 45 35 25 40 45 80 80 80 110 110 95 65 35 80 95 38.75 76.25 Table 4 presents a sample of 20 observations drawn from the theoretical distribution above, note that sample mean for yield is smaller than the population mean (33.75 for the sample mean versus 45.00 for the population mean). It follows that the sample mean for profit is smaller than the population mean for profit. ST. PETERSBURG PARADOX The Saint Petersburg paradox involves the valuation of gambles with an infinite value. The simplest form of the paradox involves the value of a series of coin flips: What is the expected value of a bet that pays off $2 for each consecutive head? EG i 1 2 2 i 11 i i In theory, the expected value of this bet is infinity, but no one is willing to pay an infinite price. This unwillingness to pay an infinite price for the gamble led to expected utility theory. Theorem 4.1.3. Let (X,Y) be a bivariate discrete random variable taking value (yi,xj) with probability P(xi,yj), i,j=1,2,…, and let (.,.) be an arbitrary function. Then E X , Y i 1 j 1 xi , y j Pxi , y j Theorem 4.1.4. Let (X,Y) be a bivariate continuous random variable with joint density function f(x,y), and let (.,.) be an arbitrary function. Then E X , Y x, y f x, y dxdy Theorem 4.1.5. If is a constant, E[]=. Theorem 4.1.6. If X and Y are random variables and and are constants, E[X+Y]=E[X]+E[Y]. Theorem 4.1.7. If X and Y are independent random variables, E[XY]=E[X] E[Y]. The last series of theorems are important to simplify decision making under risk. In the crop example we have P X C where is profit, P is the price of the output, X is the yield level and C is the cost per acre. The distribution of profit along with its expected value is dependent on the distribution of P, X, and C. In the example above, we assume that P and C are constant at p and c. The expected value of profit is then: E E p X c pEX c As a first step, assume that cost is a random variable E X , C E p X C p EX EC Next, assume that price and yield are random, but cost is constant: E X , P E P X c E P X c p x f x, p dxdp By assuming that P and X are independent (firm level assumptions) E X , P EP X c EPEX c MOMENTS Another frequently used function of random variables are the moments of the distribution function: r X EX r x dx where r is a nonnegative integer. r From this definition, it is obvious that the mean is the first moment of the distribution function. The second moment is defined as 2 X EX 2 2 x dx The higher moments can similarly be represented as moments around the mean or central moments r ~ r X EX EX Examples, the first, second, third and fourth moments of the uniform distribution can be defined as: 1 1 2 1 1 1 X x 1dx x 0 0 2 2 1 3 1 1 2 X x dx x 0 0 3 3 1 1 4 1 1 3 3 X x dx x 0 0 4 4 1 1 5 1 1 4 4 X x dx x 0 0 5 6 1 2 Definition 4.2.1. The second central moment of the distribution defines the variance of the distribution: EX V X E X EX E X 2 2 2 The last equality is derived by: EX EX E X EX X EX 2 E X 2 X EX EX 2 2 2 ExEX EX E X EX EX 2 2 2 2 Put another way, the variance can be derived as V X 2 1 2 2 ~ 2 From these definitions, we see that for the uniform distribution V X 2 1 2 2 1 1 1 1 1 3 2 3 4 12 This can be verified directly by 2 1 V X x dx 0 2 1 1 2 x x dx 0 4 1 1 1 x dx x dx dx 0 0 4 0 1 1 1 4 6 3 1 3 2 4 12 12 12 12 1 2 1