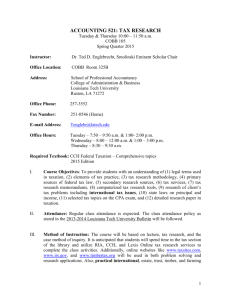

Document

advertisement

CCH Federal Taxation Basic Principles Chapter 11 Property Transactions: Nonrecognition of Gains and Losses ©2003, CCH INCORPORATED 4025 W. Peterson Ave. Chicago, IL 60646-6085 800 248 3248 http://tax.cchgroup.com Chapter 11 Exhibits 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. Sale of a Principal Residence—General Rules Sale of Home by Married Taxpayers—General Rules Sale of Home by Married Taxpayers—Examples Sale of Home by Divorced or Separated Taxpayers—Ownership Requirement Sale of Home by Divorced or Separated Taxpayers—Occupancy Requirement Sale of Home by Widowed Taxpayers Sale of Home Due to Unforeseen Circumstances Sale of Home by Incapacitated Taxpayers Sale of Home by U.S. Citizens Temporarily Working Abroad Like-Kind Exchanges—Tangible Property Like-Kind Exchanges—Intangible Property Like-Kind Exchanges—Tax Treatment for Gain or Loss Like-Kind Exchanges—Time Limitations Like-Kind Exchanges—Holding Period Rules Chapter 11, Exhibit Contents A CCH Federal Taxation Basic Principles 2 of 66 Chapter 11 Exhibits 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. Involuntary Conversions—What Qualifies Involuntary Conversions—Time Limitations Involuntary Conversions—Holding Period Rules Involuntary Conversions—Template for Problem Solving Installment Method—Eligible Property Installment Method—Four-Step Computation Installment Method— Example Installment Method— Solution Step One Installment Method— Solution Step Two Installment Method— Solution Step Three Installment Method— Solution Step Four Chapter 11, Exhibit Contents B CCH Federal Taxation Basic Principles 3 of 66 Sale of a Principal Residence—General Rules Amount and tax effect of the exclusion $250,000 (Married individuals filing jointly may exclude up to $500,000.) This is a permanent exclusion, not just a deferral or rollover of gain until a later time. Moreover, there is no reinvestment requirement. Chapter 11, Exhibit 1a CCH Federal Taxation Basic Principles 4 of 66 Sale of a Principal Residence—General Rules Qualifying for the exclusion To qualify for the exclusion, a taxpayer must: Own and use the property as a principal residence for an aggregate of at least two of the five years preceding the sale or exchange; and, Not claim the exclusion during the two years immediately preceding the sale. Chapter 11, Exhibit 1b CCH Federal Taxation Basic Principles 5 of 66 Sale of a Principal Residence—General Rules Example. Fred, a single individual, owns and occupies his home during all of 20x1 and 20x2. He rents it to a tenant during all of 20x3, 20x4 and 20x5. He sells it on December 31, 20x5, realizing a $200,000 gain. If Fred had not taken exclusion on the sale of any other principal residence during 20x4 and 20x5, he may be entitled to exclude all of the $200,000 gain in 20x5. Chapter 11, Exhibit 1c CCH Federal Taxation Basic Principles 6 of 66 Sale of a Principal Residence—General Rules Short-term absences Absences due to short-term illness, business travel and vacation generally count as occupancy. Under certain situations, taxpayers may be able to claim the exclusion even though they fail to meet either the one-sale-every-two-years limitation or the two-out-of-five-year holding period requirement. Chapter 11, Exhibit 1d CCH Federal Taxation Basic Principles 7 of 66 Sale of Home by Married Taxpayers— General Rules Rules of eligibility to claim an exclusion on a joint return The maximum exclusion that can be claimed on a joint return is either $250,000 or $500,000. Three requirements for these maximum exclusion amounts are summarized in the following charts. Chapter 11, Exhibit 2a CCH Federal Taxation Basic Principles 8 of 66 Sale of Home by Married Taxpayers— General Rules Three Requirements: Minimum Two-Year Ownership: Chapter 11, Exhibit 2b Maximum $500,000 Exclusion Either spouse owns the principal residence for an aggregate of at least two of the five years immediately preceding the sale or exchange. CCH Federal Taxation Basic Principles Maximum $250,000 Exclusion Either spouse owns the principal residence for an aggregate of at least two of the five years immediately preceding the sale or exchange. 9 of 66 Sale of Home by Married Taxpayers— General Rules Three Requirements: Minimum Two-Year Occupancy: Chapter 11, Exhibit 2c Maximum $500,000 Exclusion Maximum $250,000 Exclusion Both spouses, while married, occupy the dwelling as their principal residence for an aggregate of at least two of the five years immediately preceding the sale or exchange. The owner-spouse occupies the dwelling as a principal residence for an aggregate of at least two of the five years immediately preceding the sale or exchange. This two-year occupancy requirement can be met either before or during marriage. CCH Federal Taxation Basic Principles 10 of 66 Sale of Home by Married Taxpayers— General Rules Three Requirements: Maximum Two-Year Frequency: Maximum $500,000 Exclusion Neither spouse claimed the exclusion within two years preceding the sale. Maximum $250,000 Exclusion The owner-spouse has not claimed the exclusion within two years preceding the sale. (Note that a non-ownerspouse’s ineligibility does not bar the owner-spouse from claiming a $250,000 exclusion on a joint return.) Chapter 11, Exhibit 2d CCH Federal Taxation Basic Principles 11 of 66 Sale of Home by Married Taxpayers Example 1. While single, Greg and Lynne live in separate principal residences for over two years. On January 1, 20x1, they marry and move into a new house. Later that year they convert their former principal residences into rental properties. On June 31, 20x3, Lynne sells her former principal residence at a $600,000 gain. How much of Lynne’s gain may be excluded on a joint return? Chapter 11, Exhibit 3a CCH Federal Taxation Basic Principles 12 of 66 Sale of Home by Married Taxpayers Answer: $250,000. Only Lynne occupied the home as her principal residence during two of the five years preceding the sale. (Note: Had Greg and Lynne decided to use Lynne’s home as their principal residence during any two of the five years preceding sale, they could have claimed a $500,000 exclusion even though Greg was not an owner.) Chapter 11, Exhibit 3b CCH Federal Taxation Basic Principles 13 of 66 Sale of Home by Married Taxpayers Example 2. Continuing from example 1 above, on December 31, 20x3, the couple sells the new principal residence at a $700,000 gain. How much of the gain may be excluded on their joint return? Chapter 11, Exhibit 3c CCH Federal Taxation Basic Principles 14 of 66 Sale of Home by Married Taxpayers Answer: None. Lynne had used her exclusion on June 30, 20x3, within two years preceding the December 31, 20x3 sale. (Note: If they had sold Greg’s rental home instead of their jointly-owned principal residence, a $250,000 exclusion would have been available on their joint return. Greg would still be considered to have owned and occupied the rental house as his principal residence during two of the five years preceding sale, i.e. the two years preceding marriage. He would not have had to wait two years from June 30, 200x3, (the effective date of Lynne’s exclusion) to become eligible because a non-ownerspouse’s ineligibility does not bar the owner-spouse from claiming a $250,000 exclusion on a joint return.) Chapter 11, Exhibit 3d CCH Federal Taxation Basic Principles 15 of 66 Sale of Home by Divorced or Separated Taxpayers— Ownership Requirement If a residence is transferred to a taxpayer under a divorce or separation instrument, the time during which the taxpayer’s spouse or former spouse owned the residence is added to the taxpayer’s period of ownership. Chapter 11, Exhibit 4a CCH Federal Taxation Basic Principles 16 of 66 Sale of Home by Divorced or Separated Taxpayers— Ownership Requirement Example. John has owned his principal residence for several years. On January 1, 20x1, he marries Tina. After one year of sharing a principal residence, the marriage turns sour, John moves into an apartment and they divorce. Pursuant to a divorce decree, John transfers ownership in the house to Tina on December 31, 20x1 and she immediately sells it at a $300,000 gain. Although she did not own the residence for two years, Tina can claim a $250,000 exclusion. She is deemed to have owned the house as her ex-spouse owned it, thus satisfying the two-out-of-five-year ownership requirement. Chapter 11, Exhibit 4b CCH Federal Taxation Basic Principles 17 of 66 Sale of Home by Divorced or Separated Taxpayers— Ownership Requirement Recap of John and Tina Analysis: 20x0: Actual Deemed Ownership Ownership: John Tina Actual Occupancy: John Deemed Occupancy: Tina 20x1: John Tina John and Tina Tina Observation: Tina owned the house for only one day and occupied it for one year. Nevertheless, she is deemed to have owned, the residence for two years. Chapter 11, Exhibit 4c CCH Federal Taxation Basic Principles 18 of 66 Sale of Home by Divorced or Separated Taxpayers— Occupancy Requirement A taxpayer who owns a residence is deemed to have occupied it as a principal residence while the taxpayer’s spouse or former spouse is given use of the residence under the terms of a divorce separation. Chapter 11, Exhibit 5a CCH Federal Taxation Basic Principles 19 of 66 Sale of Home by Divorced or Separated Taxpayers— Occupancy Requirement Example. Colleen purchases her principal residence on January 1, 20x1, and marries Stan that same day. After one year of living together in Colleen’s home, the marriage turns sour and they divorce. On January 1, 20x2, Colleen moves into an apartment, and under the terms of a divorce decree, Stan is allowed to live in the house for an additional year before Colleen can sell it. On January 1, 20x3, Colleen sells the house realizing a $500,000 gain. Despite not occupying the house for a full two years, Colleen can claim a $250,000 exclusion. She is deemed to have occupied the house during the one year her ex-spouse occupied it, thus satisfying the twoout-of-five-year occupancy period requirement. Chapter 11, Exhibit 5b CCH Federal Taxation Basic Principles 20 of 66 Sale of Home by Divorced or Separated Taxpayers— Occupancy Requirement Recap of Colleen and Stan Analysis: Actual Ownership Actual Usage: Deemed Usage: 20x1: Colleen Colleen and Stan Colleen 20x2: Colleen Stan Colleen Observation: Colleen actually occupied the house for only one year, 20x1. However, she is deemed to have occupied it for two years, including 20x2, the year her ex-spouse occupied it. Chapter 11, Exhibit 5c CCH Federal Taxation Basic Principles 21 of 66 Sale of Home by Widowed Taxpayers A surviving spouse’s period of ownership and occupancy includes the period during which a deceased spouse owned and occupied the residence. Chapter 11, Exhibit 6a CCH Federal Taxation Basic Principles 22 of 66 Sale of Home by Widowed Taxpayers Example. Joe, a single individual, has owned and occupied his principal residence for over two years. On January 1, 20x2, he marries Sue and they begin living together in Joe’s house. Three weeks later, Joe dies and ownership of the house is transferred to Sue. Sue immediately sells the house. Despite not owning and occupying the residence for two years, Sue can claim a $500,000 exclusion on their joint return (Joe’s final return). She is deemed to have owned and occupied the house during the period in which her deceased spouse owned and occupied it, thus satisfying the two-out-of-five-year holding period requirement. If she delays the sale until a later year, then as a single taxpayer, her maximum exclusion would drop to $250,000. Chapter 11, Exhibit 6b CCH Federal Taxation Basic Principles 23 of 66 Sale of Home by Widowed Taxpayers Recap of Joe and Sue Analysis Less than 1 month Actual Ownership and Occupancy: Joe and Sue Deemed Ownership and Occupancy: Sue Balance of 2 years Joe Sue Observation: Although actually owning and occupying the principal residence for less than one month, Sue is deemed to have owned and occupied it during the period in which her deceased spouse owned and occupied it. Chapter 11, Exhibit 6c CCH Federal Taxation Basic Principles 24 of 66 Sale of Home Due to Unforeseen Circumstances If a change in place of employment, health or other unforeseen circumstances precipitate a sale or exchange before any of the three requirements (i.e., the two-year ownership, occupancy or frequency requirements) are satisfied, the exclusion may be prorated. The extent to which “unforeseen circumstances” qualify is to be determined by IRS regulations. Chapter 11, Exhibit 7a CCH Federal Taxation Basic Principles 25 of 66 Sale of Home Due to Unforeseen Circumstances Formula forProrating the Exclusion Where Unforeseen Circumstances Apply (a) Available exclusion (i.e., $250,000 or $500,000). (b) Aggregate # months of ownership during the five year period ending on the date of sale. (c) Aggregate # months of occupancy during the five year period ending on the date of sale. (d) # months since the previous sale to which the exclusion applied. (Use “24 months” if no previous sale.) (e) 24 months (f) = [lesser of (b) (c) or (d)] (e) Pro rata fraction (g) = (a) x (f) Available exclusion Chapter 11, Exhibit 7b CCH Federal Taxation Basic Principles 26 of 66 Sale of Home Due to Unforeseen Circumstances Example. On January 1, 20x1, Burke purchases a townhouse in Boston for $450,000. Later in the year, he accepts an offer of employment in Atlanta. On November 1, 20x1, he sells his townhouse at a $30,000 gain. His change in place of employment enables him to claim a portion of the $250,000 exclusion. Because he owned and occupied the townhouse for 10 months, his available exclusion is $104,167 ($250,000 x 10 24) and he recognizes no gain. Chapter 11, Exhibit 7c CCH Federal Taxation Basic Principles 27 of 66 Sale of Home by Incapacitated Taxpayers If an individual becomes physically or mentally incapable of self-care, the individual is deemed to use a residence as a principal residence during the time in which the individual owns the residence and resides in a licensed care facility (e.g., a nursing home). In order for this rule to apply, the taxpayer must have owned and used the residence as a principal residence for an aggregate period of at least one year during the five years preceding the sale or exchange. Chapter 11, Exhibit 8a CCH Federal Taxation Basic Principles 28 of 66 Sale of Home by Incapacitated Taxpayers Example. On January 1, 20x1, Patrick purchases a house that he occupies as his principal residence. On January 1, 20x2, he moves into a nursing home due to a sudden decline in health. On January 1, 20x3, he sells his house, realizing a $100,000 gain. Patrick’s one-year ownership of the house while under the care of a licensed medical facility is now deemed to be one-year usage since he had previously used the house for at least one year during the five years preceding the sale of the house. His oneyear occupancy of the house plus the additional one year of ownership while incapacitated, satisfies the two-out-of-fiveyear occupancy requirement, and he can claim the exclusion. Chapter 11, Exhibit 8b CCH Federal Taxation Basic Principles 29 of 66 Sale of Home by Incapacitated Taxpayers Note: If Patrick had moved into the nursing home before January 1, 20x2, he would not have been able to claim the exclusion. since he had not previously used the house for at least one year. Chapter 11, Exhibit 8c CCH Federal Taxation Basic Principles 30 of 66 Sale of Home by U.S. Citizens Temporarily Working Abroad Code section 121(a) states that the two-out-of-five-year holding period requirement is satisfied if “property has been owned and used by the taxpayer as the taxpayer’s principal residence for periods aggregating 2 years or more.” Congress intended the word “used” to encompass something more than absentee-ownership. Until Congress provides specific relief to U.S. citizens working abroad, the term “used” should be construed to mean something akin to physical occupancy, not an extended absence while working abroad. Chapter 11, Exhibit 9a CCH Federal Taxation Basic Principles 31 of 66 Sale of Home by U.S. Citizens Temporarily Working Abroad Example. Kevin purchases a house on January 1, 20x1, which he uses as a principal residence. On January 1, 20x2, he accepts a temporary assignment overseas, leaving his house unoccupied. After one year overseas, Kevin decides to sell his house. On January 1, 20x3, he realizes a $200,000 gain on the sale. Although he owned the house for two years preceding the sale, he did not physically occupy it for two years, thus he cannot claim the exclusion. Chapter 11, Exhibit 9b CCH Federal Taxation Basic Principles 32 of 66 Like-Kind Exchanges—Tangible Property General Rule for Qualifying Property Tangible personal and real property held for business or investment may qualify. The rules are rigid for all tangible personal property and flexible for all real property. Inventory and personal-use property do NOT qualify. Certain intangible property may qualify. Chapter 11, Exhibit 10a CCH Federal Taxation Basic Principles 33 of 66 Like-Kind Exchanges—Tangible Property Examples: Real for real is OK (e.g., timberland for a bowling alley). Tangible personal for tangible personal may be OK (e.g., printer for a computer is OK since both properties fall within the same General Asset Class described below; a computer for a delivery truck is NOT OK since they fall within different General Asset Classes.) Personal for real, or vice versa, is NOT OK (e.g., delivery truck for a warehouse). Inventory for anything is NOT OK (e.g., computer held for resale in exchange for a computer used in an accounting department). Personal-use property for anything is NOT OK (e.g., a principal residence for a rental home). Chapter 11, Exhibit 10b CCH Federal Taxation Basic Principles 34 of 66 Like-Kind Exchanges—Tangible Property General Asset Classes for Tangible Personal Property Rev. Proc. 87-56, [1987-2 C.B. 674] describes types of depreciable tangible personal property that frequently are used in businesses. Chapter 11, Exhibit 10c CCH Federal Taxation Basic Principles 35 of 66 Like-Kind Exchanges—Tangible Property Asset Class #: Description 00.11 Office furniture, fixtures, and equipment 00.12 Information systems (computers and peripheral equipment) 00.13 Data handling equipment, except computers 00.21 Airplanes (airframes & engines), except those used in commercial or contract carrying of passengers or freight, and all helicopters (airframes & engines) 00.22 Automobiles and taxis 00.23 Buses 00.241 Light general purpose trucks 00.242 Heavy general purpose trucks 00.25 Railroad cars and locomotives, except those owned by RR transportation cos. 00.26 Tractor units for use on public roads 00.27 Trailers and trailer-mounted containers 00.28 Vessels, barges, tugs and similar water-transportation equip., except those used in marine construction 00.4 Industrial steam and electric generation and/or distribution systems Personal property within the same Asset Class qualifies for Code Sec. 1031 treatment, if used for business or investment purposes. Chapter 11, Exhibit 10d CCH Federal Taxation Basic Principles 36 of 66 Like-Kind Exchanges—Intangible Property Code Sec. 1.1031(a)(2) allows Code Sec. 1031 application to exchanges of intangible personal property that occur after 4/10/91. Types of Code Sec. 197 intangible personal property Intangible personal property includes: copyrights, covenants not to compete, formulas, franchises, goodwill, patents, processes, trademarks or trade names. Chapter 11, Exhibit 11a CCH Federal Taxation Basic Principles 37 of 66 Like-Kind Exchanges—Intangible Property Code Sec. 197 Property that Qualifies for Code Sec. 1031 Treatment No General Asset Classes are provided for Code Sec. 197 property. To qualify, the Code Sec. 197 property must be of the same nature or character (e.g., a copyright for a patent is NOT OK; it must be a patent for a patent, or a copyright for a copyright). In addition, the nature or character of the underlying property to which the Code Sec. 197 relates must be like-kind (e.g., a patent on a factory machine for a patent on an airplane engine is NOT OK; however, a patent on an airplane engine for a patent on a helicopter engine IS OK). Chapter 11, Exhibit 11b CCH Federal Taxation Basic Principles 38 of 66 Like-Kind Exchanges— Tax Treatment for Gain or Loss Mandatory Rule A portion of realized gain or loss may be recognizable. Deferral of any remaining gain or loss is mandatory, not elective. Here are the rules for recognizing gain or loss: Code Sec. 1031 recognized gain = The lesser of: 1. Realized gain (i.e., FMV of all consideration received – basis of all consideration given – depreciation recapture, if any) 2. Net boot received (i.e., FMV of boot received - basis of boot given) Chapter 11, Exhibit 12a CCH Federal Taxation Basic Principles 39 of 66 Like-Kind Exchanges— Tax Treatment for Gain or Loss Code Sec. 1031 losses are only recognized when boot is given with a FMV below basis. Depreciation recapture is always taxable immediately as ordinary income in a gain recognized situation. Chapter 11, Exhibit 12b CCH Federal Taxation Basic Principles 40 of 66 Like-Kind Exchanges— Tax Treatment for Gain or Loss Boot defined Boot is cash or other property received or given in a Code Sec. 1031 exchange that is not “like-kind.” For example, if land is exchanged for land, and a truck is included in the exchange, the truck is boot. Conversely, if a truck is exchanged for a truck, and land is included in the exchange, the land is boot. Cash is always boot. Chapter 11, Exhibit 12c CCH Federal Taxation Basic Principles 41 of 66 Like-Kind Exchanges— Tax Treatment for Gain or Loss Net boot received (NBR) “Net boot received” however is a tricky concept. Generally, 3 rules apply to NBR: 1. Mortgage relief may be offset by any boot given, except boot in rule 3 below. 2. Mortgage assumptions may offset only mortgage relief. 3. The basis of inventory, stock and other intangible property given may not offset the FMV of any boot received. Chapter 11, Exhibit 12d CCH Federal Taxation Basic Principles 42 of 66 Like-Kind Exchanges— Tax Treatment for Gain or Loss Review the following examples below to grasp these rules. Net Boot Received Computations: Example 1 Example 2 Example 3 Example 4 Rec’d Mtg. Relief 100 Mtg. Relief 100 Cash 100 Cash 100 - Given Mtg. Ass. (60) Cash (60) Mtg. Ass. (60) Stock (60) = NBR NBR 40 NBR 40 NBR 100 NBR 100 Rule # Chapter 11, Exhibit 12e 1&2 1 CCH Federal Taxation Basic Principles 2 3 43 of 66 Like-Kind Exchanges— Tax Treatment for Gain or Loss Recognized gain or loss from boot given = [FMV – Basis], regardless of realized gain or loss on the Code Sec. 1031 exchange. [Reg. 1.1031(d)-1(e)]. Chapter 11, Exhibit 12f CCH Federal Taxation Basic Principles 44 of 66 Like-Kind Exchanges—Time Limitations Time Limitation Two time limitations govern like-kind exchanges under the Starker rule (named after a landmark court case): 1. Identification requirement. Like-kind property to be received must be identified within 45 days of the date that the like-kind property is given. 2. Receipt requirement. Like-kind property must be received within 180 days of the date that the like-kind property is given. Chapter 11, Exhibit 13a CCH Federal Taxation Basic Principles 45 of 66 Like-Kind Exchanges—Starker Transactions Starker transactions: “Giving Before Receiving” May Be OK Giving like-kind property and subsequently receiving likekind property would qualify for Code Sec. 1031 if the 45-day and 180-day time constraints were met. This is known as a “Starker transaction.” Chapter 11, Exhibit 13b CCH Federal Taxation Basic Principles 46 of 66 Like-Kind Exchanges—Reverse Starker Transactions Reverse-Starker transactions: “Receiving Before Giving” NOT OK Receiving like-kind property before giving like-kind property is known as a “reverse-Starker” transaction. IRS TAKES THE POSITION THAT Code Sec. 1031 DOES NOT APPLY TO REVERSE-STARKER TRANSACTIONS! [Preamble to final regulations, 56 Fed. Reg. 19933 (5/1/91)] Thus, in a two-party exchange where like-kind property is exchanged at different times, one party may qualify for Code Sec. 1031 while the other party may not! Chapter 11, Exhibit 13c CCH Federal Taxation Basic Principles 47 of 66 Like-Kind Exchanges—Avoiding Reverse Starkers Techniques involving leasehold interests, options to purchase, or qualified intermediaries may be used to avoid the reverseStarker problem. Rev. Proc. 2000-37 creates a safe harbor for certain postSeptember 14, 2000 reverse Starker transactions. This involves “parking” the properties to be exchanged with an “exchange accommodation titleholder’ until a qualified exchange can occur. Chapter 11, Exhibit 13d CCH Federal Taxation Basic Principles 48 of 66 Like-Kind Exchanges—Holding Period Rules The holding period of like-kind property and boot are: 1. Like-kind property received. Same as the holding period of the like-kind property given. 2. Boot received. Begins on the day AFTER receipt. Chapter 11, Exhibit 14 CCH Federal Taxation Basic Principles 49 of 66 Involuntary Conversions—What Qualifies Qualified Events Code Sec. 1033 applies to involuntary conversions occurring through casualty, theft or condemnation. A casualty qualifies for special tax treatment if it is caused by some sudden event such as fire, storm or shipwreck. Termite damage would not qualify. A condemnation qualifies if there is confirmation that property is going to be taken for public purposes. News reports are not deemed to be confirmations. Chapter 11, Exhibit 15a CCH Federal Taxation Basic Principles 50 of 66 Involuntary Conversions—What Qualifies Mandatory/Elective Rules The nature of the replacement property dictates whether Code Sec. 1033 is mandatory or elective: 1. Like-kind replacement. If the award is like-kind replacement, gains but NOT losses must be postponed. 2. Dissimilar replacement. If the award is cash or other NON-like kind replacement, Code Sec. 1033 may be elected for gains but NOT losses. Chapter 11, Exhibit 15b CCH Federal Taxation Basic Principles 51 of 66 Involuntary Conversions—What Qualifies Qualifying Like-Kind Property Code Sec. 1033 is more restrictive than Code Sec. 1031, except for the replacement of condemned real property. Generally, Code Sec. 1033 replacement property must be used in substantially the same way as the involuntary conversion property. Real for real is not always OK; (e.g., timberland - a bowling alley, unless one of the real properties had been condemned. Only condemned real property gets the same like-kind flexibility afforded Code Sec. 1031 property) Personal for personal is not always OK; (e.g., delivery truck business car; however a delivery truck for a delivery truck, or a business car for a business car, is OK.) Chapter 11, Exhibit 15c CCH Federal Taxation Basic Principles 52 of 66 Involuntary Conversions—Time Limitations Two time limitations govern like-kind replacement of involuntary conversions property: 1. Earliest date to replace involuntary conversion. The earlier of: (a) Date of disposition of the involuntary conversion property; or (b) Earliest date of threat of disposition. (Note that casualties and thefts occur "suddenly," therefore (b) would apply only to condemnations.) Chapter 11, Exhibit 16a CCH Federal Taxation Basic Principles 53 of 66 Involuntary Conversions—Time Limitations 2. Latest date to replace involuntary conversion. Like-kind property must be received or purchased: (a) Condemned real property. Within 3 years after the end of the taxable year in which gain is first realized. (b) All other qualified property. Within 2 years after the end of the taxable year in which gain is realized for: (i) Real casualty or theft property; (ii) Personal property. Chapter 11, Exhibit 16b CCH Federal Taxation Basic Principles 54 of 66 Involuntary Conversions—Holding Period Rules The holding period of like-kind property and boot are the same as under Code Sec. 1031: 1. Like-kind property received. Same as holding period of the involuntarily-converted property. 2. Non like-kind property received. Begins on the day AFTER receipt. Chapter 11, Exhibit 17 CCH Federal Taxation Basic Principles 55 of 66 Involuntary Conversions— Template for Problem Solving (a) Ins. Proceeds 100 100 100 (b) FMV replacement prop. 75 75 175 (c) AB old prop. 85 55 55 (d) = (a) – (c) Realized gain 15 45 45 (e) = (a) –(b) Limit on recognized gain 25 25 0 (cannot be negative) (f) = < of (d) or Recognized gain (e) 15 25 0 (g) = (d) – (f) Postponed gain 0 20 0 (h) = (b) – (g) AB new property 75 55 175 Chapter 11, Exhibit 18 CCH Federal Taxation Basic Principles 56 of 66 Installment Method—Eligible Property The installment method applies to gains (but not losses) from the sale of certain property where the seller will receive at least one payment after the year of sale. However, the installment method is not available for the following property: Inventory. Stock or securities traded on an established market. Depreciation recapture from Code Sec. 1245 or Code Sec. 1250 property. Chapter 11, Exhibit 19 CCH Federal Taxation Basic Principles 57 of 66 Installment Method—Four-Step Computation Installment method computations require four steps: 1. Allocate installment payments between principal and interest. 2. Compute ordinary income (“OI”) and Code Sec. 1231 gain. (If the property had been held long-term for investment purposes, rather than business purposes, then the gain would be classified as a long-term capital gain (LTCG), rather than a Code Sec. 1231 gain.) 3. Compute the gross profit %. 4. Compute recognized gain on the down payment and deferred gain on the installment payments. Chapter 11, Exhibit 20 CCH Federal Taxation Basic Principles 58 of 66 Installment Method—Example FACTS: A tract of land is sold under the following terms: 1. Date of contract: .........................................................……11/11/x1 2. Sales price of land: ..…………………………….....……....$50,000 3. Seller’s original purchase price: ..........................................$38,000 4. Terms: $8,000 cash down; 8% compounded semiannually (meets AFR requirements), resulting in 6 payments of $8,012 due on 5/11 and 11/1. QUESTION: What are the tax consequences to seller in 20x1 – 20x4? Chapter 11, Exhibit 21 CCH Federal Taxation Basic Principles 59 of 66 Installment Method—Solution Step One SOLUTION: STEP 1: Allocate $8,012 installment payments between principal and interest. ($42,000 installment loan = $50,000 sales price - 8,000 down payment) (a) (b) (c) = (a) x (8% 2)* (d) = (b) - (c) (e) = (a) - (d) Payment Due Date Loan Beg. Balance Installment Received Interest Income Principal Payment Loan End. Balance 5/11/x2 42,000 8,012 1,680 6,332 35,668 11/11/x2 35,668 8,012 1,427 6,585 29,083 5/11/x3 29,083 8,012 1,163 6,849 22,234 11/11/x3 22,234 8,012 889 7,123 15,111 5/11/x4 15,111 8,012 604 7,408 7,703 11/11/x4 7,703 8,012 308 7,703 0 * (8% is by 2 because interest is compounded semi-annually.) Chapter 11, Exhibit 22a CCH Federal Taxation Basic Principles 60 of 66 Installment Method—Solution Step One STEP ONE: CONTRACT INTEREST RATE The contract interest rate would be divided by two if payments were received by the seller semi-annually. If installments were monthly, divide the rate by 12 and show 12 rows of computations; if quarterly installments, divide by 4, and so on. Chapter 11, Exhibit 22b CCH Federal Taxation Basic Principles 61 of 66 Installment Method—Solution Step One Imputed interest rate Imputed interest computations would have been required if: 1. The installment contract price exceeded $3,000; AND 2. The interest rate charged was less than the applicable federal rate. [Sects. 483 and 1274.] This would require a slight modification to the illustration above -- i.e., column (c) would be based on the AFR rate, not the 8% contract rate. The rest of the schedule would flow as shown above. Note that the interest portion of annual installment payments must be computed using semi-annual compounding. [Secs. 1274(a), 1273(a) and 1272(a)] Chapter 11, Exhibit 22c CCH Federal Taxation Basic Principles 62 of 66 Installment Method—Solution Step Two STEP 2: COMPUTE DEFERRED GAIN (a) Cash down payment 8,000 (b) + Installment note payable to seller 42,000 (c)=(a)+(b) = Amount realized 50,000 (d) Seller’s original cost (e) - Accumulated depreciation (f)=(d) - (e) = Seller’s adjusted basis (g)=(c) - (f) Realized gain = Amount realized -seller’s basis (h) Ord. income from Code Sec. 1245 depr’n. recapture (i)=(g) - (h) Deferred gain Chapter 11, Exhibit 23 CCH Federal Taxation Basic Principles 38,000 N/A 38,000 12,000 N/A 12,000 63 of 66 Installment Method—Solution Step Three STEP 3: COMPUTE GROSS PROFIT % (j) = (a) + (b) Contract Price = Cash Down Payment + Installment N/P 50,000 (k) = (i) (k) GP % = Deferred gain Contract Price 24% Chapter 11, Exhibit 24 CCH Federal Taxation Basic Principles 64 of 66 Installment Method—Solution Step Four STEP 4: COMPUTE RECOGNIZED GAIN Year Principal Received Gross Profit % Recognized Gain ‘x1 $8,000 (down payment) 24% 1,920 ‘x2 $12,917 (6,332 + 6,585) 24% 3,100 ‘x3 $13,972 (6,849 + 7,123) 24% 3,353 ‘x4 $15,111(7,408 + 7,703) 24% 3,627 Note: “Principal received” was computed on the previous page. Chapter 11, Exhibit 25a CCH Federal Taxation Basic Principles 65 of 66 Installment Method—Solution Step Four Code Sec. 1245 and 1250 Depreciation Recapture. The full amount of any depreciation recapture must be recognized in the year of sale, even if no payments are received in that year. [Code Sec. 453(i)] The remaining gain is Code Sec. 1231 gain or long-term capital gain. Contract Price. The contract price should NOT include seller’s debt relief (i.e., seller debt assumed by buyer). Post-May 6, 1997 Installments on Pre-May 7, 1997 Contract. If Code Sec. 1231 property (or capital gain property) is sold under an installment sales contract entered into prior to May 7, 1997 installments received after May 6, 1997 are the lower rate (i.e., 10%, 15%, 20%, or 25% rates) under the new law. Of course, if the property consists of “collectibles, then the maximum capital gain rate is 28% under current law. Chapter 11, Exhibit 25b CCH Federal Taxation Basic Principles 66 of 66