Trusts and Fiduciary arrangements in Luxembourg

advertisement

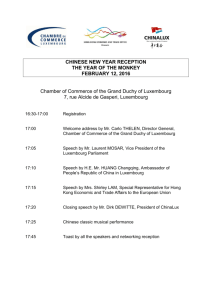

Trusts and Fiduciary arrangements in Luxembourg Carine Feipel December 2nd ,2009 Luxembourg in a nutshell 2 Located in the heart of Europe Founding member of the EU, as such submitted to EU legislation One of the most important international financial centers in the EU One of the smallest countries in the EU but one of the highest incomes per capita in the world Multicultural and multilingual population Great political stability, high level of security Well connected to the outside world with over 50 double tax treaties Money laundering: GAFI rules Cooperation between foreign authorities even in tax matters OCDE compliant - Luxembourg on no black/grey OCDE list Agenda 1. 2. 3. 4. 3 Recognition of foreign trusts Luxembourg fiduciary agreements Family wealth management company as an alternative Specialized Investment Fund as an alternative Recognition of foreign trusts 4 Recognition of foreign trusts 5 Judgment of the Luxembourg Court of Appeal of 22 May 1996 Facts: A settlor grants a guarantee to a bank on assets (cash) allocated to a Jersey trust without any intervention of the 2 trustees The bank exercises its guarantee on the assets of the trust Issue The trustees ask the Luxembourg court to force the reimbursement of the guarantee by the settlor the settlor is not entitled to grant a guarantee on the assets of the trust The settlor challenges the authority of the trustees to act as representatives of the trust before the Luxembourg court Recognition of foreign trusts Court The trust is not a legal concept existing under Luxembourg law Impossibility of establishing a trust in Luxembourg But The capacity of the trustees to act as representatives of the trust exists in the law of the trust The law of the trust is not contrary to Luxembourg law and Luxembourg public policy The action before the Luxembourg court introduced by the trustees is admissible 6 Recognition of foreign trusts The Hague Convention on the law applicable to trusts and on their recognition “…the legal relationships created - inter vivos or on death - by a person, the settlor, when assets have been placed under the control of a trustee for the benefit of a beneficiary or for a specified purpose.” Article 2 Luxembourg law dated 27 July 2003 applicable to trusts and fiduciary agreements (with effect in Luxembourg since 1st January 2004) recognition of foreign trusts 7 Recognition of foreign trusts In « common law » jurisdictions : difference between legal and economic property: the settlor transfers legal property of assets to the trustee the beneficiaries have the economic property of the assets transferred to the trustee Luxembourg law does not recognize this difference: principle of unique and full ownership no possibility to launch a Luxembourg trust but foreign trusts are recognized 8 Recognition of foreign trusts Judgment of the Luxembourg District Court of 12 December 2008 Facts A US resident, Mrs. B, holds a real estate in Luxembourg At the time of her death, the real estate is allocated to a US trust The trustee is in charge of managing the assets of the trust during a certain period of time The beneficiary of the trust is the sister of Mrs. B and the French foreign Ministry and a French association 9 Recognition of foreign trusts Issue The Luxembourg tax authorities consider that the real estate has been allocated to the trust and that inheritance tax is due at a rate applicable to non-relatives Court Principle of tax neutrality of the transfer of assets to a trust Trusts do not have legal personality Recognition by the Luxembourg tax authorities of the US trust: no inheritance tax was due 10 Luxembourg fiduciary agreements 11 Luxembourg fiduciary agreements Introduced in the Grand-Ducal regulation of 19 July 1983 modified by the law of 27 July 2003 Innovation: introduction of the principle of segregation of assets Fiduciary agreements may be used for various purposes: Management purposes (fiducie-gestion); Guarantee purposes (fiducie – sûreté); Credit purposes (fiducie – crédit); Carrying purposes (fiducie – portage) Gift or inheritance purposes (fiducie – donation) 12 Luxembourg fiduciary agreements Definition (Art 5, Law 2003) “A fiduciary agreement is an agreement by which a person, the principal, agrees with another person, the fiduciary, that, subject to the obligations determined by the parties, the fiduciary becomes the owner of assets which shall form a fiduciary estate”. full transfer of ownership in favor of the fiduciary separate patrimony held by the fiduciary on behalf of the settlor (patrimoine d'affectation) No registration requirements in Luxembourg, except when relating to real estate located in Luxembourg, or aircrafts or vessels registered in Luxembourg 13 Luxembourg fiduciary agreements Eligible persons as fiduciary credit institutions and certain professionals of the financial sector: investment firms, investment funds (SICAV, SICAF), management companies of collective investment funds (FCP), pension funds, insurance or reinsurance companies, securitization vehicles. Non-eligible persons: Lawyers, notaries, domiciliation agents 14 Luxembourg fiduciary agreements Functioning Freedom of contract In absence of defined rules set by the parties rules governing mandates except for representation and dismissal principle The fiduciary arrangement may be irrevocable and discretionary 15 Luxembourg fiduciary agreements The fiduciary assets do not belong to the personal estate of the fiduciary agent This segregation survives even in the case of bankruptcy or insolvency of the fiduciary agent the fiduciary assets cannot be seized by creditors of the fiduciary agent the fiduciary assets will not form part of the insolvency estate of the fiduciary agent 16 Family wealth management company as an alternative 17 Family wealth management company as an alternative The law on family wealth management companies (“société de gestion de patrimoine familial” - “SPF”) was adopted on 11 May 2007 The SPF is designed as an investment company intended solely for individuals managing their private wealth. The level of wealth or sophistication of the individual is irrelevant. The SPF is a legal entity separate from its shareholders 18 Family wealth management company as an alternative Shareholders of the company : any individuals acting within the framework of the management of their private wealth; any wealth management entities acting exclusively in the interest of the private wealth of individuals i.e. family offices, trusts, private foundations or similar entities; intermediaries holding shares in the SPF on a fiduciary basis or in a similar capacity, on behalf of eligible investors « Family » notion : no need to be relatives 19 Family wealth management company as an alternative Corporate form : any form of a capital company such as the private limited liability company, the public limited liability company, the partnership limited by shares, or the cooperative company in the form of a public limited company minimum registered capital 31,000 EUR for a public limited liability company 12.500 EUR for a private limited liability company 20 Family wealth management company as an alternative purpose of the company acquisition, holding, management and sale of financial assets, to the exclusion of any commercial activity The SPF cannot: hold real estate directly, but it can invest in any kind of property company grant loans subscribe to an insurance policy 21 Family wealth management company as an alternative Subjective tax exemption No Withholding tax No benefit from Double Tax Treaty 0.25% subscription tax (with a cap) 22 Specialized Investment Fund as an alternative 23 Specialized Investment Fund as an alternative Introduced by a law of 13 February 2007 Subject to a light supervision by the CSSF: Ex post approval procedure Requirement of a prospectus (issuing document) which needs to be updated only if new shares or units are issued to new investors No promoter requirement but reputable and experienced directors Principle based investment restrictions Subject to an annual subscription tax (taxe d’abonnement) at the rate of 0.01% 24 Specialized Investment Fund as an alternative Eligible investors: well-informed investors Institutional investor, or Professional investor, or Other well-informed investor, i.e. having confirmed in writing that he/she adheres to the status of well-informed investor, and investing a minimum of 125,000 Euros in a SIF 25 Specialized Investment Fund as an alternative All legal forms permitted: FCP (common fund) SICAV (investment company with variable capital) / SICAF (investment company with fixed capital) under the form of an S.A., S.C.A., S.à R.L. or S.C.S.A. Umbrella structure possible 26 Specialized Investment Fund as an alternative Risk diversification No quantitative investment restrictions except CSSF Circular 07/309 of 3 August 2007 (possible derogation): - no more than 30% of the SIF assets in securities of the same kind issued by a single issuer; Master-Feeder structure possible 27 Thank You 28 Contact us Carine Feipel Partner Tel :+1 212 554 3541 Email : carine.feipel@arendt.com