Deposit insurance funding, the UK experience.

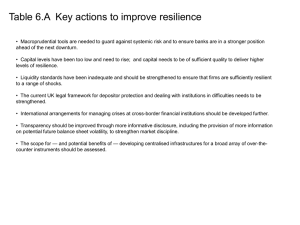

advertisement

ab High Level Seminar on Challenges for European Deposit Insurance Systems: Funding Investment Practices and Reimbursement 26 February 2015 Warsaw, Poland Karen Gibbons Head of Policy and External Affairs Financial Services Compensation Scheme, UK Confidential ab Deposit Insurance Funding – Case Study – United Kingdom » Background to FSCS » The crisis - 2008/09 » Back up funding, and practical solutions » Deposit Guarantee Scheme Directive (DGSD) » The next steps 2 Confidential ab Background to FSCS » Established in 2001 » An integrated, consolidated protection scheme › deposits › insurance › investments › home finance » Industry funded › annual levy › no pre fund › cross subsidy – total annual limit c.£4 billion (2008) › limited commercial borrowing 3 Confidential ab The Crisis – 2008/09 (1) » Northern Rock › September 2007 – the run › Nationalised – February 2008 › No FSCS intervention or funding » Banking Act 2009 › in force from February 2009 › Special Resolution Regime › FSCS funding powers › “Contingency funding” (not activated) › Contribution to costs of resolution › borrowing from National Loans Fund (government) 4 Confidential ab The Crisis – 2008/09 (2) » Bradford & Bingley Plc › 29 September 2008 › nationalised but FSCS funded transfer of protected deposits to Abbey National/Santander c.£15.65 billion » FSCS Funding › standing funds c.£4 million › emergency borrowing from Bank of England › HMT statement that the government ‘stands behind FSCS’ › FSCS refinanced with HM Government/Treasury (December 2008) › interest at LIBOR + 100 bps/HMT gilt rate 5 Confidential ab The Crisis – 2008/09 (3) » Heritable Bank Plc » Kaupthing Singer & Friedlander Limited » London Scottish Bank Plc » Icesave » All funded by borrowing from HM Treasury › total £23 billion 6 Confidential ab The Crisis – 2008/09 (4) » Bradford & Bingley Plc – repayment and recoveries › no repayment of principal to date › B&B/UKAR forecast 100% repayment – c.2024 (from 2017) › interest payable annually » c.£2 billion from 2008 › » 7 FSCS/HM Treasury MoU on recoveries/oversight of nationalised business Others – current recovery rates › Heritable – c.94% › KSF – c.81.5% › London Scottish c.42.5% › Icesave – c.84% › All loans repaid (except KSF) from recoveries and levies Confidential ab The Crisis – 2008/09 (5) » Dunfermline Building Society › 30 March 2009 › Special Resolution Regime – resolution costs c.£1.6 billion › Deposit transfer, bridge bank (and sale), wind up of assets » FSCS contribution to costs c.£570 million › Payment to be agreed once final recoveries are paid to HMT › Interim payment of £100m (2014) › not required payment at March 2009 – but at end of resolution 8 Confidential ab Deposit Guarantee Scheme Directive - Framework » DGSD › pre fund and risk based levies › opt out if pre existing bank levy/tax » Banking Act 2009 › borrowing from NLF » Financial Services and Markets Act 2010 › contingency fund – not activated » IADI Core Principles › Principle 9 – Sources and Uses of Funds › Emergency funding arrangements for the deposit system, including prearranged and assured sources of liquidity funding, are explicitly set out (or permitted) in law or regulation. Sources may include a funding agreement with the government, the central bank or market borrowing. If market borrowing is used it is not the sole source of funding. The arrangement for emergency liquidity funding is set up in advance, to ensure effective and timely access when required. 9 Confidential ab Deposit Guarantee Scheme Directive - Implementation » UK implementation › trigger event › “ex post” levy » annual limit £1.5 billion » liquidity from commercial funding or NLF › OR access bank levy “pre fund” » borrow from HM Treasury » levy to repay » interest payable › “Excess” pre fund – borrowed from NLF » HM Treasury/FSCS protocol › to be published 10 Confidential ab The Next Steps » Repay B&B » Agree HM Treasury/FSCS protocol » Implement risk based levies » Continue commercial borrowing 11 Confidential ab ANY QUESTIONS? 12 Confidential ab THANK YOU karen.gibbons@fscs.org.uk 13 Confidential ab