Work Sheet for a Merhandisign Business

advertisement

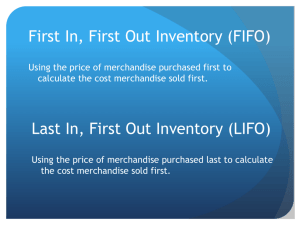

Work Sheet for a Merchandising Business Review Accounting Cycle for every Fiscal Period: 1. 2. 3. 4. Work Sheet A planning form to assist in creating Financial Statements List of General Ledger Account Balances Adjustments needed for: Depreciation Updates Merchandise Inventory Value Updates Inventory – amount of goods on hand – on the floor of the retailer and in the “back room” waiting to be put on the merchandising floor Merchandise Inventory - amount of goods on hand FOR SALE – only on the floor of the retailer Reason for Adjustment to Merchandise Inventory, M.I. Throughout the fiscal period, no journal entries have been made to the account, M.I., so the value has stayed the same – this asset value is inaccurate When we buy merchandise to re-sell, the Purchases account is affected When we sell the merchandise to costumer, the Sales account is affected We need to update the M.I. value to reflect the actual worth of inventory in the store A physical inventory count must be performed. Income Summary Account Temporary account used to off-set the adjusting entry to update merchandise inventory The Income Summary account is not classified as an A, L, OE, R, or Ex it is used when an account transaction needs to be closed/updated (every debit needs a credit Transaction Example when the M.I. value is less than it was at the start of the FP Beginning of fiscal period – Merchandise inventory was worth $270, 480 End of fiscal period Balance should be: $254, 640 Merchandise Inventory value decreased by $15, 840 Adjustment: Debit to Income Summary account - $15, 840 Credit to Merchandise Inventory account - $15, 840 Decreasing the account Transaction Example when the M.I. value is more than it was at the start of the FP Beginning of fiscal period – Merchandise inventory was worth $300,480 End of fiscal period Balance should be: $310,480 Merchandise Inventory value increased by $10,000 Adjustment: Debit to Merchandise Inventory account - $10, 000 Increasing the asset Credit to Income Summary account - $10, 000 Adjusting Entries for Supplies and Insurance Calculate depreciation amount Credit the asset Debit the expense Complete the Work Sheet Many retailers use 10-column Work Sheet because there are so many adjustment transactions to update Income Statement and Balance Sheet are accurate and ready to be published