03033fa7-d71a-4aec-9e94

advertisement

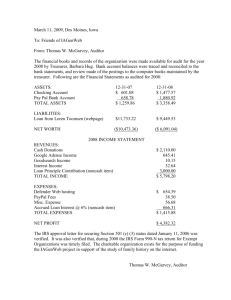

Business Practices and Internal Controls 2013-14 Presented By: Wei Pan 90 Minutes Introduction/Overview (5-10 minutes) Main Discussion (65-75 minutes, 25 slides) Treasurer’s Corner (5-10 minutes) Wrap-up/Questions (5 minutes) Topics for Discussion: Objective Employer ID Number Tax Exempt Status Code of Ethics Internal Controls On-Line Banking Bank Reconciliations FDIC Limit Accountable Plan Credit Card Policy Sample Member Expense Reimbursement Policy Employee / Independent Contractor Exempt Employee Non-Exempt Employee Payroll Responsibilities Treasurer’s Report Audit / Audit Committee Reserves Protection of Assets “Warning Signs” or “Red Flags” Objective (Page C-2) Designed for the Treasurer to work with the Executive Board in an inclusive and interactive environment to develop, document and maintain proper internal controls and good business practices, policies and procedures. (Develop/grow to be a good/better Treasurer/Officer to maintain a strong/healthy local chapter to serve its members) Documentation Document policies and procedures Executive Board review and approval Orientation for potential and new leaders Continuous improvement Employer Identification Number (EIN) (C-2 through C-4) Identification number assigned by the IRS Required to open bank accounts Does not provide exemption from income tax IRS Form SS-4 available on the IRS website www.irs.gov IRS phone number: (800) 829-4933 Tax Exempt Status (Page C-5) CTA Affiliates are not automatically exempt from federal & state income tax CTA Group Exemption List (No Cost) Name of organization President of organization Mailing address Employer Identification Number (EIN) Authorization signature of President or Chair E-Mail Address Tax Exempt Status (Continued) (Page C-5) Group Exemption Number (4 Digit GEN) Determination Letter from CTA Required on IRS 990/990-EZ & FTB 199 Fiscal Year: September 1 – August 31 CTA Standing Rule 4-1(h) Locals are still subject to property tax and sales tax Must file annually IRS 990/990EZ/990-N and FTB 199/199-N to maintain exempt status Code of Ethics (Page C-6) Govern professionally/honestly/with integrity Fiduciary responsibilities Adhere to regulatory agencies Due process Respect confidentiality of information Provide members accurate data Report violations Not be part of illegal activities Internal Controls (Page C-7) Cash Receipts – Timely deposits Membership Dues • Local Dues, FDE and Cash Flow • Accounted for on the bank statement Other revenue Cash disbursements: Check stock stored in a secured location? Are two signatures required on a check? Primary Signatories: President & Treasurer? Any officers signing blank checks? Supporting documentation attached? On-Line Banking (Page C-9) Inherent Funds may be disbursed by one member Only Risk Treasurer should bank on-line Inquiry/downloading check images preferred Pre-approved Limit payment form to Board approved vendors and limits (cell phone bills, recurring payments, etc.) Bank Reconciliations (Page C-9) Prepared and approved on a monthly basis • Segregation of duties • Treasurer prepares and President approves Balance per Bank reconciling to Balance per Books • Outstanding Checks • Interest Income • Check printing or minimum balance fees Review for electronic debits and other debit activity Transfer of cash from savings to checking to pay bills Review check images to books and records Federal Deposit Insurance Co. (FDIC) (Page C-10) FDIC deposit insurance temporarily increased from $100,000 to $250,000 per depositor through December 31, 2013 At this time, FDIC is set to end temporary insurance limit and revert back to $100,000 on January 1, 2014 Accountable Plan (Page C-11) A system in which reimbursed expenses or charged expenses are accounted for on a timely basis as defined by the IRS IRS Three Components: A valid business connection Substantiation - receipt or invoice Submit within 60 days of the charge • Consider 30 day deadline (30 days follow-up) Accountable Plan – Continued (Pages C-11, C-24 & C-25) Lodging - itemized statement required Receipt does not substantiate expense Examples of non-valid business expenses: • “Pay-per-view movies” • “Snacks” • “Health club fees” Advances need to be substantiated Failure to comply with IRS Regulations: Impute income on IRS Form 1099 or W-2 Jeopardize Accountable Plan Credit Card Policy & Review (Pages C-11, C-26 and C-27) Credit Card Policy Written Board approved policy for authorized use Establish card with Affiliate’s EIN Emboss name of affiliate and officer on card Business purpose needs to be identified Establish credit limits Receipt procedures submitted within 30 days Do not issue debit cards Credit Card Statement Review President and Treasurer should thoroughly review Sample Member Expense Policy – Travel (Page C-28) Requires advanced Board approval Plane – Coach airfare (attach receipt) Train/Bus/Taxi (attach receipt) Auto Standard Business Mileage Rate (www.irs.gov) • Currently at 56.5 cents per mile Shortest Highway Route • Safety First considerations for alternative route Mileage reimbursement cannot exceed airfare Toll roads & bridges reimburse at actual cost Sample Member Expense Policy – Lodging (Page C-28) CTA/NEA Conferences Half the cost of a double occupancy hotel room Single room – Member pays differential Extenuating circumstances – Advance approval Other Travel – Cost of a standard hotel room Extra night due to auto travel not reimbursable Personal charges not reimbursable Laundry, snacks, pay per view movies, etc. Portage/Housekeeping - $7 a day Sample Member Expense Policy – Meals (Page C-28) Reimbursements are not allowed when a meal is already paid for and provided by the local, UniServ, CTA, NEA or SCC Daily Meal Limits: Individual Meal: $40.00 Daily Meal Limit: $70.00 Receipts required for $10.00 or more Maximum Tip Percentage: 18% Extra meals due to auto travel not reimbursed Sample Member Expense Policy – Other (Page C-29) Case by Case Basis (advance approval) Cell phone and/or Home Internet (President) Sample Situations: • PAC Chair during election cycle • Bargaining Chair during bargaining with district Deadlines for filing Member Expenses 30 day policy allows for 30 day follow-up Up to three late reimbursements per year Appeals – Members should be able to appeal • Executive Board has final decision Employee vs. Independent Contractor (Page C-12) Classification is based on “degree of control” and “independence” based on: An employee (on payroll) is issued a W-2 annually When and where to do the work What equipment and supplies to use Type of training, direction and instruction Withholding: IRS & FTB income tax/FICA/SDI An independent contractor is issued a 1099 annually Exempt Employees (Page C-13) Exempt Employees Professional in nature and project oriented • Job Duty and not the Job Title and/or Description Assessments are based on timely and successful completion of the project Fixed salaries and are not paid overtime Usually paid on a monthly basis Current Contract in place and annual reviews Examples of Exempt employees: • Managers, CPAs, Attorneys, Educators, PCS Non-Exempt Employees (Page C-13) Non-Exempt Employees Administrative and support functions Assessments are based on work completed during a defined period Current Contract in place and annual reviews Paid at least semi-monthly (CA Labor Code) Hourly rate (or convert to fixed gross pay) Daily record keeping – Vacation/Sick/Overtime Admin Assistances, bookkeepers, office staff Payroll Responsibilities (Page C-12) Payroll processed: In-house or by a third party provider Quarterly and Annual payroll tax returns IRS & Employment Development Department (EDD) IRS W-4 on file for each employee IRS Form W-2s issued to individuals by 1/31 IRS Form W-3 with W-2s to the IRS by 2/28 Worker’s compensation coverage Adhere to Garnishments from IRS and FTB Employment practices liability coverage-optional Treasurer’s Report (Pages C-14 through C-16) Treasurer’s Report: Year-To-Date: Revenue and Expenses Cash Balance(s) as of the reporting date Treasurer’s Reports should be presented, “received and filed” at each Executive Board meeting and subsequent Representative Council. A year-end Treasurer’s Report is required by PERB to be signed and certified for its accuracy by the President and the Treasurer by October 30 and available for inspection by its bargaining unit members (Page E-8) Annual Audit (Pages C-17 through C-19) Accrual Basis of Accounting: Matching “revenue” with “expenses” Material release time owed to the district Accrued leave for employed staff Cash Basis of Accounting Revenue and expenses are recognized based on cash flow Small Locals – Internal Audit Committee (Page C-19) Audit Timelines (Reduce costs by being organized and timely): Commence by 10/15 and conclude audit and taxes by 1/15 Auditor presentation to E-Board by 1/15 Criteria for Determining Reserves (Page C-21) Relationship Contract in Place? When does it expire? Is the affiliate experiencing reductions in force? Status on current Bargaining: Work stoppage? Current with the District: Reserves: What are the current cash balance(s)? Positive cash flow last two to three years? Local dues qualify for CTA Crisis Arbitration Fund? Does the affiliate have an adequate Crisis Fund? Cash available to pay August & September bills? Affiliate have 3 to 6 months for operating expenses? Criteria for Determining Reserves (continued) (Page C-21) Real Property • • • • • Does the affiliate own a building? Is there a Building Fund? Is there a mortgage? Principle balance? Monthly payments? Insurance? Is affiliate looking to own in lieu of renting? Staff • Does the affiliate employ staff? • Reserves established to pay for accrued vacation? Protection of Association Assets (Pages C-31 and C-32) Misappropriation of funds tend to occur by member leaders and staff who occupy positions of trust Executive Board should evaluate each step: Identify “warning signs” or “red flags” for evaluation Assess in accordance with due process procedures Determine to contact Board member, PCS and Manager Further determination: Controller’s Office In the case of a misappropriation: Controller’s Office would assist with the Fidelity Bond Claim Police Report most likely be filed by the affiliate or insurance co. Result could be: Arrest/Probation/Restitution Sample “Warning Signs” or “Red Flags” (Pages C-31 and C-32) Audit – Not hearing from the Auditor Bank Reconciliations – Not being done or reviewed Change in Staff – Not re-evaluating business practices Checks – Blank checks/stamps/one-signature policies Credit Card – No receipts or Statements not reviewed Debit Card-Cash withdrawals/Debits on bank statement Oversight – No Budget Committee done by Rep Council Payroll – Staff handles all steps and no review Post-It-Notes- Instructing colleagues not to take calls Personal Crisis – Change in financial condition Sprinkling of Account distribution – Avoid detection Treasurer’s Corner (login required) “Treasurer’s CTA Budget Conner” on CTA.org Adopted Budget Forms Local Chapter (Affiliate) Treasurers Treasurer’s Handbook Resources and Communications Agency Fee and PERB Annual Notifications IRS Information Returns and Mileage Rate PAC – Annual Filing Fee and Updates Sample Policies (Member Expenses, Conflict of Interest, etc.) Business Practices - End Wrap-Up Questions