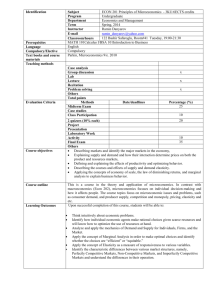

File

advertisement

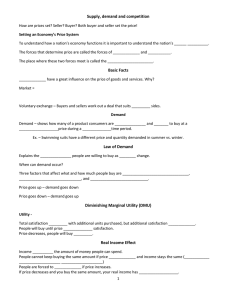

Microeconomics Key Words Word Microeconomics Basic Economic Problem Choice Economic goods Free Goods Margin Needs Opportunity Cost Production Possibility Frontier (PPF) Scarce Resources Wants Capital Productivity Division Of Labour Factors Of Production Fixed Capital Human Capital Labour Productivity Definition The study of the behaviour of individuals or groups within an economy, typically within a market context Resources have to be allocated between competing uses because wants are infinite whilst resources are scarce Economic choices involve the alternative uses of scarce resources Goods which are scarce because their use has an opportunity cost Goods which are unlimited in supply and which therefore have no opportunity cost A point of possible change The minimum which is necessary for a person to survive as a human being The benefits foregone of the next best alternative A curve which shows the maximum potential level of output of one good given a level of output for all other goods in the economy Resources which are limited in supply so that choices have to be made about their use Desires for the consumption of goods and services Output per unit of capital employed Specialisation by workers The inputs to the production process: land, which is all natural resources; labour, which is the workforce; capital, which is the stock of manufactured resources used in the production of goods and services; enterprise, individuals seeking out profitable opportunities for production and taking risks in attempting to exploit these Economic resources such as factories and hospitals which are used to transform working capital into goods and services The value of the productive potential of an individual or group of workers. It is made up of the skills, talents, education and training of an individual or group and represents the value of future earnings and production Output per worker 1 Microeconomics Market Non-renewable Resources Non-sustainable Resources Primary Sector Productivity Profits Renewable Resources Secondary Sector Specialisation Stakeholders Sustainable Resource Tertiary Sector Utility Welfare Working/Circulating Capital Base Period Index Number Any convenient set of arrangements by which buyers and sellers communicate to exchange goods and services Raw materials, such as coal or oil, which once exploited cannot be replaced Resources which are being economically exploited in such a way that it is being reduced over time Extractive and agricultural industries Output per unit of input employed The reward to the owners of a business. It is the difference between a firm’s revenues and its costs Raw materials, such as fish stocks or forests, which can be exploited over and over again because they have the potential to be reproduced Production of goods, mainly manufactured A system of organisation where economic units such as households or nations are not self-sufficient but concentrate on producing certain goods and services and trading the surplus with others Groups of people which have an interest in a firm, such as shareholders, customers, suppliers, workers, the local community and government Renewable resources which are being economically exploited in such a way that they will not diminish or run out Production of services The satisfaction derived from consuming a good The well-being of an economic agent or group of economic agents Resources which are in the production system waiting to be transformed into goods or other materials before being finally sold to the consumer The period, such as a year or a month, with which all other values in a series are compared An indicator showing the relative value of one number to another from a base of 100. It is often used to present an average of a number of statistics 2 Microeconomics Nominal Values Real Values Ceteris Paribus Equilibrium Law Normative Economics Normative Statement Partial And General Models Positive Economics Positive Statement Static And Dynamic Models The Scientific Method Theory Or Model Command Or Planned Economy Economic System Free-market Economy Mixed Economy Consumer Surplus Values unadjusted for the effects of inflation (i.e. values at current prices) Values adjusted for the effects of inflation (i.e. values at constant prices) The assumption that all other variables within the model remain constant whilst one change is being considered The point where what is expected or planned is equal to what is realised or actually happens A theory or model which has been verified by empirical evidence The study and presentation of policy prescriptions involving value judgements about the way in which scarce resources are allocated A statement which cannot be supported or refuted because it is a value judgement A partial model is one with few variables whilst a general model has many The scientific or objective study of the allocation of resources A statement which can be supported or refuted by evidence A static model is one where time is not a variable. In a dynamic model, time is a variable explicit in the model A method which subjects theories or hypotheses to falsification by empirical evidence A hypothesis which is capable of refutation by empirical evidence An economic system where government, through a planning process, allocates resources in society A complex network of individuals, organisations and institutions and their social and legal interrelationships An economic system which resolves the basic economic problem through the market mechanism An economy where both the free-market mechanism and the government planning process allocate significant proportions of total resources The difference between how much buyers 3 Microeconomics Demand Curve Demand Or Effective Demand Individual Demand Curve Market Demand Curve Shift In The Demand Curve Individual Supply Curve Market Supply Curve Producer Surplus Supply Equilibrium Price Excess Demand Excess Supply Market Clearing Price Competitive Demand Complement Composite Demand Derived Demand Joint Demand Joint Supply are prepared to pay for a good and what they actually pay The line on a price-quantity diagram which shows the level of effective demand at any given price The quantity purchased of a good at any given price, given that other determinants of demand remain unchanged The demand curve for a single consumer, firm or other economic unit The sum of all individual demand curves A movement of the whole demand curve to the right or left of the original caused by a change in any variable affecting demand except price The supply curve of a single producer The supply curve of all producers within the market. In a perfectly competitive market it can be calculated by summing the supply curves of individual producers The difference between the market price which firms receive and the price at which they are prepared to supply The quantity of goods that suppliers are willing to sell at any given price over a period of time The price at which there is no tendency to change because planned purchases (i.e. demand) are equal to planned sales (i.e. supply) Where demand is greater than supply Where supply is greater than demand The price at which there is neither excess demand nor excess supply but where everything offered for sale is purchased When two or more goods are substitutes for each other A good which is purchased with other goods to satisfy a want When a good is demanded for two or more distinct uses When the demand for one good is the result of the demand for another good When two or more complements are bought together When two or more goods are produced 4 Microeconomics Substitute Elastic Demand Inelastic Demand Price Elasticity Of Demand Unitary Inelasticity Cross-price Elasticity Of Demand Income Elasticity Of Demand Price Elasticity Of Supply Giffen Good Income Effect Inferior Good together, so that a change in supply of one good will necessarily change the supply of the other good(s) A good which can replace another to satisfy a want Where the price elasticity of demand is greater than 1. The responsiveness of demand is proportionally greater than the change in price. Demand is infinitely elastic if price elasticity of demand is infinity Where the price elasticity of demand is less than 1. The responsiveness of demand is proportionally less than the change in price. Demand is infinitely inelastic if price elasticity of demand is zero The proportionate response of changes in quantity demanded to a proportionate change in price Where the value of price elasticity of demand is 1. The responsiveness of demand is proportionally equal to the change in price A measure of the responsiveness of quantity demanded of one good to a change in price of another good. It is measured by dividing the percentage change in quantity demanded of one good by the percentage change in price of the other good A measure of the responsiveness of quantity demanded to a change in income. It is measured by dividing the percentage change in quantity demanded by the percentage change in income A measure of the responsiveness of quantity supplied to a change in price. It is measured by dividing the percentage change in quantity supplied by the percentage change in price A special type of inferior good where demand increases when price increases The impact on quantity demanded of a change in price due to a change in consumers’ real income which results from this change in price A good where demand falls when income increases (i.e. it has a negative income elasticity of demand) 5 Microeconomics Normal Good Substitution Effect Direct Tax Indirect Tax Specific Tax Ad Valorem Tax Subsidy Allocative Or Economic Efficiency Dynamic Efficiency Market Failure Externalities Productive Efficiency Static Efficiency Technical Efficiency External Costs Private Costs A good where demand increases when income increases (i.e. it has a positive income elasticity of demand) The impact on quantity demanded due to a change in price, assuming that consumers’ real incomes stay the same (i.e. the impact of a change in price excluding the income effect) Levied directly to an individual or organisation. Generally paid on incomes Usually levied on the purchase of goods and services. It represents a tax on expenditure A type of indirect tax. It is charged as a fixed amount per unit of a good. (Example: Excise Tax) Charged as a percentage of the price of a good. (Example: VAT) A grant provided by the government, to encourage suppliers to increase production of a good or service, leading to a fall in its price Occurs when resources are distributed in such a way that no consumers could be made better off without other consumers becoming worse off Occurs when resources are allocated efficiently over time Occurs when the price mechanism causes an inefficient allocation of resources; the forces of demand and supply lead to a net welfare loss in society Those costs or benefits which are external to an exchange. They are third part effects ignored by the price mechanism Is achieved when production is achieved at lowest cost Occurs when resources are allocated efficiently at a point in time Is achieved when a given quantity of output is produced with the minimum number of inputs May occur in the production and the consumption of a good or service. (i.e. pollution) Costs internal to the firm, which it directly pays for 6 Microeconomics Social Costs By adding private costs to external costs we obtain social costs External Benefits May occur in the production and consumption of a good or service. (i.e. recycling) Private Benefits The revenue that a firm obtains from selling a good or service Social Benefits By adding private benefits to external benefits we obtain social benefits Free Rider A person or organisation which receives benefits that others have paid for without making any contribution themselves Merit Good A good which is underprovided by the market mechanism. A demerit good is one which is overprovided by the market mechanism Private Good A good where consumption by one person results in the good not being available for consumption by another Public Good Or Pure Public Good A good where consumption by one person does not reduce the amount available for consumption by another person and where once provided, all individuals benefit or suffer whether they wish to or not Quasi-public Good Or Non-pure Public Good A good which may not possess perfectly the characteristics of being non-excludable but which is non-rival Commodities Raw materials used in the production of goods Principal-agent Problem Occurs when the goals of principals, those standing to gain or lose from a decision, are different from agents, those making decisions on behalf of the principal Symmetric Information Where buyers and sellers have access to the same information Asymmetric Information Where buyers and sellers have different amounts of information Buffer Stock Schemes A scheme whereby an organisation buys and sells in the open market so as to maintain a minimum price in the market for a product Government Failure This occurs if government intervention leads to a net welfare loss. 7 Microeconomics Notes Nearly all resources are scarce. Human wants are infinite. Scarce resources and infinite wants give rise to the basic economic problem – resources have to be allocated between competing uses. Allocation involves choice and each choice has an opportunity cost. The production possibility frontier (PPF) shows the maximum potential output of an economy. Production at a point inside the PPF indicates an inefficient use of resources. Growth in the economy will shift the PPF outwards. An economy is a social organisation through which decisions about what, how and for whom to produce are made. The factors of production – land, labour, capital and enterprise – are combined together to create goods and services for consumption. Specialisation and the division of labour give rise to large gains in productivity. The economy is divided into three sectors, primary, secondary and tertiary. Markets exist for buyers and sellers to exchange goods and services using barter or money. The main actors in the economy, consumers, firms and government, have different objectives. Consumers, for instance, wish to maximise their welfare whilst firms might wish to maximise profit. Economic data are collected not only to verify or refute economic models but to provide a basis for economic decision making. Data may be expressed at nominal (or current) prices or at real (or constant) prices. Data expressed in real terms take into account the effects of inflation. Indices are used to simplify statistics and to express averages. Data can be presented in a variety of forms such as tables or graphs. All data should be interpreted with care given that data can be selected and presented in a wide variety of ways. Positive economics deals with statements of ‘fact’ which can either be refuted or supported. Normative economics deals with value judgements, often in the context of policy recommendations. 8 Microeconomics Economics is the study of how groups of individuals make decisions about the allocation of scarce resources. Economists build models and theories to explain economic interactions. Models and theories are simplifications of reality. Models can be distinguished according to whether they are static or dynamic, equilibrium or disequilibrium, or partial or general. The function of any economic system is to resolve the basic economic problem. In a free market economy, resources are allocated through the spending decisions of millions of different consumers and producers. Resource allocation occurs through the market mechanism. The market determines what is to be produced, how it is to be produced and for whom production is to take place. Government must exist to supply public goods, maintain a sound currency, provide a legal framework within which markets can operate, and prevent the creation of monopolies in markets. Free markets necessarily involve inequalities in society because incentives are needed to make markets work. Free markets provide choice and there are incentives to innovate and for economies to grow. In a mixed economy, a significant amount of resources are allocated both by government through the planning mechanism, and by the private sector through the market mechanism. The degree of mixing is a controversial issue. Some economists believe that too much government spending reduces incentives and lowers economic growth, whilst others argue that governments must prevent large inequalities arising in society and that high taxation does not necessarily lead to low growth. Demand for a good is the quantity of goods or services that will be bought over a period of time at any given price. Demand for a good will rise or fall if there are changes in factors such as incomes, the price of other goods, tastes, and the size of the population. A change in price is shown by a movement along the demand curve. A change in any other variable affecting demand, such as income, is shown by a shift in the demand curve. The market demand curve can be derived by horizontally summing all the individual demand curves in the market. 9 Microeconomics A rise in price leads to a rise in quantity supplied, shown by a movement along the supply curve. A change in supply can be caused by factors such as a change in costs of production, technology and the price of other goods. This results in a shift in the supply curve. The market supply curve in a perfectly competitive market is the sum of each firm’s individual supply curves. The equilibrium or market clearing price is set where demand equals supply. Changes in demand and supply will lead to new equilibrium prices being set. A change in demand will lead to a shift in the demand curve, a movement along the supply curve and a new equilibrium price. A change in supply will lead to a shift in the supply curve, a movement along the demand curve and a new equilibrium price. Markets do not necessarily tend towards the equilibrium price. The equilibrium price is not necessarily the price which will lead to the greatest economic efficiency or the greatest equity. Some goods are complements, in joint demand. Other goods are substitutes for each other, in competitive demand. Derived demand occurs when one good is demanded because it is needed for the production of other goods or services. Composite demand and joint supply are two other ways in which markets are linked. Elasticity is a measure of the extent to which quantity responds to a change in a variable which affects it, such as price or income. Price elasticity of demand measures the proportionate response of quantity demanded to a proportionate change in price. Price elasticity of demand derives from zero, or infinitely elastic, to infinitely elastic. The value of price elasticity of demand is mainly determined by the availability of substitutes and by time. Income elasticity of demand measures the proportionate response of quantity demanded to a proportionate change in income. Cross elasticity of demand measures the proportionate response of quantity demanded of one good to a proportionate change in price of another good. 10 Microeconomics Price elasticity of supply measures the proportionate response of quantity supplied to a proportionate change in price. The value of elasticity of supply is determined by the availability of substitutes and by time factors. The price elasticity of demand for a good will determine whether a change in the price of a good results in a change in expenditure on the good. An increase in income will lead to an increase in demand for normal goods but a fall in demand for inferior goods. Normal goods have positive income elasticity whilst inferior goods have a negative elasticity. A Giffen good is one where a rise in price leads to a rise in quantity demanded. This occurs because the positive substitution effect of the price change is outweighed by the negative income effect. Upward sloping demand curves may occur if the good is a Giffen good, if it has snob or speculative appeal or if consumers judge quality by the price of a product. Indirect taxes can be either ad valorem taxes or specific taxes. The imposition of an indirect tax is likely to lead to a rise in the unit price of a good which is less than the unit value of the tax. The incidence of indirect taxation is likely to fall on both consumer and producer. The incidence of tax will fall wholly on the consumer if demand is perfectly inelastic or supply is perfectly elastic. The incidence of tax will fall wholly on the producer if demand is perfectly elastic or supply is perfectly inelastic. The labour market is a factor market where the price of labour is the wage rate and the quantity is the level of employment. Labour is a derived demand. One of the determinants of the demand for and supply of labour is the wage rate paid. Other determinants of the demand for labour include the price of other factors of production and demand for the good being made. Other determinants of the supply of labour include population migration, income tax and benefits, trade unions and government regulations such as the national minimum wage. 11 Microeconomics Economic theory suggests that trade unions, high levels of the minimum wage and high marginal rates of income tax will reduce employment levels, but economists disagree about how much impact these will have on employment. The market is a mechanism for the allocation of resources. In a free market, consumers, producers and owners of the factors of production interact, each seeking to maximise their returns. Prices have three main functions in allocating resources. These are the rationing, signalling and incentive functions. If firms cannot make enough profit from the production of a good, the resources they use will be reallocated to more profitable uses. Static efficiency refers to efficiency at a point in time. Dynamic efficiency concerns how resources are allocated over time so as to promote technical progress and economic growth. Productive efficiency exists when production is achieved at lowest cost. Allocative efficiency is concerned with whether resources are used to produce the goods and services that consumers wish to buy. All points on an economy’s production possibility frontier are both productively and allocatively efficient. Free markets tend to lead to efficiency. Market failure occurs when markets do not function efficiently. Sources of market failure include lack of competition in a market, externalities, missing markets, information failure, factor immobility and inequality. Externalities are created when social costs and benefits differ from private costs and benefits. The greater the externality, the greater the likelihood of market failure. Market failure occurs when marginal social cost and marginal social benefit are not equal at the level of output shown by the ‘welfare triangle’ on a marginal social and private cost and benefit diagram. Governments can use regulation, the extension of property rights, taxation and permits to reduce the market failure caused by externalities. There will inevitably be market failure in a pure free market economy because it will fail to provide public goods. 12 Microeconomics Public goods must be provided by the state because of the free rider problem Merit goods are goods which are underprovided by the market mechanism, for instance because there are significant positive externalities in consumption. Governments can intervene to ensure provision of public and merit goods through direct provision, subsidies or regulation. Two types of immobility of labour are geographical immobility and occupational immobility. Structural unemployment arises because of the immobility of labour. Governments use a variety of policies to tackle the problems associated with immobility including education and training, relocation subsidies and regional policy. Market failure may be caused by asymmetric information in a market. Principal-agent problems, adverse selection and moral hazard all occur because of asymmetric information in markets such as health care, pensions, education and tobacco and alcohol. The price of a good may be too high, too low or fluctuate too greatly to bring about an efficient allocation of resources. Governments may impose maximum or minimum prices to regulate a market. Maximum prices can create shortages and black markets. Minimum prices can lead to excess supply and tend to be maintained only at the expense of the taxpayer. Prices of commodities and agricultural products tend to fluctuate more widely than the prices of manufactures goods and services. Buffer stock schemes attempt to even out fluctuations in price by buying produce when prices are low and selling when prices are high. Government failure can be caused by inadequate information, conflicting objectives, administrative costs and creation of market distortions. Public choice theory suggests that governments may not always act to maximise the welfare of society because politicians may act to maximise their own welfare. 13