Instructions

9-2-10

TAC Meeting Update

TAC 9-2 Meeting Agenda and Related Discussion Items

• ERCOT Board Update including Subcommittee Restructure

• Nodal Advisory Task Force Report*Day Ahead Market (DAM)

Available Credit Limit (ACL) (Possible Vote)

• Texas Nodal Implementation

• ERCOT Program Update

• Network Operations Model Update

• Nodal Testing

• Market Cut-Over Overview

• Market Readiness

• Market Reform Market Design Report

• TAC Committee Structure Review

• Subcommittee Updates Protocol Revisions

• Subcommittee Updates

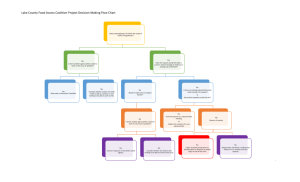

Subcommittee Restructure Report

TAC Chair asked each Subcommittee Chair to explain to TAC an update of how their Subcommittee would change (based on discussion at the TAC

Subcommittee Workshop) as well as provide added benefits.

It was noted that changes might be needed to By-laws and TAC operating procedures as well as other documentation.

Subcommittee Restructure Highlights

COPs Subcommittee

• Transition to a Single Working Group

• Primarily Settlement Focused

• Combination of all Working Groups

• COP Market Guide – Transition to a User Guide

• COPs will elect leadership in January (as usual)

• Last COPs meeting currently discussed as February 2011

• Final COPs meeting – will draft first Settlement Working Group

Agenda

Subcommittee Restructure Highlights – cont.

Other Subcommittees – Major Changes being discussed

Many Working groups To be combined

Changes to Voting Procedures being proposed

Current Voting Segments/Structure to stay in place

NATF Update from Sept. 2 nd NATF Meeting

Motion for ERCOT to reduce ACL for the DAM on non-business days as it does today, except:

• ERCOT should reduce exposure from three part offers by the product of DAM clearing price times cleared qty for each cleared transaction

• No longer increase exposure for three part offers based on the difference between historic DAM and RTM prices

• Reduce exposure from each cleared energy only offer by the product of DAM clearing price, cleared qty, and e2. e2 is set by

ERCOT for each counterparty, and only counterparties with favorable preDAM treatment qualify this reduction.“

• Conditioned on the market participants being able to test a

DAM weekend prior to golive with these changes.”

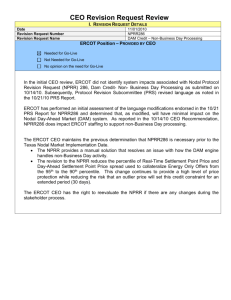

PRRs – Approved!

• PRR850, Weather Responsiveness Determination for Interval Data Recorders - URGENT

• Nodal Protocol Revision Requests

• NPRR220, Nodal Requirement of Declaring an EEA for Reserves More than 500 MW

• NPRR231, Treatment of RMR Units in the Day-Ahead Market (formerly from the Day-Ahead Market )

• NPRR232, Clarification of Block Load Transfer Registration and Deployment

• NPRR238, Resolution of Alignment Item A47, A59, A104, A105, A114, A115, A130, A188, and A189 - Provides Clarification and Updates to Network Operations Model Processes for

Resource Entities

• NPRR240, Proxy Energy Offer Curveo NPRR241, Aggregate Incremental Liability (AIL)

Calculation and Credit Reports Publish Corrections

• NPRR243, Load Resource Disqualification, Unannounced Testing, and

Complianceo NPRR247, Retail Market Testing Updates Due to the Merger of the TX SET and TTPT Working Groups

• NPRR248, Removal of Loads from Pre-1999 NOIE Load Zone

• NPRR249, Resolution of Alignment Item A155 and A159

Requirement (formerly

• NPRR250, Suspension of Annual Profile ID Validation With Advanced Meter Deployment

• NPRR251, Synchronization of PRR845, Definition for IDR Meters and Optional Removal of

IDR Meters at a Premise Where an Advanced Meter Can be Provisioned

• NPRR252, Synchronization of PRR758, Clarification of Language Related to Generation

Netting for ERCOT Polled Settlement Meters

• NPRR254, Updates to Protocol Sections 14 and 18Revision Requests Tabled at TAC (Vote):

• PRR846, Deadlines for Initiating Alternative Dispute Resolution (Vote)

• NPRR213, Deadlines for Initiating Alternative Dispute Resolution (Vote)

• NPRR209, Data Posting Changes to Comply with P.U.C. Subst. R. 25.505

ROS

Reliability and Operations Subcommittee Report

• Revisions to TAC0706060, Telemetry Standards

• SCR759, ac Line Segment Name Length Increase in

Information Model Manager NOGRR039,

• Synchronization of Section 1 with Nodal Protocols

COPs – Two Voting Items – Approved!

Commercial Operations Subcommittee Report

• LPGRRR038, Revisions for Texas Nodal

Market Implementation and Synchronization with PRR821, Update of Section 21, Process for Protocol Revision (Vote)

• LPGRRR039, Revisions for Texas Nodal

Market Implementation Part Two (Vote)

RMS – Two Voting Items – Approved!

Retail Market Subcommittee Report

• RMGRR086, Submission of Distributed Generation

Data for Advanced Meters

• RMGRR088, Updates to the IDR Meter Installation and Removal Processes

General Updates

Board: All NPRRS presented to the Board were approved

• ERCOT Operations, Planning, and IT Report

• 2011 Ancillary Services Methodology

• 2011 Project Priority List (PPL)

• Renewable Technology Working Group Report* Texas

Renewables Integration Plan

• Wholesale Market Subcommittee Report*

11

NATF

•

•

NATF: Don Blackburn provided the update

DAM Technical Workshops

–

Meetings each Tuesday and Thursday at 10AM

Sept. 17 th – double meeting. If plugged into the calls might want to attend the meeting in Taylor

– Lots of things from a NATF perspective that need to be addressed.

– Looking at 168 hour test (1 week)

– Documentation

– Will have a focused look at those tests

ERCOT Business practice Manuals

Reliability and Wholesale Market Commercial Practices

Current operating plan practices by QSEs

Network Operations

Modeling expectations for TSPs, REs and QSEs

Comment period – deadline for comments for these two documents is Tuesday,

September 7 th

Future agenda items: all important

DAM Credit issues

ACL Calculation for non-business days

ERCOT system changes priot to go-live separate presentation from the meeting held on Sept. 2

DAM Credit update

• DAM was run over non-business days for the first time with credit constraints of there weekend of Aug 14 through 16

• A significant amount of credit was consumed resulting in some CPs being constrained in the Monday DAM

• CWG and MCWG joint meetings – 4 meetings to resolve

• Current practice – every transaction in the DAM reduced your credit limit in the DAM – no allowance for “offsets”

• See presentation for details…

• Proposed motion

• Move that ERCOT reduce ACL for the DAM on non-business days as it does today with 4 exceptions: (see presentation)

• Comments…consider holiday weekends such as Thanksgiving

• Ten significant holidays throughout the year

• ERCOT CIO – Cleary noted that he has to look at benefit to market and staffing impacts

• Motion was modified to include that ACL will be “determined” on the weekend. SCR will be needed to implement.

Cleary Update

• Cleary provided an update –

• Turned it over to Ken Ragsdale

• Focused on “quality of solution” instead of the “technical defects that ERCOT is aware of.

• Making sure the right solutions are in place

• Project status update – all on schedule

• Updates to the Board will be look forward to components involved, 168 hour test, other key components

• Getting into cutover procedures – cut over timeline

• Market trials running over 31 weeks

Ken Ragsdale update

•

168 hour test

• Document has been approved – ERCOT is internally prepared to go forward with the 168 hour test and are planning out the details

• This will be a full rehearsal

•

Dam

• RUC

• Real-time

•

48 hour period for LFC test

•

This test will be consecutive for 7 days

• Generate and post settlement statements and invoices and applicable reports and extracts

•

Ercot needs good reasonable offers and bids put into the system no rogue testing going on need bilateral trades and other business behavior like that

• Set of Market Trials test

• There is a handbook for the breakdown of activities in the 168 hour test which was approved by TAC

•

Summary will be provided to TAC and Board

– Sept 17 th meeting with NATF end of the 168 hour test

Ken Ragsdale presentation continued

Full system market and reliability test

New issue for CRR came to view recently

Nodal program communication

21.12.3 – paragraph from Zonal protocols related to certification – making sure all requirements have been met

Been looking at system, process and people readiness

Key issuyes- load distribution factors looking at different methodology

Go live decision will be made on October 7 th

TAC chair comment - Need to look at things from a trajectory standpoint before the decision on October 7th

Ken Ragsdale continued - Settlements, Billing and Data

Aggregation

• Running settlements since mid April

• Some defects noted

• If software cannot perform accurately then there is a manual workaround

• Readiness is being examined

• Credit - CLM – some defects will be resolved with fixes implemented on Labor Day weekend

• MIS - Reports showing up on MIS are meeting expectations

Steve Reddy’s update

Descriptions of issues – see ppt for complete update

CRR always a hot topic…

Security around CRRS being received is that is taking around 3 hours which is not good since ERCOT is only allowed 3.5 hours for running and approving. Must speed that up!

Other critical processes are being evaluated to verify acceptable timing

Thank You

For TAC Meeting Materials related to this update please access

http://www.ercot.com/calendar/2010/09/20100902-TAC

19