Chapter 9 Financial Statement Analysis

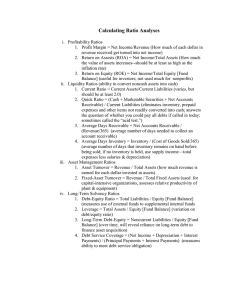

advertisement

UNIT-12 Analyzing of Financial Reports 1. Introduction: It is a standard practice for businesses to present financial statements that adhere to generally accepted accounting principles (GAAP), to maintain continuity of information and presentation across international borders. As well, financial statements are often audited by government agencies, accountants, firms, etc. to ensure accuracy and for tax, financing or investing purposes. Financial statements are integral to ensuring accurate and honest accounting for businesses and individuals alike. Definition: Financial statements are reports that show how income and expenses have affected the company as a whole. They provide a snapshot of the current financial standing of the business. There are many types of financial reports, but the three basic, essential financial statements are: 1 1 .Balance Sheet: Summarizes the assets, liabilities, and net worth (owners‘ equity) of a business on a particular date. 2.Income Statement: (Also called Profit and Loss Statement.) An accounting statement that shows the profit or loss for a business, by subtracting costs from its earnings, over a specific period of time, typically for a quarter or year. 3. Cash Flow Statement: An accounting statement that forecasts cash receipts and disbursements for a specified period. A fourth financial statement commonly produced is the Statement of Retained Earnings. 2 Financial analysis is a process of selecting, evaluating, and interpreting financial data, along with other pertinent information, in order to formulate an assessment of a company’s present and future financial condition and performance. Market Data Financial Disclosures Economic Data Financial Analysis 3 COMMON-SIZE ANALYSIS Common-size analysis is the restatement of financial statement information in a standardized form. - Horizontal common-size analysis uses the amounts in accounts in a specified year as the base, and subsequent years’ amounts are stated as a percentage of the base value. - Useful when comparing growth of different accounts over time. - Vertical common-size analysis uses the aggregate value in a financial statement for a given year as the base, and each account’s amount is restated as a percentage of the aggregate. - Balance sheet: Aggregate amount is total assets. - Income statement: Aggregate amount is revenues or sales. 4 EXAMPLE: COMMON-SIZE ANALYSIS Consider the CS Company, which reports the following financial information: Year Cash Inventory Accounts receivable Net plant and equipment Intangibles Total assets 2008 2009 2010 2011 2012 2013 SR400.00 SR404.00 SR408.04 SR412.12 SR416.24 SR420.40 1,580.00 1,627.40 1,676.22 1,726.51 1,778.30 1,831.65 1,120.00 1,142.40 1,165.25 1,188.55 1,212.32 1,236.57 3,500.00 3,640.00 3,785.60 3,937.02 4,094.50 4,258.29 400.00 402.00 404.01 406.03 408.06 410.10 SR 6,500.00SR 6,713.30SR 6,934.12SR 7,162.74SR 7,399.45 SR7,644.54 1. Create the vertical common-size analysis for the CS Company’s assets. 2. Create the horizontal common-size analysis for CS Company’s assets, using 2008 as the base year. 5 EXAMPLE: COMMON-SIZE ANALYSIS Vertical Common-Size Analysis: Year Cash Inventory Accounts receivable Net plant and equipment Intangibles Total assets 2008 2009 2010 2011 2012 2013 6% 6% 5% 5% 5% 5% 23% 23% 23% 23% 22% 22% 16% 16% 16% 15% 15% 15% 50% 50% 51% 51% 52% 52% 6% 6% 5% 5% 5% 5% 100% 100% 100% 100% 100% 100% Graphically: 100% 80% Proportion 60% of Assets 40% 20% 0% 2008 Cash Inventory 2009 Accounts receivable 2010 2011 Fiscal Year 2012 Net plant and equipment 2013 Intangibles 6 EXAMPLE: COMMON-SIZE ANALYSIS Horizontal Common-Size Analysis (base year is 2008): Year Cash Inventory Accounts receivable Net plant and equipment Intangibles Total assets 2008 100.00% 100.00% 100.00% 100.00% 100.00% 100.00% 2009 101.00% 103.00% 102.00% 104.00% 100.50% 103.08% 2010 102.01% 106.09% 104.04% 108.16% 101.00% 106.27% 2011 103.03% 109.27% 106.12% 112.49% 101.51% 109.57% 2012 104.06% 112.55% 108.24% 116.99% 102.02% 112.99% 2013 105.10% 115.93% 110.41% 121.67% 102.53% 116.53% Graphically: 130% Percentage 120% of Base 110% Year Amount 100% 90% 2008 Cash Inventory 2009 Accounts receivable 2010 2011 Fiscal Year Net plant and equipment 2012 Intangibles 2013 Total assets 7 FINANCIAL RATIO ANALYSIS • Financial ratio analysis is the use of relationships among financial statement accounts to gauge the financial condition and performance of a company. • We can classify ratios based on the type of information the ratio provides: Activity Ratios Liquidity Ratios Effectiveness in putting its asset investment to use. Ability to meet short-term, immediate obligations. Solvency Ratios Profitability Ratios Ability to satisfy debt obligations. Ability to manage expenses to produce profits from sales. 8 ACTIVITY RATIOS • Turnover ratios reflect the number of times assets flow into and out of the company during the period. • A turnover is a gauge of the efficiency of putting assets to work. • Ratios: Inventory turnover = Cost of goods sold Average inventory Receivables turnover = Total asset turnover = Total revenue Average receivables Total revenue Average total assets Working capital turnover = Total revenue Average working capital How many times inventory is created and sold during the period. How many times accounts receivable are created and collected during the period. The extent to which total assets create revenues during the period. The efficiency of putting working capital to work 9 OPERATING CYCLE COMPONENTS • The operating cycle is the length of time from when a company makes an investment in goods and services to the time it collects cash from its accounts receivable. • The net operating cycle is the length of time from when a company makes an investment in goods and services, considering the company makes some of its purchases on credit, to the time it collects cash from its accounts receivable. • The length of the operating cycle and net operating cycle provides information on the company’s need for liquidity: The longer the operating cycle, the greater the need for liquidity. Number of Days of Inventory Number of Days of Receivables | | | | Buy Inventory on Credit Pay Accounts Payable Sell Inventory on Credit Collect Accounts Receivable Number of Days of Payables Net Operating Cycle Operating Cycle 10 OPERATING CYCLE FORMULAS Number of days of inventory = Number of days of receivables = Number of days of payables = Inventory 365 = Average day′s Inventory turnover cost of goods sold Receivables 365 = Average day′s Receivables turnover revenues Accounts payable 365 = Average day′s Accounts payable turnover purchases Average time it takes to create and sell inventory. Average time it takes to collect on accounts receivable. Average time it takes to pay suppliers. 11 OPERATING CYCLE FORMULAS Number of days Number of days + of inventory of receivables Time from investment in inventory to collection of accounts. Net operating Number of days Number of days Number of days = + − cycle of inventory of payables of receivables Time from investment in inventory to collection of accounts, considering the use of trade credit in purchases. Operating cycle = 12 LIQUIDITY • Liquidity is the ability to satisfy the company’s short-term obligations using assets that can be most readily converted into cash. • Liquidity ratios: Current ratio = Quick ratio = Cash ratio = Current assets Current liabilities Cash + Short−term + Receivables investments Current liabilities Short−term investments Current liabilities Cash + Ability to satisfy current liabilities using current assets. Ability to satisfy current liabilities using the most liquid of current assets. Ability to satisfy current liabilities using only cash and cash equivalents. 13 SOLVENCY ANALYSIS • A company’s business risk is determined, in large part, from the company’s line of business. • Financial risk is the risk resulting from a company’s choice of how to finance the business using debt or equity. • We use solvency ratios to assess a company’s financial risk. • There are two types of solvency ratios: component percentages and coverage ratios. - Component percentages involve comparing the elements in the capital structure. - Coverage ratios measure the ability to meet interest and other fixed financing costs. Risk Business Risk Financial Risk Sales Risk Operating Risk 14 Component-Percentage Solvency Ratios SOLVENCY RATIOS Debt−to−assets ratio = Total debt Total assets Long−term debt−to−assets ratio = Debt−to−equity ratio = Financial leverage = Total debt Total shareholders′ equity Total assets Total shareholders′ equity Interest coverage ratio = Coverage Ratios Long−term debt Total assets EBIT Interest payments Proportion of assets financed with debt. Proportion of assets financed with longterm debt. Debt financing relative to equity financing. Reliance on debt financing. Ability to satisfy interest obligations. EBIT + Lease payments Fixed charge = coverage ratio Interest payments + Lease payments Ability to satisfy interest and lease obligations. Cash flow = coverage ratio CFO + Interest payments + Tax payments Interest payments Ability to satisfy interest obligations with cash flows. CFO Cash−flow−to− = debt ratio Total debt Length of time needed to pay off debt with cash flows. 15 PROFITABILITY • Margins and return ratios provide information on the profitability of a company and the efficiency of the company. • A margin is a portion of revenues that is a profit. • A return is a comparison of a profit with the investment necessary to generate the profit. 16 PROFITABILITY RATIOS: MARGINS Each margin ratio compares a measure of income with total revenues: Gross profit margin = Gross profit Total revenue Operating profit Operating profit margin = Total revenue Net profit margin = Net profit Total revenue Earnings before taxes Pretax profit margin = Total revenue 17 PROFITABILITY RATIOS: RETURNS Return ratios compare a measure of profit with the investment that produces the profit: Operating return on assets = Return on assets = Return on total capital = Operating income Average total assets Net income Average total assets Net income Average interest−bearing debt + Average total equity Return on equity = Net income Average shareholders′ equity Operating income Operating return on assets = Average total assets 18 THE DUPONT FORMULAS Return on Equity • The DuPont formula uses the relationship among financial statement accounts to decompose a return into Total Asset Net Profit components. Margin Turnover • Three-factor DuPont for the return on equity: - Total asset turnover Operating Profit - Financial leverage Margin - Net profit margin • Five-factor DuPont for the return on equity: Effect of - Total asset turnover Nonoperating - Financial leverage Items - Operating profit margin - Effect of nonoperating items - Tax effect Tax Financial Leverage Effect 19 FIVE-COMPONENT DUPONT MODEL Total assets Return on Return on = × equity Shareholders′ assets equity Total assets Net income Return on = × equity Shareholders′ Total assets equity Total assets Revenues Net income Return on = × × equity Shareholders′ Total assets Revenues equity Income Operating before Total assets Revenues Taxes Return on = × × income × taxes × 1− equity Income Shareholders′ Operating Total assets Revenues before equity income taxes 20 EXAMPLE: THE DUPONT FORMULA Suppose that an analyst has noticed that the return on equity of the D Company has declined from FY2012 to FY2013. Using the DuPont formula, explain the source of this decline. (millions) Revenues 2013 2012 SR1,000 SR900 SR400 SR380 SR30 SR30 SR100 SR90 Total assets SR2,000 SR2,000 Shareholders’ equity SR1,250 SR1,000 Earnings before interest and taxes Interest expense Taxes 21 EXAMPLE: THE DUPONT FORMULA 2013 2012 Return on equity Return on assets 0.20 0.13 0.22 0.11 Financial leverage Total asset turnover Net profit margin Operating profit margin 1.60 0.50 0.25 0.40 2.00 0.45 0.24 0.42 Effect of nonoperating items Tax effect 0.83 0.76 0.82 0.71 22 OTHER RATIOS • Earnings per share is net income, restated on a per share basis: Earnings per share = Net income available to common shareholders Number of common shares outstanding • Basic earnings per share is net income after preferred dividends, divided by the average number of common shares outstanding. • Diluted earnings per share is net income minus preferred dividends, divided by the number of shares outstanding considering all dilutive securities. • Book value per share is book value of equity divided by number of shares. • Price-to-earnings ratio (PE or P/E) is the ratio of the price per share of equity to the earnings per share. - If earnings are the last four quarters, it is the trailing P/E. 23 OTHER RATIOS Measures of Dividend Payment: Dividends paid to shareholders Dividends per = share (DPS) Weighted average number of ordinary shares outstanding Dividend payout ratio = Dividends paid to common shareholders Net income attributable to common shares Plowback ratio = 1 – Dividend payout ratio - The proportion of earnings retained by the company. 24 EXAMPLE: SHAREHOLDER RATIOS Calculate the book value per share, P/E, dividends per share, dividend payout, and plowback ratio based on the following financial information: Book value of equity SR100 million Market value of equity SR500 million Net income SR30 million Dividends SR12 million Number of shares 100 million 25 EXAMPLE: SHAREHOLDER RATIOS Book value per share $1.00 There is $1 of equity, per the books, for every share of stock. P/E 16.67 The market price of the stock is 16.67 times earnings per share. Dividends per share $0.12 The dividends paid per share of stock. Dividend payout ratio 40% The proportion of earnings paid out in the form of dividends. Plowback ratio 60% The proportion of earnings retained by the company. 26 EFFECTIVE USE OF RATIO ANALYSIS • In addition to ratios, an analyst should describe the company (e.g., line of business, major products, major suppliers), industry information, and major factors or influences. • Effective use of ratios requires looking at ratios - Over time. - Compared with other companies in the same line of business. - In the context of major events in the company (for example, mergers or divestitures), accounting changes, and changes in the company’s product mix. 27 4. PRO FORMA ANALYSIS Estimate typical relation between revenues and salesdriven accounts. Estimate fixed burdens, such as interest and taxes. Forecast revenues. Estimate sales-driven accounts based on forecasted revenues. Estimate fixed burdens. Construct future period income statement and balance sheet. 28 PRO FORMA INCOME STATEMENT Imaginaire Company Income Statement (in millions) Cost of goods sold Gross profit SG&A Operating income Year 0 SR1,000. 0 600.0 SR400.0 100.0 SR300.0 Interest expense Earnings before taxes Taxes Net income Dividends 32.0 SR268.0 93.8 SR174.2 SR87.1 Sales revenues One Year Ahead SR1,050.0 Growth at 5% 630.0 SR420.0 105.0 SR315.0 60% of revenues Revenues less COGS 10% of revenues Gross profit less operating exp. 33.6 SR281.4 98.5 SR182.9 SR91.5 8% of long-term debt Operating income less interest exp. 35% of earnings before taxes Earnings before taxes less taxes Dividend payout ratio of 50% 29 PRO FORMA BALANCE SHEET Imaginaire Company Balance Sheet, End of Year (in millions) Current assets Net plant and equipment Total assets Year 0 SR600.0 1,000.0 SR1,600. 0 Current liabilities Long-term debt SR250.0 400.0 Common stock and paid-in capital Treasury stock Retained earnings Total liabilities and equity 25.0 925.0 SR1,600. 0 One Year Ahead SR630.0 60% of revenues 1,050.0 100% of revenues SR1,680. 0 SR262.5 25% of revenues 420.0 Debt increased by €20 million to maintain the same capital structure 25.0 Assume no change (44.0) Repurchased shares 1,016.5 Retained earnings in Year 0, plus net income, less dividends SR1,680. 0 30 • Financial report is a set of documents prepared usually by government agencies at the end of an accounting period. It generally contains summary of accounting data for that period, with background notes, forms, and other information. Financial ratio analysis and common-size analysis help gauge the financial performance and condition of a company through an examination of relationships among these many financial items. • A thorough financial analysis of a company requires examining its efficiency in putting its assets to work, its liquidity position, its solvency, and its profitability. • We can use the tools of common-size analysis and financial ratio analysis, including the DuPont model, to help understand where a company has been. • We then use relationships among financial statement accounts in pro forma analysis, forecasting the company’s income statements and balance sheets for future periods, to see how the company’s performance is likely to evolve. 31 Practical exercises A. From the following find out gross profit ratio. 1. Gross Profit Net Sales SR 10,000 SR 50,000 Ans. 20% 2. Gross Profit SR 10,000 Net Sales SR 60,000 Sales Return SR 5,000 Ans. 16.66% 3. Cash Sales SR 60,000 Credit Sales SR 20,000 Gross Profit SR 12,000 Ans. 15% 32 4. Cash Sales SR 80,000 Credit Sales SR 25,000 Credit Sales Return SR 5,000 Gross Profit SR13,000 Ans. 13% 5. Sales Cost of goods Sold SR 75,000 SR 65,000 Ans. 13.33% B. Find out Net Profit Ratio from the following. 6. Net Profit SR5,000 Net Sales SR20,000 7 . Net Profit SR15,000 Net Sales SR1,20,000 Sales Return SR Ans. 25% 15,000 Ans.12.5% 33 8. Net Sales Gross Profit Indirect expenses SR 30,000 SR 8,000 SR2,000 Ans. 20% 9. Total Sales SR 60,000 Sales Return SR10,000 Cost of goods sold SR 35,000 Selling and administrative expenses SR 5,000 Ans. 20% 10.Find out net profit by showing your working. Total Sales Net Profit Ratio. SR 1,00,000 10% Ans. SR 10,000 34 C. Find out Current Ratio from the following information. 11. Current Assets Current Liabilities SR 10,000 SR 5,000 Ans. 2 : 1 12. Current Assets SR10,000 Creditors SR 2,000 Bank Overdraft SR 1,000 O/S Liabilities SR 1,000 Ans. 2.5 : 1 13. Debtors SR 20,000 Creditors SR 5,000 Stock SR 3,000 Bills Payables SR 6,000 Bills Receivables SR 5,000 Cash SR 4,000 Ans.2.9 :1 35 14. Particulars Amount (SR) Debtors 30,000 Stock 5,000 Machinery 15,000 General Reserve 5,000 Bills Receivables 3,000 Prepaid Expenses 1,000 Bills Payable 4,000 Capital 50,000 Creditors 18,000 Ans. Current Ratio= 1.77: 1 36 15. Liabilities Capital 30,000 Add. Net Profit 10,000 --------40,000 Less-Drawing 2 ,000 ---------Creditors Bills Payable General Reserve Balance Sheet Amount (SR) Assets Amount(SR) Cash Debtors Stock Prepaid expenses 38,000 Machinery Goodwill 4,000 Furniture 6,000 2,000 --------------50,000 Ans. 5,000 8,000 2,000 3,000 20,000 2,000 10,000 ------------50,000 Current ratio 1.8:1 37 D. Find out Quick Ratio from the following. 16. Calculate quick ratio from the following. Quick Assets SR 20,000 Current Liabilities SR 30,000 Ans. 2 : 3 17. Total Current Assets SR 25,000 Stock SR 4,000 Current Liabilities SR 28,000 Ans. 3: 4 18. Debtors SR 15,000 Creditors SR 20,000 Cash SR 25,000 Bills Payable SR 10,000 Stock SR 5,000 Prepaid expenses SR2,000 O/S Rent SR5,000 Ans.8 : 7 38 19. Machinery SR 18,000 Furniture SR 15,000 B/O SR 4,000 Drawing SR 2,000 Capital SR 50,000 Creditors SR 10,000 Debtors SR 12,000 Stock SR 6,000 B/P SR 6,000 B/R SR 2,000 Cash SR 1,000 Ans. 3: 4 39 20. Balance Sheet Liabilities Capital + N/ P 50,000 20,000 ---------- Creditors B/P General Reserve Bank Overdraft O/S Wages Amount 70,000 20,000 10,000 5,000 3,000 2,000 ----------1,10,000 Assets Land Building Debtors B/R Stock Prepaid expenses P/L Amount 40,000 30,000 20,000 5,000 10,000 2,000 3,000 ------------1,10,000 40