Actions Against the Estate (Week 6)

Week 6

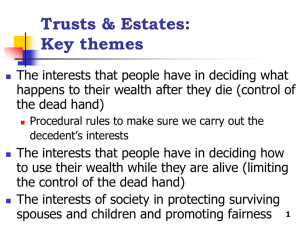

Recap

How to make a will

Intentionalities and formalities

Interpreting the will

Revoking the will

Reviving the will

Dependent Relative Revocation

Will + Revocation + Oopsie

Restrictions on disposition

Bars to succession

Lawsuits

Claims against estate or beneficiaries

Will contest actions

Lawsuits Against Estate or Beneficiaries

Tortious interference with an expected inheritance

Elder Abuse

Contract to make a will

Non-married partners rights

Creditor claims

Attorney malpractice for will drafting

Tortious Interference With An Expected

Inheritance

Does not challenge the probate of a Will

Seeks recover of their expected inheritance from the wrongdoer

Beckwith v. Dahl

What constitutes IIEI?

Necessary to afford an injured plaintiff a remedy

Expectancy of inheritance

Causation

Intent

Interference conducted by some independently tortious means

• Underlying conduct must be wrong other than the interference itself

• Must be directed at someone other than plaintiff, the beneficiary is not effected, the testator is

Damage

Elder Abuse

Welfare and Institutions Code Section 15610.30 (a)

(a)“Financial abuse” of an elder or dependent adult occurs when a person or entity does any of the following:

(1) Takes, secretes, appropriates, obtains, or retains real or personal property of an elder or dependent adult for a wrongful use or with intent to defraud, or both.

(2) Assists in taking, secreting, appropriating, obtaining, or retaining real or personal property of an elder or dependent adult for a wrongful use or with intent to defraud, or both.

(3) Takes, secretes, appropriates, obtains, or retains, or assists in taking, secreting, appropriating, obtaining, or retaining, real or personal property of an elder or dependent adult by undue influence, as defined in Section

15610.70.

Elder Abuse

Welfare and Institutions Code Section 15610.30 (b)-(c)

(b) A person or entity shall be deemed to have taken, secreted, appropriated, obtained, or retained property for a wrongful use if, among other things, the person or entity takes, secretes, appropriates, obtains, or retains the property and the person or entity knew or should have known that this conduct is likely to be harmful to the elder or dependent adult.

(c) For purposes of this section, a person or entity takes, secretes, appropriates, obtains, or retains real or personal property when an elder or dependent adult is deprived of any property right, including by means of an agreement, donative

transfer, or testamentary bequest, regardless of whether the property is held directly or by a representative of an elder or dependent adult.

Contract to Make a Will

Probate Code Section 21700:

(a) A contract to make a will or devise or other instrument, or not to revoke a will or devise or other instrument, or to die intestate, if made after the effective date of this statute, can be established only by one of the following: (1) Provisions of a will or other instrument stating the material provisions of the contract. (2) An expressed reference in a will or other instrument to a contract and extrinsic evidence proving the terms of the contract. (3) A writing signed by the decedent evidencing the contract. (4)

Clear and convincing evidence of an agreement between the decedent and the claimant or a promise by the decedent to the claimant that is enforceable in equity. (5) Clear and convincing evidence of an agreement between the decedent and another person for the benefit of the claimant or a promise by the decedent to another person for the benefit of the claimant that is enforceable in equity. (b) The execution of a joint will or mutual wills does not create a presumption of a contract not to revoke the will or wills. (c) A contract to make a will or devise or other instrument, or not to revoke a will or devise or other instrument, or to die intestate, if made prior to the effective date of this section, shall be construed under the law applicable to the contract prior to the effective date of this section.

Contract to Make a Will

Fam. Code Section 1612 (a)(4):

(a) Parties to a premarital agreement may contract with respect to all of the following:

(4) The making of a will, trust, or other arrangement to carry out the provisions of the agreement.

Contract to Make a Will

Brewer v. Simpson

Oral agreement between husband and wife to make mutual wills

Wills left the entirety of both estates to the surviving spouse, and then half to each spouses family

What evidence was that there was a contract to make a will?

Contract to Make a Will

Stewart v. Seward

Spouse orally promised to leave real property to decedent’s grandchildren and daughter in exchange for decedent keeping the real property in joint tenancy

Spouse left the real property to grandchildren but not to daughter

Daughter’s claim was governed by 1 year statute of limitation

• What about equity?

• What about testator’s intent?

Contract to Make a Will

(a)

(b)

Civil Code Section 366.2:

If a person against whom an action may be brought on a liability of the person, whether arising in contract, tort, or otherwise, and whether accrued or not accrued, dies before the expiration of the applicable limitations period, and the cause of action survives, an action may be commenced within one year after the date of death, and the limitations period that would have been applicable does not apply.

The limitations period provided in this section for commencement of an action shall not be tolled or extended for any reason except as provided in any of the following, where applicable

Contract to Make a Will

(a)

(b)

Civil Code Section 366.3

If a person has a claim that arises from a promise or agreement with a decedent to distribution from an estate or trust or under another instrument, whether the promise or agreement was made orally or in writing, an action to to enforce the claim to distribution may be commenced within one year after the date of death, and the limitations period that would have been applicable does not apply.

The limitations period provided in this section for commencement of an action shall not be tolled or extended for any reason…

Non-Married Partner Rights

Marvin v. Marvin

Express Contract

Implied Contract

Determined by behavior of parties

Does this mean that if you live with another person that any property you acquire becomes community property?

Attorney Malpractice For Will Drafting

What is legal malpractice?

Duty

Breach of Duty

Cause

Damage

What is the hardest thing to show in malpractice for will drafting cases?

Duty

Who Does the Drafting Attorney Owe a Duty To?

Lucas v. Hamm

Are intended beneficiaries owed a duty?

Yes

Why weren’t these intended beneficiaries allowed to pursue their suit?

Chang v. Lederman

Are perspective beneficiaries of a desired will owed a duty?

No

Are intended beneficiaries of a previous drafted document owed a duty?

No

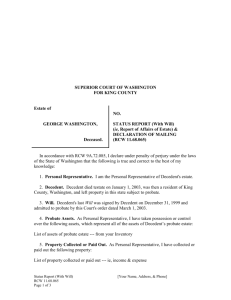

Will Contest Actions

Petition for Probate

Will Contest Complaint

Petition For Probate

“A Will is not a Will unless a court will declare it a Will.”

–Professor Keith Davidson

Will Contest Complaint

Swift v. Superior Court

What is the standard for answering a petition for probate of a will in this case?

Very liberal

Is this a good standard?

Will Contest Complaint

Probate Code Section 8250(a)

(a) When a will is contested under Section 8004, the contestant shall file with the court an objection to probate of the will.

Thereafter, a summons shall be issued and served, with notice of hearing of a petition for administration of the decedent’s estate…[t]he summons shall contain a direction that the persons summoned file with the court a written pleading in response to the contest within 30 days after service of the summons.

Probate Code Section 8250’s 1,2,3,4

1.

Petition

2.

3.

4.

Objection

Summons

Response

Will Contest Complaint

Probate Code Section 8252(a):

(a) At the trial, the proponents of the will have the burden of proof of due execution. The contestants of the will have the burden of proof of lack of testamentary intent or capacity, undue influence, fraud, duress, mistake, or revocation. If the will is opposed by the petition for probate of a later will revoking the former, it shall be determined first whether the later will is entitled to probate.