Electronic Payment Systems

advertisement

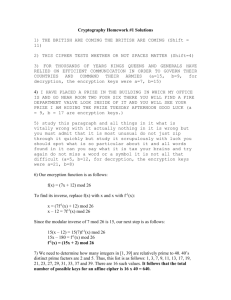

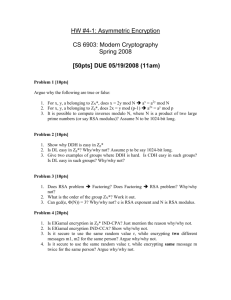

Electronic Payment Systems Electronic Payment Systems • Transaction reconciliation – Cash or check Electronic Payment Systems – Intermediated reconciliation (credit or debit card, 3rd party money order) Electronic Payment Systems • Transactions in the U.S. economy Type of Payment Volume (%) in Millions of Transactions Value (%) in Trillions of Dollars Checks 59,400.0 (96.3%) 68.3 (12.5%) Fedwire 69.7 (0.1%) 207.6 (37.9%) CHIPS 42.4 (0.1%) 262.3 (47.9%) ACH 2,200.0 (3.5%) 9.3 (1.7%) Total 61,712.10 547.5 Electronic Payment Systems • Online transaction systems – Lack of physical tokens • Standard clearing methods won’t work • Transaction reconciliation must be intermediated – Informational tokens • Ecommerce enablers – First Virtual Holdings, Inc. model • Online payment systems (financial electronic data interchange) – Secure Electronic Transaction (SET) protocol supported by Visa and MasterCard • Digital currency Electronic Payment Systems – Digital currency • Non-intermediated transactions • Anonymity • Ecommerce benefits – Privacy preserving – Minimizes transactions costs – Micropayments – Security issues with digital currency • Authenticity (non-counterfeiting) • Double spending • Non-refutability Electronic Payment Systems – Contemporary forms of digital currency • Ecash – Set up account with ecash issuing bank » Account backed by outside money (credit card or cash) – Move credit from account to ecash mint » Public key encryption used to validate coins: third parties can “bite” the coin electronically by asking the issuing bank to verify its encryption – Spend ecoin at merchant site that accepts ecash – Merchant then deposits ecoin in his account at his participating bank, or keeps it on hand to make change, or spends the ecash at a supplier merchant’s site. • Role of encryption Encryption • The need for encryption in ecommerce – Degree of risk vs. scope of risk – Institutional versus individual impact – Obvious need for ecurrencies. • Public key cryptography: an overview – One-way functions – How it works • Parties to the transaction will be called Alice and Bob. • Each participant has a public key, denoted PA and PB for Alice and Bob respectively, and a secret key, denoted SA and SB respectively Encryption • Each person publishes his or her public key, keeping the secret key secret. • Let D be the set of permissible messages – Example: All finite length bit strings or strings of integers • The public key is required to define a one-to-one mapping from the set D to itself (without this requirements, decryption of the message is ambiguous). – Given a message M from Alice to Bob, Alice would encrypt this using Bob’s public key to generate the so-called cyphertext C=PB(M). Note that C is thus a permutation of the set D. • The public and secret keys are inverses of each other – M=SB(PB(M)) – M=SA(PA(M)) • The encryption is secure as long as the functions defined by the public key are one-way functions Encryption • The RSA public key cryptosystem – Finite groups • Finite set of elements (integers) • Operation that maps the set to itself (addition, multiplication) • Example: Modular (clock) arithmetic – Subgroups • Any subset of a given group closed under the group operation – Z2 (i.e. even integers) is a subgroup (under addition) of Z • Subgroups can be generated by applying the operation to elements of the group • Example with mod 12 arithmetic (operation is addition) Encryption 1 x mod 12 2 x mod 12 Encryption 3 x mod 12 4 x mod 12 Encryption 5 x mod 12 6 x mod 12 Encryption 7 x mod 12 8 x mod 12 Encryption 9 x mod 12 10 x mod 12 Encryption 11 x mod 12 Encryption • A key result: Lagrange’s Theorem – If S’ is a subgroup of S, then the number of elements of S’ divides the number of elements of S. – Examples: Z 2 Z12 , Z 2 6 Z12 12 Z 3 Z12 , Z 3 4 Z12 12 Z 4 Z12 , Z 4 3 Z12 12 Z5 Z12 , Z5 12 Z12 12 Encryption • Solving modular equations – RSA uses modular groups to transform messages (or blocks of numbers representing components of messages) to encrypted form. – Ability to compute the inverse of a modular transformation allows decryption. – Suppose x is a message, and our cyphertext is y=ax mod n for some numbers a and n. To recover x from y, then, we need to be able to find a number b such that x=by mod n. – When such a number exists, it is called the mod n inverse of a. – A key result: For any n>1, if a and n are relatively prime, then the equation ax=b mod n has a unique solution modulo n. Encryption • In the RSA system, the actual encryption is done using exponentiation. • A key result: Fermat’s Little Theorem If p is pr ime, then for any a Z p a 0, a p 1 mod p 1 Encryption • RSA technicals – – – – Select 2 prime numbers p and q Let n=pq Select a small odd integer e relatively prime to (p-1)(q-1) Compute the modular inverse d of e, i.e. the solution to the equation de 1 mod p 1q 1 – Publish the pair P=(e,n) as the public key – Keep secret the pair S=(d,n) as the secret key Encryption – For this specification of the RSA system, the message domain is Zn – Encryption of a message M in Zn is done by defining C P( M ) M e mod n – Decrypting the message is done by computing S C C d mod n Encryption – Let us verify that the RSA scheme does in fact define an invertible mapping of the message. For any M Z n P S M S P M M ed mod n. Since d and e are modular inverses of each other ed 1 k p 1q 1 for some integer k . Hence, M ed mod n MM k ( p 1)( q 1) mod n MM ( p 1) M k ( q 1) mod n M M ( q 1) mod n M (the last steps follow by applying Fermat' s theorem.) k Encryption – Note that the security of the encryption system rests on the fact that to compute the modular inverse of e, you need to know the number (p-1)(q-1), which requires knowledge of the factors p and q. – Getting the factors p and q, in turn, requires being able to factor the large number n=pq. This is a computationally difficult problem. – Some examples: http://econ.gsia.cmu.edu/spear/rsa3.asp Encryption • Applications – Direct message encryption – Digital Signatures • Use secret key to encrypt signature: S(Name) • Appended signature to message and send to recipient • Recipient decrypts signature using public key: P(S(Name)=Name – Encrypted message and signature • Create digital signature as above, appended to message, encrypt message using recipients public key • Recipient uses own secret key to decrypt message, then uses senders public key to decrypt signature, thus verifying sender Policy Issues • Privacy and verification • Transaction costs and micro-payments • Monetary effects – Domestic money supply control and economic policy levers – International currency exchanges and exchange rate stability • Market organization effects – Development of new financial intermediaries • Effects on government – Seniorage – Legal issues