The Energy Innovation System

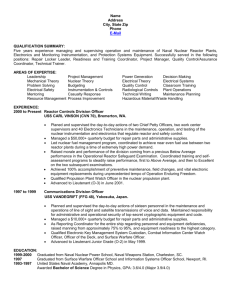

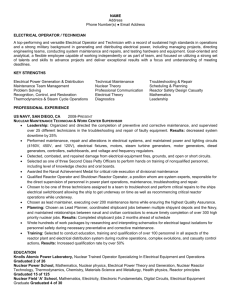

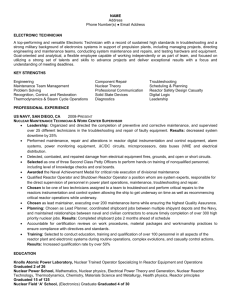

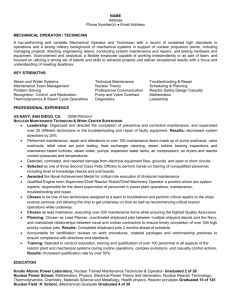

advertisement