final 2014

advertisement

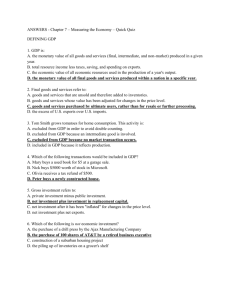

FACULTE DES HAUTES ETUDES COMMERCIALES DE L'UNIVERSITE DE LAUSANNE Final exam Professeur : Olivier Cadot Matière : Session : Globalization and development Fall 2014 Duration : 2 hours No documentation No calculator Exam is 7 pages long Please return the exam questions with your answers Multiple-choice questions have only one correct answer, and there is no penalty for wrong answers. If you are stuck on one question, do not panick ; just move on to the next. Make sure you keep some time to re-read your answers at the end of the exam. Name, first name Matricule # Grade -0- Seat # Question 1 1. (10 points) What is trade in value added ? In your answer, please define value added, explain in what sense trade data is not comparable to GDP data in terms of value added, explain precisely why and how trade data may involve double counting (possibly with an example if it helps). Explain what type of data is needed to calculated exports in value added. How did Koopman et al. (2011) solve the problem ? Trade in value added is trade in which the value of exports is calculated as gross value minus all intermediate consumptions. Calculating exports that way reconciles it with GDP data. Right now, trade data is not comparable with GDP data because GDP data is based on value added (GDP is defined as the sum of value added by all firms in the country) while trade data counts the gross value of each export transaction. Double counting comes in the following way. Suppose that China exports an ipod’s components are imported by China (from Japan, Korea or the US). already been counted in international trade data. If the ipod was sold in accounts would only count the value added, not the value of the imported contrast, if the ipod is exported, everything is counted. ipod. Most of the Thus, they have China, national components. By In order to calculate the value-added content of exports, one would have to use either firm data or input-output tables. However input-output tables typically do not distinguish at the sectoral level where inputs come from (domestic or imported), so some approximations have to be used. Koopman et al. (2011) combined input-output data with trade data by product to come up with approximations. 2. (10 points) In what sectors do you expect to see the smallest/largest difference between gross exports and exports in terms of value added? Explain and give an example of a country (or type of country) for which the difference does not matter too much, based on the sectoral composition of its exports. Hint : This is not the place to talk about the ipod ! The difference between gross exports and exports in terms of value added is smallest for products using few intermediate products, for instance mining or agricultural products. Therefore the difference does not matter too much for countries, say in sub-Saharan Africa or the Middle East, which export essentially primary resources (oil, minerals, or agricultural products). By contrast, the difference is largest in the case of manufactured products ; typically, the more complex is the production process—say, for electronics, machinery, transportation equipment, and the like) the more it uses imported components. It is also true of clothing products. -1- 3. (10 points) For what type of countries is the difference between gross exports and exports likely to matter most ? Give examples and explain. Would stiff rules of origin in a free-trade agreement have any effect on this ? It is for countries exporting products after final assembly, importing most or all of the components. Prominent examples include China or Mexico. The reason is that the local value added is minimal. Yes rules of origin forcing the country exporting a final (assembled) product in the free-trade zone to have a minimum degree of local value added would reduce the discrepancy between gross exports and exports in terms of value added. 4. (15 points) Consider Figure 1. What does it show ? Explain as precisely as possible what is measured on each axis, what a point represents, what does it mean if a point is on, below or above the 45-degree line. Select two remarkable country pairs illustrating the interest of the approach and explain the economic intuition behind it. Why does it matter for « economic diplomacy » ? Suppose you were a Chinese diplomat at the WTO. What would you use this figure for? What would you suggest to the US administration on its basis ? Do you expect it to apply to the EU as well ? Why or why not ? Figure 1 45o line Note: as one moves away from the origin, for country pairs involving the U.S., the U.S. trade deficit becomes larger. Source : Koopman et al. 2011 -2- Figure 1 shows the gross balance of trade, i.e. the conventional one that is measured in trade stats, on the horizontal axis. On the vertical axis, it shows the balance of value-added trade. A point is a pair of countries. A country pair on the 45-degree line is one for which the bilateral trade balance is equal, whether measured in gross or value-added flows. There is only one in that case, US vs. ROW (no particular reason for that). A country pair below the 45 degree line is one for which the US deficit is higher when measured in gross flows ; one above the 45 degree line is one where the US deficit is higher when measured in value added. What is remarkable is the position of the US-China and US-Japan trade balances which straddle the 45-degree line. With China, the US runs a larger deficit in gross flows (below the line). With Japan, the US runs a larger deficit in value added (above the line). This is because China assembles electronics products before export to the US ; most of the expensive components of those products are made in Japan. Therefore the US deficit with China picks up the full value of those products, whereas only a small part of them is made in China. The opposite is true with Japan : components exported by Japan to China for assembly and re-export to the US are not picked up in the US trade deficit with Japan. This observation is very important and matters a lot for economic diplomacy. The Clinton, Bush and Obama administrations have all accused the Chinese government of deliberately undervaluing the Chinese currency in order to get an unfair competitive advantage which translates into heavy US trade deficits and « steals jobs » from the US. A Chinese trade diplomat would be well advised to use Figure 1 to argue that the US is « barking up the wrong tree » as the real competitiveness problem is with Japan, not China. China does not compete with the US, because it does labor-intensive assembly in which the US has no comparative advantage anyway. It is Japan that competes with the US in the production of capital-intensive and skill-intensive components. The US should talk about exchange rates with Japan and leave China alone (so says the diplomat). The exact same argument applies to the EU which imports the same electronics assembled in China out of Japanese components. -3- Question 2 (multiple choice) Each multiple-choice question is worth 5 points. Please respond on the grid on page 7. 1. Consider Figure 2 in which each point represents a country. The vertical axis measures growth in per-capita GDP between 1980 and 1990, and the horizontal axis measures GDP per capita in 1980, in logs. The scatter plot shows a. Conditional convergence b. Absolute divergence if the slope of the line is significantly different from zero c. Heteroskedasticity d. The scatter plot cannot be interpreted because it includes only OECD countries e. None of the above. -1 -.5 0 .5 1 Figure 2 4 6 8 lggdppc1980 GDP per cap real growth 1980-1990 10 12 Fitted values Source : World Bank, World Development indicators 2. In Figure 3, the horizontal axis measures average growth in GDP per capita during a set of growth accelerations, while the vertical axis measures average income growth for the bottom quintile during the same growth accelerations. The figure shows that a. Growth is regressive except during accelerations ; b. The figure cannot demonstrate anything about growth and poverty because of selection bias ; c. The figure cannot demonstrate anything about growth and poverty unless we also have the evolution over time of the Gini coefficient; d. Nothing ; we cannot say anything about the relationship between growth and poverty without running a panel regression with country and most importantly year fixed effects ; e. Growth accelerations are neither regressive nor progressive provided that the slope of the regression line is not significantly different from one ; Figure 3 -4- Source : Dollar et Kray (2005) 3. Suppose that in a randomized-control trial, insecticide-treated nets (ITNs) are sold at 40 shillings, (a fraction of their production cost) to a treatment group of pregnant women in Kenya. Suppose also that exposure to malaria is measured by the rate of hemoglobin in blood (a lower rate means more exposure to the disease). The cumulative distribution of hemoglobin rates is shown in Figure 4, with dots for the treatment group and empty circles for a control group representing the population at large. a. Under the selection hypothesis, the curve for the treatment group should lie to the right of the curve for the control group. b. Under the selection hypothesis, the curve for the treatment group should lie to the left of the curve for the control group. c. Under the moral hazard hypothesis, the two curves should be roughly identical (i.e. there should not be a statistical difference between the two) d. The figure has nothing to do with either selection or moral hazard ; it is about the price elasticity of demand for ITNs e. None of the above Figure 4 Source : Cohen et Dupas (2010) -5- 4. Malaria was successfully eradicated in India between 1950 and 1965 roughly. Consider the following approach to estimate whether malaria creates a vicious circle of low achievement, poverty and disease. Let yit be individual i’s educational achievement at t, d i be his/her residence district, Pi a dummy variable equal to one if the individual was born after the period of eradication (completed in 1965), and M d the initial incidence of malaria in district d. We estimate: yit 0 2 Pi 3 Pi M d Xitβ uit (1) where X it is a vector of individual characteristics observed at time t. Suppose that 3 is positive and significant. This suggests that a. Malaria eradication raises future educational achievement b. Educational achievement is higher for individuals born after eradication in districts with heavy initial infestation c. There is convergence in educational achievements across districts in India d. Nothing as long as the equation does not include time and district fixed effects e. None of the above 5. Suppose that we want to estimate the effect of a program of technical assistance to managers of small and medium enterprises (SMEs) in a given country on the performance of their company. Suppose also that (i) estimated treatment effects are not significant ; (ii) regressing the performance of control firms on encounters between their managers and those of treated firms returns a positive and significant effect at the 1% level, this effect being robust. The results suggest that a. The program is ineffective and should be terminated, because only (i) matters b. The program should be continued with the same treatment group, but on a full-cost recovery basis (service for fee) c. There is absolutely no way the program can be evaluated if the treatment effect « leaks » ; only a randomized-control trial would generate hard evidence on treatment effects in the presence of such leaks d. The program should be extended to all firms but should not be subsidized e. The results are encouraging and should be confirmed using a better control group ; at least the program passes the market-failure test (generates a positive externality) 6. The paper by Nunn and Qiang (2011) suggests that a. US food aid may encourage conflicts in beneficiary countries b. US food aid goes primarily to fragile and failed states (like Congo, the Central African Republic, or Afghanistan) c. US development aid is targeted to countries whose vote patterns at the UN are aligned with US interests d. US development aid does not go to corrupt countries because of the adoption by the US of the Foreign Corrupt Practices Act e. None of the above -6- 7. Suppose that we want to estimate the effect of a training program with the following differencein-differences regression yit 0 i i 1Tit 2 xit uit (2) where i is an individual, i is an individual fixed effect, t a year, Tit a dummy variable equal to one when the individual is « treated » by the educational program (during his/her treatment period) and zero otherwise, and xit a set of relevant characteristics of invididual i that could possibly correlate with performance. Suppose that enrolment in the program and is voluntary. Propensity-score matching a. Reduces selection bias in (2) by assigning weights to control-group individuals on the basis of how similar they are with treated invididuals, using as a summary statistics their predicted probability of treatment on the basis of a first-stage regression where treatment status (treated or not) is the dependent variable b. Eliminates selection bias by matching each treated individual with another treated individual, using as a summary statistic their predicted probability of treatment on the basis of a first-stage regression c. Is a technique that consists of using an instrumental variable for treatment status, with the instrument satisfying two basic requirements (exclusion restriction and correlation with the endogenous regressor) d. Is an econometric technique that consists of estimating the odds of treatment and using them as an instrument e. Has nothing to do with the estimation of treatment effects, which can be estimated only using randomization. 8. Consider the effect of social capital, measured by the degree of trust between people and by the degree of civic behaviour, both measured in surveys, on growth. Results from a Barro growth regression are shown in Table 1. When instrumented, trust is instrumented by ethnolinguistic fragmentation. The results suggest that a. Civic behaviour and trust correlate with growth but trust weakens convergence b. Trust behaviour correlates with growth but not when instrumented, in which case the effect is no longer significant at 5% c. Trust correlates with growth at the 5% level or above in all specifications and reinforces convergence d. Trust and civic behaviour apparently correlate with contemporaneous growth but the results are suspicious since they are incompatible with conditional convergence e. Instrumental variable estimation makes no sense in this case because ethnolinguistic fragmentation is a subjective measure that is itself influenced by culture etc. Table 1 -7- Note: standard errors in parentheses Source: Knack and Keefer (1997) 9. The World Trade Organization’s agreements a. Explicitly prohibit the use of non-tariff barriers through Article XI of the GATT b. Permit the imposition of restrictive measures on products in the case where conditions of production are deemed unacceptable ; in that case the measures must be justified (Article XX of the GATT) c. Prohibit the use of anti-dumping regulations unless those use the « zeroing » calculation method, in which case they must be cleared with the WTO Secretariat (Article 6 of the antidumping agreement) d. Allow the imposition of restrictive measures on imports provided that those measures are based on scientific evidence (Article 5.2 of the TBT agreement) e. Make it illegal to ask questions about the WTO in bachelor exams, especially at the end when everybody is getting tired and just wants to get off the damn overheated room (Article I of the Unfair Measures agreement). -8- ANSWER GRID (PLEASE CIRCLE THE CORRECT ANSWER) : Example of correct formatting (b being the right answer): 0. a b c d e 0. a b c d e Example of wrong formatting (b being the right answer): 1. a b c d e 1. a b c d e 1. a b c d e 2. a b c d e 3. a b c d e 4. a b c d e 5. a b c d e 6. a b c d e 7. a b c d e 8. a b c d e 9. a b c d e Answers: -9-