Golf 20/20

advertisement

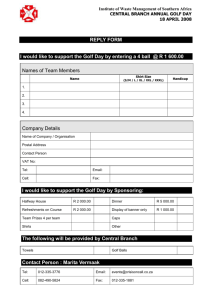

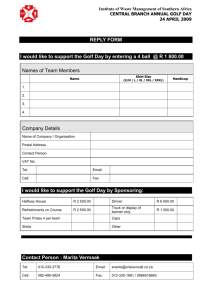

Ruffin Beckwith Senior Vice President World Golf Foundation COACH C Communications O O Juni Or GOlf A Alternative Facilities C College Golf Opportunities H H Researc Regulation Round • A regulation round of golf is defined by one person who tees off in an authorized “start” on a regulation golf course. The round is not defined by the number of holes played or the fees paid. Timothy W. Finchem Commissioner, PGA TOUR Chairman, World Golf Foundation Dr. Joe Beditz President National Golf Foundation GOLF 20/20: Consumer Research Findings Opportunities to Grow the Game Goals • In 2000, GOLF 20/20 set forth two ambitious participation goals for the year 2020: – Increase the number of participants in the U. S. from 35 million to 55 million – Increase the number of rounds from 570 million to one billion. Consumer Research Initiative • To help strategize on how to achieve those objectives, unprecedented consumer research was conducted: – Phase I -- Participation and Interest Survey mailed to 100,000 U. S. households – Phase II – In depth follow-up surveys to 1,500 golfers and 2,000 non-golfers with interest This Consumer Research Was Conducted to Address Several Key Objectives: • Identify our best and most profitable customers. • Identify our best and most profitable prospects, and determine how they can be identified and located. • Understand what strategies can be implemented to help convert those prospects. • Provide a benchmark against which future progress will be measured Consumer Research Team • Paul Metzler: PGA of America • Ken Lovell: PGA TOUR • Joe Beditz, Jim O’Hara: NGF • World Golf Foundation • NFO WorldGroup Golf Participation in the United States Growth in Golf Participants Since 1950 Millions of golfers 30 25 20 15 10 Plenty of money for course development Baby Boomers coming of age Recession, declining income Tiger Woods emerges CAGR = 4.3% Arnold and Jack on TV 5 0 1950 Source: NGF 1960 1970 1980 1990 2000 CAGR=Compound Annual Growth Golf Participation Rates by Decade Average annual golf participation rates 11.7% 9.5% 6.5% 3.5% 1960s Source: NGF 1970s 1980s 1990s Growth in Golfers – 1950 - 2000 Millions of Golfers 30 25 20 15 10 5 0 1950 Source: NGF 1965 1980 1995 2000 Participation Changes in the Last 5 Years • Over the past 5 years, the number of core and avid players are on the rise. Yet, the number of occasional golfers has dipped slightly. 3.4% -0.8% Occasional Golfers Core Golfers Participation in 2001 • The 2001 consumer research confirmed the existence of 36 million golf participants. 6.6 7.0 Core 11.8 4.0 1.7 36.0 Occasional Juniors Exclusive Alter. Facility Exclusive Users 4.9 Range Users Total Golf Participants Millions of Participants Avid Latent Demand in 2001 Millions of Prospects • There are 40+ million people in the United States who express an interest in playing or playing more than they do now. Express Interest in Playing or Playing More Express Interest and Fit Best Customer Profile 43.2 12.0 Good Prospects Best Prospects Jim O’Hara Vice President, Research National Golf Foundation What We Learned The 20/80 Rule Does Not Apply to the Golf Industry Golfers Playing 25+ Rounds Annually Account For Three-Fourths of Total Rounds Percent of Golfers 16% Occasional (1-7) 47% Core (8-24) 27% Avid (25+) 26% Source:Golf 20/20 Percent of Rounds Played 6% 78% Golfers Spending $1,000+ Annually Account For Three-Fourths of Total Spending Percent of Golfers Percent of Spending 25% Spend <$1,000 70% 75% Spend $1,000+ Source:Golf 20/20 30% But Not All Avid Golfers are Best Spenders and Not All Best Spenders are Avid Golfers 6.6 million Avid Golfers (25+) 7.6 Million Best Spenders ($1,000+) 2.5 Mil 4.1 Mil 3.5 Mil Thus, there are 10+ Million “Best Customers” Source:Golf 20/20 The Rule in the Golf Industry is 40/80 Percent of Golfers Other Golfers Percent of Rounds Played Percent of Spending 15% 19% 85% 81% 60% Best Customers Source:Golf 20/20 40% Best Customers Are Distinguishable There is a Distinct Demographic Profile Demographics Gender Age 18-39 30% Male 75% 40-64 51% Female 25% 65+ 19% Presence of Children Income <$50K 24% Under 13 30% $50-74K 21% 13-18 24% $75K+ 55% None 60% Source:Golf 20/20 Most Are Recreational Public Golfers Golf Characteristics Private Club Member Years Played Yes 27% <5 16% No 73% 5-9 18% 10-19 25% 20+ 41% Average Score <85 15% 85-99 38% 100+ 47% Source:Golf 20/20 They Have Distinct Lifestyle Characteristics • Best Customers are distinguishable by their perceived athleticism and physical fitness, sports TV consumption, traveling, and investing. Source:Golf 20/20 They Have Distinct Lifestyle Characteristics How Best Customers Can Be Distinguished From Other Golfers Source:Golf 20/20 Rank Best Golfers Views of Themselves 1 Athletic 2 Sports TV Viewer 3 Frequent Flyer 4 Investor 5 Domestic Traveler 6 Cell Phone User 7 Foreign Traveler 8 Into Physical Fitness And They Are Concentrated in Three Regions Source:Golf 20/20 There is Both Room and Opportunity to Grow Our “Best Customers” There Are Millions of Solid Prospects • There are 12 Million Adults in the U.S. Who Fit The Best Customer Profile, Express Interest in Playing or Playing More, But Are Not Currently Best Customers 3 12 Never Evers Best Prospects 6 3 Current Golfers Source:Golf 20/20 Former Golfers It Does Not Take Long to Cultivate a Best Customer Amount of Time It Took Best Customers To Become Committed to the Game from the Time They Started Playing the Game 2.8 years on Average 3+ years 26% < 3 months 35% 1-3 years 21% 3-12 mos 18% Source:Golf 20/20 Less than 1 Year 53% And Growing the Best Customer Base Can Have a Dramatic Impact on the Industry The Addition of a New Best Customer Could Result in an Average of 8 Times the Number of Rounds and 6 Times the Amount of Money Other Customer Best Customer Added Value Rounds Played 6 48 8X Annual Spending $265 $1,700 6X Source:Golf 20/20 We Can Find Adults Who Fit The Best Customer Profile On a National Basis The Areas Highlighted Represent Above Average Concentrations of Adults Who Fit The Best Customer Profile Source:Golf 20/20 And In Small Market Groups Raleigh-Durham-Chapel Hill, NC Source:Golf 20/20 Ken Lovell Director of Research and Development, PGA TOUR Additional Insights and Key Considerations Be Mindful of Time Constraints • Former Golfers Are Leaving Because of the Constraints of the Game on Their Time Reasons Why Former Golfers Quit Didn’t have time 62% Family obligations 38% Costs too much 29% Health reasons 18% No one to play with 16% Didn’t play well 12% Willingness to Spend 4+ Hours at the Course 73% 60% 38% Other Best Customers Golfers Source:Golf 20/20 Former Golfers Emphasize Ball Striking When Teaching and Help Forge Playing Partnerships Factors Influencing Enjoyment of Golf Ball Striking Golf’s Best Customers 29% 2 Playing Partners 19% 3 Course Conditions 9% 4 Score 8% 5 Exercise 8% 6 Course Aesthetics 9% 7 Weather 9% 8 Competition 5% 9 Treatment from Staff 4% Rank 1 Source:Golf 20/20 100% Opportunities for Industry Growth – Focus on Growing Best Customers Best Customers Other Golfers Former Golfers 35% 31% 28% 19% Ball Striking 21% 23% Playing Partners Consider Lowering Costs For Beginners Too Expensive $117 $59 Getting Expensive $55 Good Value $35 Source:Golf 20/20 $36 Best Customers $24 Prospective Golfers Continue to Fuel Junior Programs There is strong evidence to suggest that junior programs really pay off in the long run. 18 – 34 yr olds who started playing golf as a junior Average Rounds Played Average Household Spending/ Year Source:Golf 20/20 Not Exposed to a Structured Program Exposed to a Structured Program 12 19 58% Increase 71% Increase $608 $1,041 Promote Learning Percent Likely To Participate in Link Up 2 Golf 46% 36% Best Customers Source:Golf 20/20 Best Prospects Target Women Men Women 75% 25% Best Customers 65% 35% Best Prospects 4.2 Million Female Best Prospect s Recognize Best Customer Potential In All Groups All Golfers Women Golfers Minority Golfers Best Customers 40% 42% 35% Other Golfers 60% 58% 65% Dr. Joe Beditz President National Golf Foundation Key Thoughts Leading Into Monday and Tuesday Final Remarks • The stability of the golf industry is stronger than other industries given the 40/80 rule. • We have as many potential best customers as we do current best customers – and we can find them. • Best customers can be created quickly and the keys are ball striking and playing partners. • The industry should target prospects with efficient market level strategies. Final Remarks (cont.) • Women are an important target group – there are more female best customer prospects than female best customers. • Affordability is the key to attracting new players. • Time is the key to retaining players. • For long term growth, there is nothing more important than introducing kids to the game through structured junior programs. • The Link Up 2 Golf concept is well received, favorably priced, and represents a good tool for recruiting both short term and long term growth prospects. MONDAY Ruffin Beckwith Senior Vice President World Golf Foundation Alternative Facilities Mike Hurdzan Hurdzan and Fry Golf Course Design Alternative Facilities: What Are They? • Golf Ranges • Par Three Courses • Pitch & Putt Courses • Executive Courses • Courses of Non-traditional Hole Configuration Alternative Facilities: What Do They Mean to the Industry? • Lots of Theories, Not Many Facts Alternative Facilities: 2001 Objectives • Quantify How Many Alternative Facilities There Are • Determine the Qualities That Make For Successful Alternative Facilities • Examine the Relationship Between Traditional and Alternative Facilities • Determine Consumer Attitudes Toward Alternative Facilities Alternative Facilities: Today We’ll Learn the Results of Our Research From... • Dr. Peter Melvin, Sportometrics, on the facilities side • Jim O’Hara, NGF, on the consumer side Peter Melvin PH.D. Bobby McCormick PH.D. Sportometrics Alternative Golf Facilities Study GOLF 20/20 commissioned Sportometrics to perform research on alternative golf facilities • Build an Alternative Golf Facilities Database • Determine successful features of alternative facilities • Analyze the relationship between alternative and traditional facilities Golf 20/20 Alternative Golf Facilities Database Database created by compiling data from the multiple data sources and eliminating duplicates • Golf Digest • Golf Magazine • Golf Range Association of America • National Golf Foundation • United States Golf Association Golf 20/20 Alternative Golf Facilities Database • 5,542 alternative golf facilities in the United States • 5,312 alternative golf facilities open to the public, excluding military and private • 30.1 percent of all golf facilities in the United States are alternative; half are stand-alone golf ranges; and the other half have golf holes Alternative Golf Facilities Par 3s 30% Executives 16% Pitch & Putts 3% Other 1% Golf Ranges 50% Green Fees, Rounds and Age at Alternatives • The average 18-hole Weekend Green Fee is $16.25 • 28,920 average annual rounds played • 92 rounds per day on average • The average facility is 25.3 years old Success at Alternatives • Golfers prefer newer and longer alternative facilities • Golfers pay and play more at facilities with ranges • Golfers pay more for facilities that accept tee times • Golfers pay more for facilities with a beverage cart, snack bar, and restaurant Success at Alternatives • Golfers pay more at facilities with a full bar • Golfers pay more for a facility with a dress code requiring a collared shirt and not allowing denim • Fees and average rounds per day are higher in regions where courses are closed some portion of the year because of weather. However, total rounds per year are higher in warm climate regions where clubs are open more days. Relation of Alternative and Traditional Facilities Green fees and rounds are higher at traditional courses with lots of alternatives in close proximity Green fees and rounds at alternatives are higher where there are more traditional facilities Alternative and traditional facilities are complements, companions, and both components of a thriving golf market Impact on Green Fees at Alternative Facilities Located in Dense TraditionalCourse Area $17.20 $17.00 $16.80 $16.60 $16.40 $16.20 $16.00 $15.80 $15.60 Average 18-Hole Weekend Green Fee at Alternative Facilities Green Fee with Above Average Number of Traditionals in Area Impact on Rounds at Alternative Facilities Located in Dense TraditionalCourse Area 110 105 100 95 90 85 Average Rounds Per Day Rounds per Day with at Alternative Facilities Above Average Number of Traditionals in Area Conclusions • Alternative Golf Facilities are part of the overall golf market and golfing experience • The presence of Alternatives both aids and is aided by proximity to traditional 18-hole layouts • Overall Success of Golf should not exclude the important role played by Alternative Facilities Jim O’Hara Vice President, Research National Golf Foundation Objectives • Participation at Alternative Facilities was studied to answer the following key questions: – Who plays at alternative facilities? – Why do golfers choose alternative facilities? – Are alternative facilities a stepping stone for beginner golfers? Who Plays At Alternative Facilities? Regulation Course Players Comprise the Majority of Alternative Facility Participation 2.6 1.7 1.5 Juniors Additional Golfers Golf’s Best Customers Exclusive Alternative Facility Users 6.7 Million Adult Regulation Course Golfers 9.9 Millions of Participants 4.1 Total Alternative Facility Participants And Golf’s Best Customers Are Also Best Customers at Alternative Facilities Rounds Played at Alternative Facilities Junior Golfers 3% 55% Exclusive Alternative 25% Remaining Customers 17% Source:Golf 20/20 Best Customers However, The Majority of Regulation Course Players Do Not Play at Alternative Facilities % of Golfers Who Have Played at an Alternative Facility in the Past 12 Months Golf’s Best Customers Additional Golfers Junior Golfers Source:Golf 20/20 26% 27% 38% And Few of Best Customer Rounds Are Played at Alternative Facilities Rounds Played by Best Customers Alternative 6% Regulation 94% Source:Golf 20/20 Why Do Golfers Choose Alternative Facilities? Best Customers Use Alternative Facilities As A Practice Venue Top Reasons to Play Alternative Facilities Golf’s Best Customers Exclusive Alternative Facility Users Good Place to Practice My Short Game (64%) Less Expensive than a Regulation Course (60%) Takes Less Time than a Regulation Course (43%) Easy to Get a Tee Time (50%) Easy To Get a Tee Time (36%) Good Place to Practice My Short Game (40%) Less Expensive than a Regulation Course (31%) Takes Less Time than a Regulation Course (36%) Source:Golf 20/20 Are Alternative Facilities a Stepping Stone for Beginner Golfers? Alternative Facilities Are An Integral Part of Beginner Rounds When Readily Available Total Rounds Played Alternative Regulation 3 11 2 9 2 8 16 12 11 8 7 4 1999 2000 2001 Beginners with Alternative Supply (w/in 15 miles) Source:Golf 20/20 1999 2000 2001 Beginners w/o Alternative Supply Summary Summary • Regulation course players comprise the majority of Alternative Facility participation, and golf’s Best Customers are also Best Customers at Alternative Facilities. • However, the majority of Regulation Course players do not play at Alternative Facilities, and few of Best Customer rounds are played at Alternative Facilities. • Alternative Facilities are largely a practice venue for Best Customers, but are an integral part of rounds from beginner golfers when they are readily available. Summary (cont.) • The consumer research does seem to suggest that Alternative Facilities are largely a compliment to regulation facilities, particularly for Best Customers: • Best customers play Alternative Facilities when they are practicing their short game or when they don’t have the time for a full round at a regulation facility • Few are playing because of the higher expense or lack of availability relative to regulation facilities • This may suggest that play at Alternative facilities would have been a range visit or some other non-golf activity if the Alternative Facility were not present. Mike Hurdzan Hurdzan and Fry Golf Course Design ALTERNATIVE FACILITIES: ASSUMPTIONS That all participants in the Alternative Facility breakout sessions: • Endorse and support the GOLF 20/20 mission of growing the game. • Accept the new research as valid and a foundation for ongoing thinking. • Will focus on developing recommendations based on the following questions, or others with equal merit. ALTERNATIVE FACILITIES: QUESTIONS • Do we have enough information on alternative facilities? Is any other research or data needed? • How can alternative and regulation facilities specifically work together to meet their separate but overlapping business objectives? • How can alternative facilities play a more meaningful and functional role at the following levels: – Entry – Junior – Practice/Improvement – Retention – Family – Other ALTERNATIVE FACILITIES: QUESTIONS • Should a special player development program be developed for alternative facilities? If so, what does it look like and how should it be implemented? • Are alternative facilities appropriately represented within the industry and are they aligned with the issues facing the game? If not, how do we address this issue? Junior Golf • Adults 19-34 who were exposed to golf through a structured program are playing 50% more rounds and spending over 70% more on fees and equipment compared to those who were exposed to the game but not through a structured program. Junior Golf • Of every 10 kids exposed to the game through a structured program, six will become active adult golfers. Of every 10 kids exposed but not through a structured program, three will become active adult golfers. David Fay USGA Executive Director GOLF 20/20 Executive Board Jessica Turnwald USGA Foundation GOLF 20/20 Junior Initiative Communications Objectives: • Quantify the scope of junior golf in this country • Establish communication mechanisms that will enable and engage kids, their parents, and program administrators • Impact more kids through golf GOLF 20/20 Junior Initiative Strategies: • Develop, promote and maintain a master database of all junior programs in the U.S. • Develop and maintain a global junior golf website hosting the searchable database and featuring content for kids, parents and program administrators • Facilitate local/regional “summit” meetings for junior golf communities GOLF 20/20 Junior Initiative Progress Reports: • The Website – Developing a Brand/Logo – Virtual Tour of the Site – Phases • Junior Golf Summits – Sites – Successes GOLF 20/20 Junior Initiative GOLF 20/20 Junior Initiative Developing a Brand/Logo: • Family of logos • Stand-alone figure • Consistency of fonts • Dynamic personality • Versatility of character GOLF 20/20 Junior Initiative Phases: • Phase One - “November 12th Launch” – Development of Database – Registering Programs – Exhibiting Content Potential • Phase Two and beyond – Content Buildup – Kid-Friendly – Creative Interactions GOLF 20/20 Junior Initiative Junior Golf Summit Sites: • Philadelphia: November 2000 • Monterey County: March 2001 • North Florida (Ponte Vedra): July 28th • Southern California (LA): October 4th • Southwest (Albuquerque): October 20th • Texas (Ft. Worth): November 8th • Massachusetts (Boston): November 17th GOLF 20/20 Junior Initiative Junior Golf Summit Successes: • Positive Media Coverage • Distribution of Resources • Collaborative Communication • Displays of Organizational Leadership • Sharing of “Best Practices” • Follow-up and Action • It’s Beyond Junior Golf, It’s about Community GOLF 20/20 Junior Initiative Overall Needs Going Forward: • Widespread communication and content support of industry • Support of state golf associations, PGA sections, etc. in getting programs online to register • Promotion from within the industry • Continued vision and new alliances David Shapiro USGA Foundation GOLF 20/20 Junior Initiative Breakout Session Objectives: • Inclusion of all kids • How to enhance current efforts • Multi-lateral expansion of current efforts • Future issues to be addressed • Need for action-oriented input and clear responsibilities GOLF 20/20 Junior Initiative Breakout Session Philosophy: • Emphasis is on objectives not affiliations • Taking stock of where we are and where we have the ability to go • Seizing a unique opportunity to hear all voices and to collaborate GOLF 20/20 Junior Initiative Breakout Session Agenda: • Reaction to Current Junior Initiatives – Website Review – Summits • New Concepts for Junior Initiatives Joe Louis Barrow, Jr. National Director, The First Tee Senior Vice President, World Golf Foundation Oversight Committee Honorary Chairman President George Bush Jim L. Awtrey Judy Bell Timothy W. Finchem James H. Armstrong Ty M. Votaw Public Sector Partnerships • National Association of County Officials • National League of Cities • National Recreation & Park Association • US Bureau of Land Management • US Conference of Mayors • US Department of Housing & Urban Development • US Drug Enforcement Administration • White House Office of Drug Policy • Local Housing Authorities • Local School Districts Allied Partnerships • • • • • • • • • American Junior Golf Association American Society of Golf Course Architects Golf Course Builders Association of America Golf Course Superintendents Association of America National Golf Course Owners Association of America National Golf Foundation National Minority Golf Foundation National Minority Junior Golf Scholarship Foundation Tiger Woods Foundation Youth Service Partnerships • Police Athletic League • Boys & Girls Clubs of America • YMCA of the U.S.A. • Goodwill Industries Official Suppliers • Callaway Golf • Club Car Inc. • Coastal Netting and Steel Pole Company • Eagle One Golf Products • Electronic Arts • Greensmix • Kohler Company Official Suppliers • Lesco, Inc. • PGA TOUR Design Services, Inc. • Piganato Group • Pursell Technologies • Redden Nets • Simplot Turf and Horticulture • Spalding Worldwide • Standard Golf Company Official Suppliers • SynchroFlo • TaylorMade-adidas • The St. Paul Companies • The Toro Company • THOR GUARD Inc. • Titleist Footjoy Worldwide • TourTurf • Wittek Golf Supply Company Topics • First Step of Phase II • Life Skills and Golf Experience • Facility Development • Chapter Services • Resource Development • Communications Mission Statement • To impact the lives of young people around the world by creating affordable and accessible golf facilities to primarily serve those who have not previously had exposure to the game and its positive values. Phase II Goals • 500,000 Young People • 250 Facilities • 500 Affiliates The First Tee PARTICIPATION 500 400 500 300 325 200 185 100 0 100 20 50 30 50 2000 2001 2002 Annual 140 175 85 2003 2004 Cumulative (Thousands) 2005 The First Tee FACILITY DEVELOPMENT 250 200 150 250 210 170 100 130 90 *Estimated 50 by year-end * 50 40 40 40 40 40 2000 2001 2002 2003 2004 2005 0 Annual Cumulative The First Tee AFFILIATES 500 400 500 300 350 200 225 125 100 0 75 100 2002 2003 50 125 150 2004 2005 0 2000 2001 Annual Cumulative Youth Participation (2005) (Thousands) 800 700 600 500 534 400 364 300 200 34 100 134 20 84 64 2000 2001 0 Annual 224 140 170 50 90 2002 2003 2004 2005 Cumulative Increase Over Projected Goal Facility Development (2005) 250 200 250 150 4 100 205 135 170 44 50 35 35 45 2001 2002 2003 2004 2005 85 50 41 0 2000 Annual Cumulative Increase Over Projected Goal Affiliates (2005) 750 650 550 450 524 350 374 250 249 24 149 0 74 75 100 125 150 2000 2001 2002 2003 2004 2005 150 50 -50 Annual Cumulative Increase Over Projected Goal National Association Accomplishments Life Skills & Golf Experience Life Skills & Golf Experience • Chapters have embraced the Life Skills program as a key component of The First Tee • Regional Life Skills training sessions were attended by 90% of The First Tee chapters contracted as of April 1, 2001 • Par and Birdie level materials including Instructor workbooks, summary cards for volunteers and yardage books for students were successfully utilized • 100 students and 30 site leaders participated in The First Tee 2nd Annual National Academy Facility Development Facility Development • Regionally located Development Directors are now working closely in local communities • Local chapters helped to open 44 new facilities in 2001 • Local chapters have created 74 new affiliate relationships • Changing chapter needs accommodated through newly created operating grants and disbursement guidelines • Newly formed chapters are being guided by prototype designs Regional Development Directors Leon Gilmore Western Region Mountain Region Midwest Region Northeast Region Southeast Region Mark Lowry Henry Sandles Jennifer Wollman CH Swan Snapshot of Information Facility Profiles • 78 offering The First Tee experience • 53% are attached • 47% are stand alone Facility Configuration • • • • • • 18% of total are 3 hole 13% of total are 6 hole 45% of total are 9 hole 12% of total are 9+ hole 8% of total are 18 hole 5% of total are other Snapshot of Information Another Look • 76% of total are 3-9 hole • 87% of total are 3-9+ hole The First Tee is offering an alternative golf experience Snapshot of Information Chapter Finances • 59% of the total revenue is created from donations, contributions, grants, etc. • $310,000 is the average revenue produced • $375,000 is the average expense utilized at the facilities Snapshot of Information Rounds Utilization • On average total rounds played at each facility were approximately 18,000 • 32% of the 18,000 were accounted for as The First Tee or youth rounds Chapter Services • Facilities are utilizing the Participant Database • Chapters are tracking participants • The First Tee Card is being issued • Chapters are utilizing digital cameras to capture participant pictures • The First Tee clubs and balls are in play • Chapters will benefit from operational and comparative data being collected Snapshot of Information Participant Database and Profile • Distributed 48 computers • 58% are transmitting data • 5,139 The First Tee black and white cards were issued • 1,330 color photo cards were issued • 6,469 total cards issued • 78 facilities/chapters received clubs and balls Snapshot of Information Participant Database and Profile • 64,000 young people were exposed to the game through The First Tee • 6,347 are registered in the participant database Snapshot of Information 2,555 reported information on gender • 71% were male • 29% were female Snapshot of Information 2,877 Reported Information on Ethnicity • 46% were Caucasian • 19% were African American • 15% were Hispanic American • 9% were Asian American • .001% were Pacific Islander • 11% chose not to discuss Snapshot of Information 3,220 Report Program Participation as Follows: • 74% Pre-par • 24% Par • 2% Birdie • .0003% Eagle Allocation of National Resources 6% Chapter Development 30% Chapter Programs & Services 14% Admin./Fundraising 50% Chapter Grants Communications Communications • Refined a consistent message for the organization • Awareness of The First Tee among golf fans reaching 45% and 95% of those had a favorable opinion • Defined 9 core values of The First Tee • Opened The Learning Curve • Converted website to FrontPage format • Created new informational brochure • Publishing our 1st Annual Report Impact Impact • The lives of the young people participating in The First Tee • The communities and leaders that have embraced The First Tee • The partnerships that have been created to make The First Tee a reality Partner • Government • Private Sector • Youth Service Agencies • Existing Golf Organizations Develop • Affordable and Accessible Golf Facilities • The Full Potential of Young People VALUE David Pillsbury Co-CEO American Golf Corporation Will Mann Honorary Past President PGA of America Gary Stevenson OnSport Timeline • November ’00: Discussed at 20/20 Conference • February ’01: Raleigh area selected for pilot • March – May: Materials developed; meetings with Will Mann and area facilities • May 1: OnSport hired to execute program • May 15: Facility selection finalized • June 4: – PGA of America conducts “Instructor Orientation” – Link Up 2 Golf announced to the press and general public • June 19: First Class Program Objectives • Can we attract and retain golfers? • Will the program work at different types of golf facilities? • Is the program designed properly? • What is the most effective way to market the program? • What is the most efficient way to expand? • What does it cost to acquire a new golfer? Program Design • Provide an opportunity for new, infrequent, or former golfers to become engaged (or re-engaged) in golf. • Reduce factors which restrict or constrain participation: – Provide a low-cost introduction to the game – Create a comfortable environment by offering a relaxed, supportive learning experience – Introduce new players to other new players – Create a smooth transition from the range to the course – Provide ongoing opportunities to play in a non-intimidating environment Program Components • $199 (rental equipment included) • Orientation for new players (optional) • Facility tour and course review • Six hours of instruction, including basic fundamentals of the golf swing and short game • Five rounds of golf • Range balls Facilities • Two golf ranges • Five Public/Semi-private – Two central to population centers – Three sites more remote • One private club Research • Registration Form – Database • Application Form – Attitudinal/Demographic/ Golf Interest • Satisfaction Survey – Expectations/Satisfaction • Facility Survey – Program Design • Instructor Survey – Program Design Marketing • Call Center and Website launched • Print and radio advertising • Direct Sales • Flex funds • Public relations and celebrity involvement • Special events (New Golfer Day, Tournaments) Results 6/15 – 9/15 PARTICIPATION Level of Facility Involvement • During the three-month test, 334 participants at eight facilities – Four facilities more than 50 participants each – Two facilities 30 to 50 participants each – Two facilities less than 10 participants each PARTICIPATION Participant Profile • 20% never played golf • 17% have only hit balls at a range • 25% only played a few times in their lives • 37% hardly ever read about or watch golf • 34% never watch tournament golf • 75% with income $25k - $100k • 90% college grads, 40% of those graduate degrees • 61% of participants are female PARTICIPATION Why Did They Participate? I have always wanted to learn to play golf 76.3% Because of the value of the program 9.5% To improve my game 3.9% To meet new people 3.4% My spouse, family, and friends play 3.0% For business reasons 2.2% Other 1.7% PARTICIPATION Participant Feedback • Level of comfort AT a golf facility – Before LU2G: 60% somewhat or very uncomfortable – After LU2G: 80% comfortable or very comfortable • Level of comfort ON a golf course – Before LU2G: 64% somewhat or very uncomfortable – After LU2G: 63% comfortable or very comfortable • 92% rate overall program value “Very Good or Excellent” • 91.8% would highly recommend it to others • 73% plan on purchasing golf equipment in the next year: 45% of those at the LU2G facility, 33% at a discount store, 8% at another club FACILITIES Two Alternative Facilities • Very active marketing the program (37% of all participants) – Enthusiastic from the beginning – Conducted New Golfer Days – Referred all lesson requests to the program • Made own arrangements for the five rounds of golf • Sold one to two sets of clubs per class of eight FACILITIES Five Public/Semi-Private Facilities • Varying degrees of enthusiasm – One facility had 21% of total participant count – Other four combined had 24% of the total • Competing instruction programs weakened interest • Late start diminished effectiveness • Success totally dependent upon the willingness of the leadership FACILITIES Private Country Club • Initial reluctance • Late start; course under renovation • Promotion targeted to non-playing members – Put a blurb in newsletter – Followed immediately by a mailer that was an invitation to learn golf or get more engaged in the game • 62 total participants; couldn’t accommodate an additional 40 (signed up for Spring ’02) • Results will become one of the golf pros’ accomplishments in his annual report FACILITIES What They Said • Price was right: Great value, Ample compensation • Materials “very good”, but too much paperwork • Scheduling is difficult, requires flexibility • Call Center ineffective • Need local Link Up 2 Golf liaison to “keep us going” • Would like to continue in the program - several will do it “with or without you” Instructor Feedback • Overall satisfaction with program was “Very good” • All instructors expect additional lessons to graduates • 80% of instructors expect to sell equipment to graduates: instructors estimate 25% of participants will buy clubs • The ideal lesson size is six per group, not eight • Difficult to get new golfers confident enough to play in four 90-minute lessons MARKETING Source Of LU2G Information 38% Heard about it from someone they knew 18% Newspaper or magazine 17% At the golf facility 18% Other sources (TV news, company e-mailer, door-to-door, brochure drop, speeches, etc ) 8% Radio ad MARKETING What Worked • Direct mail impact at private club – 950 pieces, 62 signed up (40 more deferred to spring) • Celebrity involvement for PR (Immediate attention from media) • Direct sales – Corporations – Executive Women’s Golf Association – Rotary Clubs – Municipal recreation centers – Restaurants • Flex-fund and Special Events – New Golfer Day: three different locations, approx. 130 attended, 28 signed up for the program – Tournaments: five scheduled, three occurred, 100+ Golfers MARKETING What Didn’t Work • Advertising: Print and radio were helpful but inefficient. • Publicity: It is not a news story without celebrity involvement. Future Considerations Program Design Issues • Assess the opportunity to offer a stratified learning progression (novice, beginner, intermediate) where participants enter at their level of comfort • Start earlier in the Spring • Orientation should be mandatory • Pricing may vary at different types of facilities • Participants want more information on how to purchase equipment as part of the program Facilities • Facilities should be selected to participate after an application process rather than recruited • There seems to be a significant latent demand at family-oriented private clubs • There is a significant interest in building this program at military golf facilities, such as 80 Air Force facilities • Link Up 2 Golf must make it “easy” for the facilities to implement this program Marketing • The entire marketing plan must be built in cooperation with the selected facilities and take advantage of their respective strengths • Link Up 2 Golf must provide collateral materials and creative/placement of any advertising that supports facilities’ marketing plans • Good old fashioned sales calls on group and corporate business within a 15 mile radius of facilities are important What Next? • Consider expanding via Link Up 2 Golf clusters; take advantage of economies of scale • A cluster can be 48 facilities in a 200-mile radius (six markets, eight facilities each) • Local management is essential – PGA/LPGA representation – LU2G Management • Execution • Sales and marketing What Next? • Participating facilities should average 150 LU2G participants in calendar year • Research and Economic modeling in 2002 – Cost of LU2G participant – Retention rates – Value of new golfer LU2G Breakout • What is the value of a new golfer? • What should the structure of Link Up 2 Golf be, going forward • How should it expand? • How can we implement the Private Club model? TUESDAY See breakout results