Innovation Management

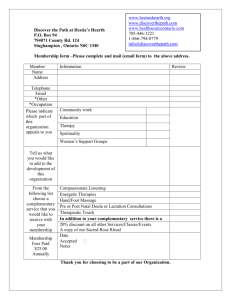

advertisement

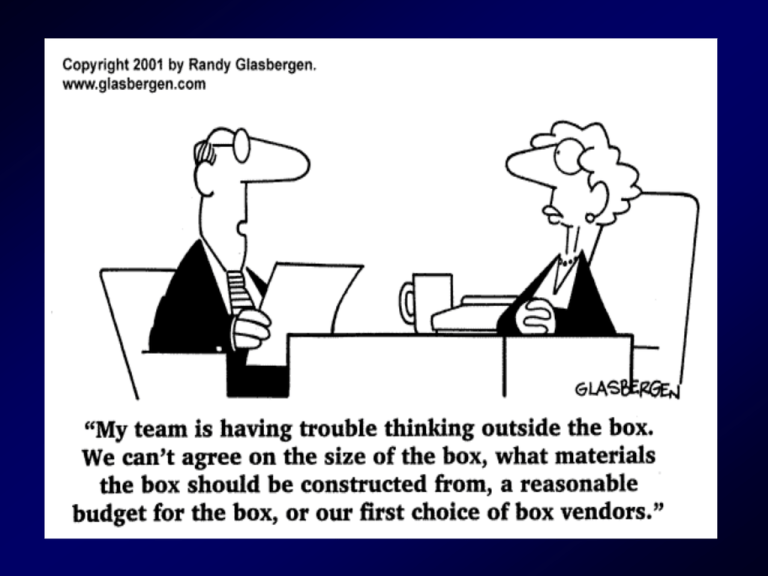

Innovation Management An effective innovation strategy answers three key questions: How will we Create value? How will we How will we Capture value? Deliver value? Step 1: Creating Value How will the technology evolve? How will the market change? How will consumer preferences and behavior change? Where will innovations come from? What is our value proposition? Step 2: Capturing Value How should we design the business model? Where should we compete in the value chain? How should we compete if standards are important? Step 3: Delivering Value How do we manage the core business and growth simultaneously? How do we use our strategy to drive real resource allocation? What organizational structure, processes, measurements, and incentive mechanisms do we use? Question: Can you think of an industry that has gone through drastic changes in the past several decades in terms of technology, business models, and major players? Examples Personal computers Retail Photography Video games A harder question: Can you think of an industry that has not gone through drastic changes in the past several decades in terms of technology, business models, and major players? Examples Soft drinks Ready-to-eat breakfast cereals Rough diamonds Business education? The Traditional Model of Industry Life Cycle Shakeout Maturity Sales volume Fermentation Time Decline An Alternate Model of Industry Life Cycle Convergence Coexistence Sales volume Emergence Dominance Established Industry Emerging Industry Time The Industry Life Cycle as an S curve Performance Maturity Discontinuity Takeoff Ferment Time Transitions often challenge existing organizations severely Cumulate share of sales of photolithographic alignment equipment, 1962-1986, by generation Contact Cobilt Kasper 44 17 Canon Proximity Scanner S&R (1) <1 8 67 P-Elmer GCA Nikon Total 61 S&R (2) 75 7 21 9 78 10 55 <1 12 81 70 82+ 99+ But they also create major opportunity Corning glass – Cookware to optical fiber IBM – Mainframes to PCs to Services Nintendo – Playing cards to video games Where do innovations come from? Sources of innovation according to Peter F. Drucker Industry and market changes Demographic changes New knowledge Changes in perception Unexpected occurrences Incongruities Process needs The second of three key questions... How will we Create value? How will we How will we Capture value? Deliver value? Or: What Determines the Innovator’s Share? Suppliers Imitators, followers Customers Innovator Sources of Uniqueness Intellectual property protection – Patents • Finite length • The right to prohibit “producing” – Copyrights • The right to prohibit “copying” Secrecy – Trade secrets & non-compete clauses – “Tacit” knowledge – Causal ambiguity Speed Uniqueness is powerful but often difficult to maintain Legal mechanisms can be costly to create, and then even more costly to enforce: and sometimes they require public disclosure Secrecy may be difficult to maintain Speed is hard work, and sometimes imitable What are Complementary Assets? Those assets that allow a firm to make money, even if the innovation is not unique. The answer to the question: – If our innovations were instantly available to our competitors, would we still make money? Why? In the best case, complementary assets should be tightly held Complementary assets that are tightly held are not easily available to entrants or to most competitors Types of Complementary Assets Things you can do – – – Manufacturing capabilities Sales and service expertise Strategic alliances COMPETENCIES Things you own – – – Brand name Distribution channels Customer relationships RESOURCES Exercise: Position: Soft drinks Windows Office Book publishing Travel agencies Your industry/firm Complementary assets are: Easy to maintain Available Tightly held B A C D Uniqueness is: Hard to maintain Uniqueness & Complementary Assets over the Life Cycle: Uniqueness Maturity Takeoff Ferment Complementary Assets Managing discontinuities means managing complementary assets: Maturity Performance Takeoff Discontinuity Which of my complementary assets is critical? Ferment Time Complementary Assets/Uniqueness speak to Rivalry, the Threat of Entry & Substitutes. Entrants Suppliers Rivals Substitutes Buyers Porter reminds us to think about the structure of the value chain: Entrants Suppliers Rivals Substitutes Buyers The last of three key questions... How will we Create value? How will we How will we Capture value? Deliver value? Discontinuous Innovation as a strategic problem Genuine uncertainty – It’s not going to happen – certainly not now Cannibalization – It will compete with our current products Shifts in the customer base – Our current customers don’t want it Margin erosion – It will make less money New S curves may be hard to spot in advance The new opportunity doesn’t meet our current customer’s needs The new opportunity doesn’t offer nearly the same margins and profit opportunity Discontinuous Innovation as an Organizational Problem My experience has been that creating a compelling new technology is so much harder than you think it will be that you're almost dead when you get to the other shore. --Steve Jobs Discontinuous Innovation as an organizational problem Time horizons & Incentives Fear of (individual) cannibalization Overload Competency Traps Case discussion: Kodak (A) 1. Evaluate Kodak’s strategy in traditional photography. Why has the company been so successful throughout the history of the industry? 2. Compare traditional photography to digital imaging. What are the main structural differences? Will digital imaging replace traditional photography? How have value creation and value appropriation changed in digital imaging relative to traditional photography? 3. How would you assess Fisher’s attempt to transform Kodak? 4. What is Kodak’s current position in digital imaging? Evaluate Kodak’s strategies from the mid-1980s onward.