Invoicing Trip & Equipment Grant

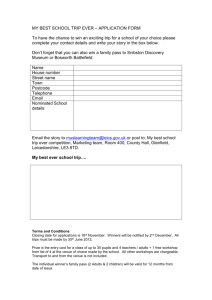

advertisement

Maintaining Accountability for the Transportation Disadvantaged Program Your Responsibilities as the CTC / STP Agenda Introduction • Background • What is a CTC / STP Role & Coordination • Expectations / Coordination efforts • Relationship Administration • Grants & Agreements • Requirements • Deliverables • Invoicing • Record Retention Introduction Background Commission for the Transportation Disadvantaged • Chapter 427, Florida Statutes • Rule 41-2, Florida Administrative Code • Independent State Agency; administratively within FDOT • Accountable to Governor & Legislators • Must comply with State and Federal rules and regulations • Subject to State and Federal review and audits Introduction What is a CTC / STP? - Back to basics • CTC – Community Transportation Coordinator • • • • • Selected through Planning Agency procurement process Recommended by Planning Agency to CTD Designation for 5 years Government, Non-Profits and Profits Sole, Partial or Complete Broker • STP – Subcontracted Transportation Provider • CTCs and Non-CTCs • Non-CTCs selected through CTD procurement process Role & Coordination Expectations CTC • Become and remain apprised of all TD resources available or planned in service area. (Mobility Management) • Provide or arrange 24-7 transportation as needed for sponsoring agency(s). • Comply with all grants, contracts and agreement requirements. STP • Provide or arrange 24-7 Medicaid Non-Emergency Medical Transportation • Comply with all contract requirements Role & Coordination Relationships CTC STP • Work cooperatively with CTD Project Manager, Planning Agency and LCB. • Work cooperatively with CTD Project Manager, AHCA area office staff. • Other Medical Providers • • • • • • • • • TDSP Priorities Eligibility Regular Operating Reports Evaluation Sponsoring Agencies Funding Sources Local Networks MMAs, HMOs • • • • PPEC Dialysis Nursing Homes Hospitals Administration Grants/Agreements • Trip & Equipment Grant • Shirley Conroy Rural Capital Equipment Grant • Medicaid STP Agreement Requirements Deliverables Invoicing Record Retention Administration • State Government Funding • Taxpayers Dollars • Accountability • Audits Trip & Equipment Grant Purpose • Funds deposited in the trust fund may be used to subsidize a portion of a transportation disadvantaged person’s transportation costs which is not sponsored by any agency, only if a cash or inkind match is required. • Funds may also be used to purchase capital equipment that is used for the provision of nonsponsored transportation services. Trip & Equipment Grant Requirements • CTC is only eligible recipient • Grant Program Manual and Application Forms • Eligible Expenditures • Non-sponsored trips • Capital Equipment • Funding • • • • • • Reimbursement Grant Local Match Requirement Trust Fund Allocation Voluntary Dollar Funds Transfer of Planning Allocation Rates • Grant Approval • Resolution • Effective Date • Amendments must be submitted to CTD for consideration no later than April 30th. Trip & Equipment Grant Requirements – Rider Eligibility What is the GOAL of having TD Eligibility? Ensure that the persons who are receiving benefits from the funding meet the requirements of the Chapter 427, F.S How the Statute Defines Transportation Disadvantaged: “Those persons who because of physical or mental disability, income status, or age are unable to transport themselves or to purchase transportation and are, therefore, dependent upon others to obtain access to health care, employment, education, shopping, social activities, or other life-sustaining activities, or children who are handicapped or high-risk or at-risk as defined in s. 411.202. (Florida Stautes 427.011(1)) Trip & Equipment Grant Requirements – Rider Eligibility What is Required & Who is Responsible? • Local TD Eligibility Policy to be developed by CTC & LCB • Local Policy based upon CTD Criteria • Local Policy must be detailed in TDSP • CTC implement Policy as stated in TDSP Trip & Equipment Grant Requirements – Rider Eligibility At a minimum: • No other funding available – A person would not be considered TDTF eligible if another purchasing agency is responsible for such transportation. • No other means of transportation is available – As specified by the LCB and CTC. (The dreaded car in driveway dilema) • Public Transit – If fixed route transit is available the person must demonstrate why it cannot be used. • Physical or mental disability – Disability as outlined in the ADA of 1990. • Age – As specified by the CTC and LCB. • Individual and household income status is a specified percent of the poverty level – As specified by the CTC and LCB. • No self-declarations allowed – The CTC will use an enrollment process that substantiates the individual’s ability to meet the criteria listed and any other CTC determined criteria. • Ability to pay – The CTC & LCB may establish an ability to pay policy for ‘non-sponsored” customers using a sliding scale based on the customer’s income and/or assets status. Trip & Equipment Grant Requirements – Rider Eligibility Audit Findings: • Non-sponsored TD not defined in TDSP • No documentation maintained • Insufficient documentation maintained Best Practices: • Standard In-take form • Periodic Recertifications • Self-monitoring Trip & Equipment Grant Requirements – Equipment • Allowable Equipment including but not limited to: • Vehicles to be used to transport TD Population; not Fixed Route • Vans, SUVs, Buses, Sedans • Computer Hardware/software • Communication equipment • Support equipment above $500 per piece • Must be no more than 25% of total grant amount, excluding voluntary dollars • 10% match Trip & Equipment Grant Requirements – Equipment • LCB approval • Equipment must be included in grant; Do not purchase equipment before initial grant or amendment is executed • Application for Vehicle Title must reflect CTD as lienholder. • Vehicle must be insured • All equipment purchased must be maintained appropriately Trip & Equipment Grant Requirements – Voluntary Dollar Funds • Voluntary Dollar Funds are local donated funds from Motor Vehicle Registrations • Funds are returned to donating county • Must be matched; maybe soft/in-kind • Usually invoiced at beginning or end of grant • Support documentation Trip & Equipment Grant Deliverables • Ridership eligibility documents must be maintained by CTC • Trip Detail Report and Summary Report are submitted with invoices • Rate Model Worksheets must match rates for services in Grant • Vendor Invoice for Capital Equipment purchases Trip & Equipment Grant Invoicing • Use CTD Invoice Template • Information must be correct and should come directly from executed grant • • • • • • • vendor name & address, respective vendor number contract number grant execution date grant termination date type of service unit cost • Reimbursement will be rejected if any element is incorrect. Trip & Equipment Grant Invoicing • Support documentation must accompany all invoices. • Trip Reimbursement • Summary Report condensing detail report per service type being invoiced • • • • Ambulatory (trip and/or mile) Wheelchair (trip and/or mile) Stretcher (trip and/or mile) Bus Passes • • • • • Rider Name Date of Service Trip Length if invoicing includes mileage Trip Type (Ambulatory/Wheelchair/Stretcher/Bus Pass) Cost of trip • Rider Trip Detail Report Trip & Equipment Grant Invoicing • Support documentation must accompany all invoices. • Equipment Reimbursement • Invoice from Vendor with Serial number or identification number • Application for Title for Vehicle Purchase reflecting CTD as lienholder • Invoice from Vendor with $0 Balance or canceled check to indicate reimbursement. • Submit Invoice and Support Documentation to: FLCTDInvoice@dot.state.fl.us Trip & Equipment Grant Record Retention • Retain sufficient records demonstrating its compliance with the terms of the Trip and Equipment Grant agreement for a period of at least five years from the date the Single Agency Audit report is issued. • Allow the Commission, or its designee, CFO, or Auditor General access to such records upon request. • Ensure audit working papers are made available to the Commission, or its designee, CFO, or Auditor General upon request for a period of at least five years from the date the audit report is issued, unless extended in writing by the Commission. • Electronic documents are included Shirley Conroy Rural Capital Equipment Grant Purpose • To provide financial assistance to CTCs in rural areas for the purchase of capital equipment. • FDOT transfers $1.4 Million to CTD Shirley Conroy Rural Capital Equipment Grant Requirements • CTC is only eligible recipient • Grant Program Manual and Application Forms • Eligible Expenditures • Capital Equipment • Funding • Application Process (Amount needed, specific equipment, support for need, impact and value of project to coordinated system) • Reimbursement Grant • Local Match Requirement • Application Review/Selection and Grant Approval • Subcommittee recommends grant awards • Resolution • Effective Date Shirley Conroy Rural Capital Equipment Grant Deliverables • Application documents • Invoice for Vendor • Equipment must be included in Grant and/or amendment prior to purchase • Amendments must be submitted to CTD for consideration no later than April 30th. Shirley Conroy Rural Capital Equipment Grant Invoicing • Use CTD Invoice Template • Information must be correct and should come directly from executed grant • • • • • • vendor name & address, respective vendor number contract number grant execution date grant termination date Capital equipment purchased as specified in grant • Reimbursement will be rejected if any element is incorrect. Shirley Conroy Rural Capital Equipment Grant Invoicing • Support documentation must accompany all invoices. • Equipment Reimbursement • Invoice from Vendor with Serial number or identification number • Application for Title for Vehicle Purchase reflecting CTD as lienholder • Invoice from Vendor with $0 Balance or canceled check to indicate reimbursement. • Submit Invoice and Support Documentation to: FLCTDInvoice@dot.state.fl.us Shirley Conroy Rural Capital Equipment Grant Record Retention • Retain sufficient records demonstrating its compliance with the terms of the Grant agreement for a period of at least five years from the date the Single Agency Audit report is issued. • Allow the Commission, or its designee, CFO, or Auditor General access to such records upon request. • Ensure audit working papers are made available to the Commission, or its designee, CFO, or Auditor General upon request for a period of at least five years from the date the audit report is issued, unless extended in writing by the Commission. • Electronic documents are included Medicaid Non-Emergency Transportation STP Agreement Purpose • To provide Medicaid Non-Emergency Transportation Services for eligible recipients. Medicaid Non-Emergency Transportation STP Agreement Requirement • Agreement with CTD • CTC or STP (non-CTC) • Gatekeeping • • • • Eligibility Application Medicaid eligible; not MMA recipient No other transportation resources available Receiving Medicaid compensable Service • Provide Transportation • Ambulatory/Wheelchair/Stretcher/Bus Passes/Air Transport • Transportation Related Expenses Medicaid Non-Emergency Transportation STP Agreement Deliverables • Encounter Data • Complete, Accurate, Timely • Only Eligible Recipients covered by CTD; not MMA • Elements: • Do not include numbers with names • Be consistent with addresses • Correct Trip Cost (Rate Model Worksheets Unsubsidized Rates • Reports • • • • • • Grievance System Summary Reports Trip Travel Expense Reports Safety Compliance Self-Certification Report Systems Outage Notification Critical Incident Report Performance Measures Medicaid Non-Emergency Transportation STP Agreement Invoicing • Use CTD Invoice Template http://www.dot.state.fl.us/ctd/programinfo/finance/newinvoice.htm. • Information must be correct and should come directly from executed grant • • • • • • • vendor name & address, respective vendor number contract number grant execution date grant termination date type of service unit cost • Reimbursement will be rejected if any element is incorrect. Medicaid Non-Emergency Transportation STP Agreement Invoicing • Support documentation must accompany all invoices. • PDF Document showing Member Months and dollar amount • Trip Report from CTDFL • Submit Invoice and Support Documentation to: ctd-medicaid@dot.state.fl.us Medicaid Non-Emergency Transportation STP Agreement Record Retention • Retain sufficient records demonstrating its compliance with the terms of the STP agreement for a period of at least five years from the date the Single Agency Audit report is issued. • Allow the Commission, or its designee, AHCA, CFO, or Auditor General access to such records upon request. • Ensure audit working papers are made available to the Commission, or its designee, CFO, or Auditor General upon request for a period of at least five years from the date the audit report is issued, unless extended in writing by the Commission. • Electronic documents are included. Questions? Project Managers: Area 1 Cecile Del Moral (850) 410-5702 cecile.delmoral@dot.state.fl.us Area 2 Angela Cavanaugh (850) 410-5715 angela.cavanaugh@dot.state.fl.us Area 3 Dan Zeruto (850) 410-5704 dan.zeruto@dot.state.fl.us Area 4 Robert Craig (850) 410-5713 robert.craig@dot.state.fl.us Area 5 Sheri Powers (850) 410-5710 sheri.powers@dot.state.fl.us Area 6 John Irvine (850) 410-5712 john.irvine@dot.state.fl.us Financial Staff: Elmer Melendez (850) 410-5707 Elmer.melendez@dot.state.fl.us Ray Anderson (850) 410-5722 Ray.Anderson@dot.state.fl.us Marcus Mack (850) 410-5711 Marcus.mack@dot.state.fl.us Thank you! Karen Somerset, Assistant Director (850)410-5701 Karen.somerset@dot.state.fl.us