Asset Exchanges

advertisement

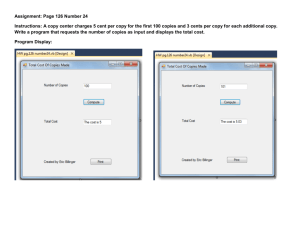

Asset Exchanges Accounting Issues: Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 1. At what value should the asset received be recorded? 2. Should a gain or loss be recognized on the exchange of the assets? Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #1 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Adams Mining Co. traded a rare, 1913 antique truck (specially equipped for mining during that era), for an patent with Gemstone Industries. Adams had $150,000 invested in the truck, with accumulated depreciation of $90,000. Gemstone had $20,000 in capitalized costs for the patent, along with $2,000 in amortization. Neither Adams nor Gemstone were able to reasonably determine the FMV of either of these two items. Required: Record the transaction for both Adams and Gemstone. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #1 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Adams: Truck: $ 150,000 Acc. Dep: (90,000) BV: $ 60,000 Adams: Patent Accumulated Depreciation Old Equipment Gemstone: Investment--antiques Patent Gemstone: Patent: $ 20,000 Amort: (2,000) BV: $ 18,000 Debit Credit 60,000 90,000 150,000 18,000 18,000 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 FMV of either asset determinable? No Record asset received at BV of asset given-up 1 Yes Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #2 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Bain Media Services traded a printing press for a parcel of land held by Pitt Development. The land was appraised at $150,000. Pitt had the land recorded at $90,000 on their books. Bain paid $240,000 for the press 5-years ago, and has accumulated depreciation in the amount of $80,000. Required: Record the transaction for both Bain and Pitt. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges General Procedures Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart 1. 2. 3. 4. Remove old asset from books Record new asset at FMV Record any cash paid or received Record any gain or loss Accumulated Depreciation New Aset (at FMV) Cash Loss on Exchange Old Asset Cash Gain on Exchange Debit 1 2 3 4 Credit 1 3 4 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Determining Gain or Loss Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart What you Get Less: What you Give Up Gain/(Loss) $aaa (bbb) $ccc Example: You trade a car with a BV of $15,000 for another car with a FMV of $25,000. FMV of Assets Received: Less: BV of Old Assets: Realized Gain: $ 25,000 (15,000) $ 10,000 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #2 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Bain: Press: $ 240,000 Acc. Dep: (80,000) BV: $ 160,000 FMV: ? Bain: Land Accumulated Depreciation Loss on Exchange of Assets Equipment Pitt: Equipment Land Gain on Exchange of Assets Pitt: Land: Acc. Dep: BV: FMV: Debit $ 90,000 $ 90,000 150,000 Credit 150,000 80,000 10,000 240,000 150,000 90,000 60,000 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 FMV of either asset determinable? No Record asset received at BV of asset given-up 1 Yes Assets similar in nature? No Record transaction using General Procedure. 2 Yes Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #3 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Stone Transportation arranged to trade a delivery pickup for a newer custom pickup with ABC Tire Company. The CEO of Stone Transportation plans to use the pickup for personal use (as a company perquisite). Stone paid $25,000 for their pickup 3-years ago, and has accumulated depreciation in the amount of $8,000. Stone paid ABC an additional $5,000 for the newer pickup. The Newer pickup had a bluebook value of $29,000. Required: Record the transaction for Stone transportation. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #3 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Stone: Truck: $ 25,000 Acc. Dep: (8,000) BV: $ 17,000 FMV: 29,000 Stone: Automobiles Accumulated Depreciation Cash Automobiles Gain on Exchange of Assets Debit Credit 29,000 8,000 5,000 25,000 7,000 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 FMV of either asset determinable? No Record asset received at BV of asset given-up 1 Yes Assets similar in nature? No Record transaction using General Procedure. 2 Record transaction using General Procedure. 3 Yes Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Asset given-up normally held for sale? No Are both assets Productive assets? No 1 Yes Yes Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #4 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Trader Jim is an outdoor store—primarily clothing. Trader Jim arranged to swap some of its outdoor clothing inventory for some uniforms with Scott’s Uniform Supply Company. The uniforms will be issued to employees as standard company attire. The clothing inventory exchanged cost $1,800, has a replacement value of $2,500 and could have been sold for $3,000. Scott’s Uniforms intended to use the outdoor clothing in another line of business. Scott’s cost for the uniforms was $2,000. Required: Record the transaction for Trader Jim and Scott’s Uniforms. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #4 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Trader Jim: Inventory: FMV: 1,800 2,500 Trader Jim: Uniforms Inventory Gain on Exchange of Assets Scott's Uniforms Inventory (Clothes) Inventory (uniforms) Gain on Exchange of Assets Scott's Uniforms Inventory: $ 2,000 Debit Credit 2,500 1,800 700 2,500 2,000 500 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges FMV of either asset determinable? Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 No Record asset received at BV of asset given-up 1 Yes Assets similar in nature? Flowchart 1 2 3 4 5 6 7 8 No Record transaction using General Procedure. 2 Record transaction using General Procedure. 3 Yes Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Asset given-up normally held for sale? No Are both assets Productive assets? No 1 Yes 4 Record transaction using General Procedure. No Is asset received to be sold? Yes Yes 2 Return 2 The asset received must be held for sale in the same line of business. Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #5 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Webber Electric sells industrial electrical components to local industrial manufacturers. Webber arranged to exchange a gasoline powered forklift for an electric-powered forklift with Jensen Electric. Webber’s gas-powered forklift had a book value of $13,000 (originally, Webber paid $25,000). Likewise, Jensen’s forklift had a book value of $12,000 and accumulated depreciation of $20,000. The electric-powered forklift has a FMV of $10,000. Required: Record the transaction for both Webber and Jensen. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #5 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Webber: Gas Forklift Acc. Dep: BV: FMV: $ 25,000 (12,000) $ 13,000 ? Webber: Equipment Accumulated Depreciation Loss on Exchange of Assets Equipment Jensen: Equipment Accumulated Depreciation Loss on Exchange of Assets Equipment Jensen: Elect Forklift $ 32,000 Acc. Dep: (20,000) BV: $ 12,000 FMV: 10,000 Debit Credit 10,000 12,000 3,000 25,000 10,000 20,000 2,000 32,000 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Problems 1 2 3 4 5 6 7 8 FMV of either asset determinable? Answers 1 2 3 4 5 6 7 8 No Record asset received at BV of asset given-up 1 Yes Assets similar in nature? Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart 2 Yes Asset given-up normally held for sale? No Are both assets Productive assets? No Record transaction using General Procedure. 3 No Record transaction using General Procedure. 5 1 Yes 4 Return Record transaction using General Procedure. No Record transaction using General Procedure. No Is asset received to be sold? Yes Yes Does transaction create a gain? 2 Yes 2 The asset received must be held for sale in the same line of business. Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #6 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Webber Electric sells industrial electrical components to local industrial manufacturers. Webber arranged to exchange a gasoline powered forklift for an electric-powered forklift with Jensen Electric. Webber’s gas-powered forklift had a book value of $9,000 (originally, Webber paid $25,000). Likewise, Jensen’s forklift had a book value of $12,000 and accumulated depreciation of $20,000. The electric-powered forklift has a FMV of $10,000. Required: Record the transaction for both Webber and Jensen. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #6 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Webber: Gas Forklift Acc. Dep: BV: FMV: $ 25,000 (16,000) $ 9,000 ? Webber: Equipment Accumulated Depreciation Equipment Jensen: Equipment Accumulated Depreciation Loss on Exchange of Assets Equipment Jensen: Elect Forklift $ 32,000 Acc. Dep: (20,000) BV: $ 12,000 FMV: 10,000 Debit Credit 9,000 16,000 25,000 10,000 20,000 2,000 32,000 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Problems 1 2 3 4 5 6 7 8 Assets similar in nature? Answers 1 2 3 4 5 6 7 8 Record transaction using General Procedure. No 2 Yes Asset given-up normally held for sale? Flowchart 1 2 3 4 5 6 7 8 Are both assets Productive assets? No No Record transaction using General Procedure. 3 No Record transaction using General Procedure. 5 1 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Yes 4 Record transaction using General Procedure. Is asset received to be sold? No Yes Yes Does transaction create a gain? 2 Yes 6 Defer all gains No Is cash received? Return Yes Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #7 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Trader Jim is an outdoor store—primarily clothing. Trader Jim arranged to swap some of its outdoor clothing inventory for similar clothes with Scott’s Outdoor & More. The clothing received by Trader Jim will be held for resale in the same line of business. Trader Jim’s inventory cost $18,000, has a replacement value of $25,000 and could have been sold for $30,000. Scott’s inventory cost was $19,000. In addition, Scott had to pay an additional $6,500 cash to complete the transaction. Required: Record the transactions for Trader Jim and Scott’s Outdoor & More. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #7 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Trader Jim: Inventory: FMV: 18,000 25,000 Trader Jim: Cash Inventory (new) Inventory (old) Gain on Exchange of Assets Scott's Outdoor Inventory (new) Loss on Exchange of Assets Inventory (old) Cash Scott's Outdoor Inventory: $ 19,000 Cash paid: 6,500 Debit Credit 6,500 18,500 18,000 7,000 25,000 500 6,500 26% 25,000 Recognize all gain Recognize all losses 19,000 6,500 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Asset given-up normally held for sale? Problems 1 2 3 4 5 6 7 8 No Record transaction using General Procedure. 3 No Record transaction using General Procedure. 5 Yes Record transaction using General Procedure. 7 1 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Are both assets Productive assets? No Yes Record transaction 4 using General Procedure. Is asset received to be sold? No Yes Yes Does transaction create a gain? 2 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Yes 6 Defer all gains No Yes No Return Is cash received? Is cash ³ 25% of total transaction's FMV? Dr. Wallace R. Leese, Ph.D. Asset Exchanges Sample Problem #8 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Trader Jim is an outdoor store—primarily clothing. Trader Jim arranged to swap some of its outdoor clothing inventory for similar clothes with Scott’s Outdoor & More. The clothing received by Trader Jim will be held for resale in the same line of business. Trader Jim’s inventory cost $18,000, has a replacement value of $25,000 and could have been sold for $30,000. Scott’s inventory cost was $19,000. In addition, Scott had to pay an additional $3,500 cash to complete the transaction. Required: Record the transactions for Trader Jim and Scott’s Outdoor & More. Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Partial Answer to Problem #8 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Trader Jim: Inventory: FMV: 18,000 25,000 Trader Jim: Cash Inventory (new) Inventory (old) Gain on Exchange of Assets Scott's Outdoor Inventory (new) Inventory (old) Cash Scott's Outdoor Inventory: $ 19,000 Cash paid: 3,500 Debit Credit 3,500 ? 3,500 14% 25,000 18,000 ? Recognize partial gain 19,000 3,500 Cash Paid, Defer all gains 22,500 Return Dr. Wallace R. Leese, Ph.D. Asset Exchanges Calculating Partial Gains/New Basis Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Ste p 1: Calculate re alize d gain FMV of assets received - BV of assets given up Realized gain Ste p 2: Compute pe rce ntage of cash re ce ive d Cash received Total value of transaction = % Cash Ste p 3: Re cognize partial gain (% cash) x (realized gain) = recognized gain Ste p 4: De te rmine basis for ne w asse t FMV of asset received - Deferred gain 1 New basis Return 1 Caution: Deferred gain is realized gain less recognized gain. Note: The remaining gain is recognized over the life of the asset through lower depreciation. Dr. Wallace R. Leese, Ph.D. Asset Exchanges Answer to Problem #8 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Trader Jim: Inventory: FMV: 18,000 25,000 Scott's Outdoor Inventory: $ 19,000 Cash paid: 3,500 Debit Trader Jim: Cash Credit 3,500 1 Inventory (new) Inventory (old) Gain on Exchange of Assets Scott's Outdoor Inventory (new) Inventory (old) Cash Trader Jim: Realized Gain: 25,000 FMV received (18,000) BV given up 7,000 % Cash Received: 15,480 18,000 980 3,500 = 14% 25,000 Recognized Gain: 14% x 7,000 = 980 22,500 19,000 3,500 Deferred Gain: 7,000 Realized (980) Recognized 6,020 1 New Basis Return 21,500 FMV Received (6,020) Deferred Gain 15,480 Dr. Wallace R. Leese, Ph.D. Asset Exchanges Asset given-up normally held for sale? Problems 1 2 3 4 5 6 7 8 No Record transaction using General Procedure. 3 No Record transaction using General Procedure. 5 Yes Record transaction using General Procedure. 7 1 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Are both assets Productive assets? No Yes Record transaction 4 using General Procedure. Is asset received to be sold? No Yes Yes Does transaction create a gain? 2 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Yes 6 No Is cash received? Yes 8 Return Defer all gains Defer a portion of the gains No Is cash ³ 25% of total transaction's FMV? Dr. Wallace R. Leese, Ph.D. 1 Problems 1 2 3 4 5 6 7 8 2 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 3 Conceptual APB-29 4 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart 5 6 Return 8 7 Dr. Wallace R. Leese, Ph.D. Asset Exchanges APB Opinion No. 29 Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Return Normal Procedure • FMV is recognized on reciprocal nonmonetary transactions (gains/losses recognized) Exceptions to Normal Procedure Generally: • Transactions recorded at BV • Some monetary consideration allowed Where exceptions are applicable: 1) Held for sale products/property in exchange for products/property to be sold in the same line of business. 2) Productive assets for similar productive assets (NOTE: Exchange cannot be made for the purpose of facilitating a sale to a customer) Dr. Wallace R. Leese, Ph.D. Asset Exchanges Definitions Problems 1 2 3 4 5 6 7 8 Answers 1 2 3 4 5 6 7 8 Flowchart 1 2 3 4 5 6 7 8 Conceptual APB-29 Definitions General Procedure Determine Gain/Loss Compute Partial Gains Comprehensive Flowchart Monetary items: Cash, claims to cash, obligations to pay cash, and other balance-sheet items that are fixed in dollar amounts. (Examples: Cash, A/R, A/P, Bonds) Nonmonetary transactions: Exchanges that involve few or no monetary items. Similar Productive Assets: Assets that are of the same general type, that perform the same function, or that are employed in the same line of business. Return Dr. Wallace R. Leese, Ph.D.