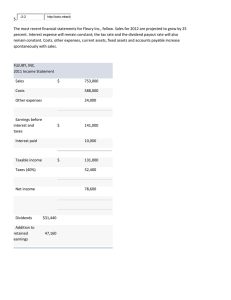

Debt vs. Equity

advertisement

Full Spectrum of Financial Options September 14, 2011 Agenda ICCC Program Overview Impact as of 2010 Program Benefits Eligibility and Application Financing your business growth Copyright © 2010 ICIC 2 1 Inner City Capital Connections Program Copyright © 2010 ICIC 3 1.1 Overview The Inner City Capital Connections (ICCC) is a free national program designed to drive the growth of inner city businesses. It is the country’s only program that teaches growing inner city companies about capital and matches them with investors to create jobs and local economic prosperity. History: Seven (7) ICCC events have already occurred: Los Angeles (2005), New York (2006), Miami (2006), Chicago (2007), New York (200809), and Los Angeles (2010). Partners: The ICIC, Bank of America and Fortune Copyright © 2010 ICIC 4 1.1 Timeline Training Nominations & Applications Selection of Applicants Oct. 20: Detroit July Aug. Sept. Oct. Oct. 25: Webinar Nov. 10: Main Event Nov. Dec. 5 companies selected to present Copyright © 2010 ICIC 5 1.2 Impact as of 2010 ICCC companies have raised $372 million in capital: $150 million in equity financing and $223 million in debt. 21% CAGR for revenues and 24% average CAGR for employment 72% of ICCC participants surveyed this year will add a collective 900 new jobs -- a 40% increase Participants have been featured in publications like the Wall Street Journal, Reuters, Inc. Magazine, Portfolio, PE Hub, MSN Money and Small Business Television Copyright © 2010 ICIC 6 1.3 Program Benefits Companies will… Discover a full range Learn how to optimize of financial options business plans to attract potential investors ICCC Build networks and Obtain company-specific strengthen relationships with investors feedback from seasoned investors Copyright © 2010 ICIC 7 1.4 Eligibility and Application Eligibility Criteria: Companies headquartered in or having at least 51% of their physical operations in an inner city For-profit corporations, partnerships, or proprietorships with revenues of at least $2 million or more OR have 40% of their employees located in the inner city Application Process: Simple one-page application Copyright © 2010 ICIC 8 1.5 Application Form 1.6 What to do at ICCC S trategize your approach T hink about what you need capital for A ssess your business plan R ehearse your 5 minute After pitch T rain at the training day During L isten: hear what other have Before to say E ngage yourself in the process A sk for feedback: ask investors what they think, not just for their capital G ather feedback R each out to investors O ptimize new relationships from ICCC W elcome new wealth creation strategies R e-assess your business plan and your strategy N etwork: meet investors and other companies Copyright © 2010 ICIC 10 2 Financing your business growth 11 2.1 Growth Requires Capital Operational capacity Working capital needs Capital expansion Management Accounts receivables Technology Sales and distribution Inventory Equipment Support and service New sales/orders Leasehold improvements Administration Equity, Tax Credits Line of credit, Factoring, Equity, Purchase order financing Debt, Tax Credits, Grants 12 2.2 Debt vs. Equity Debt Equity Risk Emphasis on collateral and cash flow to reduce risk (higher risk for borrower) Emphasis on future opportunity and return on investment by assuming risk (higher risk for investor) Repayment Repayment starts after funding Deferred repayment Return Return for lender not based on company performance Return for investor dependent on company performance Cost Lower cost for company if business is successful Higher cost for company if business is successful Dilution No ownership dilution Ownership dilution Relationship Monitoring relationship Involved partnership Documents Standard issues and documents Complex issues and documentation 13 Forms of Financing 2.3 Bank Debt Mezzanine Debt Venture Capital Growth Equity For companies with positive cash flows (need to support current interest payments) For start-up companies searching for large amounts of capital For companies seeking an infusion of capital to meet growth objectives Used for line of credit, working capital, real estate and other investments in capital equipment Used in conjunction with bank debt and private equity to “fill the gap” Used for proof of concept or to test the business model and begin building out professional management team Used after a company has a viable product or service and is seeking to scale the business Requires collateral and operating history Unsecured high interest (e.g. 12-18%) debt often bundled with equity “kickers” known as warrants For companies with positive cash flows Pre-revenue or early stage revenue companies 14 2.4 The more established your business, the less risk a lender or investor takes on Stage Risk Angel and Venture Capital 25-55% high 15-25% Growth Equity Active Investors Return Later Stage Equity 5-18% Mezzanine Risk Capital Passive Investors Debt low Risk high 15 2.5 Equity is the most expensive, risk tolerant form of capital Traditional Equity Equity Stage Form Amount Seed Stage Wealthy individuals, small VC funds $25k-$250K Early Stage Development Stage Later Stage Community Development Equity Double Bottom Line Angel groups, VC funds Growth equity Private equity Financial returns and job creation for underserved regions and/or people $500k-$3M $3M-$10M $10M-$1B $250K-$2M 16 Debt Capital Overview 2.3 Ownership None Typically a non-dilutive form of financing Structure Secured vs. Unsecured Private vs. Public debt Mezzanine and other sub-debt ; - Placed first in recovery of assets in event of company’s liquidation - Include covenants that require strict financial ratios to be maintained Timelines Variable terms Typically 3-5 year term loans Repayment is not dependent up on “liquidity” event Pricing: Commercial debt price ranges from 8-14% interest rate and Mezzanine debt ranges from 12-18% interest rates + equity stakes via warrant positions Partnership Debt investors are typically comprised of commercial lenders, mezzanine investors, and hedge funds Focus – debt investors are generally focused on cash flow of the underlying business and ability to repay Operational Involvement – debt investors are usually not as involved in the business on a day to day basis as equity investors Exit – debt repaid by cash flow; can be refinanced\ 17 2.7 Debt Considerations Pros Non-dilutive Cons Necessitates strong and consistent cash flows Cheaper capital (with current cash flow needs); leverages equity of owner Maintains management control Restricts cash flow; often requires financial covenants Debt providers typically not involved in day to day of business Significant owner risk Management doesn’t benefit from operational expertise of investors 18 Equity Overview 2.3 Ownership Typically, 1545% ownership plus 1-2 seats on board of directors Structure Timelines Preferred stock vs. common stock) 3-8 years holding period Select super rights Expectations of company “liquidity” event—sale, merger, IPO or recap Control new financings, sale of company, key hires, etc Partnership Strategy—e.g. business and financing strategy, business and partnership development Operations—e.g. sales, marketing, finance, etc Finance—e.g. raising capital including loans, equity, grants, etc. 19 2.9 Equity Considerations Pros Owner liquidity Remove the day-to-day funding street Added strategic advise Provide supplementary resources like financial management experience New Networks Cons Ownership dilution Reduced management control Less owner risk More involved than your debt provider Reduces the short-term trade-off between cash flow and growth Expensive capital Cost of legal and other documentation 20 2.10 A Successful Investment Win-win for founders and investors Company Example: $5M revenue, nearing breakeven Raised $3M of equity, selling 33% of company Valuation: pre-money + newmoney = post money $6M pm + $3M = $9M Five Year Growth 18 16 14 12 10 8 6 4 2 0 Sales 1 Growth & Value: 20% annual growth for five years = $15.3M revenue Sell company for $30M to third party Owners get $19M (66%), investors get $10M (33%) original investment 2 3 4 5 6 30 20 10 Exit Valuation Founders Investors Starting Valuation Total 21 Questions?