Revenue Management

advertisement

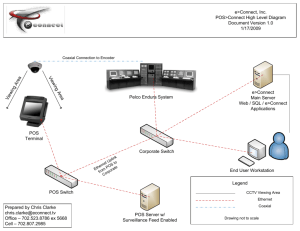

chapter 13 Revenue Management Class Name Instructor Name Date, Semester Foundations of Cost Control Daniel Traster Fixed and Variable Costs Sales Variable Costs Fixed Costs Profit Profit Sales Variable Costs Fixed Costs -Fixed costs do not change as sales change. -Variable costs change with sales fluctuations, but their percent of sales should remain roughly the same. 2 Variable Rate Variable Rate is the percent of sales that go toward covering variable costs. It is an average over time, since the rate changes slightly from month to month. Variable Costs Variable Rate = Sales 3 Variable Rate Graphic VC VR x Sales VC = Variable Costs; VR = Variable Rate 4 Contribution Rate Contribution Rate is percent of sales that covers fixed costs and percent; it is everything left after variable costs are taken out. Contribution Rate = 1 – Variable Rate • Since CR and VR are expressed in decimals, they add up to 1 (equivalent to 100%). • Similar concept to food cost percent and contribution margin, but applied over all sales for a longer period of time 5 Example 13a Business has monthly variable costs of $28,900, fixed costs of $22,400 and profit of $800. Calculate total sales dollars, variable rate, and contribution rate. 1) Sales = Variable Cost + Fixed Cost + Profit = $28,900 + $22,400 + $800 = $52,100 1) VR = VC ÷ Sales = $28,900 ÷ $52,100 = 0.555 2) CR = 1 – VR = 1 – 0.555 = 0.445 6 Predicting Profit When only variable rate is known (not variable costs), use the variable rate graphic to calculate variable costs, then… Profit Sales Variable Costs Fixed Costs 7 Example 13b Restaurant has VR of 0.555 and FC of $22,400. Calculate profits if sales are $70,000. 1) Variable Cost = Variable Rate X Sales = 0.555 X $70,000 = $38,850 2) Profit = Sales – Variable Costs – Fixed Costs = $70,000 - $38,850 - $22,400 = $8,750 8 Correcting a Loss When a business operates at a loss, it is not earning enough to cover fixed costs. To correct this problem: A) Increase contribution rate by raising prices or cutting variable costs. B) Increase Sales Volume. 9 Table 13.1: Profit Changes as VR and Sales Change Sales Var. Rate Cont. Rate Fixed Cost Var. Cost Profit $150,000 0.741 0.259 $47,000 $111,150 ($8,150) $150,000 0641 0.359 $47,000 $96,150 $6,850 $150,000 0541 0.459 $47,000 $81,150 $21,850 $150,000 0.741 0.259 $47,000 $111,150 ($8,150) $175,000 0.741 0.259 $47,000 $129,675 (1,675) $200,000 0.741 0.259 $47,000 $148,200 $4,800 10 Lessons from Table 13.1 • There is a minimum sales volume needed to generate a profit with a given variable rate and fixed cost. • It is easier to generate profit by controlling costs than by increasing sales, but costs can only be cut so far. Cost/Volume/Profit Analysis is a comparison of how company’s profit shifts as business volume and variable costs change. 11 Break-Even Point The Break-Even Point is point at which a business neither loses money nor earns a profit; profit= 0. Fixed Cost + Profit Sales = Contribution Rate 12 Break-Even Point Can rewrite formula as… Fixed Cost + Profit Sales = 1- Variable Rate • For break-even point, insert profit = 0 • For given profit target, insert the profit amount into the formula 13 Example 13c Restaurant has fixed costs of $84,900. Variable Rate is 0.573. What is break-even point? Sales = FC+ Profit = 1- VR $84,900 + 0 1- 0.573 = $198,829 14 Example 13d Owner of restaurant in Example 13c wants to make $10,000 profit. How many sales dollars are needed to reach the profit goal? Sales = FC+ Profit = 1- VR $84,900 + 10,000 1- 0.573 = $201,717 15 Converting Sales Dollars to Guests Use the following equation to calculate breakeven point or sales needed for profit goal in terms of number of customers. Sales Number of Customers = Check Average 16 Example 13e Restaurant hits profit target at $201,171 in sales. If check average is $40.89, how many customers are needed to hit the profit goal? Number of Customers $201,171 Sales = = Check Average $40.89 = 4,920 customers 17 Example 13f Annual fixed costs are $93,800; VR is 0.649. Guest check average is $27.45. What is break-even point in number of customers? $93,800 +0 Sales = $267,236 = 1 – 0.649 Customers = $267,236 = 9,736 $27.45 Always round up for BEP calculation 18 Break-Even Point Graph Guests on X axis; Dollars on Y axis. 1) Start with horizontal line at fixed cost amount 2) Chart sales line using check average X guests 3) Chart total cost as variable costs + fixed costs. In a spreadsheet, this is the fixed cost amount + (Sales X VR). Intersection of total cost and sales is Break-Even Point Wedge to right of BEP is profit; Wedge to left of BEP is loss. 19 Break-Even Point Graph 20 Break-Even Point and Management Decisions • Increasing sales prices makes the sales line steeper (in the graph). • Cutting variable costs makes the total cost line flatter. • Either change causes the break-even point to move further left (fewer customers and dollars) • But either change can also reduce the number of customers who come to the restaurant. 21 Break-Even Point and Management Decisions • By estimating change in number of customers or sales dollars, managers can decide whether a change to pricing or costs would generate more profit or less profit. • If business volume increases enough, lowering prices can actually increase profit 22 Example 13g • Restaurant averages 4,200 guests/month. • Monthly VC averages $151,200. • Monthly fixed costs are $88,200. • Average check is $60.00. • Management forecasts that by lowering prices 10%, it would see a 7% increase in the number of customers. Would this change increase or decrease profit? 23 Example 13g (cont.) Current Scenario: Sales = 4,200 guests X $60/guest = $252,000 Profit = $252,00 - $151,200 - $88,200 = $12,600 Also, need to know variable cost per customer. VC/customer = $151,200 (VC) ÷ 4,200 (guests) = $36 variable cost per guest 24 Example 13g (cont.) New Scenario: prices down 10%, guests up 7% Profit = Sales – VC – FC but first recalculate new Sales and VC numbers. Prices 10% lower = Check average 10% lower Average check = $60.00 X (1 – 0.1) = $54.00 Customers = 4,200 X (1 + 0.07) = 4,494 Sales = 4,494 guests X $54/guest = $242,676 25 Example 13g (cont.) New VC = $36 (old VC/customer) X 4,494 (new customer count) = $161,784 Profit = $242,676 (sales) - $161,784 (VC) - $88,200 (FC) = -$7,308 loss Prices are best left unchanged. 26 Cost/Volume/Profit Assumptions Cost/Volume/Profit scenarios are based on assumptions, which may or may not be accurate. • Managers cannot know for certain how changes will impact business and profit until they are fully implemented. • But the analyses are educated guesses, which is better than nothing. 27 Break-Even Point and Expanding Hours • Use cost/volume/profit analysis to determine if extending business hours makes financial sense. • Treat the additional hours as a mini-study in which the minimum additional costs that must be incurred (including minimal labor) are treated as fixed costs and the additional sales are estimated. 28 Example 13h Manager estimates that keeping the bar open an extra hour, he can bring in an extra $127 in drink sales. Beverage cost is 23.5%. To remain open, manager must spend another $36 in labor and $47 in utilities and other fixed costs. What is the breakeven point for this extra hour? FC BEP = 1- VR = $36 + $47 1- 0.235 = $108.50 in sales 29 Example 13h (cont.) If management gets $127 in sales, how much profit would it make? Variable Cost = $127 (sales) X 0.235 (VR) = $29.85 Profit = $127 (sales) - $29.85 (VC) – ($36+$47) (FC) = $14.15 30 Marketing: 4 ways to increase revenue 1. Market Development 2. Product Development 3. Market Penetration 4. Diversification 31 External Marketing Market outside the 4 walls of the business to bring in new customers. • Advertising • Public Relations or PR • Signage • Internet Exposure 32 Internal Marketing Market to the current customer base. • Menu • Electronic Communication • Loyalty Programs • Servers • Food and Drink Presentation 33 Server Marketing Techniques Suggestive Selling • when servers encourage sales of certain foods or additional menu categories Upselling • when servers encourage the customer to spend more money on a higher quality product • often used for alcohol sales. 34 POS Systems and Technology POS systems are ordered with various levels of software (at corresponding costs), so management must decide which functions is wants the POS to do and which the employees/managers will do by hand or on another computer system. 35 How Technology Drives Revenue POS Increases service speed and maximize customer flow, by: • Recommending reservation counts • Forecasting wait times • Alerting management of a delay in customer service • Vibrating pagers keep servers on floor instead of in kitchen • Pagers or cell phone calls keep waiting guests comfortable outside waiting area • Hand-held devices process credit cards at table 36 How Technology Drives Revenue POS Increases service speed and maximize customer flow, by: • Screens in kitchen connect to POS to track orders and highlight delays • Mobile phone apps allow guests to create and settle tab without a server • Guests can place an order for take-out without going through a person • POS creates menu mix reports for any time period 37 How Technology Drives Revenue POS Increases service speed and maximize customer flow, by: • Tracks business volume and item sales in real time, so manager can make immediate decisions to push certain items. • Can store guest personal information and buying patterns, which helps with service, targeted marketing, and loyalty building • Technology must support the company’s brand 38 How Technology Controls Costs POS helps control costs by: • Forecasting in 15-minute increments and recommend employee schedule to match customer flow • Serving as company’s time clock • Tracking employee vacation and schedule requests • Requiring all food ordered to be assigned to an account and employee, so theft is difficult • With recipes, POS can use menu mix and forecasts to adjust recipe yields and generate kitchen production schedule 39 How Technology Controls Costs POS helps control costs by: •With ingredient costs and recipes entered, POS can track standard food cost and theoretical inventory in real time and recommend food orders •(Physical inventory must still be taken to check on theft and waste) •POS can notify managers of employees with large number of voids, no sales, or other errors •POS is a cash register and can notify manager when to empty till or get change 40 How Technology Controls Costs POS helps control costs by: •POS records server tips for proper tip payment and income tax records •POS can create data reports for most management functions – labor cost, food cost, expense percents, average check, etc. •For multi-property businesses, POS can compare data reports across units or compile a single report for all units 41 Why Learn the Non-Electronic Systems at All • Each POS function requires additional purchase cost • Some functions require extensive employee data input for them to work at all • Working by hand or on a standard computer may be more cost-effective • Managers must keep working when the power goes out. 42 Why Learn the Non-Electronic Systems at All • Managers must understand all of the system data and calculations to know how to use them in making management decisions. • POS only gives information; managers must interpret it and make decisions from it and from other non-POS information • POS only does what it is programmed to do; manager must be able to give it the right information for it to work effectively. 43