Extractive Industries Transparency Initiative

advertisement

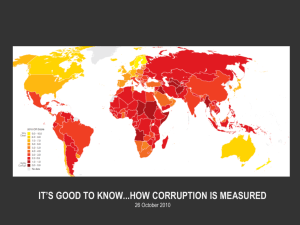

Petroleum Sector Corruption OGMC/ PREM/ OPCS BBL Seminar Series Presenters: Charles McPherson, COCPO Stephen MacSearraigh, Consultant Discussants: Clive Armstrong, COCDR Erika Jorgensen, OPCCE Outline of Presentation “Paradox of Plenty” Ominous correlations Corruption typology Relevant actors Oil value chain Remedies and responses Extractive Industries Transparency Initiative (EITI) “Paradox of Plenty” Widespread resource wealth in developing countries Potential for good has not been realised Resource rich developing countries have experienced: • Low per capita growth • Slow progress on human development • Social and political instability and violence The Record in Oil-Rich Africa Oil-rich countries include: Nigeria, Angola, Equatorial Guinea, Cameroon, Gabon, ROC, Sudan, Chad Significant resources: 4MMBD or 5% of world production High dependency:70% of government revenues Below average per capita Africa income Below average scores on infant mortality, life expectancy, literacy Instability and violence: Nigeria, Angola, Chad, Sudan, ROC… “Awash in Oil, Mired in Poverty” “Oil Fuels War and Corruption” Role of Governance Good governance is critical…. Good governance has multiple features: • • • • • • • • Clear and stable laws and regulations Rule of law High level of capacity and skills in government Fiscal monetary and budget discipline Open dialogue between government and civil society Public sector/private sector balance Transparency Control of corruption Resource-rich developing countries do not score well on governance, or corruption… Ominous Correlations: Oil and Governance Ominous Correlations: Oil and Corruption Transparency International 2000 Corruption Perceptions Index: Country 1 2 3 4 5 6 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Country Finland Denmark New Zealand Sweden Canada Norway Netherlands United Kingdom Luxembourg Switzerland Australia USA Austria Hong Kong Germany Chile Ireland Spain France Israel Japan Portugal Belgium Botswana Estonia Slovenia Taiwan Score 10.0 9.8 9.4 9.4 9.2 9.1 8.9 8.7 8.6 8.6 8.3 7.8 7.7 7.7 7.6 7.4 7.2 7.0 6.7 6.6 6.4 6.4 6.1 6.0 5.7 5.5 5.5 Country 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 Country Costa Rica Namibia Hungary Tunisia South Africa Greece Malaysia Mauritius Morocco Italy Jordan Peru Czech Republic Belarus El Salvafor Lithuania Malawi Poland South Korea Brazil Turkey Croatia Argentina Bulgaria Ghana Senegal Slovak Republic Latvia Zambia Mexico Score 5.4 5.4 5.2 5.2 5.0 4.9 4.8 4.7 4.7 4.6 4.6 4.4 4.3 4.1 4.1 4.1 4.1 4.1 4.0 3.9 3.8 3.7 3.5 3.5 3.5 3.5 3.5 3.4 3.4 3.3 Country 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 Country Colombia Ethiopia Thailand China Egypt Burkina Faso Kazakhstan Zimbabwe Romania India Philippines Bolivia Côte-d’Ivoire Venezuela Ecuador Moldova Score 3.2 3.2 3.2 3.1 3.1 3.0 3.0 3.0 2.9 2.8 2.8 2.7 2.7 2.7 2.6 2.6 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 Armenia Tanzania Vietnam Uzbekistan Uganda Mozambique Kenya Russia Cameroon Angola Indonesia Azerbaijan Ukraine Yugoslavia Nigeria 2.5 2.5 2.5 2.4 2.3 2.2 2.1 2.1 2.0 1.7 1.7 1.5 1.5 1.3 1.2 Corruption as a Development Issue Major threat to development Undermines ability of governments to function properly Distorts markets Stifles private sector Encourages non-productive activity Reduces investment, incomes and growth A Widely Recognized Challenge: Corruption Concerns in Developing Countries A Widely Recognized Challenge: International Community Initiatives US FCPA (1977) Inter-American Convention on Corruption (1966) OECD Convention Against Bribery (1997) UN Convention Against Corruption (2003) EITI (2002) Special Features of the Petroleum Sector Strategic significance (“Commanding Heights”) Large margins Large transaction sizes Heavily regulated Corruption Typology Policy corruption (sector policies, laws, contracts, taxes…) Enforcement corruption (approvals, access, fiscal administration, price controls, HSE regulations) Procurement corruption (kickbacks, local content abuse) Grand corruption (Niger Delta bunkering, diversion of funds, activities outside the sector…) Relevant Actors Governments (host and home) Industry (IOCs, NOCs and INOCs) “Big Men” Banks Host Governments: “My Money to Spend” “My Money to Spend,” says Deby. Economist, January 6, 2001 Home Governments: “With Friends Like These…” Big Men: “Following the Oil Money” Washington Post, September 25, 2000 The Oil Value Chain Exploration and production (licensing, laws, contracts, taxes, approvals procurement) Trading and transport (liftings, invoicing, deliveries, theft, access to pipelines/terminals) Refining and marketing (black markets, smuggling, theft, product adulteration) Corporate (accounting, reporting, transparency) Beyond the Oil Sector: Contributions to the “Paradox of Plenty” Erosion of governance Weakens institutional capacity Undermines popular support/consensus Remedies and Responses Improved sector governance Broader context of reform Stakeholder engagement (civil society) Transparency (EITI) Extractive Industries Transparency Initiative (EITI): A Specific Response Transparency has many dimensions: • • • • • • Revenues Expenditures Policies Laws and regulations Administration Applies to all sectors EITI focuses on EI resource revenue transparency as a manageable, meaningful starting point. EITI Principles and Objectives Ensure that resource revenues are properly accounted for and contribute to sustainable development and poverty reduction Provide guidelines to stakeholders on auditing, reporting and disseminating information on resource payments and revenues Facilitate TA in support of EITI implementation EITI Implementation Criteria Credible, independent audit of payments made and revenues received Publication and widespread dissemination of the audit results in easily accessed format Comprehensive coverage, i.e., all companies including NOCs Engagement of civil society in the process Public, financially sustainable, time-bound plan of implementation Petroleum Sector Corruption Thank you! Questions or Comments? Open for Discussion