Internal audit - الجامعة الإسلامية بغزة

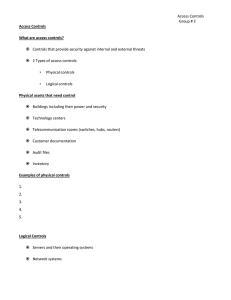

advertisement