Pricing

advertisement

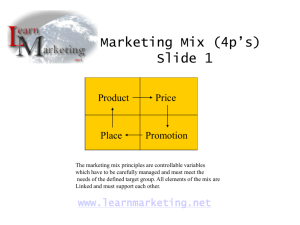

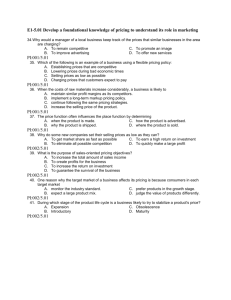

Pricing What Is a Price? • The amount of money charged for a product or service, or the sum of the values that customers exchange for the benefits of having or using the product or service. • Pricing: the only part of the marketing mix that is revenue generating, all the others are costs. FACTORS TO CONSIDER WHEN SETTING PRICES CUSTOMER PERCEPTIONS OF VALUE Considerations in Setting Price Other internal & external considerations --------------------------------------------------- Customer perception of value Price ceiling No demand above this price Marketing strategy, objectives, and mix Nature of the market and demand Competitors’ strategies and prices Product costs Price floor No profits below this price Value-Based Pricing Versus Cost-Based Pricing Cost-based pricing Not that good way Design a good product Determine product costs Set price based on cost Convince buyers of product’s value Setting prices based on the costs for producing, distributing, and selling the product plus a fair rate of return for effort and risk. Value-based pricing Good pricing starts with customer Assess customer needs & value perceptions Set target price to match customer perceived value Determine costs that can be incurred Setting price based on buyers’ perceptions of value rather than on seller’s cost. Design product to deliver desired value at target price GOOD VALUE = LOW PRICE ? Value-based Pricing 2 types of value-based pricing: • Good value pricing Offering just the right combination of quality and good service at a fair price to match with changing economic conditions and consumer price perception. • Value-added pricing Attaching value-added features and services to differentiate a company’s offer and charging higher prices to increase company’s pricing power. Type of good-value pricing in the retail level • Everyday Low Pricing (EDLP) involves charging a constant, everyday low price with few or no temporary price discounts. • High-low pricing involves charging higher prices on an everyday basis but running frequent promotions to lower prices temporarily on selected items. COMPANY & PRODUCT COSTS Company & Product Costs Types of Costs • Fixed costs (overhead) Costs that do not vary with production or sales level e.g. each month’s bills for rent, interest, employee salaries. • Variable costs Costs that vary directly with the level of production e.g. raw materials are needed in production process. • Total costs = Fixed costs + Variable costs The sum of the fixed and variable costs for any given level of production. Pricing Method Cost-plus pricing Adding a standard markup to the cost of the product. Cost-plus pricing (Markup Pricing) • Suppose a toaster manufacturer had the following costs and expected sales: – Variable cost – Fixed costs – Expected unit sales $10 $300,000 50,000 Unit Cost • Then the manufacturer’s cost per toaster is given by the following: Unit cost = Variable Cost + Fixed costs Unit Sales Unit Cost • Then the manufacturer’s cost per toaster is given by the following: Unit cost = Variable Cost + Fixed costs Unit Sales = $10 + $300,000 50,000 = $16 Markup Price • Suppose the manufacturer wants to earn a 20% markup on sales. The manufacturer’s markup price is given by the following: Markup Price = Unit Cost (1 – Desired Return on Sales) Markup Price • Suppose the manufacturer wants to earn a 20% markup on sales. The manufacturer’s markup price is given by the following: Markup Price = Unit Cost (1 – Desired Return on Sales) = $16 (1 - 0.2) = $20 The manufacturer would charge dealers $20 per toaster and make profit of $4 ($20 - $16) per unit. Pricing Method (con’t) Break-Even Pricing (Target Profit Pricing) Setting price to break even on the costs of making and marketing product, or setting price to make a target profit. (No pain, no gain) • Break-Even Volume = Fixed Cost Price – Variable Cost Break-Even Volume • Break-Even Volume = Fixed Cost Price – Variable Cost = $300,000 $20-$10 = 30,000 If the company wants to make a target profit, it must sell more than 30,000 units at $20 each. In-class Assignment (pair work) • • • • You are opening a “Chicken Rice Restaurant” Unit sales 6,000 serves/month Price (per serve) Bht 20 Raw materials cost – Bht 6,000/1,000 serves • Costs (per month) – Renting Bht 5,000 – Tables + Chairs + Utensils Bht 500 – Waiter wages Bht 4,500 Calculate *Suppose you open restaurant everyday (30 days a month) • Total cost (per month) • Profit (per month) Fixed Cost • Break even volume (per month) Price – Variable Cost • If there’s a new location has cheaper renting (Bht 2,000 per month) but can sell only 100 serves a day, is it worth enough to move to this new location compare to the current one? Total Costs (TC) = TFC + TVC • TFC = Renting+Equipments+Wages = 5,000 + 500+ 4,500 = Bht 10,000 ----- 1 • VC = Raw materials = 6,000/1,000 = Bht 6 • TVC = 6,000*6 = Bht 36,000 ----- 2 • TC = 10,000 + 36,000 = Bht 46,000 ----- 3 Profit = Total Sales – Total Costs • Total Sales = Unit Sales*Price = 6,000*20 = Bht 120,000 ---- 4 • Profits = 120,000 – 46,000 = Bht 74,000 • Break-Even Volume = Fixed Cost Price – Variable Cost = 10,000/ (20-6) = 714.29 = 715 serves New Location • New Renting = Bht 2,000 (currently is Bht 5,000) • New TFC = 2,000 + 500 + 4,500 = Bht 7,000 • New Unit Sales = 100 serves a day = 100*30 = 3,000 serves a months New TVC = Unit Sales*VC = 3,000*6 = Bhts 18,000 • New Total Sales = Unit Sales*Price = 3,000*20 = Bht 60,000 ---- 1 • New TC = New TFC + New TVC = 7,000 + 18,000 = Bhts 25,000 ---- 2 New profit = 1 – 2 = 60,000 -25,000 = Bht 35,000 Pricing Strategies New-Product Marketing Strategies The major strategies for pricing imitative and new products. Market-Skimming Pricing Market-Penetration Pricing Market-Skimming Pricing • Setting a high price for a new product to skim maximum revenues layer by layer from the segments willing to pay the high price; the company makes fewer but more profitable sales. Sony HDTV New movie or audio CD Christian Louboutin Spring/Summer 2011 Market-Penetration Pricing • Setting a low price for a new product in order to attract a large number of buyers and a large market share quickly and deeply. BTS sky train in BKK Dell selling high-quality computer products through lower-cost direct channels once it entered the PC market. Product Mix Pricing Strategies How companies find a set of prices that maximizes the profits from the total product mix. 1. Product Line Pricing 2. Optional-Product Pricing 3. Captive-Product Pricing 4. By-Product Pricing 5. Product Bundle Pricing 1.Product Line Pricing • Setting the price steps between various products in a product line based on cost differences between the products, customer evaluations of different features, and competitors’ prices. 2.Optional-Product Pricing • The pricing of optional or accessory products along with a main product. • When you order a new PC, you can select your own hard drives, software options, service plans, and carrying cases. 3.Captive-Product Pricing • Setting a price for products that must be used along with a main product, such as blades for razor and SD card for a digital camera. + + 4.By-Product Pricing • Setting a price for by-products in order to make the main product’s price more competitive. • MeadWestvaco, papermaker company, turned what was once considered chemical waste of wood-processing activities into profit-making products in paving industry. 5.Product Bundle Pricing • Combining several products and offering the bundle at a reduced price. Burger King Whopper Combo Price-Adjustment Strategies How companies adjust their prices to take into account different types of customers and situations. 1. 2. 3. 4. 5. 6. 7. Discount and Allowance Pricing Segmented Pricing Psychological Pricing Promotional Pricing Geographical Pricing Dynamic Pricing International Pricing 1.Discount and Allowance Pricing • Discount: a straight reduction in price on purchases during a stated period of time. Forms of Discounts • Cash discount: a price reduction to buyers who pay their bills promptly • Quantity discount: a price reduction to buyers who buy large volumes • Functional discount (trade discount): is offered by the seller to trade-channel members who perform certain functions, such as selling, storing, and record keeping • Seasonal discount: a price reduction to buyers who buy merchandise or services out of season Samples of Discounts • Cash discount: “2/10, net 30” means the payment is due within 30 days, the buyer can deduct 2% if the bill is paid within 10 days. • Quantity discount: if you buy Bht 50,000100,000, you’ll get 1% off. Bht 100,001-200,000 => 2% off. • Functional discount (trade discount): producer give 10% discount to wholesalers. Then, wholesalers give 5% discount to retailers. • Seasonal discount: the beach hotels give 50% discount for customers who reserve the room on Mon-Thurs. 1.Discount and Allowance Pricing • Allowance: promotional money paid by manufacturers to retailers in return for an agreement to feature the manufacturer’s products in some way. Sample of Promotional Allowance • ThaiNamThip Company give a financial support of publishing Carrefour’s brochure to its customer & give 10% discount for 1,000 boxes of Coca Cola to use for discount promotion at Carrefour. 2.Segmented Pricing • Selling a product or service at 2 or more prices, where the difference in prices is not based on differences in costs but on differences in customers, products, or locations. Bus charges lower for students and senior citizens 5-ounce aerosol can = $11.39 1 liter bottle = $1.59 3.Psychological Pricing • A pricing approach that considers the psychology of prices and not simply the economics; the price is used to say something about the product. Smirnoff BEFORE Wolfschmidt AFTER ($1 higher) Smirnoff Relska (Same price) Popov ($1 cheaper) ($1 cheaper) • Reference prices: price that buyers carry in their minds and refer to when they look at a given product • Sales sign “Now 2 for only…!” • Price ending in “9” 4.Promotional Pricing • Temporarily pricing products below the list price, and sometimes even below cost, to increase short-run sales. 5.Geographical Pricing • Setting prices for customers located in different parts of the country or world. FOB-origin pricing: customers pays the freight from the factory to the destination Uniform-delivered pricing: company charges the same price plus freight to all customers Zone pricing: customers in different zones pay for different prices Basing-point pricing: sellers selects some city as a basing point & charges all customers the freight cost from that city to the customer Freight-absorption pricing: sellers absorbs all or part of the freight charges in order to get the desired business 6.Dynamic Pricing • Adjusting prices continually to meet the characteristics and needs of individual customers and situations. 7.International Pricing • Adjusting prices for international markets to reflect local market conditions and cost considerations depending on economic conditions, competitive situations, law & regulations, and development of the wholesaling & retailing system. $140 in Milan, Italy $240 in Brazil